A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. A guaranty of the payment of a debt is different from a guaranty of the collection of the debt. A guaranty of payment is absolute while a guaranty of collection is conditional.

Salt Lake Utah Guaranty of Collection of Promissory Note is a legal document executed to ensure the repayment of a promissory note by a borrower located in Salt Lake City, Utah. This agreement serves as a guarantee or assurance that the lender will receive the full amount owed under the promissory note in case of default. The Salt Lake Utah Guaranty of Collection of Promissory Note contains specific terms and conditions that outline the rights and obligations of the guarantor. It typically includes: 1. Parties involved: This section identifies the borrower, the lender, and the guarantor. 2. Promissory note details: The agreement provides a detailed description of the promissory note, including the principal amount, interest rate, repayment terms, and any applicable late fees or penalties. 3. Guarantor’s obligations: This section outlines the guarantor’s responsibilities, such as assuming liability for the borrower’s default and agreeing to repay the lender in case the borrower fails to do so. 4. Guarantor’s rights: The agreement may specify certain rights of the guarantor, such as the ability to participate in any legal actions against the borrower or to demand collateral provided by the borrower. 5. Notice requirements: The document may include provisions stating how and when the lender should notify the guarantor regarding the borrower's default and the intent to seek repayment. 6. Governing law: The Salt Lake Utah Guaranty of Collection of Promissory Note typically states that it is governed by the laws of the state of Utah. 7. Severability: This clause ensures that if any provision of the agreement is found to be unenforceable, the remaining provisions will still be valid. 8. Signatures and notarization: Both the guarantor and the lender sign the document, and it is often required to be notarized to ensure its legality. Different types of Salt Lake Utah Guaranty of Collection of Promissory Note may exist based on variations in specific terms and conditions, thus fulfilling the unique requirements of different lending arrangements. Some possible types include: 1. Limited Guaranty of Collection: This type of guaranty may limit the guarantor's liability to a specific amount or a defined period. 2. Continuing Guaranty: In this form of guaranty, the guarantor's obligations extend to multiple promissory notes or future loans. 3. Unconditional Guaranty: This type of guaranty ensures the guarantor's unconditional and unlimited liability for the repayment of the promissory note without any restrictions or conditions. In conclusion, the Salt Lake Utah Guaranty of Collection of Promissory Note is a legal instrument that secures the repayment of a promissory note and protects the lender's interests in Salt Lake City, Utah. These agreements involve various terms and conditions, and different types of guaranty may exist depending on the specific requirements of the borrowing arrangement.Salt Lake Utah Guaranty of Collection of Promissory Note is a legal document executed to ensure the repayment of a promissory note by a borrower located in Salt Lake City, Utah. This agreement serves as a guarantee or assurance that the lender will receive the full amount owed under the promissory note in case of default. The Salt Lake Utah Guaranty of Collection of Promissory Note contains specific terms and conditions that outline the rights and obligations of the guarantor. It typically includes: 1. Parties involved: This section identifies the borrower, the lender, and the guarantor. 2. Promissory note details: The agreement provides a detailed description of the promissory note, including the principal amount, interest rate, repayment terms, and any applicable late fees or penalties. 3. Guarantor’s obligations: This section outlines the guarantor’s responsibilities, such as assuming liability for the borrower’s default and agreeing to repay the lender in case the borrower fails to do so. 4. Guarantor’s rights: The agreement may specify certain rights of the guarantor, such as the ability to participate in any legal actions against the borrower or to demand collateral provided by the borrower. 5. Notice requirements: The document may include provisions stating how and when the lender should notify the guarantor regarding the borrower's default and the intent to seek repayment. 6. Governing law: The Salt Lake Utah Guaranty of Collection of Promissory Note typically states that it is governed by the laws of the state of Utah. 7. Severability: This clause ensures that if any provision of the agreement is found to be unenforceable, the remaining provisions will still be valid. 8. Signatures and notarization: Both the guarantor and the lender sign the document, and it is often required to be notarized to ensure its legality. Different types of Salt Lake Utah Guaranty of Collection of Promissory Note may exist based on variations in specific terms and conditions, thus fulfilling the unique requirements of different lending arrangements. Some possible types include: 1. Limited Guaranty of Collection: This type of guaranty may limit the guarantor's liability to a specific amount or a defined period. 2. Continuing Guaranty: In this form of guaranty, the guarantor's obligations extend to multiple promissory notes or future loans. 3. Unconditional Guaranty: This type of guaranty ensures the guarantor's unconditional and unlimited liability for the repayment of the promissory note without any restrictions or conditions. In conclusion, the Salt Lake Utah Guaranty of Collection of Promissory Note is a legal instrument that secures the repayment of a promissory note and protects the lender's interests in Salt Lake City, Utah. These agreements involve various terms and conditions, and different types of guaranty may exist depending on the specific requirements of the borrowing arrangement.

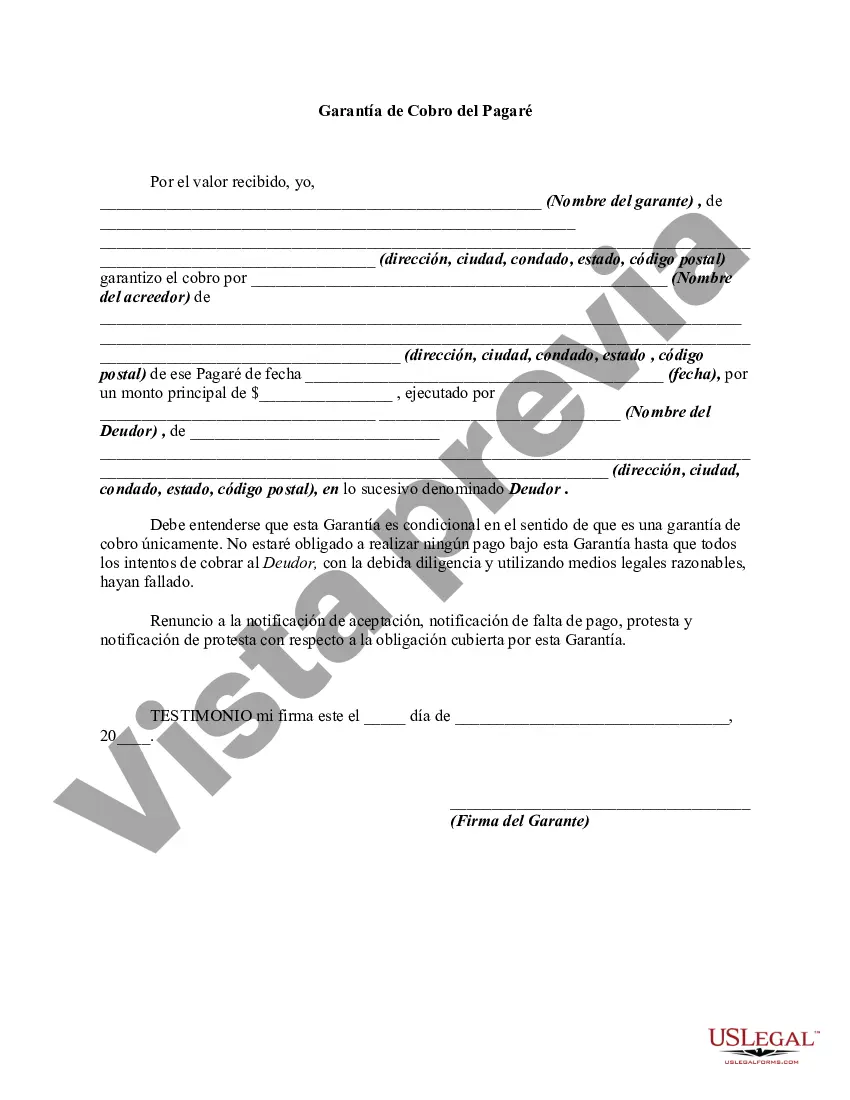

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.