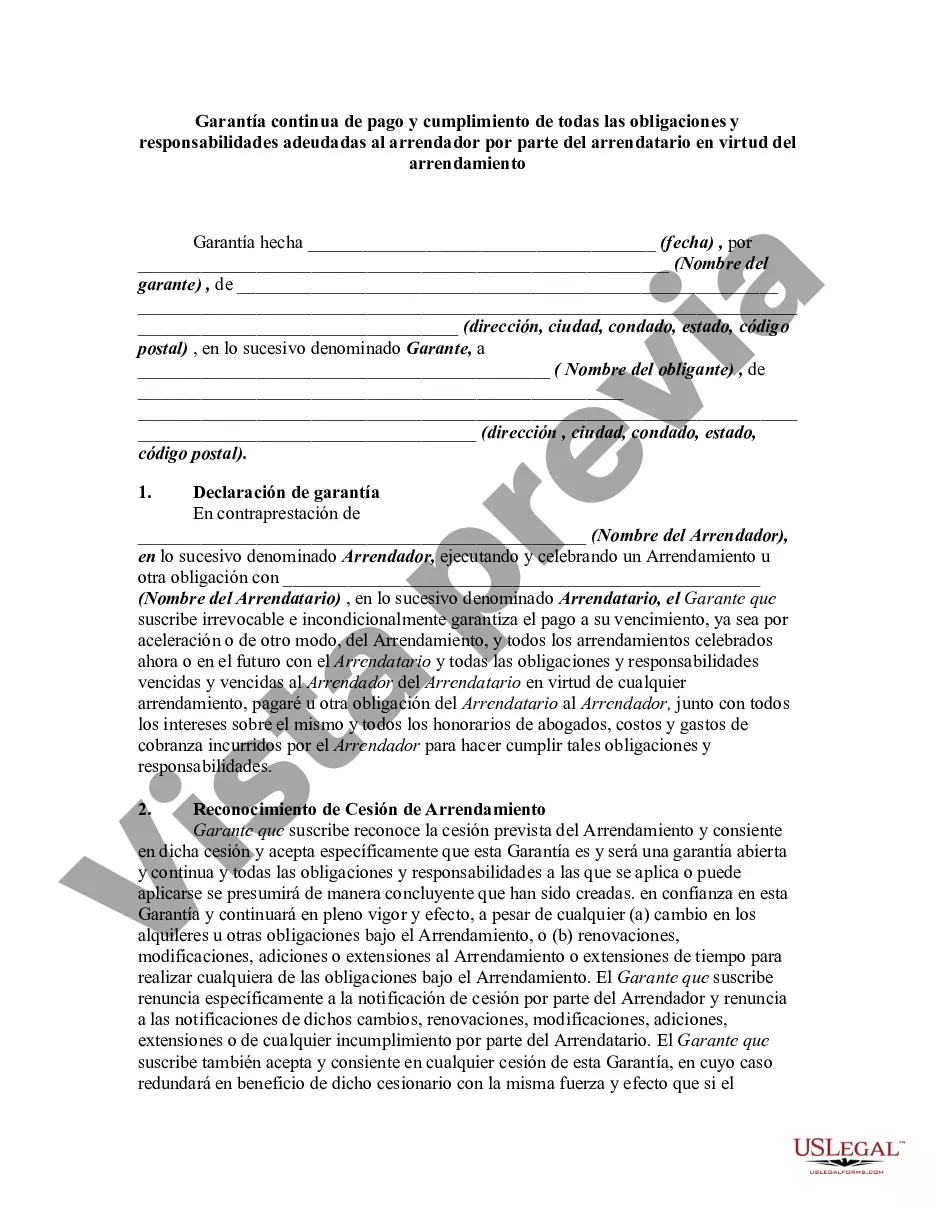

In this guaranty, the guarantor is guaranteeing both payment and performance of all leases now or later entered into with lessee and all the obligations and liabilities due and to become due to lessor from lessee under any lease, note, or other obligation of lessee to lessor. Such a blanket guaranty would suggest a close business relationship between the lessee and guarantor like that of a parent and subsidiary corporation.

A Salt Lake Utah Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease is a legal document that serves as a promise from a third party (usually an individual or a company) to guarantee the payment and performance of all obligations and liabilities owed to the lessor by the lessee in a lease agreement. This type of guaranty is commonly used in commercial real estate leasing transactions and provides an added layer of security for the lessor. Keywords: Salt Lake Utah, continuing guaranty, payment, performance, obligations, liabilities, lessor, lessee, lease. There are different variations of Salt Lake Utah Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease: 1. Individual Guaranty: This type of guaranty involves a specific individual (guarantor) guaranteeing the payment and performance of all obligations and liabilities of the lessee. 2. Corporate Guaranty: In this case, a corporation guarantees the payment and performance of the lessee's obligations and liabilities. The guarantor in this scenario is the corporation itself, rather than an individual. 3. Limited Guaranty: A limited guaranty places certain restrictions or limitations on the guarantor's obligations. It may limit the guarantor's liability to a specific amount or for a certain period. 4. Absolute Guaranty: An absolute guaranty offers an unconditional promise from the guarantor to fully pay and perform all obligations and liabilities of the lessee without any restrictions or limitations. 5. Conditional Guaranty: This type of guaranty is contingent upon specific conditions being met, such as the failure of the lessee to fulfill their obligations or the occurrence of certain events outlined in the lease agreement. 6. Subordinate Guaranty: A subordinate guaranty means that the guarantor agrees that their obligations and liabilities will be secondary to any other existing liens or claims on the leased property. This type of guaranty may be necessary when multiple parties have an interest in the property. In conclusion, a Salt Lake Utah Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease is a legally binding document that provides assurance to the lessor that the obligations and liabilities of the lessee will be fulfilled. Various types of guaranties exist, including individual, corporate, limited, absolute, conditional, and subordinate guaranties. Each type has its own specific conditions and limitations, offering different levels of security for the lessor.A Salt Lake Utah Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease is a legal document that serves as a promise from a third party (usually an individual or a company) to guarantee the payment and performance of all obligations and liabilities owed to the lessor by the lessee in a lease agreement. This type of guaranty is commonly used in commercial real estate leasing transactions and provides an added layer of security for the lessor. Keywords: Salt Lake Utah, continuing guaranty, payment, performance, obligations, liabilities, lessor, lessee, lease. There are different variations of Salt Lake Utah Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease: 1. Individual Guaranty: This type of guaranty involves a specific individual (guarantor) guaranteeing the payment and performance of all obligations and liabilities of the lessee. 2. Corporate Guaranty: In this case, a corporation guarantees the payment and performance of the lessee's obligations and liabilities. The guarantor in this scenario is the corporation itself, rather than an individual. 3. Limited Guaranty: A limited guaranty places certain restrictions or limitations on the guarantor's obligations. It may limit the guarantor's liability to a specific amount or for a certain period. 4. Absolute Guaranty: An absolute guaranty offers an unconditional promise from the guarantor to fully pay and perform all obligations and liabilities of the lessee without any restrictions or limitations. 5. Conditional Guaranty: This type of guaranty is contingent upon specific conditions being met, such as the failure of the lessee to fulfill their obligations or the occurrence of certain events outlined in the lease agreement. 6. Subordinate Guaranty: A subordinate guaranty means that the guarantor agrees that their obligations and liabilities will be secondary to any other existing liens or claims on the leased property. This type of guaranty may be necessary when multiple parties have an interest in the property. In conclusion, a Salt Lake Utah Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease is a legally binding document that provides assurance to the lessor that the obligations and liabilities of the lessee will be fulfilled. Various types of guaranties exist, including individual, corporate, limited, absolute, conditional, and subordinate guaranties. Each type has its own specific conditions and limitations, offering different levels of security for the lessor.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.