A guaranty is an undertaking on the part of one person (the guarantor) that is collateral to an obligation of another person (the debtor or obligor), and which binds the guarantor to performance of the obligation in the event of default by the debtor or obligor. A guaranty agreement is a type of contract. Thus, questions relating to such matters as validity, interpretation, and enforceability of guaranty agreements are decided in accordance with basic principles of contract law.

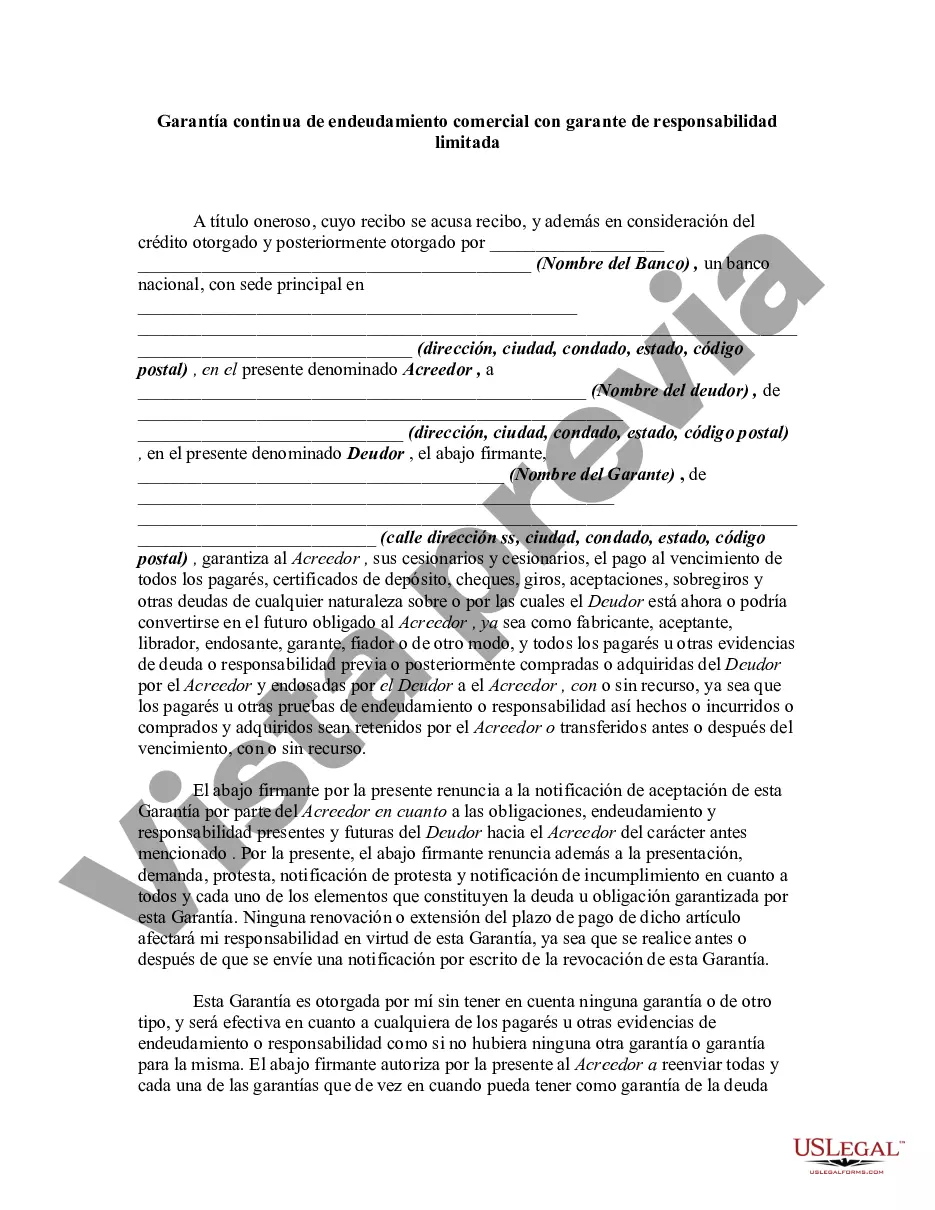

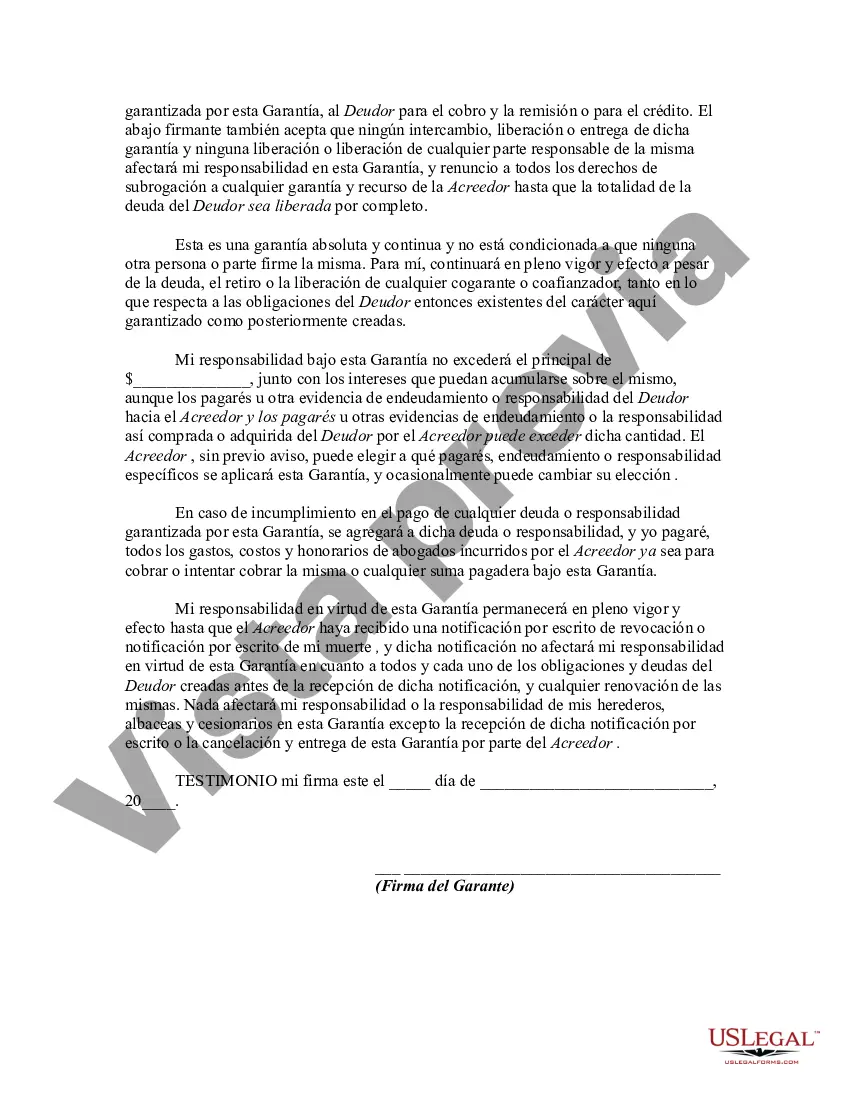

A San Diego California Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability is a legal agreement entered into by a business and a guarantor to ensure the repayment of any outstanding debts or obligations owed by the business. This type of guarantee is commonly used to provide additional security to lenders or creditors, allowing them to pursue the guarantor's assets or personal funds to recover any outstanding amounts if the business fails to fulfill its financial obligations. One of the main features of this agreement is the limited liability aspect of the guarantor. This means that the guarantor's liability is restricted to a certain amount or the value of specific assets pledged as collateral. This limitation acts as a protective measure for the guarantor, reducing their exposure to financial risk. In San Diego, California, there may be different variations or specific types of Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability depending on the terms and conditions negotiated between the parties involved. For example, some variations may include: 1. Limited Personal Guaranty: This type of guaranty may impose a cap on the guarantor's personal liability, limiting their obligation to a specific dollar amount or a set percentage of the business indebtedness. 2. Asset-Based Guaranty: In this case, the guarantor pledges specific assets as collateral to secure the repayment of the business's debts. The extent of the guarantor's liability is tied to the value of these assets. 3. Time-Limited Guaranty: This type of guaranty may have a predetermined expiration date or a specific timeframe during which the guarantor's liability is in effect. Once the period expires, the guarantor is released from any further obligations. 4. Joint and Several guaranties: This variation involves multiple guarantors who are collectively and individually responsible for the business's indebtedness. Each guarantor can be pursued for the full amount owed, making it easier for the lender to recover their funds. In summary, a San Diego California Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability is a legal agreement created to ensure the repayment of a business's outstanding debts. By restricting the guarantor's liability and defining the terms and conditions of the guaranty, this agreement provides additional security to lenders and protects the guarantor from excessive financial risk. Different variations of this guaranty exist, such as the limited personal guaranty, asset-based guaranty, time-limited guaranty, and joint and several guaranties, allowing for customization to suit the specific needs and circumstances of the parties involved.A San Diego California Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability is a legal agreement entered into by a business and a guarantor to ensure the repayment of any outstanding debts or obligations owed by the business. This type of guarantee is commonly used to provide additional security to lenders or creditors, allowing them to pursue the guarantor's assets or personal funds to recover any outstanding amounts if the business fails to fulfill its financial obligations. One of the main features of this agreement is the limited liability aspect of the guarantor. This means that the guarantor's liability is restricted to a certain amount or the value of specific assets pledged as collateral. This limitation acts as a protective measure for the guarantor, reducing their exposure to financial risk. In San Diego, California, there may be different variations or specific types of Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability depending on the terms and conditions negotiated between the parties involved. For example, some variations may include: 1. Limited Personal Guaranty: This type of guaranty may impose a cap on the guarantor's personal liability, limiting their obligation to a specific dollar amount or a set percentage of the business indebtedness. 2. Asset-Based Guaranty: In this case, the guarantor pledges specific assets as collateral to secure the repayment of the business's debts. The extent of the guarantor's liability is tied to the value of these assets. 3. Time-Limited Guaranty: This type of guaranty may have a predetermined expiration date or a specific timeframe during which the guarantor's liability is in effect. Once the period expires, the guarantor is released from any further obligations. 4. Joint and Several guaranties: This variation involves multiple guarantors who are collectively and individually responsible for the business's indebtedness. Each guarantor can be pursued for the full amount owed, making it easier for the lender to recover their funds. In summary, a San Diego California Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability is a legal agreement created to ensure the repayment of a business's outstanding debts. By restricting the guarantor's liability and defining the terms and conditions of the guaranty, this agreement provides additional security to lenders and protects the guarantor from excessive financial risk. Different variations of this guaranty exist, such as the limited personal guaranty, asset-based guaranty, time-limited guaranty, and joint and several guaranties, allowing for customization to suit the specific needs and circumstances of the parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.