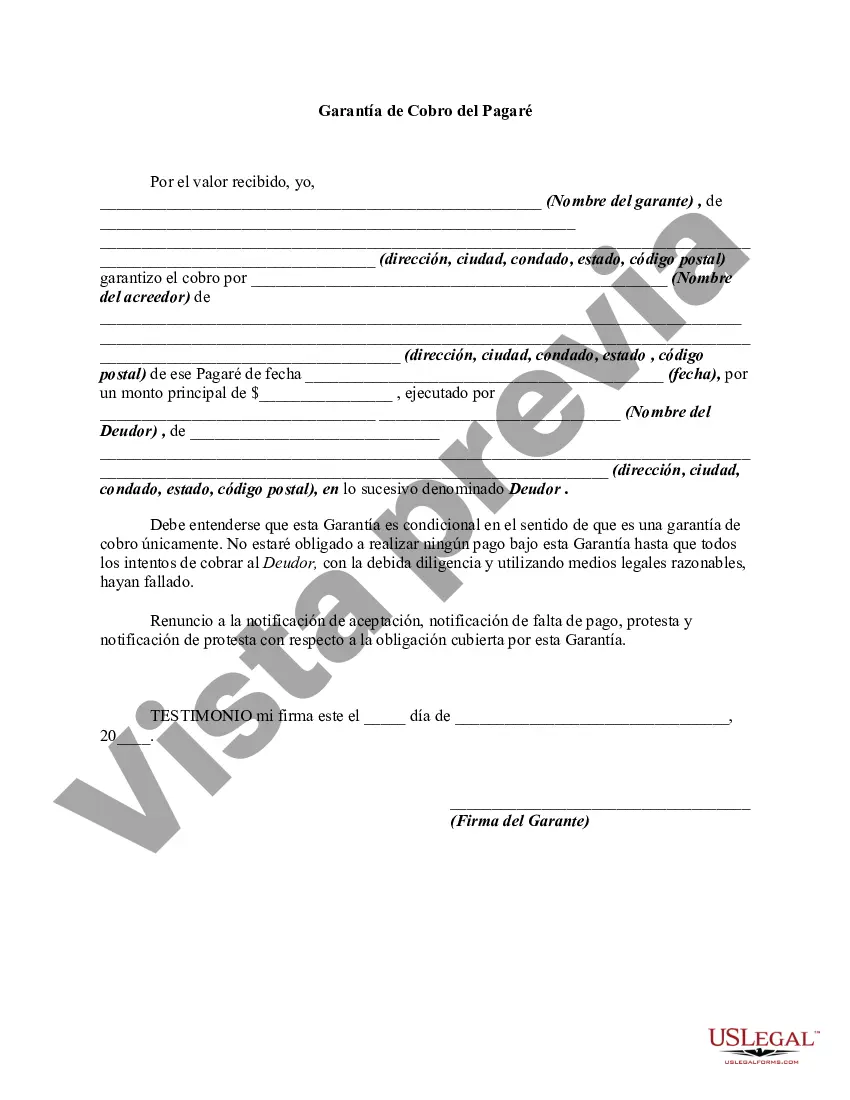

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. A guaranty of the payment of a debt is different from a guaranty of the collection of the debt. A guaranty of payment is absolute while a guaranty of collection is conditional.

San Diego California Guaranty of Collection of Promissory Note is a legal document that serves as a guarantee for the repayment of a promissory note in San Diego, California. It outlines the terms and conditions under which the guarantor agrees to be responsible for the collection of the promissory note in the event of default by the borrower. This type of guaranty is commonly used in various financial transactions, such as loans, mortgages, or credit agreements, to ensure that the lender has an additional layer of protection in case the borrower fails to repay the promissory note as agreed. It provides security and peace of mind to the lender, as it establishes a contractual obligation on the part of the guarantor to fulfill the borrower's obligations. The San Diego California Guaranty of Collection of Promissory Note typically includes the names and contact information of the borrower, the lender, and the guarantor. It clearly identifies the promissory note being guaranteed, stating the principal amount, interest rate, repayment terms, and any other relevant details. Furthermore, it specifies the conditions under which the guarantor's obligations will be triggered, such as the borrower's default or failure to make timely payments. The document also outlines the steps the guarantor should take to collect the outstanding debt, including the ability to pursue legal actions, if necessary. In San Diego, there may be variations or specific types of Guaranty of Collection of Promissory Note, based on specific circumstances or industries. Some examples include: 1. Real Estate Guaranty of Collection of Promissory Note: This type of guaranty is commonly used in real estate transactions, where a guarantor guarantees the repayment of a promissory note related to a real estate purchase, lease, or mortgage. It ensures that the lender has financial recourse in case of default. 2. Business Loan Guaranty of Collection of Promissory Note: This type of guaranty is used in commercial lending, where a business owner or partner guarantees the repayment of a business loan. It provides additional protection to the lender and is often required in small business financing. 3. Student Loan Guaranty of Collection of Promissory Note: In certain educational settings, a student may require a guarantor to secure a student loan. This guarantor would be responsible for the repayment of the loan if the student defaults. It is important to consult with legal professionals or experts specializing in San Diego, California law to ensure that the Guaranty of Collection of Promissory Note meets all necessary legal requirements and accurately reflects the specific details of the transaction.San Diego California Guaranty of Collection of Promissory Note is a legal document that serves as a guarantee for the repayment of a promissory note in San Diego, California. It outlines the terms and conditions under which the guarantor agrees to be responsible for the collection of the promissory note in the event of default by the borrower. This type of guaranty is commonly used in various financial transactions, such as loans, mortgages, or credit agreements, to ensure that the lender has an additional layer of protection in case the borrower fails to repay the promissory note as agreed. It provides security and peace of mind to the lender, as it establishes a contractual obligation on the part of the guarantor to fulfill the borrower's obligations. The San Diego California Guaranty of Collection of Promissory Note typically includes the names and contact information of the borrower, the lender, and the guarantor. It clearly identifies the promissory note being guaranteed, stating the principal amount, interest rate, repayment terms, and any other relevant details. Furthermore, it specifies the conditions under which the guarantor's obligations will be triggered, such as the borrower's default or failure to make timely payments. The document also outlines the steps the guarantor should take to collect the outstanding debt, including the ability to pursue legal actions, if necessary. In San Diego, there may be variations or specific types of Guaranty of Collection of Promissory Note, based on specific circumstances or industries. Some examples include: 1. Real Estate Guaranty of Collection of Promissory Note: This type of guaranty is commonly used in real estate transactions, where a guarantor guarantees the repayment of a promissory note related to a real estate purchase, lease, or mortgage. It ensures that the lender has financial recourse in case of default. 2. Business Loan Guaranty of Collection of Promissory Note: This type of guaranty is used in commercial lending, where a business owner or partner guarantees the repayment of a business loan. It provides additional protection to the lender and is often required in small business financing. 3. Student Loan Guaranty of Collection of Promissory Note: In certain educational settings, a student may require a guarantor to secure a student loan. This guarantor would be responsible for the repayment of the loan if the student defaults. It is important to consult with legal professionals or experts specializing in San Diego, California law to ensure that the Guaranty of Collection of Promissory Note meets all necessary legal requirements and accurately reflects the specific details of the transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.