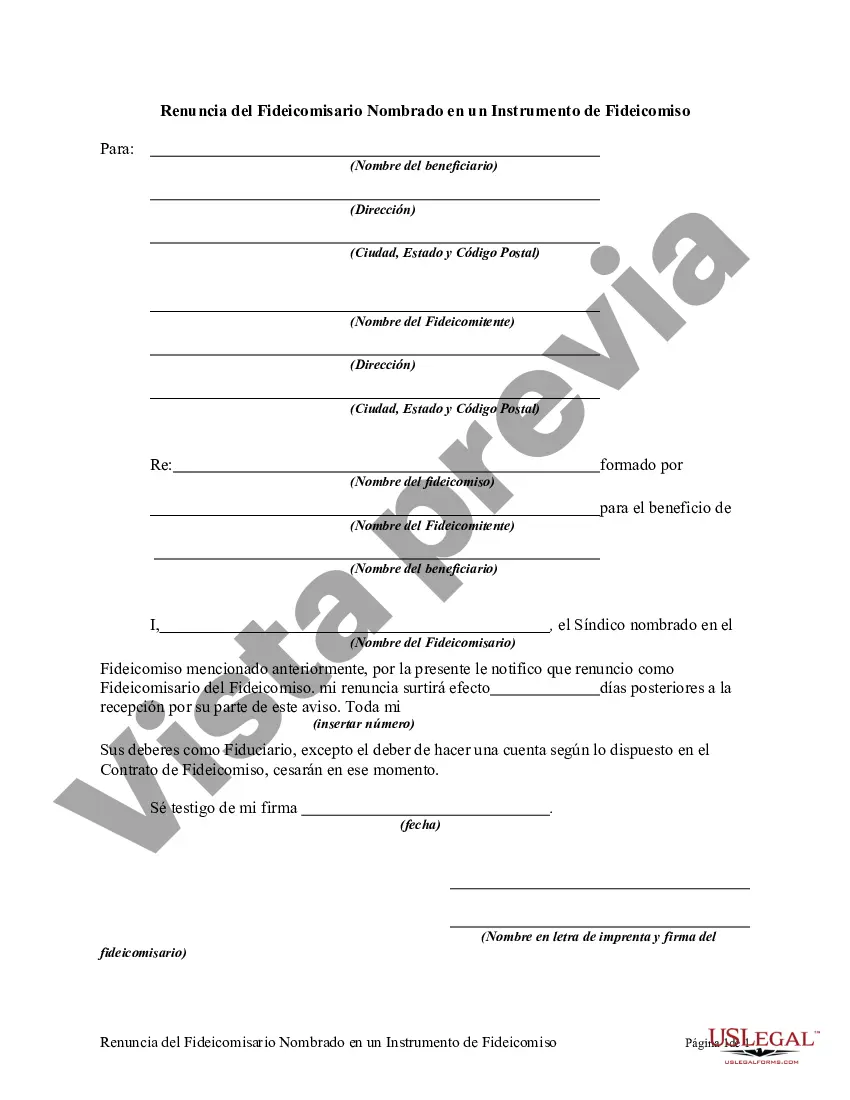

A well drafted trust instrument will generally prescribe the method and manner of substitution, succession, and selection of successor trustees. Such provisions must be carefully followed. A trustee may be given the power to appoint his or her own successor. Also, a trustor may reserve, or a beneficiary may be given, the power to change trustees. This form is a sample of a resignation by the trustee prior to the appointment of a new trustee.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Cook County, Illinois, has specific guidelines and procedures in place for a trustee named in a trust instrument who wishes to resign from their trustee role. A Cook Illinois Resignation by Trustee Named in a Trust Instrument refers to the legal process by which a trustee seeks to step down from their responsibilities outlined in a trust document within Cook County. When a trustee named in a trust instrument decides to resign, they must follow Cook County's requirements to comply with legal obligations and ensure a smooth transition of trustee duties. The process involves several steps and may differ depending on the type of trust involved. Here are a few types of Cook Illinois Resignation by Trustee Named in a Trust Instrument: 1. Resignation from a revocable living trust: A trustee who wishes to resign from their role in a revocable living trust can initiate the Cook Illinois Resignation process by providing a written notice of resignation to the granter, beneficiaries, and any co-trustees mentioned in the trust instrument. The notice should include the effective date of the resignation and detailed reasons for their decision. 2. Resignation from an irrevocable trust: When a trustee named in an irrevocable trust wishes to resign, they must follow Cook County's statutory requirements. This involves providing formal written notice to both granters and beneficiaries, specifying the resignation date and reasons for stepping down. In some cases, court approval may be necessary to accept the resignation and appoint a new trustee. 3. Resignation due to incapacity or death: If a trustee becomes incapacitated or passes away, resulting in the need for resignation, the Cook Illinois Resignation process may slightly differ. In this situation, the trust instrument should outline the steps to be taken, such as an alternate trustee assuming the role or the trust transitioning to successor beneficiaries following the resignation of the original trustee. It is important to note that Cook Illinois Resignation by Trustee Named in a Trust Instrument must adhere to the laws governing trusts established within Cook County. Following the correct protocol ensures that the resignation is valid, legal, and protects the interests of the beneficiaries involved. In conclusion, Cook Illinois Resignation by Trustee Named in a Trust Instrument is the formal legal process through which a trustee named in a trust document within Cook County can step down from their responsibilities. The specific type of resignation will depend on the nature of the trust being administered, such as revocable living trusts or irrevocable trusts. Proper compliance with Cook County's requirements and regulations is crucial for a smooth transition and maintaining the integrity of the trust.Cook County, Illinois, has specific guidelines and procedures in place for a trustee named in a trust instrument who wishes to resign from their trustee role. A Cook Illinois Resignation by Trustee Named in a Trust Instrument refers to the legal process by which a trustee seeks to step down from their responsibilities outlined in a trust document within Cook County. When a trustee named in a trust instrument decides to resign, they must follow Cook County's requirements to comply with legal obligations and ensure a smooth transition of trustee duties. The process involves several steps and may differ depending on the type of trust involved. Here are a few types of Cook Illinois Resignation by Trustee Named in a Trust Instrument: 1. Resignation from a revocable living trust: A trustee who wishes to resign from their role in a revocable living trust can initiate the Cook Illinois Resignation process by providing a written notice of resignation to the granter, beneficiaries, and any co-trustees mentioned in the trust instrument. The notice should include the effective date of the resignation and detailed reasons for their decision. 2. Resignation from an irrevocable trust: When a trustee named in an irrevocable trust wishes to resign, they must follow Cook County's statutory requirements. This involves providing formal written notice to both granters and beneficiaries, specifying the resignation date and reasons for stepping down. In some cases, court approval may be necessary to accept the resignation and appoint a new trustee. 3. Resignation due to incapacity or death: If a trustee becomes incapacitated or passes away, resulting in the need for resignation, the Cook Illinois Resignation process may slightly differ. In this situation, the trust instrument should outline the steps to be taken, such as an alternate trustee assuming the role or the trust transitioning to successor beneficiaries following the resignation of the original trustee. It is important to note that Cook Illinois Resignation by Trustee Named in a Trust Instrument must adhere to the laws governing trusts established within Cook County. Following the correct protocol ensures that the resignation is valid, legal, and protects the interests of the beneficiaries involved. In conclusion, Cook Illinois Resignation by Trustee Named in a Trust Instrument is the formal legal process through which a trustee named in a trust document within Cook County can step down from their responsibilities. The specific type of resignation will depend on the nature of the trust being administered, such as revocable living trusts or irrevocable trusts. Proper compliance with Cook County's requirements and regulations is crucial for a smooth transition and maintaining the integrity of the trust.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.