A guaranty is an undertaking on the part of one person (the guarantor) that is collateral to an obligation of another person (the debtor or obligor), and which binds the guarantor to performance of the obligation in the event of default by the debtor or obligor. A guaranty agreement is a type of contract. Thus, questions relating to such matters as validity, interpretation, and enforceability of guaranty agreements are decided in accordance with basic principles of contract law.

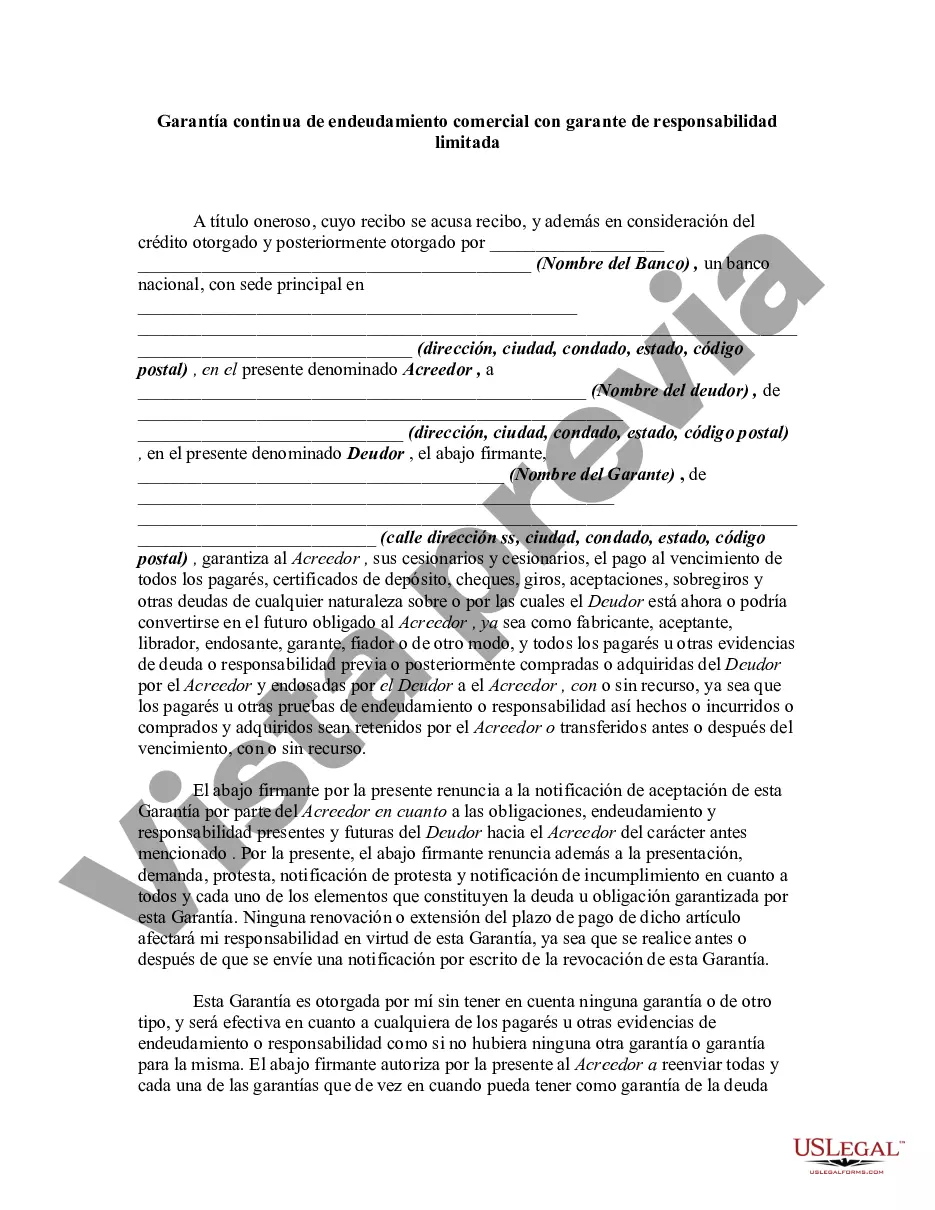

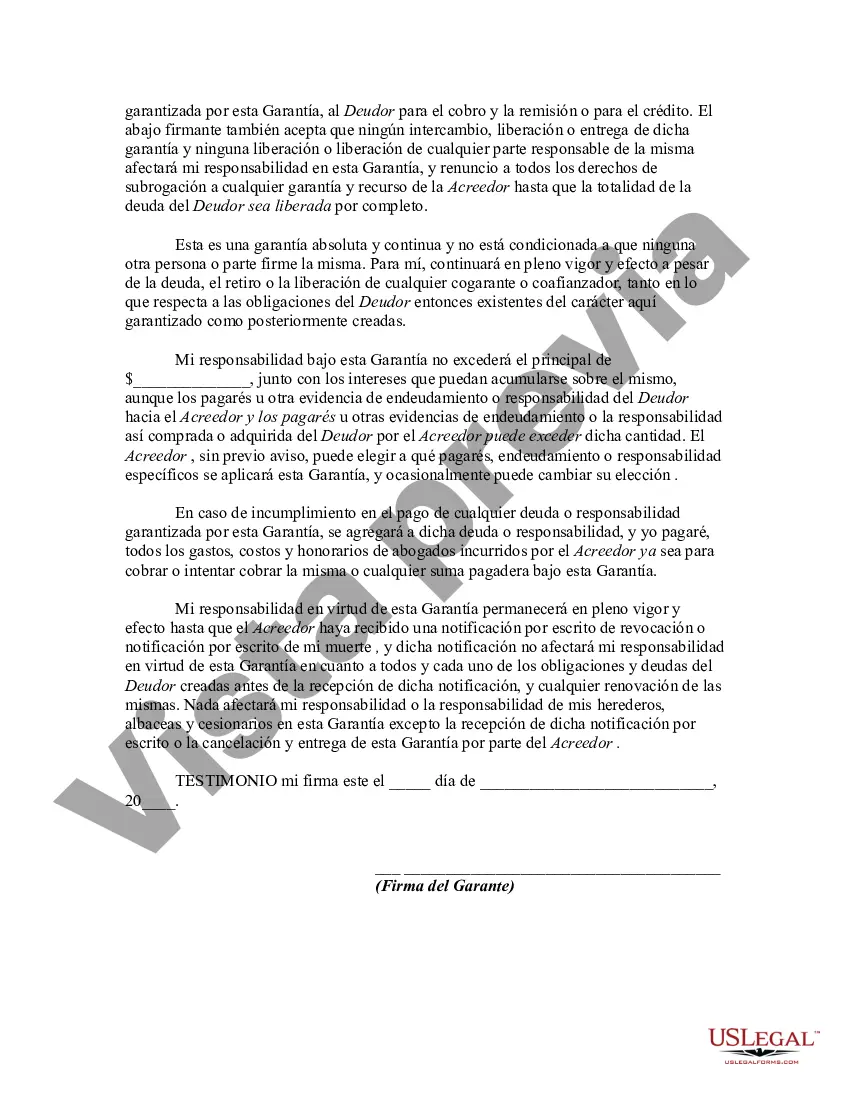

Phoenix Arizona Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability is a legally binding agreement that serves as a financial assurance for lenders and creditors. This agreement ensures that in cases where a business fails to meet its financial obligations, the guarantor with limited liability steps in to repay the outstanding debts. This article will delve into the key elements of this agreement, its importance, and potential variations in the Phoenix, Arizona area. In Phoenix, Arizona, the Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability is a crucial legal document that provides additional security to lenders and creditors. By having a guarantor with limited liability, these entities can mitigate the risks associated with lending funds or extending credit to businesses. This agreement guarantees the guarantor's commitment to assume responsibility for any unpaid debts or default on financial obligations, up to their pre-determined liability limit. Under the terms of the Phoenix, Arizona Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability, the guarantor, be it an individual or a separate legal entity, agrees to be held accountable for any outstanding debts of the business. The liability of the guarantor is predetermined and limited, safeguarding them from bearing the entire burden of the business's obligations. This limitation protects guarantors from severe financial repercussions in case of unforeseen events or business failures. While Phoenix, Arizona adheres to the general principles of Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability, there can be variations depending on the specific requirements of the involved parties. Some possible types or variations of this agreement in Phoenix, Arizona include: 1. Limited Liability Corporate Guaranty: In this case, a corporation acts as the guarantor, assuming limited responsibility for a business's debts and obligations. This structure separates the guarantor's liability from that of the business itself, protecting the corporation from excessive financial risk. 2. Personal Continuing Guaranty: A personal guarantor offering limited liability for business indebtedness. Individuals can pledge their assets or personal guarantees to secure business loans while establishing a liability limit, protecting their personal wealth. 3. Limited Partnership Guaranty: This type of guaranty involves a limited partner within a partnership, assuming limited liability for the business's debts. The limited partnership structure safeguards the partner's personal assets while offering some level of financial support to creditors. In summary, a Phoenix, Arizona Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability is a valuable tool for lenders and creditors to safeguard their financial interests. This agreement entails a pre-determined liability limit for the guarantor, protecting them from excessive personal financial risk. It offers the necessary security to lenders and creditors by ensuring an alternate source for debt repayment. Whether it is a limited liability corporate guaranty, personal continuing guaranty, or limited partnership guaranty, the underlying goal remains the same: to establish a legally binding agreement between the guarantor and the creditors, ensuring financial stability in business transactions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.