A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. A guaranty agreement is a type of contract. Thus, questions relating to such matters as validity, interpretation, and enforceability of guaranty agreements are decided in accordance with basic principles of contract law. A conditional guaranty contemplates, as a condition to liability on the part of the guarantor, the happening of some contingent event. A guaranty of the payment of a debt is distinguished from a guaranty of the collection of the debt, the former being absolute and the latter conditional.

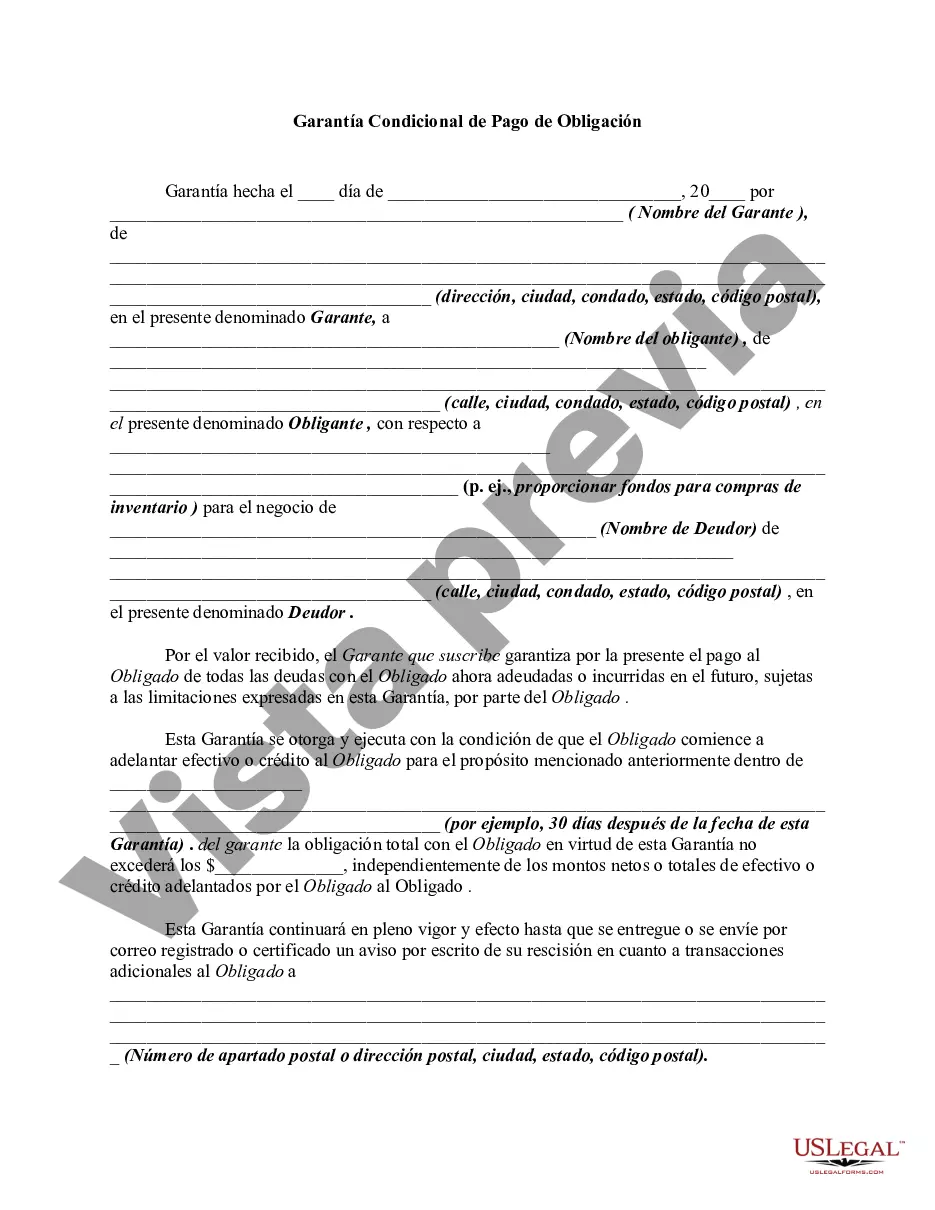

A San Antonio Texas Conditional Guaranty of Payment of Obligation is a legally binding agreement in which one party agrees to be responsible for the payment of a specific obligation if the primary borrower fails to fulfill their payment obligations. This type of guarantee provides assurance to the lender that they will receive payment even if the primary borrower defaults. One common type of San Antonio Texas Conditional Guaranty of Payment of Obligation is a guarantee for a business loan. In this scenario, a business owner might be required to provide a guarantee to the lender, ensuring that they will step in and make payments on the loan if the business fails to meet its obligations. Another type of guaranty is for real estate transactions. When purchasing a property, the buyer may need to provide a conditional guaranty of payment of obligation to secure financing. This guarantee gives the lender confidence that the buyer has the means to make the necessary mortgage payments. In San Antonio, Texas, where the agreement is often utilized due to its vibrant business scene and robust real estate market, the Conditional Guaranty of Payment of Obligation serves as a crucial tool in mitigating financial risks. It provides protection for lenders and reassurance for borrowers, fostering an environment conducive to economic growth and sustainability. In order to be legally enforceable, a San Antonio Texas Conditional Guaranty of Payment of Obligation must meet certain requirements. It should clearly identify the primary borrower, the obligation being guaranteed, and the guarantor assuming responsibility for payment. The terms and conditions, including any contingencies or conditions that trigger the guarantor's obligation, must be explicitly stated. To draft an effective Conditional Guaranty of Payment of Obligation, it is recommended to consult with legal professionals experienced in Texas law, specifically in San Antonio. They can provide valuable guidance in ensuring that the agreement adheres to local legal requirements and protects the interests of all parties involved. In conclusion, a San Antonio Texas Conditional Guaranty of Payment of Obligation is a contract that provides assurance to lenders in business or real estate transactions. It safeguards against default by holding a guarantor responsible for fulfilling the obligations if the primary borrower fails to do so. By using this powerful legal mechanism, both lenders and borrowers can have greater certainty and security in their financial dealings.A San Antonio Texas Conditional Guaranty of Payment of Obligation is a legally binding agreement in which one party agrees to be responsible for the payment of a specific obligation if the primary borrower fails to fulfill their payment obligations. This type of guarantee provides assurance to the lender that they will receive payment even if the primary borrower defaults. One common type of San Antonio Texas Conditional Guaranty of Payment of Obligation is a guarantee for a business loan. In this scenario, a business owner might be required to provide a guarantee to the lender, ensuring that they will step in and make payments on the loan if the business fails to meet its obligations. Another type of guaranty is for real estate transactions. When purchasing a property, the buyer may need to provide a conditional guaranty of payment of obligation to secure financing. This guarantee gives the lender confidence that the buyer has the means to make the necessary mortgage payments. In San Antonio, Texas, where the agreement is often utilized due to its vibrant business scene and robust real estate market, the Conditional Guaranty of Payment of Obligation serves as a crucial tool in mitigating financial risks. It provides protection for lenders and reassurance for borrowers, fostering an environment conducive to economic growth and sustainability. In order to be legally enforceable, a San Antonio Texas Conditional Guaranty of Payment of Obligation must meet certain requirements. It should clearly identify the primary borrower, the obligation being guaranteed, and the guarantor assuming responsibility for payment. The terms and conditions, including any contingencies or conditions that trigger the guarantor's obligation, must be explicitly stated. To draft an effective Conditional Guaranty of Payment of Obligation, it is recommended to consult with legal professionals experienced in Texas law, specifically in San Antonio. They can provide valuable guidance in ensuring that the agreement adheres to local legal requirements and protects the interests of all parties involved. In conclusion, a San Antonio Texas Conditional Guaranty of Payment of Obligation is a contract that provides assurance to lenders in business or real estate transactions. It safeguards against default by holding a guarantor responsible for fulfilling the obligations if the primary borrower fails to do so. By using this powerful legal mechanism, both lenders and borrowers can have greater certainty and security in their financial dealings.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.