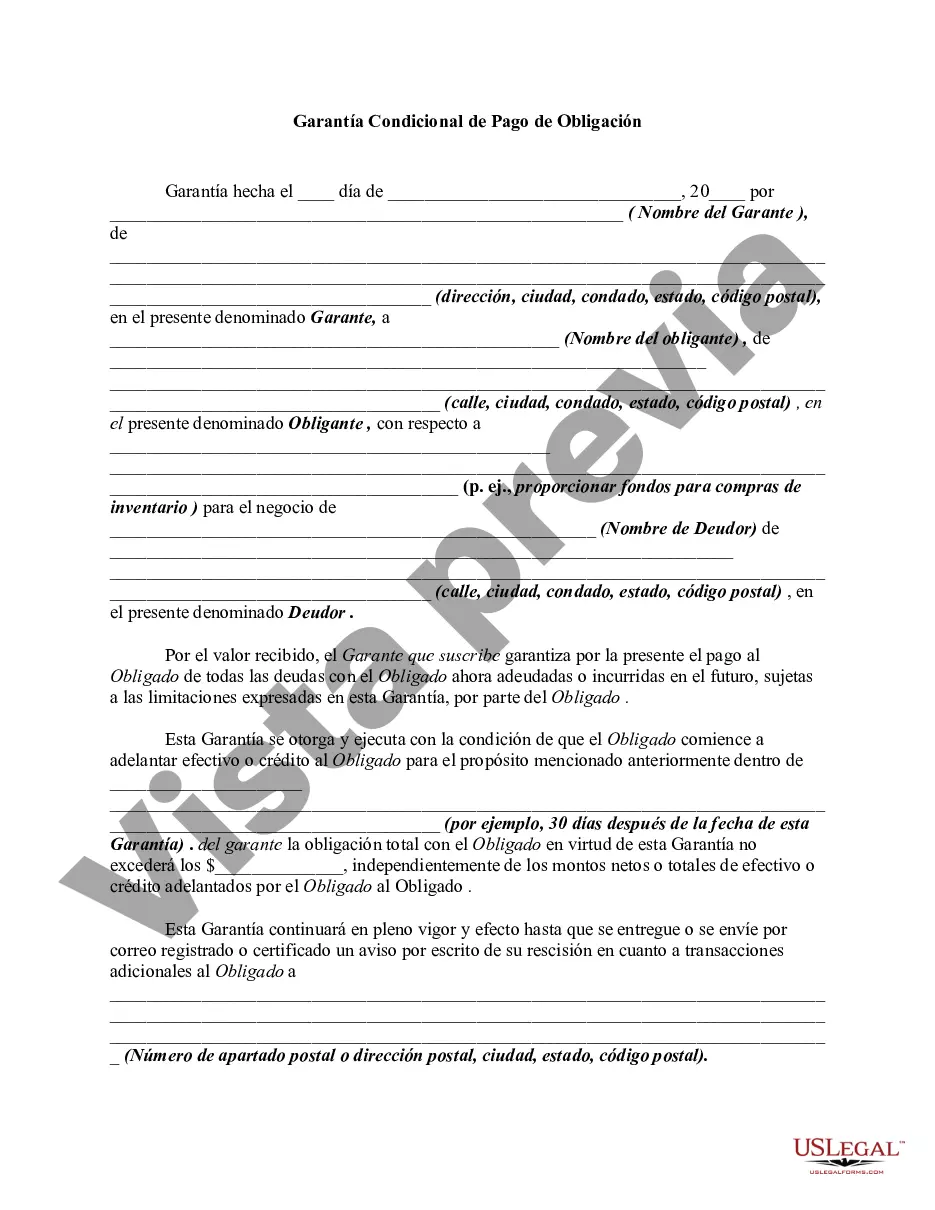

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. A guaranty agreement is a type of contract. Thus, questions relating to such matters as validity, interpretation, and enforceability of guaranty agreements are decided in accordance with basic principles of contract law. A conditional guaranty contemplates, as a condition to liability on the part of the guarantor, the happening of some contingent event. A guaranty of the payment of a debt is distinguished from a guaranty of the collection of the debt, the former being absolute and the latter conditional.

A San Diego California Conditional Guaranty of Payment of Obligation is a legal document that ensures the repayment of a debt or obligation by a third party if the primary debtor fails to fulfill their financial responsibilities. This type of guaranty offers an additional layer of security for lenders or creditors who want to minimize their risk of non-payment. In San Diego, California, like in any other jurisdiction, there are various types of conditional guaranties of payment of obligation that may exist. These include: 1. Commercial Guaranty: This type of guaranty is commonly used in business transactions, where a business owner or a third-party entity guarantees the payment obligation of a commercial transaction. It serves as a reassurance to the creditor that, in case of default by the borrower, another party will be responsible for the debt repayment. 2. Real Estate Guaranty: This form of guaranty applies to obligations related to real estate transactions. It guarantees the repayment of loans, mortgages, or other financial obligations secured by a property. In San Diego, this type of guaranty is relevant in the thriving real estate industry, which necessitates the need for additional financial security. 3. Construction Guaranty: Construction projects often involve substantial financial commitments and may require a conditional guaranty of payment of obligation. Contractors or developers may request a guaranty from a third party to guarantee the repayment of loans, subcontractors, labor, or materials in the event of project failure or non-payment by the primary parties. 4. Lease Guaranty: When leasing a property in San Diego, a conditional guaranty of payment of obligation may be required. In this case, a third party, often an individual or a corporate entity, guarantees the payment of rent and other lease-related obligations if the tenant defaults or fails to fulfill their lease obligations. It is essential to note that the terms and conditions of a conditional guaranty of payment of obligation may vary depending on the specific situation, the parties involved, and the nature of the financial commitment. These documents are legally binding and should be drafted carefully by qualified professionals to ensure compliance with San Diego and California's legal requirements. If you require a San Diego California Conditional Guaranty of Payment of Obligation, it is advisable to consult with an attorney or legal expert specializing in contract and business law to ensure that your specific needs and interests are adequately protected and outlined in the document.A San Diego California Conditional Guaranty of Payment of Obligation is a legal document that ensures the repayment of a debt or obligation by a third party if the primary debtor fails to fulfill their financial responsibilities. This type of guaranty offers an additional layer of security for lenders or creditors who want to minimize their risk of non-payment. In San Diego, California, like in any other jurisdiction, there are various types of conditional guaranties of payment of obligation that may exist. These include: 1. Commercial Guaranty: This type of guaranty is commonly used in business transactions, where a business owner or a third-party entity guarantees the payment obligation of a commercial transaction. It serves as a reassurance to the creditor that, in case of default by the borrower, another party will be responsible for the debt repayment. 2. Real Estate Guaranty: This form of guaranty applies to obligations related to real estate transactions. It guarantees the repayment of loans, mortgages, or other financial obligations secured by a property. In San Diego, this type of guaranty is relevant in the thriving real estate industry, which necessitates the need for additional financial security. 3. Construction Guaranty: Construction projects often involve substantial financial commitments and may require a conditional guaranty of payment of obligation. Contractors or developers may request a guaranty from a third party to guarantee the repayment of loans, subcontractors, labor, or materials in the event of project failure or non-payment by the primary parties. 4. Lease Guaranty: When leasing a property in San Diego, a conditional guaranty of payment of obligation may be required. In this case, a third party, often an individual or a corporate entity, guarantees the payment of rent and other lease-related obligations if the tenant defaults or fails to fulfill their lease obligations. It is essential to note that the terms and conditions of a conditional guaranty of payment of obligation may vary depending on the specific situation, the parties involved, and the nature of the financial commitment. These documents are legally binding and should be drafted carefully by qualified professionals to ensure compliance with San Diego and California's legal requirements. If you require a San Diego California Conditional Guaranty of Payment of Obligation, it is advisable to consult with an attorney or legal expert specializing in contract and business law to ensure that your specific needs and interests are adequately protected and outlined in the document.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.