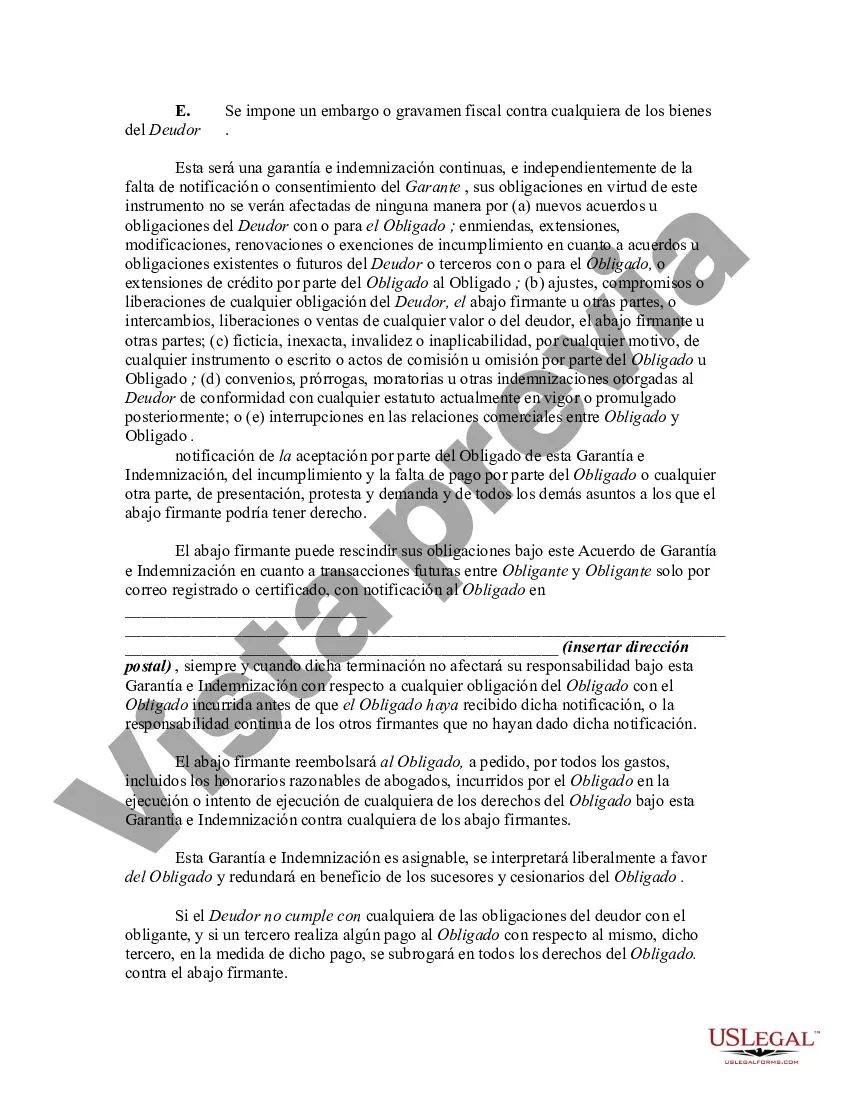

A guaranty is an undertaking on the part of one person (the guarantor) which binds the guarantor to performing the obligation of the debtor or obligor in the event of default by the debtor or obligor. The contract of guaranty may be absolute or it may be conditional. An absolute or unconditional guaranty is a contract by which the guarantor has promised that if the debtor does not perform the obligation or obligations, the guarantor will perform some act (such as the payment of money) to or for the benefit of the creditor.

A guaranty may be either continuing or restricted. The contract is restricted if it is limited to the guaranty of a single transaction or to a limited number of specific transactions and is not effective as to transactions other than those guaranteed. The contract is continuing if it contemplates a future course of dealing during an indefinite period, or if it is intended to cover a series of transactions or a succession of credits, or if its purpose is to give to the principal debtor a standing credit to be used by him or her from time to time.

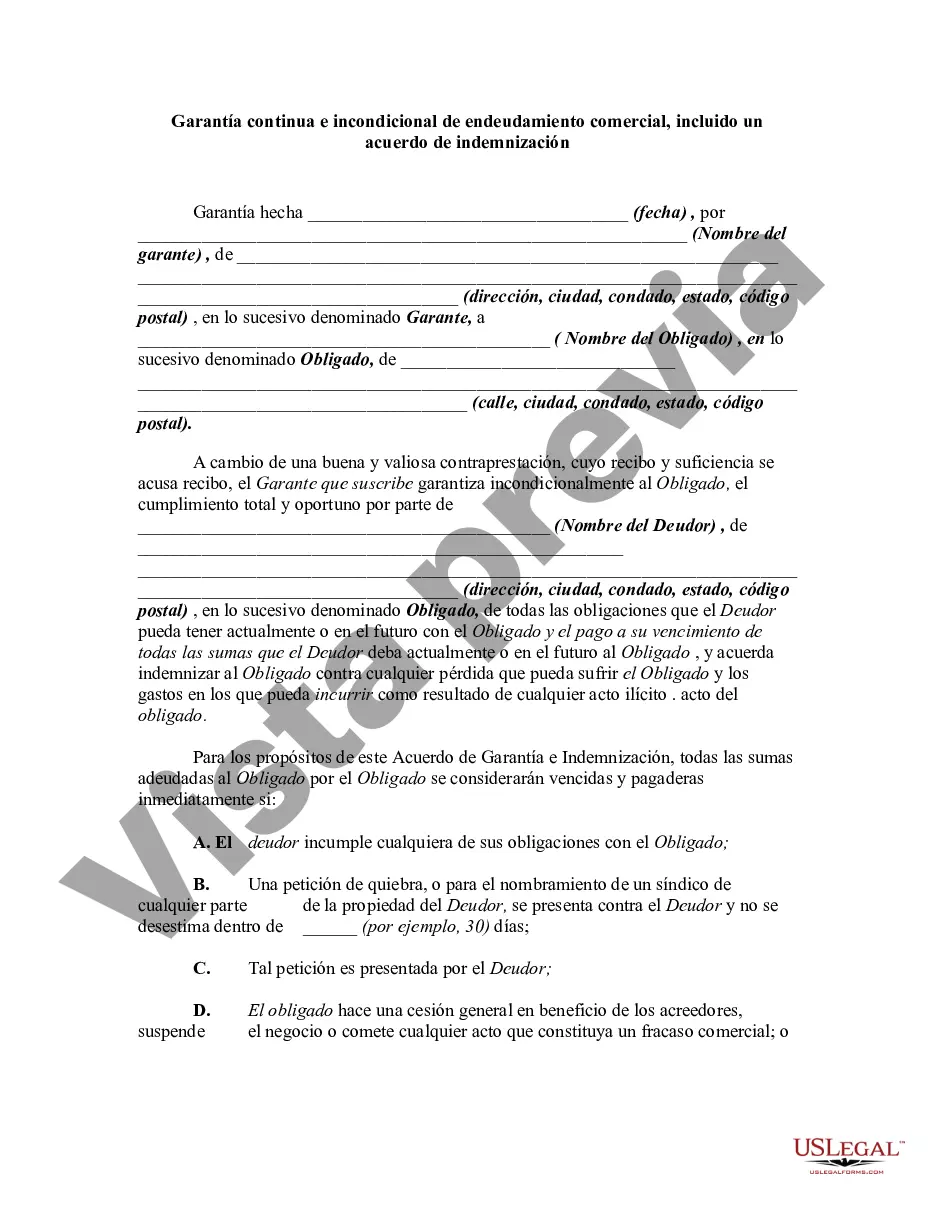

Oakland Michigan Continuing and Unconditional Guaranty of Business Indebtedness Including an Indemnity Agreement is a legal contract that aims to provide financial security to lenders or creditors in case of default on business loans or other forms of debt by a borrower in Oakland County, Michigan. This guaranty agreement ensures that the guarantor takes responsibility for the fulfillment of the borrower's obligations, including repayment of the debt and any associated expenses. Key terms included in the Oakland Michigan Continuing and Unconditional Guaranty of Business Indebtedness Including an Indemnity Agreement may address the following: 1. Parties Involved: The guaranty agreement defines the parties involved, including the lender, borrower, and guarantor. It specifies their legal names, addresses, and roles in the agreement. 2. Debt Coverage: The agreement lists the specific indebtedness or loans that the guarantor assumes responsibility for. It outlines the loan amounts, interest rates, due dates, and any collateral associated with the debt. 3. Continuing and Unconditional Guaranty: This type of guaranty is "continuing" and remains in effect until the debt is fully repaid, even if the lender makes alterations to the loan terms. It is also "unconditional" as the guarantor relinquishes any defenses or requirements before fully assuming responsibility for the debt. 4. Scope of Guarantor's Liability: The guaranty agreement defines the extent of the guarantor's liability, specifying that it is not limited to the borrower's default but extends to all amounts owed under the loan agreement, including interest, penalties, legal fees, and collection costs. 5. Indemnity Agreement: Along with the guaranty, an indemnity agreement may be included. This agreement ensures that the guarantor indemnifies the lender against any losses, damages, or expenses incurred due to the borrower's default. 6. Termination and Amendments: The agreement may outline the circumstances under which the guarantor's obligations can be terminated, such as full repayment of the debt or mutual consent of all parties involved. It may also include provisions regarding amendments to the agreement, requiring written consent or formal notice. It's important to note that variations or specific types of Oakland Michigan Continuing and Unconditional Guaranty of Business Indebtedness Including an Indemnity Agreement may exist based on factors such as the nature of the business, the type of debt, or specific lender requirements. However, the key elements mentioned above generally form the foundation of such agreements.Oakland Michigan Continuing and Unconditional Guaranty of Business Indebtedness Including an Indemnity Agreement is a legal contract that aims to provide financial security to lenders or creditors in case of default on business loans or other forms of debt by a borrower in Oakland County, Michigan. This guaranty agreement ensures that the guarantor takes responsibility for the fulfillment of the borrower's obligations, including repayment of the debt and any associated expenses. Key terms included in the Oakland Michigan Continuing and Unconditional Guaranty of Business Indebtedness Including an Indemnity Agreement may address the following: 1. Parties Involved: The guaranty agreement defines the parties involved, including the lender, borrower, and guarantor. It specifies their legal names, addresses, and roles in the agreement. 2. Debt Coverage: The agreement lists the specific indebtedness or loans that the guarantor assumes responsibility for. It outlines the loan amounts, interest rates, due dates, and any collateral associated with the debt. 3. Continuing and Unconditional Guaranty: This type of guaranty is "continuing" and remains in effect until the debt is fully repaid, even if the lender makes alterations to the loan terms. It is also "unconditional" as the guarantor relinquishes any defenses or requirements before fully assuming responsibility for the debt. 4. Scope of Guarantor's Liability: The guaranty agreement defines the extent of the guarantor's liability, specifying that it is not limited to the borrower's default but extends to all amounts owed under the loan agreement, including interest, penalties, legal fees, and collection costs. 5. Indemnity Agreement: Along with the guaranty, an indemnity agreement may be included. This agreement ensures that the guarantor indemnifies the lender against any losses, damages, or expenses incurred due to the borrower's default. 6. Termination and Amendments: The agreement may outline the circumstances under which the guarantor's obligations can be terminated, such as full repayment of the debt or mutual consent of all parties involved. It may also include provisions regarding amendments to the agreement, requiring written consent or formal notice. It's important to note that variations or specific types of Oakland Michigan Continuing and Unconditional Guaranty of Business Indebtedness Including an Indemnity Agreement may exist based on factors such as the nature of the business, the type of debt, or specific lender requirements. However, the key elements mentioned above generally form the foundation of such agreements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.