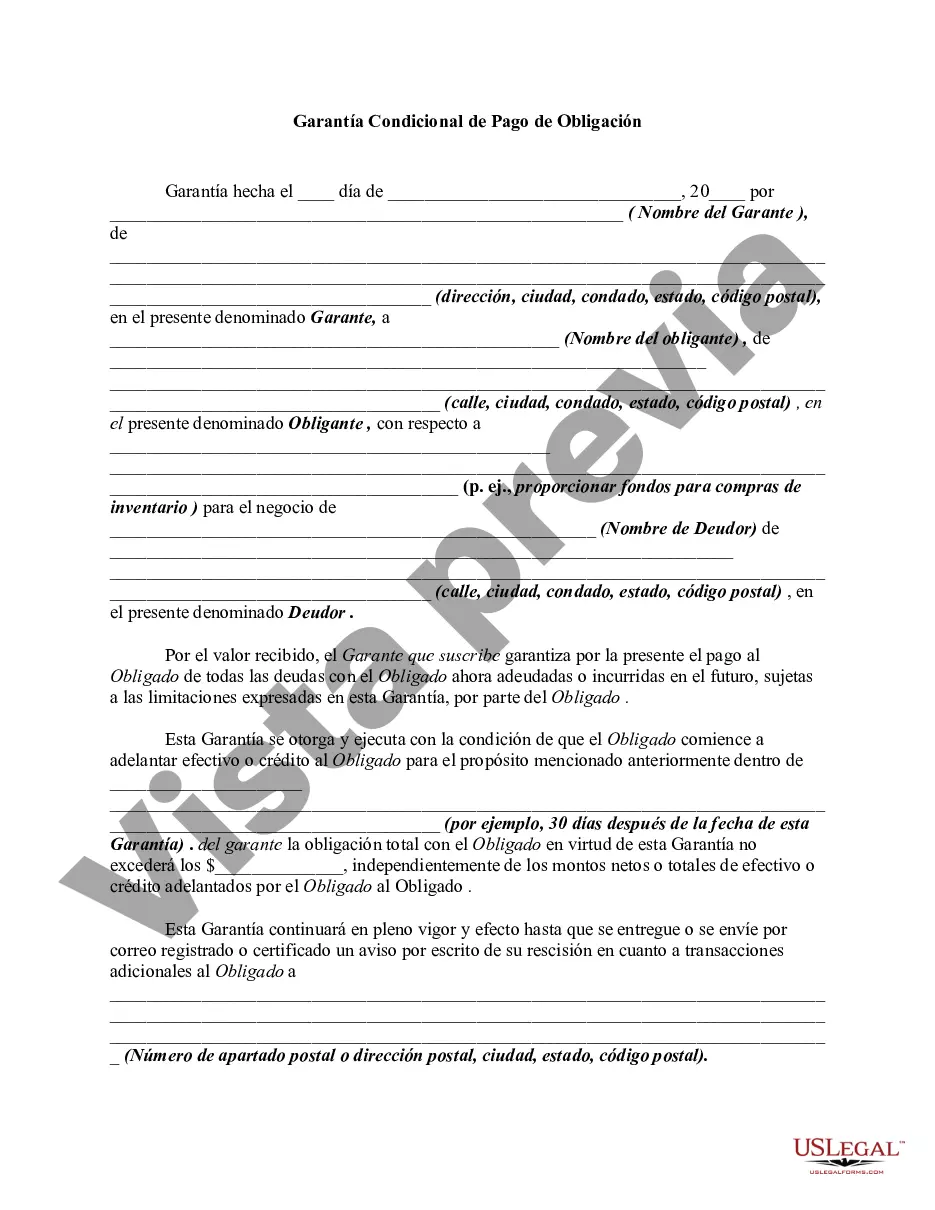

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. A guaranty agreement is a type of contract. Thus, questions relating to such matters as validity, interpretation, and enforceability of guaranty agreements are decided in accordance with basic principles of contract law. A conditional guaranty contemplates, as a condition to liability on the part of the guarantor, the happening of some contingent event. A guaranty of the payment of a debt is distinguished from a guaranty of the collection of the debt, the former being absolute and the latter conditional.

Hennepin County, Minnesota, Conditional Guaranty of Payment of Obligation is a legally binding agreement that serves as a form of collateral or assurance for the repayment of a debt or obligation. This guaranty is often used in various financial transactions, such as loans, leases, or contracts, where an individual or entity agrees to be responsible for the debt or performance of another party if they fail to fulfill their obligations. Keywords: Hennepin County, Minnesota, conditional, guaranty, payment, obligation, collateral, assurance, repayment, debt, entity, responsible, fulfill, obligations. There are different types of Hennepin Minnesota Conditional Guaranty of Payment of Obligation commonly used in various legal contexts, including: 1. Personal Guaranty: This type of guaranty involves an individual, usually a business owner or a company executive, personally guaranteeing the repayment or performance of a debt or obligation. In case the primary debtor defaults, the guarantor becomes legally obligated to fulfill the obligations on their behalf. 2. Corporate Guaranty: In this type of guaranty, a corporation guarantees the repayment or performance of a debt or obligation. It often occurs when a subsidiary company guarantees the financial responsibilities of a parent company or vice versa. This helps provide an extra layer of financial security for the creditor. 3. Limited Guaranty: A limited guaranty sets restrictions or limitations on the guarantor's liability. For example, the guarantor may be responsible for only a portion of the debt or for a specific time frame. It helps protect the guarantor by limiting their exposure to potential financial risks. 4. Continuing Guaranty: A continuing guaranty is an ongoing agreement where the guarantor's liability continues even after the fulfillment of the initial obligation. This means that if the primary debtor incurs additional debts or obligations in the future, the guarantor remains responsible for their repayment or performance. 5. Unconditional Guaranty: Unlike a conditional guaranty, an unconditional guaranty provides immediate liability for the guarantor. In case of default by the primary debtor, the guarantor must fulfill the obligations without delay or condition. These different types of Hennepin Minnesota Conditional Guaranty of Payment of Obligation offer flexibility and varying levels of liability for the guarantor, depending on the specific agreement and the parties involved.Hennepin County, Minnesota, Conditional Guaranty of Payment of Obligation is a legally binding agreement that serves as a form of collateral or assurance for the repayment of a debt or obligation. This guaranty is often used in various financial transactions, such as loans, leases, or contracts, where an individual or entity agrees to be responsible for the debt or performance of another party if they fail to fulfill their obligations. Keywords: Hennepin County, Minnesota, conditional, guaranty, payment, obligation, collateral, assurance, repayment, debt, entity, responsible, fulfill, obligations. There are different types of Hennepin Minnesota Conditional Guaranty of Payment of Obligation commonly used in various legal contexts, including: 1. Personal Guaranty: This type of guaranty involves an individual, usually a business owner or a company executive, personally guaranteeing the repayment or performance of a debt or obligation. In case the primary debtor defaults, the guarantor becomes legally obligated to fulfill the obligations on their behalf. 2. Corporate Guaranty: In this type of guaranty, a corporation guarantees the repayment or performance of a debt or obligation. It often occurs when a subsidiary company guarantees the financial responsibilities of a parent company or vice versa. This helps provide an extra layer of financial security for the creditor. 3. Limited Guaranty: A limited guaranty sets restrictions or limitations on the guarantor's liability. For example, the guarantor may be responsible for only a portion of the debt or for a specific time frame. It helps protect the guarantor by limiting their exposure to potential financial risks. 4. Continuing Guaranty: A continuing guaranty is an ongoing agreement where the guarantor's liability continues even after the fulfillment of the initial obligation. This means that if the primary debtor incurs additional debts or obligations in the future, the guarantor remains responsible for their repayment or performance. 5. Unconditional Guaranty: Unlike a conditional guaranty, an unconditional guaranty provides immediate liability for the guarantor. In case of default by the primary debtor, the guarantor must fulfill the obligations without delay or condition. These different types of Hennepin Minnesota Conditional Guaranty of Payment of Obligation offer flexibility and varying levels of liability for the guarantor, depending on the specific agreement and the parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.