A guaranty is an undertaking on the part of one person (the guarantor) which binds the guarantor to performing the obligation of the debtor or obligor in the event of default by the debtor or obligor. The contract of guaranty may be absolute or it may be conditional. An absolute or unconditional guaranty is a contract by which the guarantor has promised that if the debtor does not perform the obligation or obligations, the guarantor will perform some act (such as the payment of money) to or for the benefit of the creditor.

A guaranty may be either continuing or restricted. The contract is restricted if it is limited to the guaranty of a single transaction or to a limited number of specific transactions and is not effective as to transactions other than those guaranteed. The contract is continuing if it contemplates a future course of dealing during an indefinite period, or if it is intended to cover a series of transactions or a succession of credits, or if its purpose is to give to the principal debtor a standing credit to be used by him or her from time to time.

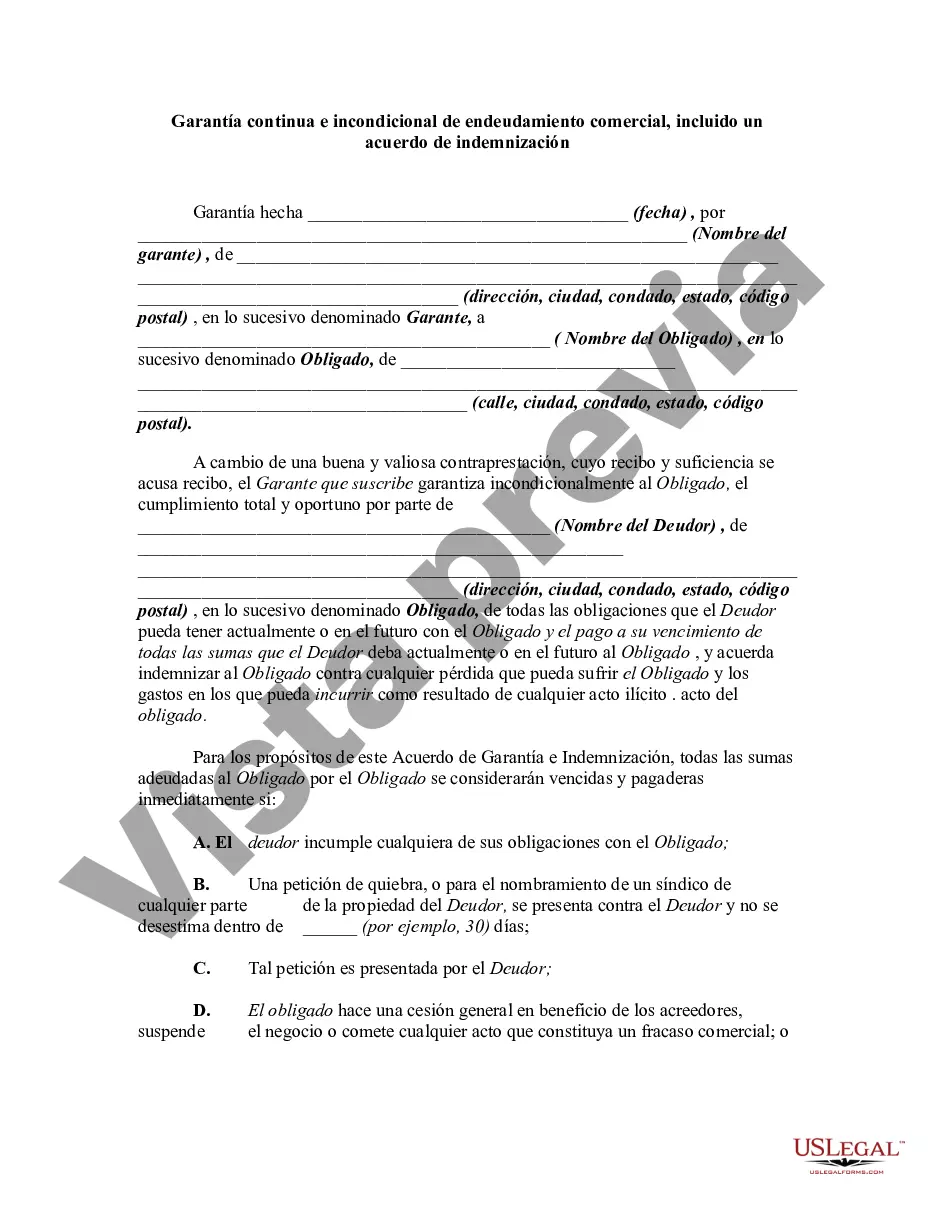

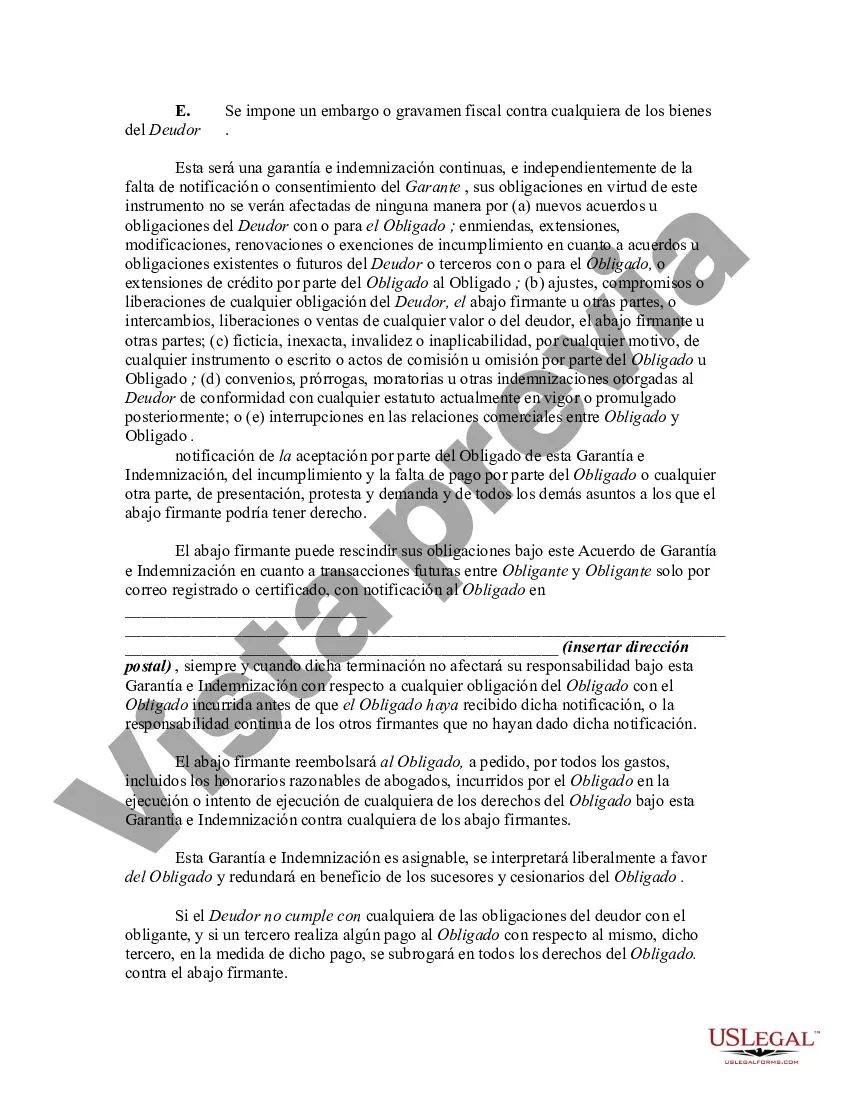

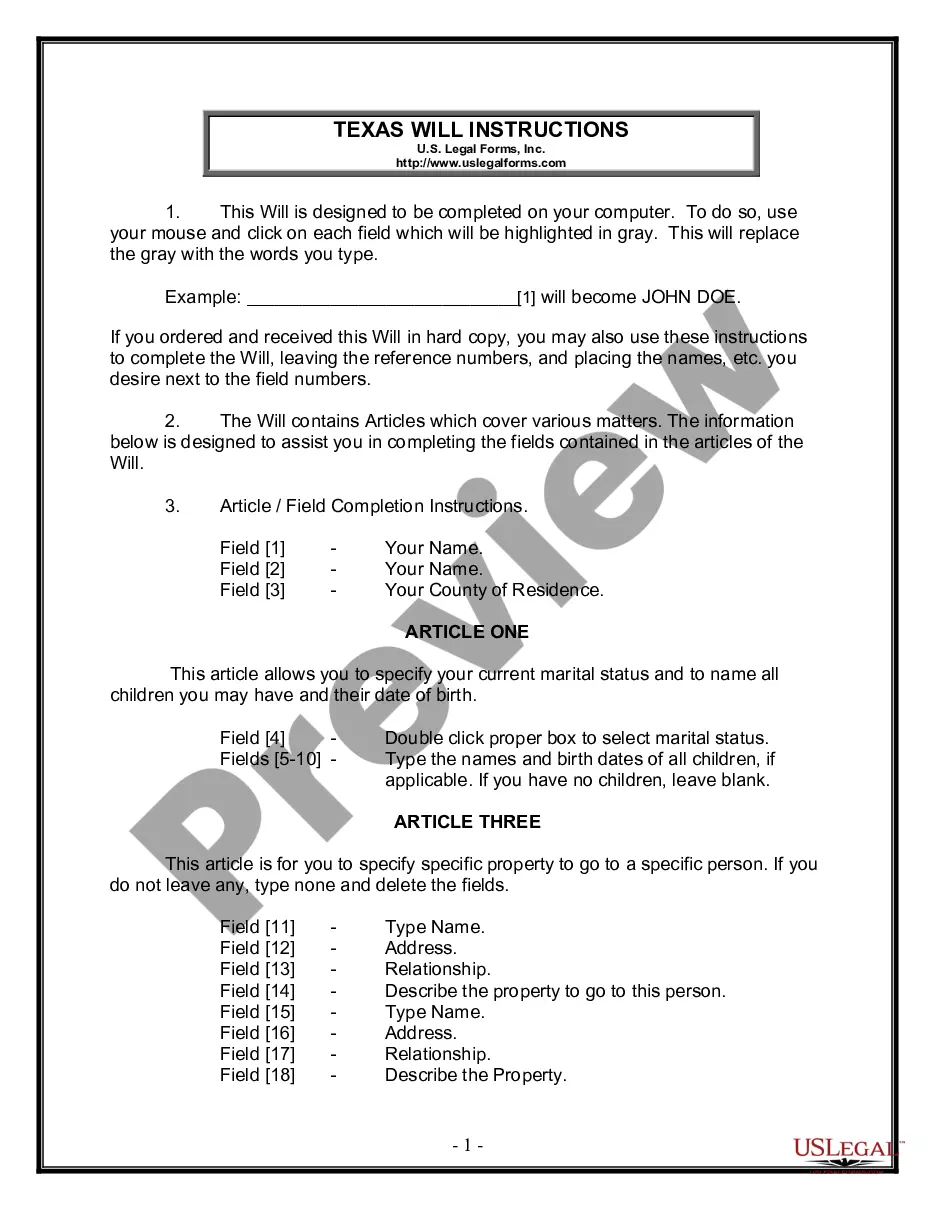

Title: Understanding Wayne Michigan Continuing and Unconditional Guaranty of Business Indebtedness Including an Indemnity Agreement Introduction: In Wayne, Michigan, businesses often use Continuing and Unconditional Guaranty of Business Indebtedness Including an Indemnity Agreement to provide financial security and assurance to lenders. This detailed guide examines the various types and key provisions of Wayne Michigan's Guaranty of Business Indebtedness Including an Indemnity Agreement, shedding light on its importance for both businesses and lenders. 1. Definition and Purpose: A Continuing and Unconditional Guaranty of Business Indebtedness Including an Indemnity Agreement is a legal contract signed by a business entity, also known as the guarantor, guaranteeing the repayment of a loan or credit facility taken by another entity, referred to as the principal debtor. The primary purpose is to ensure that lenders are protected against any potential default on the indebtedness. 2. Types of Wayne Michigan Continuing and Unconditional Guaranty: a) General Continuing Guaranty: This form of guaranty applies to a specific loan or credit facility and remains in effect until the full repayment or satisfaction of the indebtedness. b) Continuing Blanket Guaranty: This guaranty covers multiple loans or credit facilities, often offered by the same lender or financial institution. It provides blanket coverage for any present or future indebtedness, including loans, credit lines, and other financial obligations. 3. Key Provisions: a) Continuing and Unconditional Nature: The guarantor's obligation is ongoing and remains effective until the debt is repaid. It is not contingent upon any change in circumstances or events. b) Personal Guarantee: The guarantor agrees to be personally liable for the repayment of the indebtedness in case of default by the principal debtor. c) Indemnity Agreement: This provision requires the guarantor to indemnify and hold the lender harmless from any losses, claims, or damages arising from the guarantor's breach or failure to perform their obligations. d) Waiver of Rights: The guarantor typically waives certain rights, such as the right to notice of default or demand for payment, ensuring a quicker resolution in case of non-payment. e) Enforceability: The Guaranty is enforceable under Wayne Michigan law, empowering the lender to take legal action to recover the debt owed. Conclusion: Wayne Michigan Continuing and Unconditional Guaranty of Business Indebtedness Including an Indemnity Agreement is a crucial legal tool that provides lenders with additional security and peace of mind when extending credit or loans to businesses. Understanding the different types and key provisions of these Guaranty agreements is essential for businesses looking to secure financing and lenders seeking robust protection against defaults.Title: Understanding Wayne Michigan Continuing and Unconditional Guaranty of Business Indebtedness Including an Indemnity Agreement Introduction: In Wayne, Michigan, businesses often use Continuing and Unconditional Guaranty of Business Indebtedness Including an Indemnity Agreement to provide financial security and assurance to lenders. This detailed guide examines the various types and key provisions of Wayne Michigan's Guaranty of Business Indebtedness Including an Indemnity Agreement, shedding light on its importance for both businesses and lenders. 1. Definition and Purpose: A Continuing and Unconditional Guaranty of Business Indebtedness Including an Indemnity Agreement is a legal contract signed by a business entity, also known as the guarantor, guaranteeing the repayment of a loan or credit facility taken by another entity, referred to as the principal debtor. The primary purpose is to ensure that lenders are protected against any potential default on the indebtedness. 2. Types of Wayne Michigan Continuing and Unconditional Guaranty: a) General Continuing Guaranty: This form of guaranty applies to a specific loan or credit facility and remains in effect until the full repayment or satisfaction of the indebtedness. b) Continuing Blanket Guaranty: This guaranty covers multiple loans or credit facilities, often offered by the same lender or financial institution. It provides blanket coverage for any present or future indebtedness, including loans, credit lines, and other financial obligations. 3. Key Provisions: a) Continuing and Unconditional Nature: The guarantor's obligation is ongoing and remains effective until the debt is repaid. It is not contingent upon any change in circumstances or events. b) Personal Guarantee: The guarantor agrees to be personally liable for the repayment of the indebtedness in case of default by the principal debtor. c) Indemnity Agreement: This provision requires the guarantor to indemnify and hold the lender harmless from any losses, claims, or damages arising from the guarantor's breach or failure to perform their obligations. d) Waiver of Rights: The guarantor typically waives certain rights, such as the right to notice of default or demand for payment, ensuring a quicker resolution in case of non-payment. e) Enforceability: The Guaranty is enforceable under Wayne Michigan law, empowering the lender to take legal action to recover the debt owed. Conclusion: Wayne Michigan Continuing and Unconditional Guaranty of Business Indebtedness Including an Indemnity Agreement is a crucial legal tool that provides lenders with additional security and peace of mind when extending credit or loans to businesses. Understanding the different types and key provisions of these Guaranty agreements is essential for businesses looking to secure financing and lenders seeking robust protection against defaults.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.