A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. A guaranty agreement is a type of contract. Thus, questions relating to such matters as validity, interpretation, and enforceability of guaranty agreements are decided in accordance with basic principles of contract law. A conditional guaranty contemplates, as a condition to liability on the part of the guarantor, the happening of some contingent event. A guaranty of the payment of a debt is distinguished from a guaranty of the collection of the debt, the former being absolute and the latter conditional.

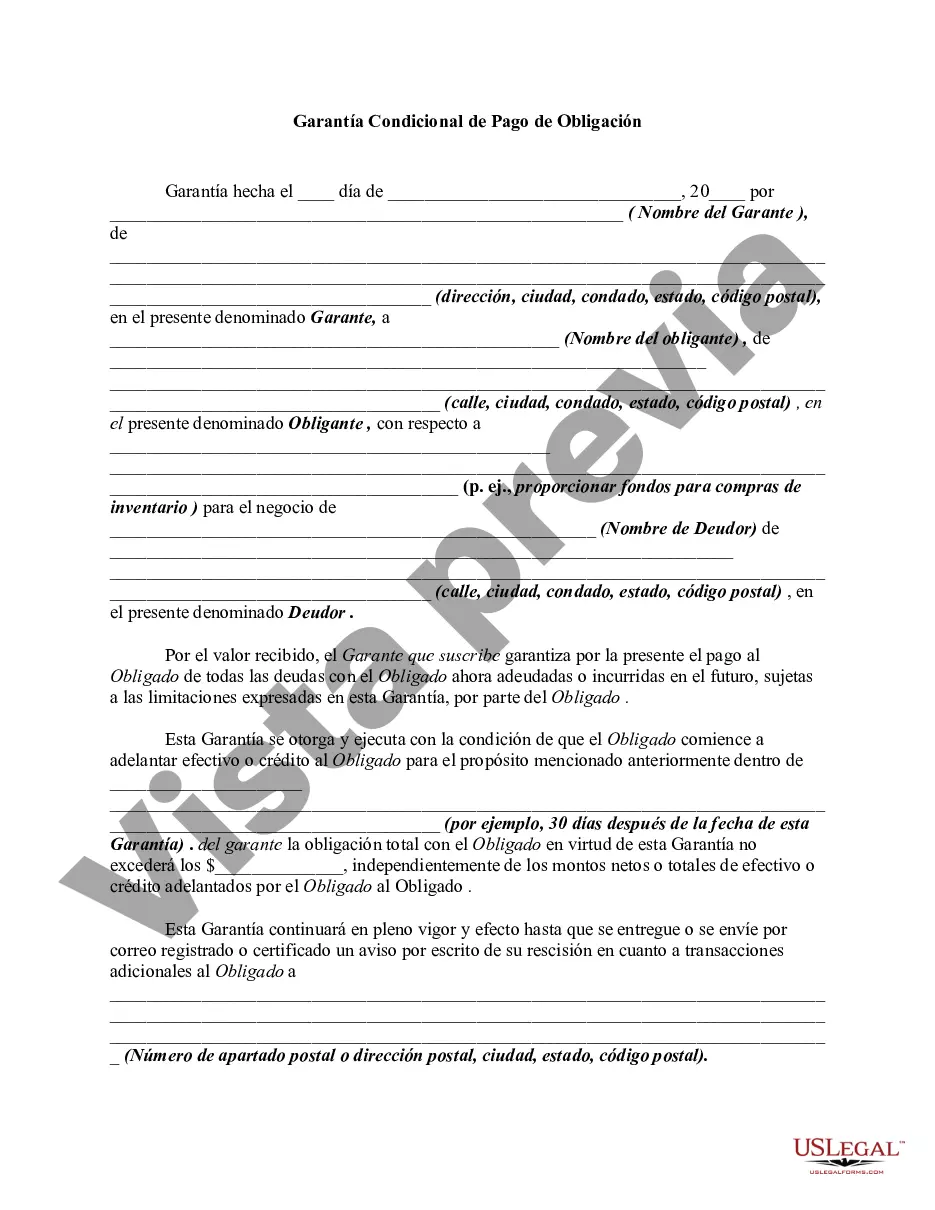

Middlesex Massachusetts Conditional Guaranty of Payment of Obligation is a legal document that outlines the terms and conditions under which one party (the guarantor) agrees to assume responsibility for the payment of a financial obligation owed by another party (the primary obliged) in the Middlesex County, Massachusetts area. This agreement serves to protect the creditor or lender by providing an additional source of payment in case the primary obliged fails to fulfill their obligations. The Middlesex Massachusetts Conditional Guaranty of Payment of Obligation can be categorized into different types based on the specific conditions and requirements outlined in the agreement: 1. Personal Guaranty: A personal guaranty is a type of conditional guaranty where an individual, often the owner or principal of a business, assumes personal responsibility for the payment of the financial obligation. This type of guaranty is common in business transactions involving loans, leases, or credit lines. 2. Corporate Guaranty: A corporate guaranty is a type of conditional guaranty wherein a company or corporation agrees to be the guarantor for the payment of the financial obligation. This type of guaranty is often used in commercial transactions involving business entities, contracts, or partnerships. 3. Limited Guaranty: A limited guaranty is a type of conditional guaranty that places certain restrictions or limitations on the extent of the guarantor's responsibility. The limitations can cover the amount of the financial obligation, the duration of the guaranty, or specific events that trigger the guarantor's liability. 4. Unconditional Guaranty: An unconditional guaranty is a type of conditional guaranty where the guarantor assumes full responsibility for the payment of the financial obligation without any limitations or conditions attached. In this case, the guarantor's liability is absolute and not dependent on the actions or financial situation of the primary obliged. Middlesex Massachusetts Conditional Guaranty of Payment of Obligation can greatly benefit creditors or lenders by providing an additional layer of financial security. It ensures that in case the primary obliged defaults on their payment obligations, the guarantor is legally bound to fulfill the obligation. This document is often used in various financial transactions, such as loans, leases, contracts, and credit lines, to mitigate the risks associated with lending and ensure timely payment of debts.Middlesex Massachusetts Conditional Guaranty of Payment of Obligation is a legal document that outlines the terms and conditions under which one party (the guarantor) agrees to assume responsibility for the payment of a financial obligation owed by another party (the primary obliged) in the Middlesex County, Massachusetts area. This agreement serves to protect the creditor or lender by providing an additional source of payment in case the primary obliged fails to fulfill their obligations. The Middlesex Massachusetts Conditional Guaranty of Payment of Obligation can be categorized into different types based on the specific conditions and requirements outlined in the agreement: 1. Personal Guaranty: A personal guaranty is a type of conditional guaranty where an individual, often the owner or principal of a business, assumes personal responsibility for the payment of the financial obligation. This type of guaranty is common in business transactions involving loans, leases, or credit lines. 2. Corporate Guaranty: A corporate guaranty is a type of conditional guaranty wherein a company or corporation agrees to be the guarantor for the payment of the financial obligation. This type of guaranty is often used in commercial transactions involving business entities, contracts, or partnerships. 3. Limited Guaranty: A limited guaranty is a type of conditional guaranty that places certain restrictions or limitations on the extent of the guarantor's responsibility. The limitations can cover the amount of the financial obligation, the duration of the guaranty, or specific events that trigger the guarantor's liability. 4. Unconditional Guaranty: An unconditional guaranty is a type of conditional guaranty where the guarantor assumes full responsibility for the payment of the financial obligation without any limitations or conditions attached. In this case, the guarantor's liability is absolute and not dependent on the actions or financial situation of the primary obliged. Middlesex Massachusetts Conditional Guaranty of Payment of Obligation can greatly benefit creditors or lenders by providing an additional layer of financial security. It ensures that in case the primary obliged defaults on their payment obligations, the guarantor is legally bound to fulfill the obligation. This document is often used in various financial transactions, such as loans, leases, contracts, and credit lines, to mitigate the risks associated with lending and ensure timely payment of debts.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.