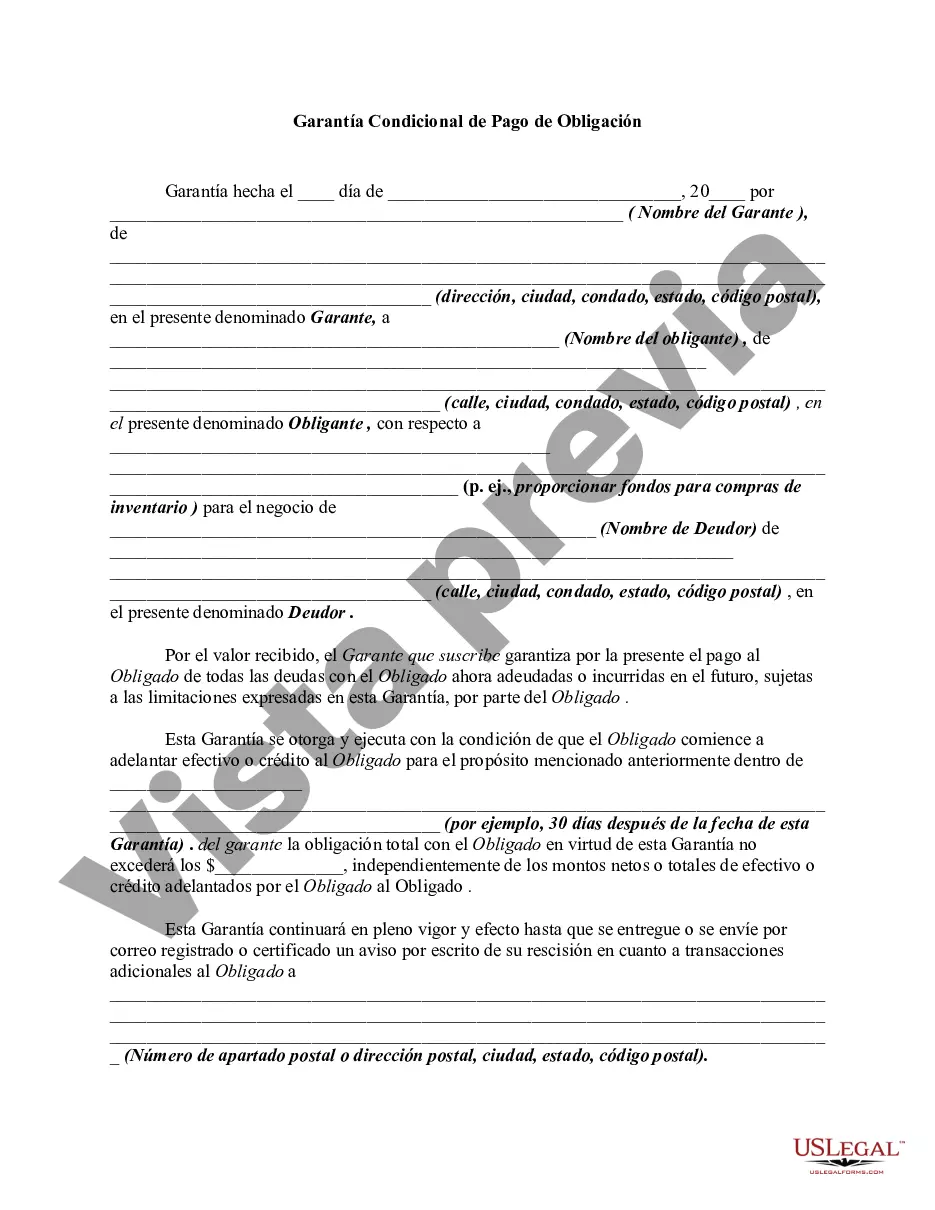

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. A guaranty agreement is a type of contract. Thus, questions relating to such matters as validity, interpretation, and enforceability of guaranty agreements are decided in accordance with basic principles of contract law. A conditional guaranty contemplates, as a condition to liability on the part of the guarantor, the happening of some contingent event. A guaranty of the payment of a debt is distinguished from a guaranty of the collection of the debt, the former being absolute and the latter conditional.

Miami-Dade Florida Conditional Guaranty of Payment of Obligation is a legal document that outlines the conditions and terms under which one party guarantees the payment of another party's obligation in the Miami-Dade County of Florida. This guarantee acts as a form of security for the creditor in case the primary debtor fails to fulfill their obligation. In Miami-Dade, there are various types of Conditional Guaranty of Payment of Obligation, each serving a different purpose. Here are a few notable ones: 1. Commercial Conditional Guaranty: This type of guaranty is commonly used in commercial transactions within Miami-Dade County. It typically involves a business entity or an individual (guarantor) providing a guarantee for the payment or performance of obligations owed by a commercial entity (debtor) to a third party (creditor). 2. Residential Conditional Guaranty: As the name suggests, this type of guaranty is specific to residential properties in Miami-Dade. It offers additional security to landlords or mortgage lenders by guaranteeing the payment of rent or mortgage obligations by the tenant or borrower, respectively. 3. Construction Conditional Guaranty: Construction projects in Miami-Dade often require financial security to ensure the completion of the project and payment to subcontractors. In this type of guaranty, a third party (guarantor) assures the payment of obligations owed by a contractor or developer (debtor) to subcontractors, suppliers, or other parties involved in the project. 4. Performance Conditional Guaranty: A performance guaranty is often utilized in Miami-Dade in contracts involving service providers or contractors. It guarantees the satisfactory performance of the obligated party, ensuring that they meet the agreed-upon standards or deliver the required services or goods. Miami-Dade Florida Conditional Guaranty of Payment of Obligation contains several key clauses and provisions. These include identification of the parties involved, a description of the primary obligation being guaranteed, the conditions triggering the guaranty, limitations, and the specific rights and obligations of the guarantor and creditor. It is important for all parties involved to carefully review and understand the terms and conditions outlined in the Miami-Dade Florida Conditional Guaranty of Payment of Obligation before entering into such an agreement. Seeking legal counsel is advised to ensure compliance with local laws and regulations, thereby protecting the interests of all parties.Miami-Dade Florida Conditional Guaranty of Payment of Obligation is a legal document that outlines the conditions and terms under which one party guarantees the payment of another party's obligation in the Miami-Dade County of Florida. This guarantee acts as a form of security for the creditor in case the primary debtor fails to fulfill their obligation. In Miami-Dade, there are various types of Conditional Guaranty of Payment of Obligation, each serving a different purpose. Here are a few notable ones: 1. Commercial Conditional Guaranty: This type of guaranty is commonly used in commercial transactions within Miami-Dade County. It typically involves a business entity or an individual (guarantor) providing a guarantee for the payment or performance of obligations owed by a commercial entity (debtor) to a third party (creditor). 2. Residential Conditional Guaranty: As the name suggests, this type of guaranty is specific to residential properties in Miami-Dade. It offers additional security to landlords or mortgage lenders by guaranteeing the payment of rent or mortgage obligations by the tenant or borrower, respectively. 3. Construction Conditional Guaranty: Construction projects in Miami-Dade often require financial security to ensure the completion of the project and payment to subcontractors. In this type of guaranty, a third party (guarantor) assures the payment of obligations owed by a contractor or developer (debtor) to subcontractors, suppliers, or other parties involved in the project. 4. Performance Conditional Guaranty: A performance guaranty is often utilized in Miami-Dade in contracts involving service providers or contractors. It guarantees the satisfactory performance of the obligated party, ensuring that they meet the agreed-upon standards or deliver the required services or goods. Miami-Dade Florida Conditional Guaranty of Payment of Obligation contains several key clauses and provisions. These include identification of the parties involved, a description of the primary obligation being guaranteed, the conditions triggering the guaranty, limitations, and the specific rights and obligations of the guarantor and creditor. It is important for all parties involved to carefully review and understand the terms and conditions outlined in the Miami-Dade Florida Conditional Guaranty of Payment of Obligation before entering into such an agreement. Seeking legal counsel is advised to ensure compliance with local laws and regulations, thereby protecting the interests of all parties.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.