A method of deferring compensation for executives is the use of a rabbi trust. The instrument was named - rabbit trust - because it was first used to provide deferred compensation for a rabbi. Generally, the Internal Revenue Service (IRS) requires that the funds in a rabbi trust must be subject to the claims of the employer's creditors.

This information is current as of December, 2007, but is subject to change if tax laws or IRS regulations change. Current tax laws should be consulted at the time of the preparation of such a trust.

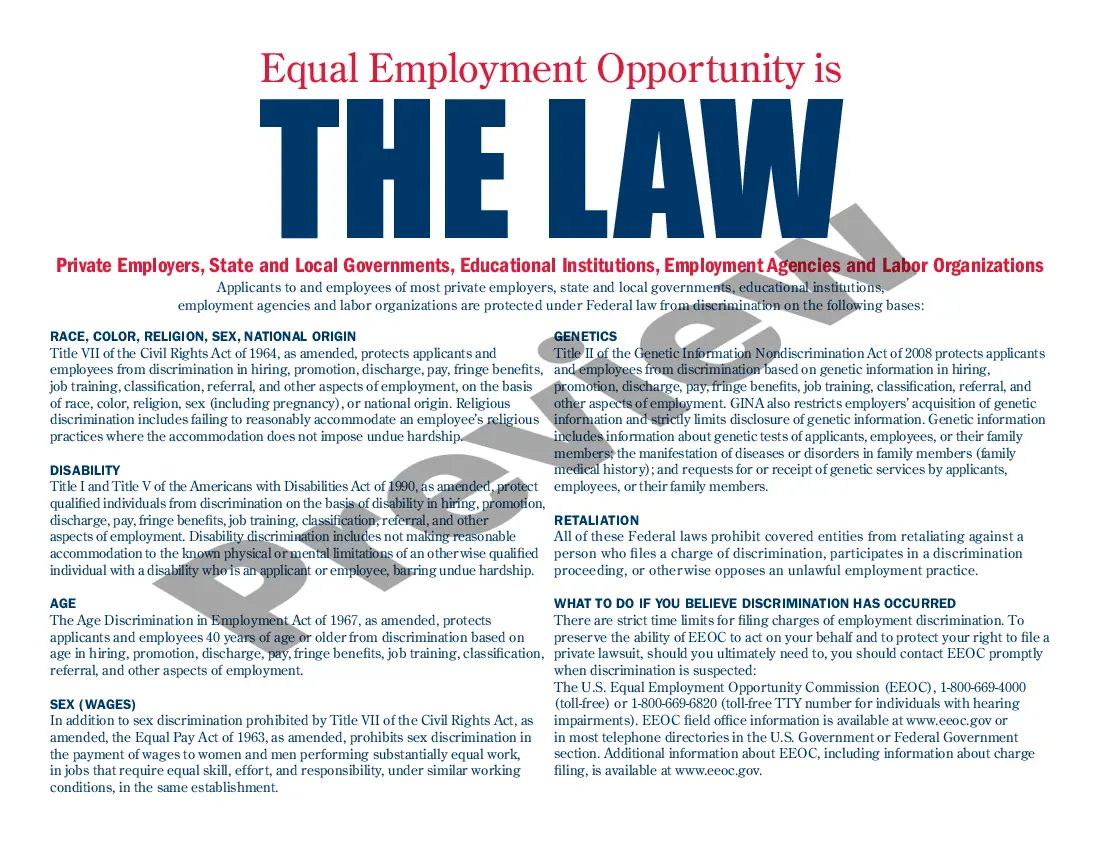

The Phoenix Arizona Nonqualified Deferred Compensation Trust for the Benefit of Executive Employees, also known as a Rabbi Trust, is a specialized financial instrument designed to provide key executives with a means to defer compensation beyond the usual taxable year. This trust allows executives to defer a portion of their salary, bonuses, and other income until a future date, providing tax advantages and potential growth opportunities for the beneficiaries. Operating under the laws and regulations of Arizona, this type of trust helps executive employees accumulate funds and better plan for their financial future. Here are some different types or variations of the Phoenix Arizona Nonqualified Deferred Compensation Trust for the Benefit of Executive Employees — a Rabbi Trust: 1. Salary Deferral Trust: This particular type of trust allows employees to defer a portion of their salary into the trust, which helps in reducing their taxable income for the year. The amount that is deferred is then invested and grows tax-deferred until the employee chooses to receive it in the future, often during retirement. 2. Bonus Deferral Trust: Executives who receive annual bonuses as part of their compensation package can utilize this trust to defer a portion or the entirety of their bonuses. By deferring the bonus, the executive can potentially minimize their current tax liability and benefit from tax-deferred growth over time. 3. Stock Option Deferral Trust: This trust is specifically designed for executives who receive stock options as part of their compensation. It allows them to defer the exercise of the stock options and the receipt of the underlying shares until a later date, typically when they expect to be in a lower tax bracket or when they retire. 4. Change in Control (CIC) Trust: In the event of a significant corporate change, such as a merger, acquisition, or sale, this trust ensures that executives' deferred compensation remains protected. It provides a safeguard for executives by segregating their deferred amounts from the general assets of the company, protecting them from potential loss or mismanagement during the transition. 5. Supplemental Executive Retirement Plan (SERP) Trust: This type of trust is commonly used to enhance retirement benefits for key executives. It allows executives to defer additional amounts beyond what is allowed in traditional retirement plans, such as 401(k)s or pensions. Overall, the Phoenix Arizona Nonqualified Deferred Compensation Trust for the Benefit of Executive Employees — a Rabbi Trust is a flexible and customizable financial tool that offers executives the opportunity to defer compensation, reduce current tax liability, and potentially accumulate additional wealth for their future financial security.The Phoenix Arizona Nonqualified Deferred Compensation Trust for the Benefit of Executive Employees, also known as a Rabbi Trust, is a specialized financial instrument designed to provide key executives with a means to defer compensation beyond the usual taxable year. This trust allows executives to defer a portion of their salary, bonuses, and other income until a future date, providing tax advantages and potential growth opportunities for the beneficiaries. Operating under the laws and regulations of Arizona, this type of trust helps executive employees accumulate funds and better plan for their financial future. Here are some different types or variations of the Phoenix Arizona Nonqualified Deferred Compensation Trust for the Benefit of Executive Employees — a Rabbi Trust: 1. Salary Deferral Trust: This particular type of trust allows employees to defer a portion of their salary into the trust, which helps in reducing their taxable income for the year. The amount that is deferred is then invested and grows tax-deferred until the employee chooses to receive it in the future, often during retirement. 2. Bonus Deferral Trust: Executives who receive annual bonuses as part of their compensation package can utilize this trust to defer a portion or the entirety of their bonuses. By deferring the bonus, the executive can potentially minimize their current tax liability and benefit from tax-deferred growth over time. 3. Stock Option Deferral Trust: This trust is specifically designed for executives who receive stock options as part of their compensation. It allows them to defer the exercise of the stock options and the receipt of the underlying shares until a later date, typically when they expect to be in a lower tax bracket or when they retire. 4. Change in Control (CIC) Trust: In the event of a significant corporate change, such as a merger, acquisition, or sale, this trust ensures that executives' deferred compensation remains protected. It provides a safeguard for executives by segregating their deferred amounts from the general assets of the company, protecting them from potential loss or mismanagement during the transition. 5. Supplemental Executive Retirement Plan (SERP) Trust: This type of trust is commonly used to enhance retirement benefits for key executives. It allows executives to defer additional amounts beyond what is allowed in traditional retirement plans, such as 401(k)s or pensions. Overall, the Phoenix Arizona Nonqualified Deferred Compensation Trust for the Benefit of Executive Employees — a Rabbi Trust is a flexible and customizable financial tool that offers executives the opportunity to defer compensation, reduce current tax liability, and potentially accumulate additional wealth for their future financial security.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.