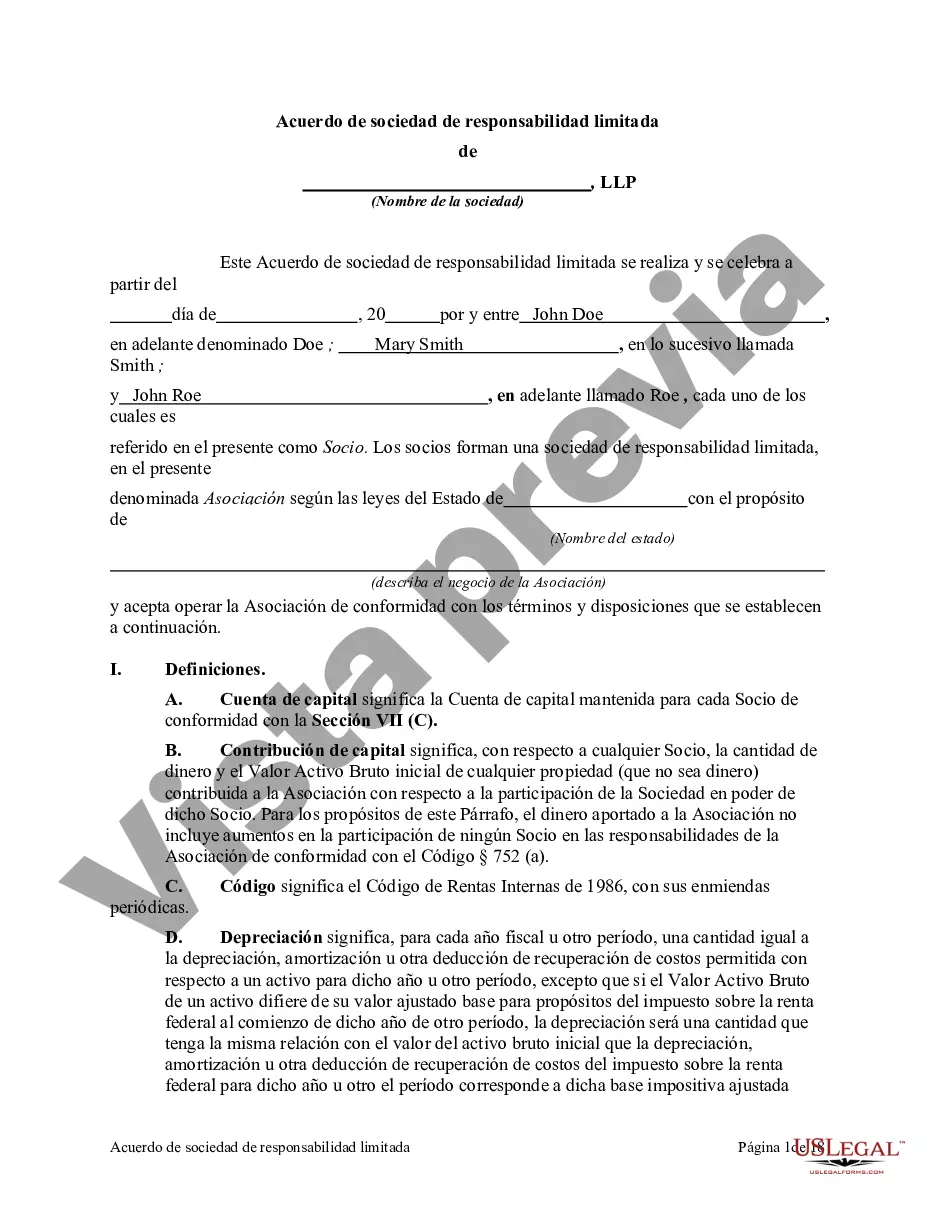

Harris Texas Limited Liability Partnership Agreement is a legal document that governs the formation and operation of a limited liability partnership (LLP) in Harris County, Texas. This agreement outlines the rights, responsibilities, and obligations of the partners involved, as well as the procedures for managing the partnership. Keywords: 1. Harris Texas: Refers to the specific geographical location where the partnership is established — Harris County, Texas. 2. Limited Liability Partnership: Indicates the business structure chosen by the partners, which provides limited liability protection to individual partners. 3. Agreement: Denotes the legally binding contract that outlines the terms and conditions agreed upon by the partners. The Harris Texas Limited Liability Partnership Agreement covers various essential aspects of the partnership, including the partners' roles, contributions, profit-sharing arrangements, decision-making procedures, and dispute resolution processes. It typically includes the following information: 1. Formation: Describes the process of forming the LLP, including the name of the partnership, registered office address, duration, and purpose of the business. 2. Capital Contributions: Specifies the amount and nature of each partner's contribution to the partnership's capital. 3. Profit and Loss Sharing: Outlines how the profits and losses will be distributed among partners, considering factors such as capital contributions, work performed, and other agreed-upon criteria. 4. Management and Decision Making: Details the decision-making process within the partnership, including the roles and responsibilities of partners, voting rights, and the appointment of managing partners or a designated management committee. 5. Partnership Dissolution: Specifies the events and procedures leading to the dissolution of the partnership, such as bankruptcy, withdrawal of partners, or mutual agreement. 6. Dispute Resolution: Provides mechanisms for resolving conflicts and disagreements, including mediation, arbitration, or litigation. 7. Amendments and Governing Law: States the procedures for making amendments to the agreement and identifies the specific laws of Harris County, Texas, that govern the partnership's operations. Different types of Harris Texas Limited Liability Partnership Agreements may exist based on the nature of the partnership or the industry it operates in. For example: 1. Professional LLP Agreement: This agreement is specific to partnerships formed between professionals, such as lawyers, accountants, architects, or engineers. 2. General LLP Agreement: This is a more generic agreement applicable to partnerships formed for various business activities other than professional services. 3. Real Estate LLP Agreement: This agreement focuses on partnerships involved in real estate investment, development, or property management. Note: It is important to consult a legal professional to understand the specific requirements and considerations when creating a Harris Texas Limited Liability Partnership Agreement, as the content and legalities may vary depending on the circumstances and jurisdiction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Acuerdo de sociedad de responsabilidad limitada - Limited Liability Partnership Agreement

Description

How to fill out Harris Texas Acuerdo De Sociedad De Responsabilidad Limitada?

Draftwing forms, like Harris Limited Liability Partnership Agreement, to take care of your legal matters is a difficult and time-consumming task. A lot of situations require an attorney’s participation, which also makes this task expensive. Nevertheless, you can consider your legal issues into your own hands and handle them yourself. US Legal Forms is here to the rescue. Our website comes with more than 85,000 legal forms intended for different scenarios and life circumstances. We make sure each form is compliant with the regulations of each state, so you don’t have to be concerned about potential legal pitfalls associated with compliance.

If you're already familiar with our services and have a subscription with US, you know how straightforward it is to get the Harris Limited Liability Partnership Agreement form. Simply log in to your account, download the template, and personalize it to your requirements. Have you lost your form? No worries. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new customers is just as straightforward! Here’s what you need to do before downloading Harris Limited Liability Partnership Agreement:

- Ensure that your template is specific to your state/county since the regulations for creating legal paperwork may differ from one state another.

- Learn more about the form by previewing it or going through a quick intro. If the Harris Limited Liability Partnership Agreement isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Sign in or create an account to begin utilizing our service and download the document.

- Everything looks good on your end? Hit the Buy now button and select the subscription option.

- Select the payment gateway and enter your payment details.

- Your template is all set. You can go ahead and download it.

It’s easy to find and buy the appropriate template with US Legal Forms. Thousands of businesses and individuals are already benefiting from our extensive library. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!