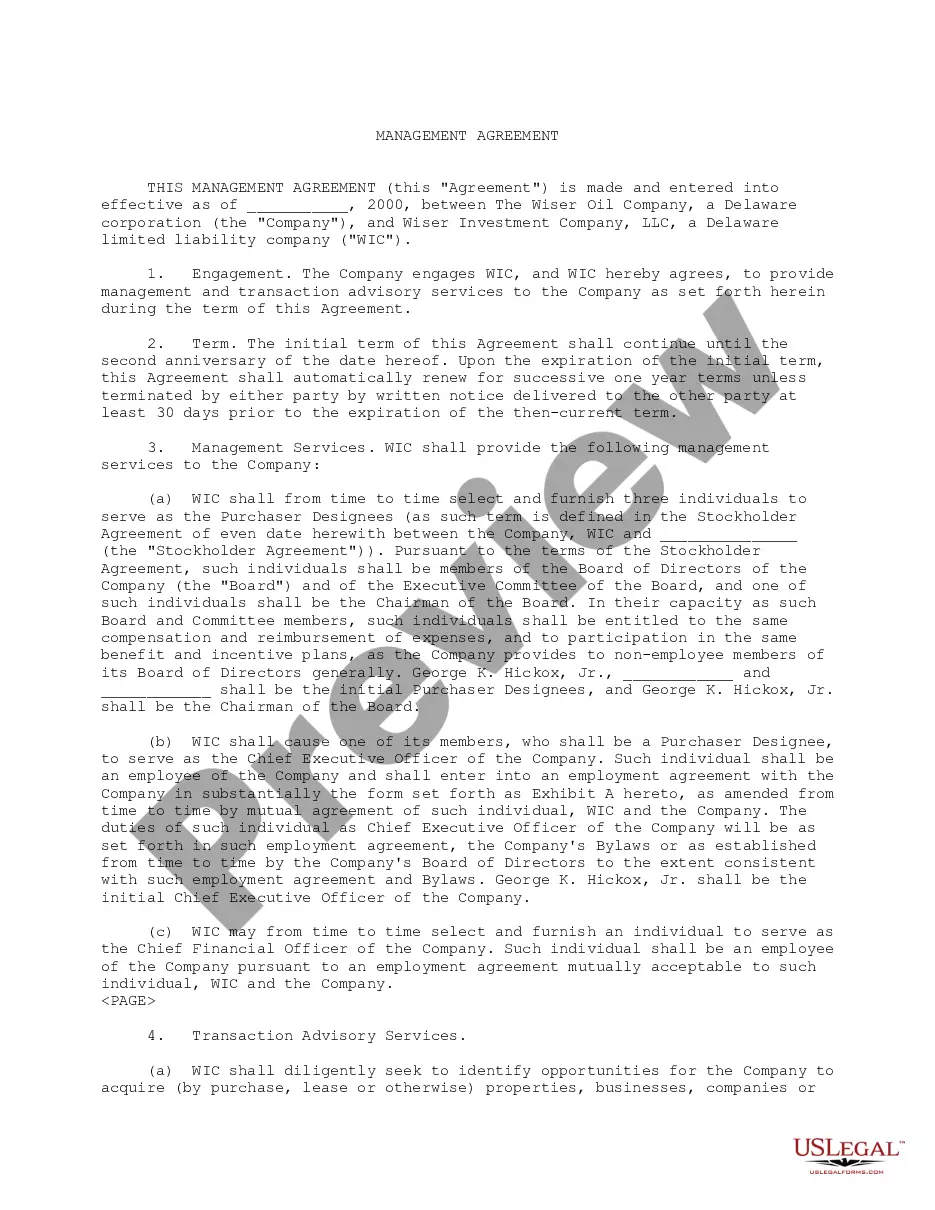

A method of deferring compensation for executives is the use of a rabbi trust. The instrument was named - rabbit trust - because it was first used to provide deferred compensation for a rabbi. Generally, the Internal Revenue Service (IRS) requires that the funds in a rabbi trust must be subject to the claims of the employer's creditors.

This information is current as of December, 2007, but is subject to change if tax laws or IRS regulations change. Current tax laws should be consulted at the time of the preparation of such a trust.

Maricopa Arizona Nonqualified Deferred Compensation Trust for the Benefit of Executive Employees — a Rabbi Trust is a specific type of trust established in Maricopa, Arizona, to provide nonqualified deferred compensation benefits to executive employees. This trust is commonly used by companies to compensate and retain key executives by offering them additional retirement income and tax advantages. The Maricopa Arizona Nonqualified Deferred Compensation Trust, also known as a Rabbi Trust, is structured to hold and invest assets separate from the employer's general assets. It ensures that the deferred compensation funds are protected and cannot be accessed by the employer's creditors. This trust essentially acts as a vehicle for executive employees to set money aside for retirement or other specified purposes while deferring the tax implications until withdrawal. There are several variations or types of Maricopa Arizona Nonqualified Deferred Compensation Trust for the Benefit of Executive Employees — a Rabbi Trust that may exist, classified based on specific plan provisions and requirements. These variations can include: 1. Traditional Rabbi Trust: This is the most common type of Rabbi Trust where a company establishes a trust to hold executive employees' deferred compensation funds and invests them according to the plan documents. The trust is subject to certain limitations, such as creditors' rights and withdrawal restrictions. 2. Secured Rabbi Trust: This type of trust adds an extra layer of security to the deferred compensation funds by providing collateral or other assets as security to protect the trust assets even further. This arrangement offers enhanced protection to the executive employees' funds against potential financial risks. 3. Rabbi Trust with Vesting Schedule: Some employers may incorporate a vesting schedule into their Rabbi Trust, which means that the executive employee's access to the funds in the trust is gradual and contingent upon meeting specific criteria, such as years of service or achievement of certain performance targets. 4. Rabbi Trust with Performance-Based Features: This variation of the trust includes performance-based features where the executive employees' compensation is tied to the company's performance metrics, such as stock performance or profitability. Performance-based Rabbi Trusts can serve as additional incentives for executives to contribute to the company's success. Overall, the Maricopa Arizona Nonqualified Deferred Compensation Trust for the Benefit of Executive Employees — a Rabbi Trust provides a powerful tool for employers to attract and retain top talent by offering deferred compensation benefits. By establishing this trust, companies can provide their executives with additional financial security, tax advantages, and a commitment to protect their deferred compensation assets.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.