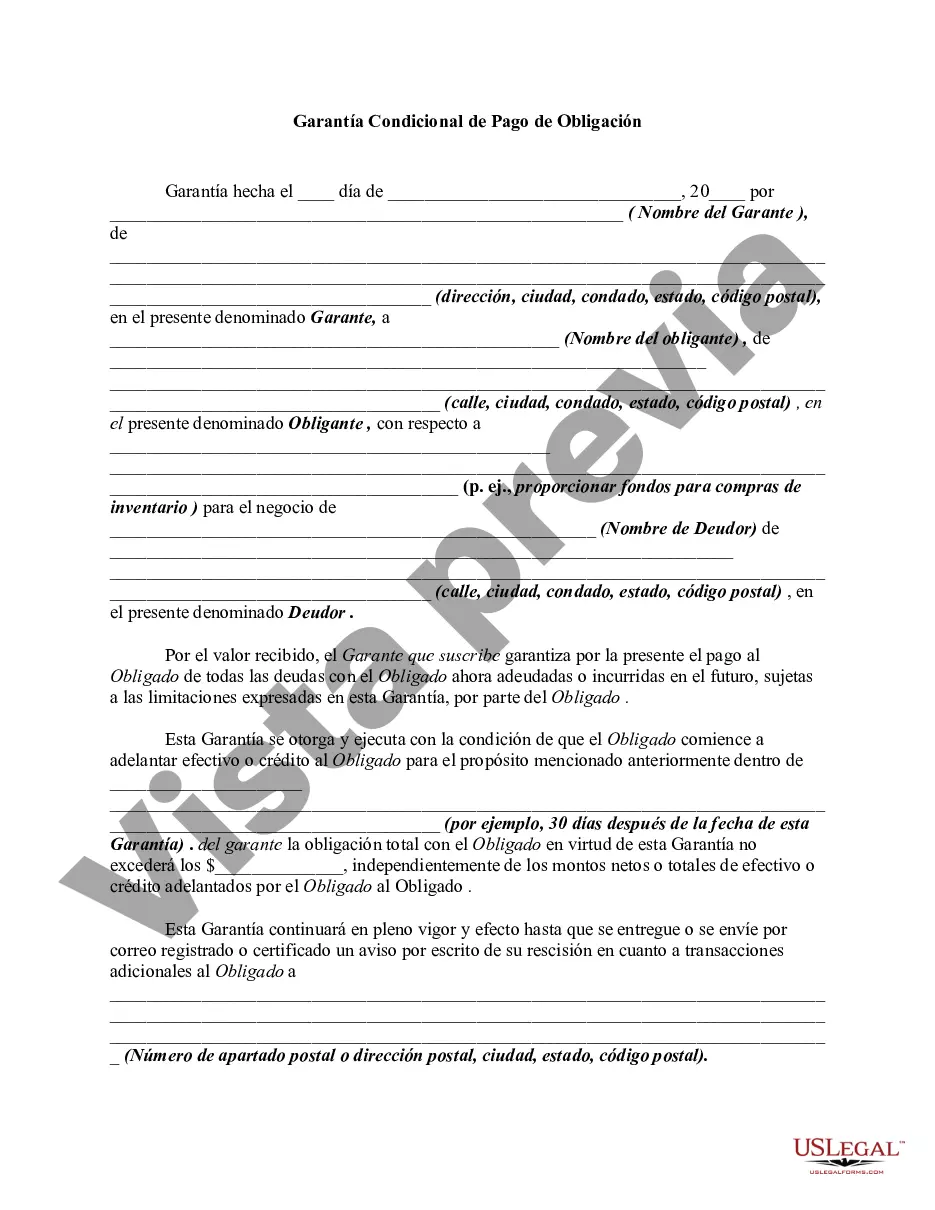

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. A guaranty agreement is a type of contract. Thus, questions relating to such matters as validity, interpretation, and enforceability of guaranty agreements are decided in accordance with basic principles of contract law. A conditional guaranty contemplates, as a condition to liability on the part of the guarantor, the happening of some contingent event. A guaranty of the payment of a debt is distinguished from a guaranty of the collection of the debt, the former being absolute and the latter conditional.

Wayne Michigan Conditional Guaranty of Payment of Obligation is a legal document that outlines the terms and conditions under which a guarantor agrees to be responsible for the payment of a debt or obligation if the primary debtor fails to fulfill their obligations. This type of guarantee is commonly used in various financial transactions, including loans, leases, and contracts. The Wayne Michigan Conditional Guaranty of Payment of Obligation acts as a safeguard for the lender or creditor, providing them with an added layer of security in case the debtor defaults on their payment. It ensures that the guarantor will step in and fulfill the obligations of the debtor, including making payments, complying with terms and conditions, and covering any other monetary obligations as stipulated in the agreement. It is important to note that there may be different types of conditional guaranty of payment obligations within the Wayne Michigan legal framework, including: 1. Unconditional Guaranty: This type of guaranty is the most common and straightforward. The guarantor agrees to be responsible for the debt or obligation without any conditions or limitations. In case the primary debtor fails to make payments or defaults, the guarantor is immediately liable for the entire amount owed. 2. Limited Guaranty: In contrast to an unconditional guaranty, a limited guaranty imposes certain restrictions on the guarantor's liability. These limitations can include setting a maximum liability amount, specifying a duration of the guaranty, or excluding specific types of obligations from the guarantor's responsibility. 3. Continuing Guaranty: A continuing guaranty is one that extends beyond a single transaction or event. It covers multiple transactions and remains in effect until the guarantor revokes it in writing or the parties involved mutually terminate the agreement. This type of guaranty offers ongoing protection for the creditor, as it allows them to hold the guarantor responsible for future debts or obligations. 4. Conditional Guaranty: Unlike an unconditional guaranty, a conditional guaranty only comes into effect under specific circumstances specified in the agreement. For example, it may trigger if the debtor's financial condition deteriorates, if the debtor fails to meet certain performance obligations, or if the debtor breaches any terms of the agreement. This type of guaranty protects the creditor under specific predefined conditions. When drafting or reviewing a Wayne Michigan Conditional Guaranty of Payment of Obligation, it is crucial to consult with legal professionals who specialize in contract law and are familiar with the intricacies of local legislation to ensure compliance and protection for all parties involved.Wayne Michigan Conditional Guaranty of Payment of Obligation is a legal document that outlines the terms and conditions under which a guarantor agrees to be responsible for the payment of a debt or obligation if the primary debtor fails to fulfill their obligations. This type of guarantee is commonly used in various financial transactions, including loans, leases, and contracts. The Wayne Michigan Conditional Guaranty of Payment of Obligation acts as a safeguard for the lender or creditor, providing them with an added layer of security in case the debtor defaults on their payment. It ensures that the guarantor will step in and fulfill the obligations of the debtor, including making payments, complying with terms and conditions, and covering any other monetary obligations as stipulated in the agreement. It is important to note that there may be different types of conditional guaranty of payment obligations within the Wayne Michigan legal framework, including: 1. Unconditional Guaranty: This type of guaranty is the most common and straightforward. The guarantor agrees to be responsible for the debt or obligation without any conditions or limitations. In case the primary debtor fails to make payments or defaults, the guarantor is immediately liable for the entire amount owed. 2. Limited Guaranty: In contrast to an unconditional guaranty, a limited guaranty imposes certain restrictions on the guarantor's liability. These limitations can include setting a maximum liability amount, specifying a duration of the guaranty, or excluding specific types of obligations from the guarantor's responsibility. 3. Continuing Guaranty: A continuing guaranty is one that extends beyond a single transaction or event. It covers multiple transactions and remains in effect until the guarantor revokes it in writing or the parties involved mutually terminate the agreement. This type of guaranty offers ongoing protection for the creditor, as it allows them to hold the guarantor responsible for future debts or obligations. 4. Conditional Guaranty: Unlike an unconditional guaranty, a conditional guaranty only comes into effect under specific circumstances specified in the agreement. For example, it may trigger if the debtor's financial condition deteriorates, if the debtor fails to meet certain performance obligations, or if the debtor breaches any terms of the agreement. This type of guaranty protects the creditor under specific predefined conditions. When drafting or reviewing a Wayne Michigan Conditional Guaranty of Payment of Obligation, it is crucial to consult with legal professionals who specialize in contract law and are familiar with the intricacies of local legislation to ensure compliance and protection for all parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.