A well drafted trust instrument will generally prescribe the method and manner of substitution, succession, and selection of successor trustees. Such provisions must be carefully followed. A trustee may be given the power to appoint his or her own successor. Also, a trustor may reserve, or a beneficiary may be given, the power to change trustees. This form is a sample of a trustee naming a successor trustee pursuant to the terms of the trust.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

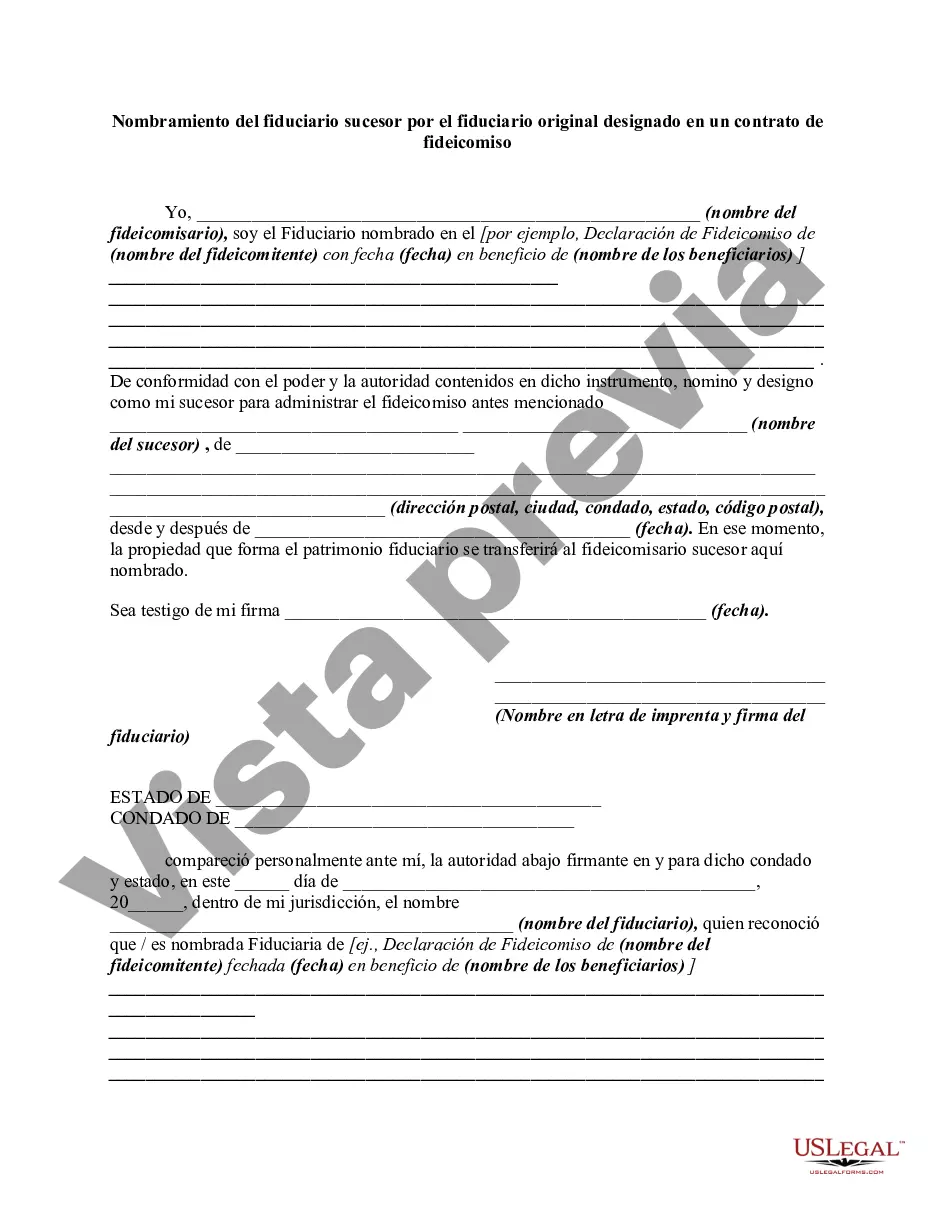

Miami-Dade Florida Appointment of Successor Trustee By Original Trustee Named in a Trust Agreement: A Comprehensive Guide Introduction: In Miami-Dade County, Florida, the appointment of a successor trustee by the original trustee named in a trust agreement is a crucial process that ensures the seamless transfer of trust administration responsibilities. This detailed description aims to provide key information regarding this appointment, along with its significance and possible variations. Keywords: Miami-Dade County, Florida, appointment of successor trustee, original trustee, trust agreement, trust administration, transfer of responsibilities, successor trustee roles, trust management, trust assets, trust beneficiaries. 1. Understanding the Appointment of Successor Trustee: When creating a trust agreement in Miami-Dade County, Florida, it's essential to designate an original trustee responsible for managing the trust's assets and safeguarding the interests of its beneficiaries. However, circumstances may arise wherein the original trustee is unable, unwilling, or ineligible to continue serving in that capacity. In such instances, the appointment of a successor trustee becomes necessary. 2. Importance of Appointing a Successor Trustee: The appointment of a successor trustee ensures the smooth transition of trust administration and the preservation of the trust's integrity. By designating a qualified individual or corporate entity, the trust granter safeguards the welfare and financial interests of the trust beneficiaries, ensuring uninterrupted trust management. 3. Roles and Responsibilities of a Successor Trustee: The successor trustee's primary role is to assume the duties of the original trustee, as specified in the trust agreement. This typically includes managing trust assets, making investment decisions, distributing income and principal, maintaining accurate records, filing tax returns, and working in the best interest of the beneficiaries. The specific responsibilities may vary depending on the terms outlined in the trust agreement. 4. Variation of Miami-Dade Florida Appointment of Successor Trustee: While the general concept of appointing a successor trustee remains consistent, variations may exist within Miami-Dade County, Florida, based on specific trust agreements. These variations could include, but are not limited to: — Conditional Appointment: Some trust agreements dictate specific conditions for the appointment of a successor trustee, such as reaching a certain age or attaining a particular level of professional expertise. — Multiple Successor Trustees: In certain cases, trust agreements may name multiple successor trustees in order of priority, ensuring a backup plan if the first appointee is unable to fulfill their obligations. — Professional Trustee Appointment: Instead of designating an individual, the trust agreement may authorize the appointment of a professional trustee, such as a trust company or an attorney with expertise in trust administration. Conclusion: In Miami-Dade County, Florida, the appointment of a successor trustee by an original trustee named in a trust agreement is a critical aspect of trust administration. By selecting a trustworthy and capable successor trustee, the trust granter ensures the smooth continuity of managing trust assets and fulfilling responsibilities for the benefit of the trust beneficiaries. Careful consideration should be given to the various variations that may exist within this appointment, tailored to the specific requirements outlined in the trust agreement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.