A guaranty is an undertaking on the part of one person (the guarantor) that is collateral to an obligation of another person (the debtor or obligor), and which binds the guarantor to performance of the obligation in the event of default by the debtor or obligor. A guaranty agreement is a type of contract. Thus, questions relating to such matters as validity, interpretation, and enforceability of guaranty agreements are decided in accordance with basic principles of contract law.

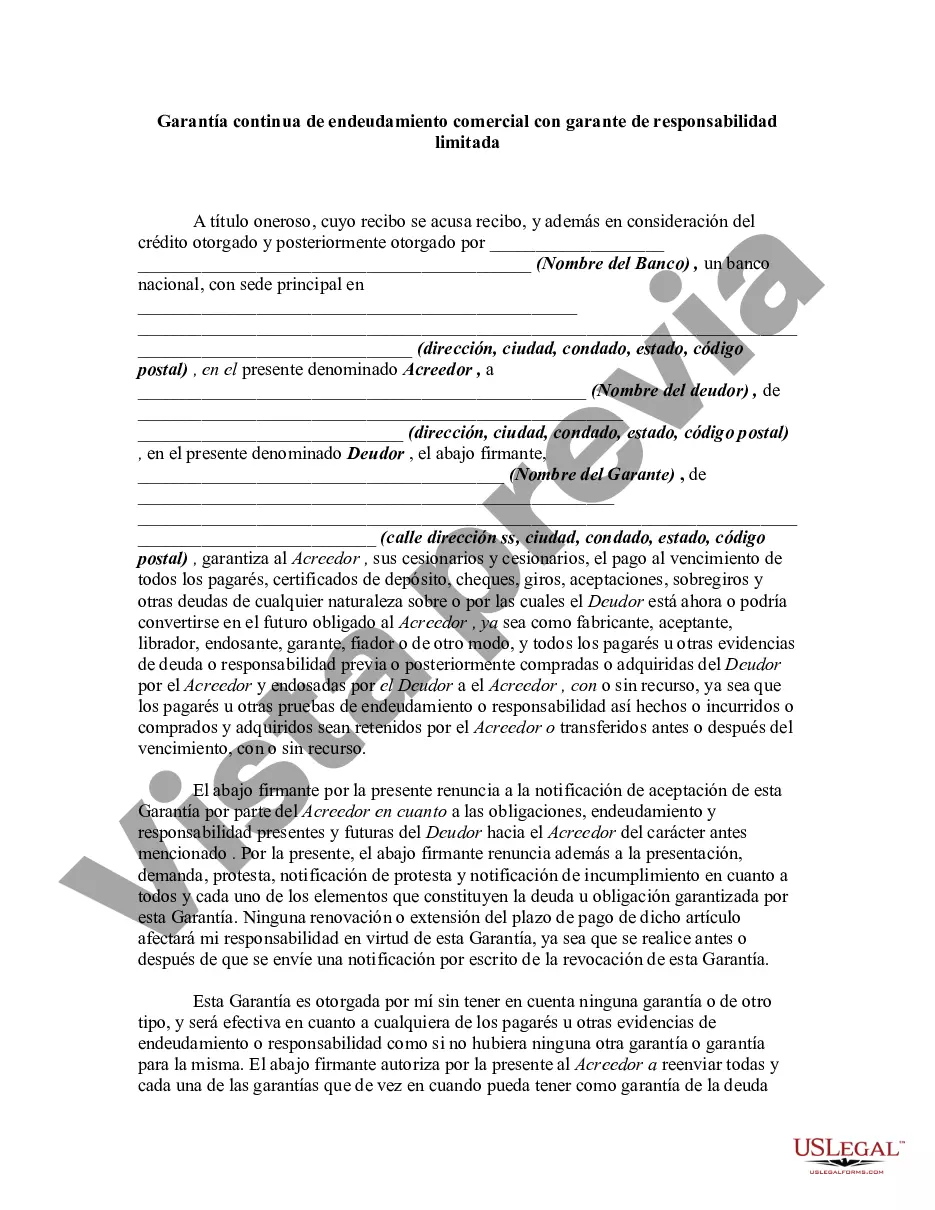

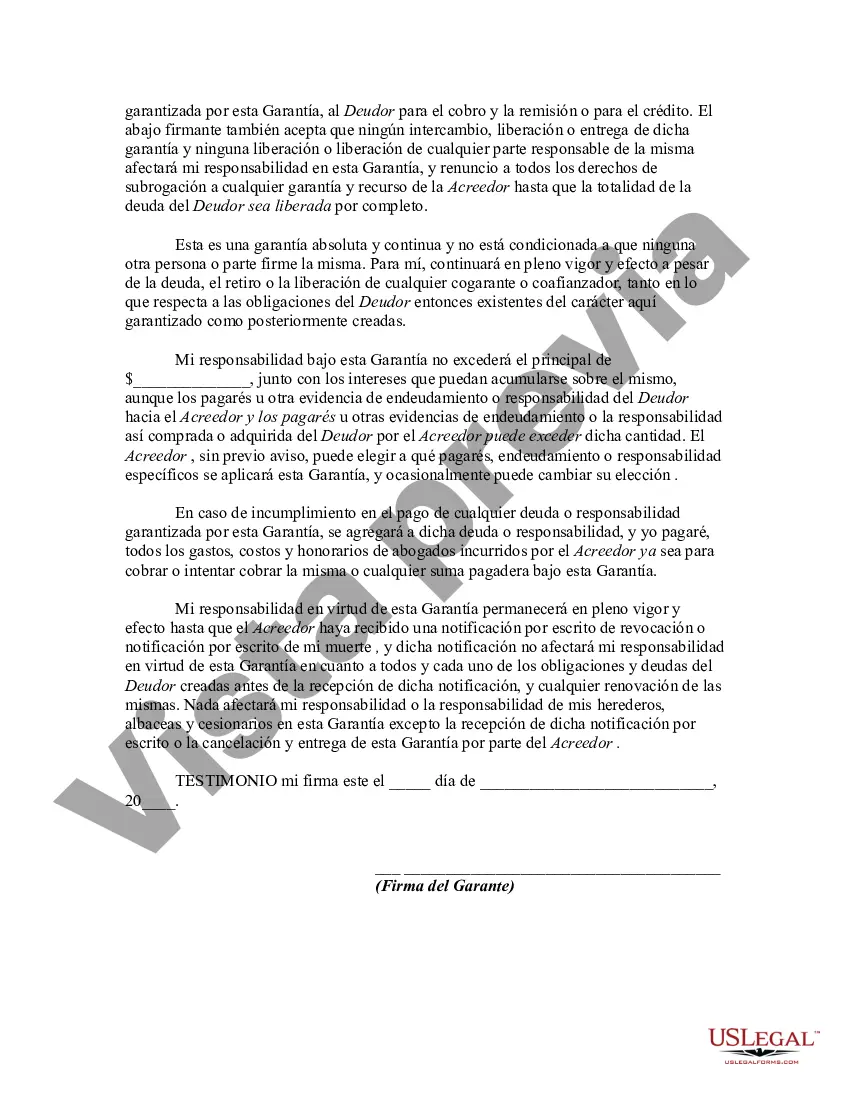

Lima, Arizona Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability In Lima, Arizona, a Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability is a legal document that outlines the agreement between a business debtor and a third-party guarantor who offers limited liability protection. This document is commonly used when a company seeks additional financial support but wants to mitigate the risk for the guarantor. The Lima, Arizona Continuing Guaranty of Business Indebtedness allows a business to secure credit or loans from creditors with the assurance that any default or non-payment will be covered by the guarantor, who will assume a specified amount of responsibility. However, unlike a typical guarantor arrangement, the guarantor in this case has limited liability, meaning their liability is restricted to a specific amount or duration. Different types of Lima, Arizona Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability may include: 1. Fixed Amount Limited Liability: In this scenario, the guarantor's liability is limited to a predetermined fixed amount. Once that amount is reached, the guarantor will not be responsible for any further debts or obligations. 2. Time-Limited Liability: Under this type of Continuing Guaranty, the guarantor's liability is restricted to a specific timeframe. Once the agreed-upon duration expires, the guarantor is no longer responsible for the business's indebtedness. 3. Debt-Specific Limited Liability: This form of Continuing Guaranty restricts the guarantor's responsibility to a particular indebtedness or financial obligation. The guarantor's liability may only be triggered if the specified debt defaults or remains unpaid. 4. Percentage-Limited Liability: In this variation, the guarantor's responsibility is limited to a certain percentage of the overall indebtedness. Once this threshold is achieved, the guarantor will not be liable for any additional amounts. It's important for both the business debtor and the guarantor to thoroughly review the terms and conditions of the Lima, Arizona Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability before entering into the agreement. Consulting with legal professionals experienced in business law is highly recommended ensuring compliance with local regulations and safeguard the interests of all parties involved.Lima, Arizona Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability In Lima, Arizona, a Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability is a legal document that outlines the agreement between a business debtor and a third-party guarantor who offers limited liability protection. This document is commonly used when a company seeks additional financial support but wants to mitigate the risk for the guarantor. The Lima, Arizona Continuing Guaranty of Business Indebtedness allows a business to secure credit or loans from creditors with the assurance that any default or non-payment will be covered by the guarantor, who will assume a specified amount of responsibility. However, unlike a typical guarantor arrangement, the guarantor in this case has limited liability, meaning their liability is restricted to a specific amount or duration. Different types of Lima, Arizona Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability may include: 1. Fixed Amount Limited Liability: In this scenario, the guarantor's liability is limited to a predetermined fixed amount. Once that amount is reached, the guarantor will not be responsible for any further debts or obligations. 2. Time-Limited Liability: Under this type of Continuing Guaranty, the guarantor's liability is restricted to a specific timeframe. Once the agreed-upon duration expires, the guarantor is no longer responsible for the business's indebtedness. 3. Debt-Specific Limited Liability: This form of Continuing Guaranty restricts the guarantor's responsibility to a particular indebtedness or financial obligation. The guarantor's liability may only be triggered if the specified debt defaults or remains unpaid. 4. Percentage-Limited Liability: In this variation, the guarantor's responsibility is limited to a certain percentage of the overall indebtedness. Once this threshold is achieved, the guarantor will not be liable for any additional amounts. It's important for both the business debtor and the guarantor to thoroughly review the terms and conditions of the Lima, Arizona Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability before entering into the agreement. Consulting with legal professionals experienced in business law is highly recommended ensuring compliance with local regulations and safeguard the interests of all parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.