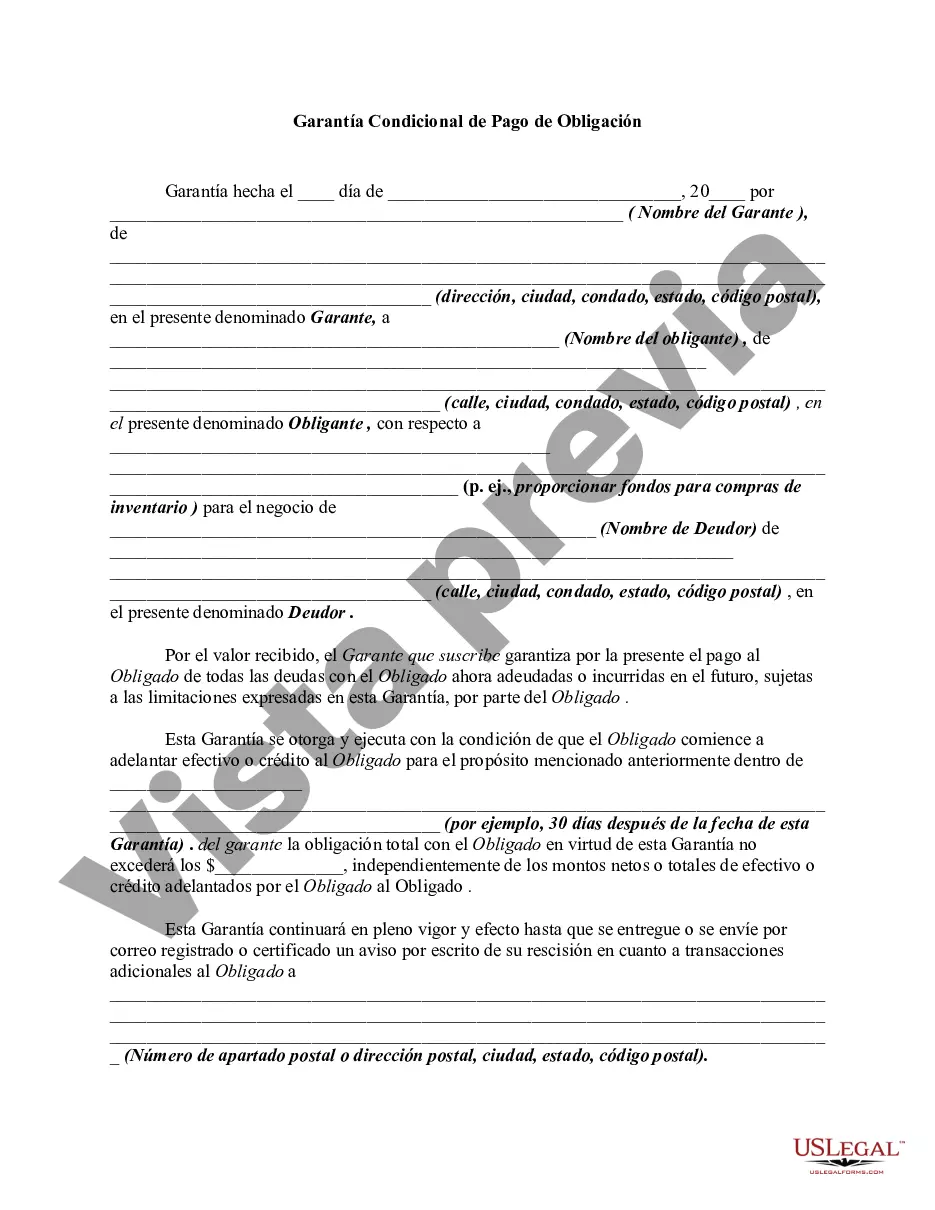

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. A guaranty agreement is a type of contract. Thus, questions relating to such matters as validity, interpretation, and enforceability of guaranty agreements are decided in accordance with basic principles of contract law. A conditional guaranty contemplates, as a condition to liability on the part of the guarantor, the happening of some contingent event. A guaranty of the payment of a debt is distinguished from a guaranty of the collection of the debt, the former being absolute and the latter conditional.

Los Angeles, California Conditional Guaranty of Payment of Obligation: Explained In the bustling city of Los Angeles, California, a Conditional Guaranty of Payment of Obligation refers to a legal agreement that ensures the fulfillment of financial obligations under certain predetermined conditions. This document acts as a promise made by a guarantor, who takes responsibility for the payment of debt or the performance of an obligation if the primary obliged defaults. The different types of Conditional Guaranty of Payment of Obligation in Los Angeles, California can be categorized based on their specific purposes and requirements. These may include: 1. Real Estate: This type of guaranty is commonly used in the real estate industry, where a property owner may require a guarantee from a third party for loan repayment or lease obligations. It provides an additional layer of security to lenders or lessors. 2. Construction: Contractors and construction project developers may enter into a Conditional Guaranty of Payment of Obligation to ensure that subcontractors, suppliers, or laborers are adequately compensated for their work despite any default by the primary contractor. 3. Financing: Financial institutions such as banks may require a conditional guaranty when extending credit to individuals or businesses. This type of guaranty ensures the lender will be repaid even if the borrower defaults on their loan. 4. Performance: In business transactions or government contracts, a conditional guaranty can be established to guarantee the satisfactory completion of certain tasks or the delivery of goods or services as agreed upon. It is important to note that a Conditional Guaranty of Payment of Obligation is a legally binding document, enforceable under Los Angeles, California state laws. The terms and conditions of the guaranty, including the triggering events for the guarantor's liability, the amount guaranteed, and the duration of the guaranty, should be clearly stated within the agreement. This type of guaranty offers an added layer of security for creditors, lessors, and other parties involved in various financial transactions in Los Angeles, California. It minimizes the risks associated with default and creates a safety net for the fulfillment of obligations, promoting financial stability and confidence among participants in the marketplace. In conclusion, a Los Angeles, California Conditional Guaranty of Payment of Obligation provides a legal framework for ensuring the fulfillment of financial obligations through a conditional agreement between a primary obliged and a guarantor. By offering specific guarantees under predetermined conditions, this documentation plays a crucial role in the smooth functioning of various industries, including real estate, construction, financing, and commercial transactions.Los Angeles, California Conditional Guaranty of Payment of Obligation: Explained In the bustling city of Los Angeles, California, a Conditional Guaranty of Payment of Obligation refers to a legal agreement that ensures the fulfillment of financial obligations under certain predetermined conditions. This document acts as a promise made by a guarantor, who takes responsibility for the payment of debt or the performance of an obligation if the primary obliged defaults. The different types of Conditional Guaranty of Payment of Obligation in Los Angeles, California can be categorized based on their specific purposes and requirements. These may include: 1. Real Estate: This type of guaranty is commonly used in the real estate industry, where a property owner may require a guarantee from a third party for loan repayment or lease obligations. It provides an additional layer of security to lenders or lessors. 2. Construction: Contractors and construction project developers may enter into a Conditional Guaranty of Payment of Obligation to ensure that subcontractors, suppliers, or laborers are adequately compensated for their work despite any default by the primary contractor. 3. Financing: Financial institutions such as banks may require a conditional guaranty when extending credit to individuals or businesses. This type of guaranty ensures the lender will be repaid even if the borrower defaults on their loan. 4. Performance: In business transactions or government contracts, a conditional guaranty can be established to guarantee the satisfactory completion of certain tasks or the delivery of goods or services as agreed upon. It is important to note that a Conditional Guaranty of Payment of Obligation is a legally binding document, enforceable under Los Angeles, California state laws. The terms and conditions of the guaranty, including the triggering events for the guarantor's liability, the amount guaranteed, and the duration of the guaranty, should be clearly stated within the agreement. This type of guaranty offers an added layer of security for creditors, lessors, and other parties involved in various financial transactions in Los Angeles, California. It minimizes the risks associated with default and creates a safety net for the fulfillment of obligations, promoting financial stability and confidence among participants in the marketplace. In conclusion, a Los Angeles, California Conditional Guaranty of Payment of Obligation provides a legal framework for ensuring the fulfillment of financial obligations through a conditional agreement between a primary obliged and a guarantor. By offering specific guarantees under predetermined conditions, this documentation plays a crucial role in the smooth functioning of various industries, including real estate, construction, financing, and commercial transactions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.