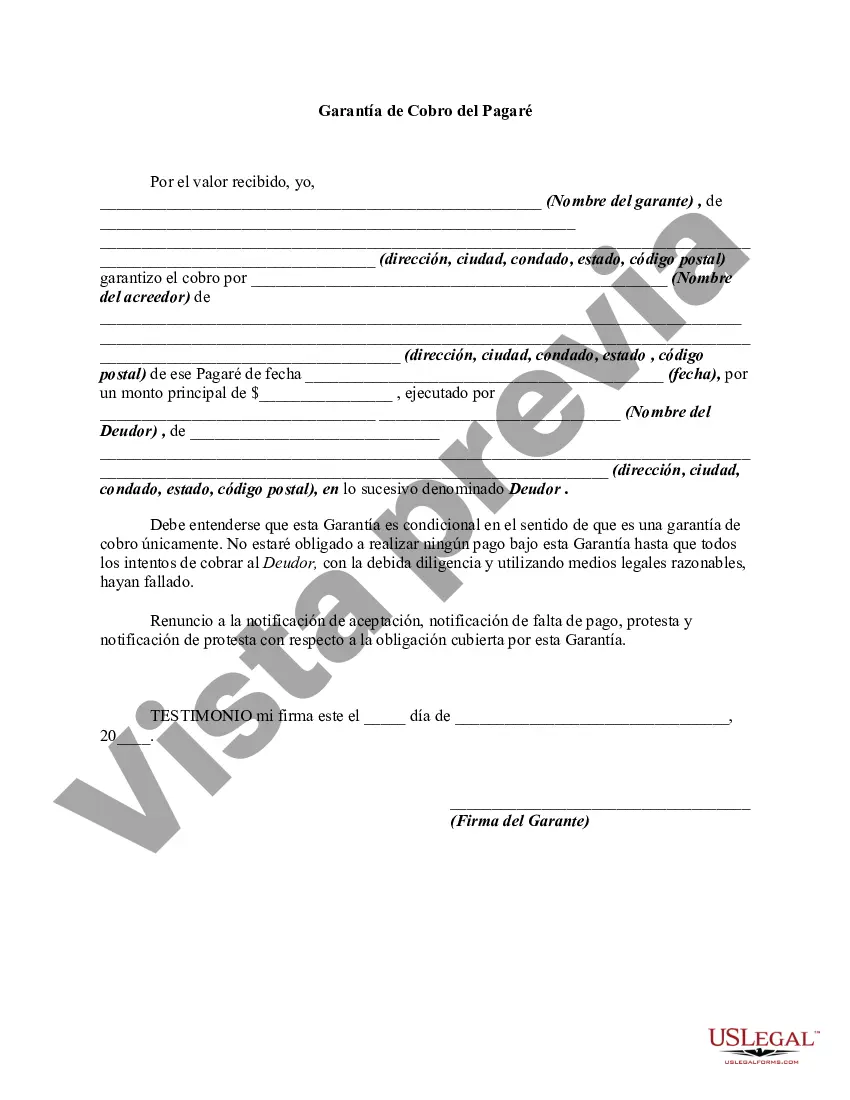

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. A guaranty of the payment of a debt is different from a guaranty of the collection of the debt. A guaranty of payment is absolute while a guaranty of collection is conditional.

A Harris Texas Guaranty of Collection of Promissory Note is a legally binding document that ensures the repayment of a promissory note in the state of Texas. It serves as a guarantee or an additional security measure for the lender by holding someone other than the borrower responsible for the repayment of the debt. This document protects the lender's interests in case the borrower fails to fulfill their payment obligations. However, it is important to note that there are no specific types or variations of a Harris Texas Guaranty of Collection of Promissory Note. The term refers to a standardized agreement that is commonly used in the state of Texas to protect lenders and facilitate loan transactions. Key terms often associated with a Harris Texas Guaranty of Collection of Promissory Note include: 1. Guarantor: The person or entity assuming responsibility for the repayment of the promissory note in case the borrower defaults. 2. Lender: The individual or organization providing the loan. 3. Borrower: The individual or organization receiving the loan and agreeing to repay it as per the terms and conditions outlined in the promissory note. 4. Promissory Note: A legal document that outlines the terms and conditions of a loan, including the repayment schedule, interest rate, and other relevant details. 5. Collection: The act of pursuing and recovering the owed funds from the borrower in case of default. 6. Liability: The legal obligation of the guarantor to fulfill the repayment obligations of the borrower if they fail to do so. 7. Jurisdiction: The location or state (e.g., Harris County, Texas) where the guaranty is enforceable and where any legal disputes would be resolved. In conclusion, a Harris Texas Guaranty of Collection of Promissory Note provides protection to lenders by holding guarantors responsible for the repayment of a promissory note in case the borrower defaults. Although there may not be different types of this guaranty, the document is widely used in Texas to secure loan transactions.A Harris Texas Guaranty of Collection of Promissory Note is a legally binding document that ensures the repayment of a promissory note in the state of Texas. It serves as a guarantee or an additional security measure for the lender by holding someone other than the borrower responsible for the repayment of the debt. This document protects the lender's interests in case the borrower fails to fulfill their payment obligations. However, it is important to note that there are no specific types or variations of a Harris Texas Guaranty of Collection of Promissory Note. The term refers to a standardized agreement that is commonly used in the state of Texas to protect lenders and facilitate loan transactions. Key terms often associated with a Harris Texas Guaranty of Collection of Promissory Note include: 1. Guarantor: The person or entity assuming responsibility for the repayment of the promissory note in case the borrower defaults. 2. Lender: The individual or organization providing the loan. 3. Borrower: The individual or organization receiving the loan and agreeing to repay it as per the terms and conditions outlined in the promissory note. 4. Promissory Note: A legal document that outlines the terms and conditions of a loan, including the repayment schedule, interest rate, and other relevant details. 5. Collection: The act of pursuing and recovering the owed funds from the borrower in case of default. 6. Liability: The legal obligation of the guarantor to fulfill the repayment obligations of the borrower if they fail to do so. 7. Jurisdiction: The location or state (e.g., Harris County, Texas) where the guaranty is enforceable and where any legal disputes would be resolved. In conclusion, a Harris Texas Guaranty of Collection of Promissory Note provides protection to lenders by holding guarantors responsible for the repayment of a promissory note in case the borrower defaults. Although there may not be different types of this guaranty, the document is widely used in Texas to secure loan transactions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.