The Oakland Michigan Limited Liability Partnership Agreement is a legally binding document that outlines the rights, obligations, and responsibilities of partners involved in a limited liability partnership (LLP) formed in Oakland County, Michigan. It serves as the governing framework for the partnership, setting forth the rules and regulations that partners must adhere to. In Oakland County, there are primarily two types of Limited Liability Partnership Agreements: 1. General Oakland Michigan Limited Liability Partnership Agreement: This type of agreement is commonly used by professional service firms like law firms, accounting firms, or medical practices. It offers partners limited liability protection, meaning their personal assets are safeguarded against the partnership's debts and liabilities. Each partner's liability is limited to their invested capital or personal contributions to the partnership. 2. Limited Oakland Michigan Limited Liability Partnership Agreement: This type of agreement, often used in real estate ventures or private investment partnerships, allows partners to have a combination of general and limited partners. General partners have unlimited liability, being personally responsible for the partnership's debts and obligations. Limited partners, however, have liability limited to their invested capital and are typically not actively involved in the partnership's management. The Oakland Michigan Limited Liability Partnership Agreement is a comprehensive document that typically includes the following key provisions: 1. Partnership Name: The legally registered name of the partnership. 2. Purpose: A clear description of the partnership's business activities and objectives. 3. Partner Contributions: The amount and nature of capital or assets each partner contributes to the partnership. 4. Profit and Loss Distribution: The manner in which profits and losses will be shared among partners, which can be based on the percentage of capital contributions or other agreed-upon methods. 5. Management and Decision-Making: The procedures for decision-making, voting rights, and authority of partners in managing the partnership. 6. Transfer of Interests: The conditions and procedures for transferring or selling partner interests, including any restrictions or requirements. 7. Dissolution: The process for dissolving the partnership, including procedures for distributing assets, settling liabilities, and notifying partners. 8. Dispute Resolution: The methods for resolving disputes among partners, such as mediation, arbitration, or litigation. By having a well-drafted Oakland Michigan Limited Liability Partnership Agreement, partners can safeguard their interests, outline their roles within the partnership, and establish a clear framework for decision-making and dispute resolution. It is essential to consult with a legal professional experienced in partnership agreements to ensure compliance with Michigan laws and regulations.

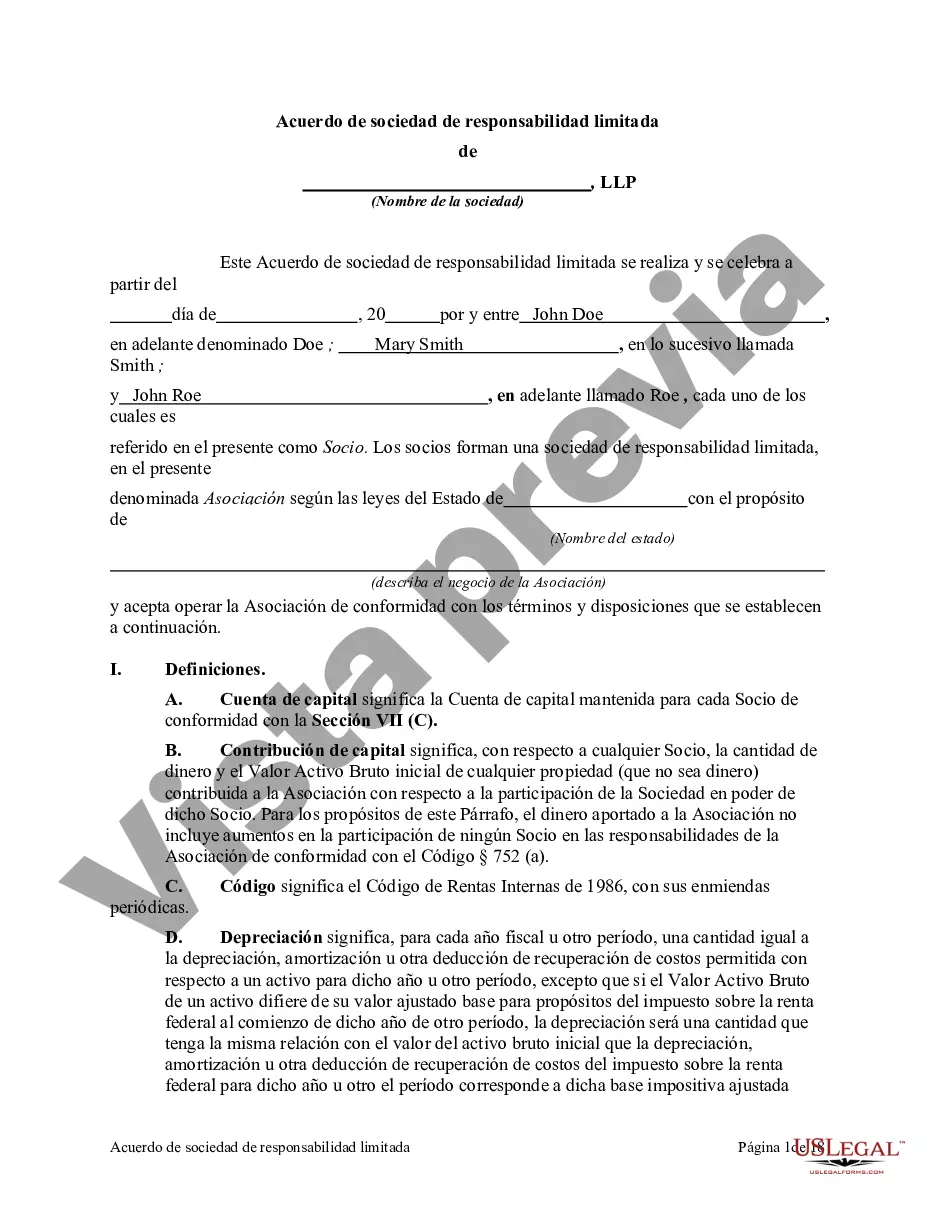

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oakland Michigan Acuerdo de sociedad de responsabilidad limitada - Limited Liability Partnership Agreement

Description

How to fill out Oakland Michigan Acuerdo De Sociedad De Responsabilidad Limitada?

Preparing legal documentation can be difficult. In addition, if you decide to ask an attorney to write a commercial contract, documents for ownership transfer, pre-marital agreement, divorce papers, or the Oakland Limited Liability Partnership Agreement, it may cost you a lot of money. So what is the most reasonable way to save time and money and draw up legitimate forms in total compliance with your state and local laws? US Legal Forms is a great solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case gathered all in one place. Consequently, if you need the latest version of the Oakland Limited Liability Partnership Agreement, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Oakland Limited Liability Partnership Agreement:

- Glance through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now once you find the required sample and select the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a payment with a credit card or through PayPal.

- Choose the file format for your Oakland Limited Liability Partnership Agreement and save it.

Once done, you can print it out and complete it on paper or import the template to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the paperwork ever obtained many times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

¿Como crear una empresa en Republica Dominicana? Registrar el Nombre Comercial en la Oficina Nacional de Propiedad Industrial (ONAPI) Registrar los documentos legales en la Camara de Comercio y Produccion que corresponda. Solicitar el Registro Nacional Contribuyente (RNC) en la Direccion General de Impuestos Internos.

California LLC Fees and Taxes The CA LLC fee is $85, payable to the secretary of state. In addition, a California LLC fee is also due for the statement of information, a document that must be submitted within 90 days of LLC formation and carries a filing cost of $20.

No solo se reducira el numero de tramites, tambien la IGJ entregara los libros de la nueva sociedad rubricados con lo cual habra un ahorro la compra de los libros y en honorarios de escribano, y dara el CUIT para comenzar a operar. Abrir una nueva SRL tendra en la IGJ un costo total de 4300 pesos.

$800 de impuesto de franquicia anual Si desea ser una LLC en California, debe pagar $800 cada ano. La tarifa de $800 se paga mediante el formulario 3522. Este formulario cambia cada ano.

Crear una LLC en 6 Sencillos Pasos Selecciona Tu Estado. Nombra Tu LLC. Elige un Agente Registrado. Presenta Tu LLC con el Estado. Crea un Acuerdo Operativo de LLC. Obten un EIN.

Se constituye con la firma de un contrato entre los socios por medio del cual se crea la sociedad y se aprueban los estatutos sociales. Al igual que en el caso de las SA, conviene que los documentos sean preparados por un profesional.

¿Que necesito? - Formulario de constitucion.- Formulario 185 de la AFIP.- Dictamen de precalificacion profesional conforme al art.- Primer testimonio de escritura publica de constitucion o instrumento privado original -con sus firmas certificadas por escribano publico.

Constituye tu empresa en seis pasos Busqueda y reserva de nombre.Elaboracion de la Minuta de Constitucion de la Empresa o Sociedad.Aporte de capital.Elaboracion de Escritura Publica ante el notario.Inscripcion de la empresa o sociedad en el Registro de Personas Juridicas de la Sunarp.

Como Formar una Sociedad de Responsabilidad Limitada en Paraguay Redactar y firmar un poder notarial. Reserve el nombre de su empresa. Proyecto de constitucion de la empresa (estatutos) Registre su sociedad de responsabilidad limitada en Paraguay. Obtenga su identificacion fiscal. Abrir una cuenta bancaria corporativa.

To form an LLC in California, go to bizfileOnline.sos.ca.gov, log in, select Register a Business under the Business Entities Tile, Articles of Organization - CA LLC and follow the prompts to complete and submit.