Allegheny Pennsylvania Limited Liability Partnership Agreement is a legal document that serves as a contractual agreement between two or more businesses or individuals forming a limited liability partnership (LLP) in the state of Pennsylvania, specifically in the county of Allegheny. This partnership agreement outlines the rights, responsibilities, and obligations of each partner involved, as well as the terms and conditions on which the partnership will operate. Some relevant keywords relating to Allegheny Pennsylvania Limited Liability Partnership Agreement include: 1. Limited Liability Partnership (LLP): An organizational structure that combines the benefits of a partnership and a corporation, providing limited liability to partners. 2. Legal Agreement: A binding contract that outlines the terms, conditions, and rules agreed upon by the partners. 3. Business Partnership: The agreement establishes a partnership between two or more businesses or individuals to pursue a common goal or venture. 4. Allegheny County: The geographic location where the partnership is formed, specifically in Pennsylvania's Allegheny County. 5. Partners: The individuals or businesses involved in the LLP, each having a stake in the partnership and sharing profits, losses, and decision-making responsibilities. 6. Business Structure: The partnership agreement defines the structure, roles, and authority of the partners within the LLP. 7. Capital Contributions: Specifies the amount or value of assets or funds that each partner contributes to the partnership. 8. Profit Sharing: Describes how profits will be allocated and distributed among the partners based on their individual contributions or as agreed upon. 9. Liability Protection: Laps provide limited liability protection to partners, shielding personal assets from business-related debts or obligations. 10. Dissolution: Outlines the process for dissolving the partnership, including the distribution of assets and settlement of any outstanding debts. While the specific types of Allegheny Pennsylvania Limited Liability Partnership Agreements may vary depending on the partners' unique circumstances, needs, and preferences, the aforementioned keywords provide a comprehensive understanding of the essential elements and considerations relevant to any LLP agreement established within Allegheny County, Pennsylvania.

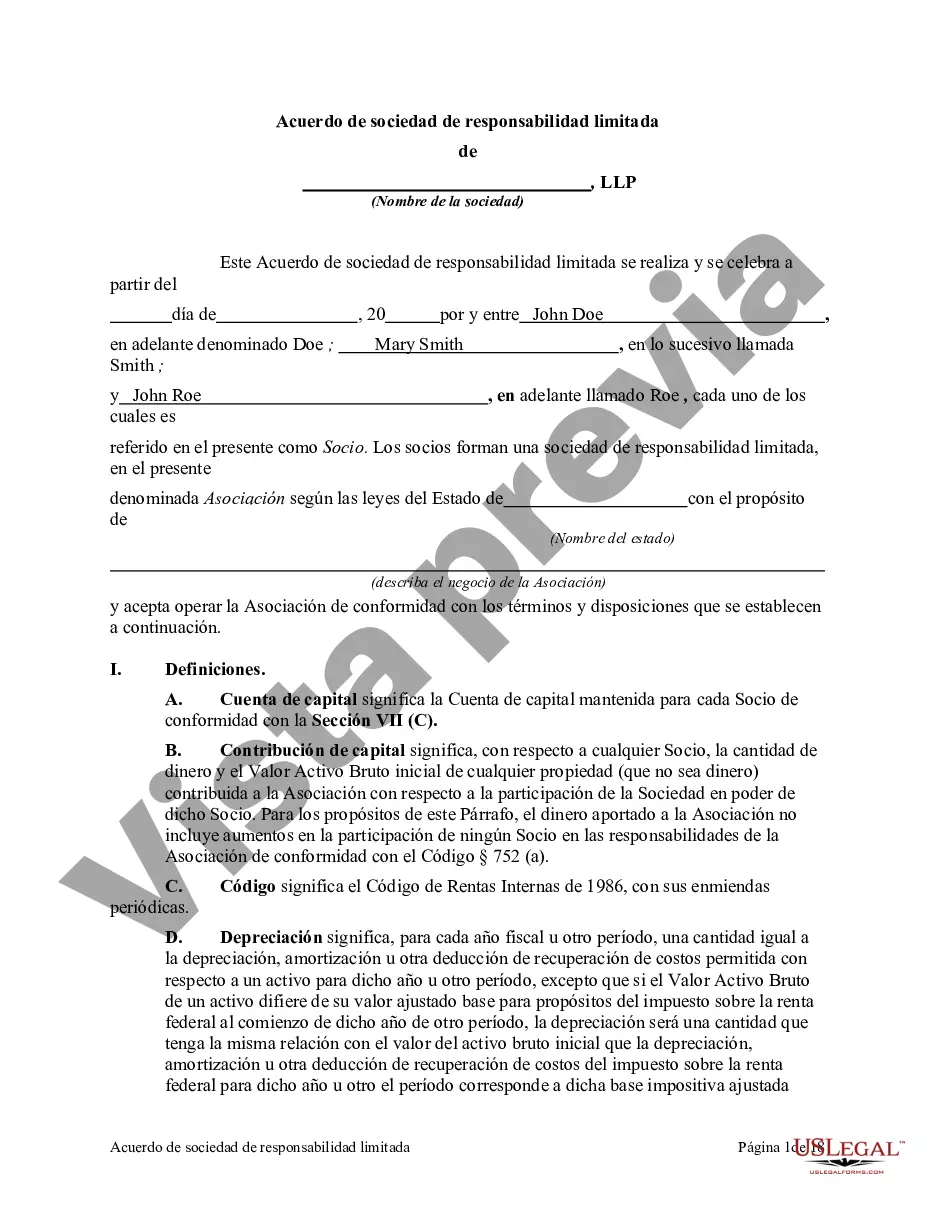

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Allegheny Pennsylvania Acuerdo de sociedad de responsabilidad limitada - Limited Liability Partnership Agreement

Description

How to fill out Allegheny Pennsylvania Acuerdo De Sociedad De Responsabilidad Limitada?

Drafting paperwork for the business or personal needs is always a huge responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's essential to consider all federal and state laws of the specific area. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it burdensome and time-consuming to create Allegheny Limited Liability Partnership Agreement without expert assistance.

It's possible to avoid wasting money on lawyers drafting your documentation and create a legally valid Allegheny Limited Liability Partnership Agreement by yourself, using the US Legal Forms online library. It is the biggest online catalog of state-specific legal templates that are professionally cheched, so you can be sure of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to download the needed form.

If you still don't have a subscription, follow the step-by-step guide below to obtain the Allegheny Limited Liability Partnership Agreement:

- Examine the page you've opened and verify if it has the document you need.

- To do so, use the form description and preview if these options are presented.

- To find the one that meets your requirements, use the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal templates for any situation with just a couple of clicks!