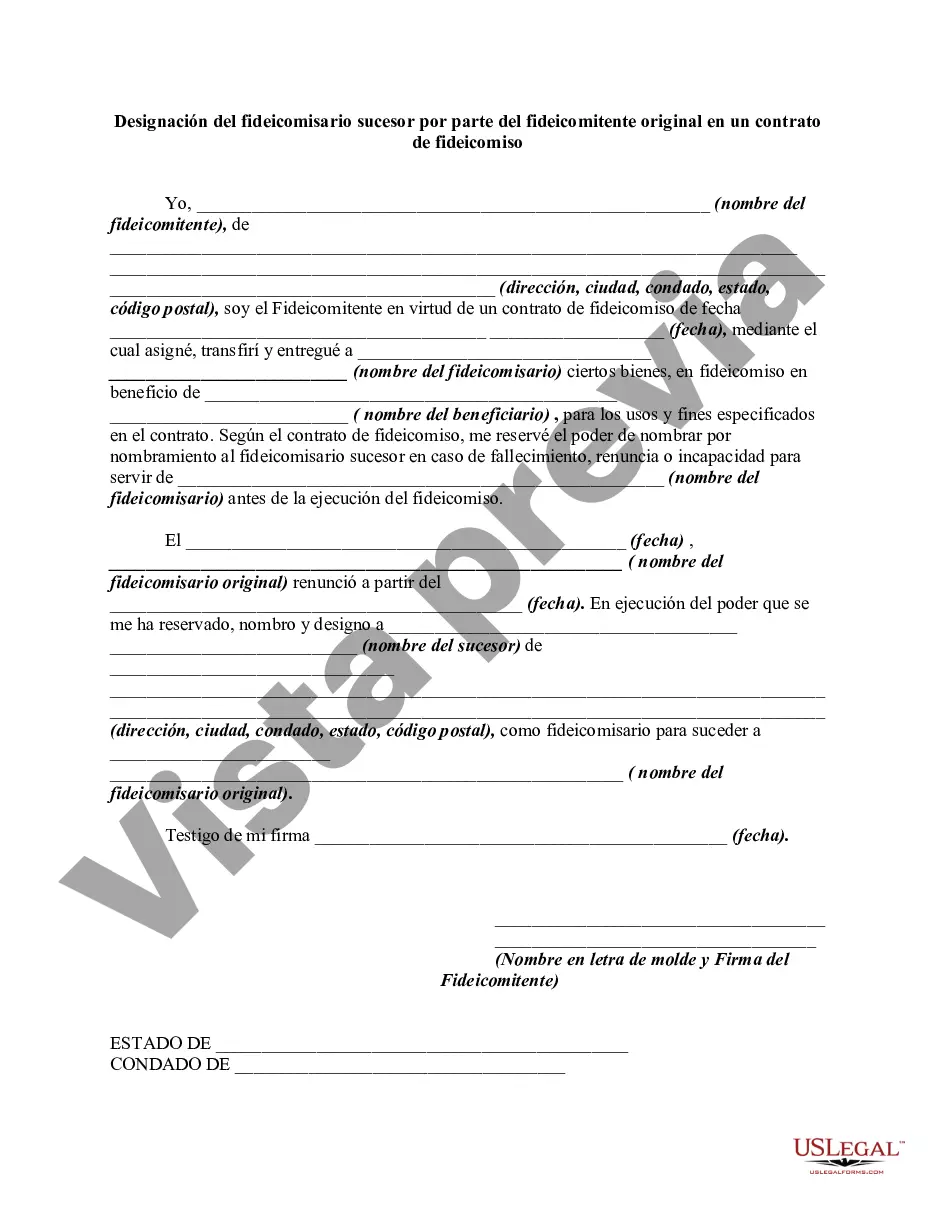

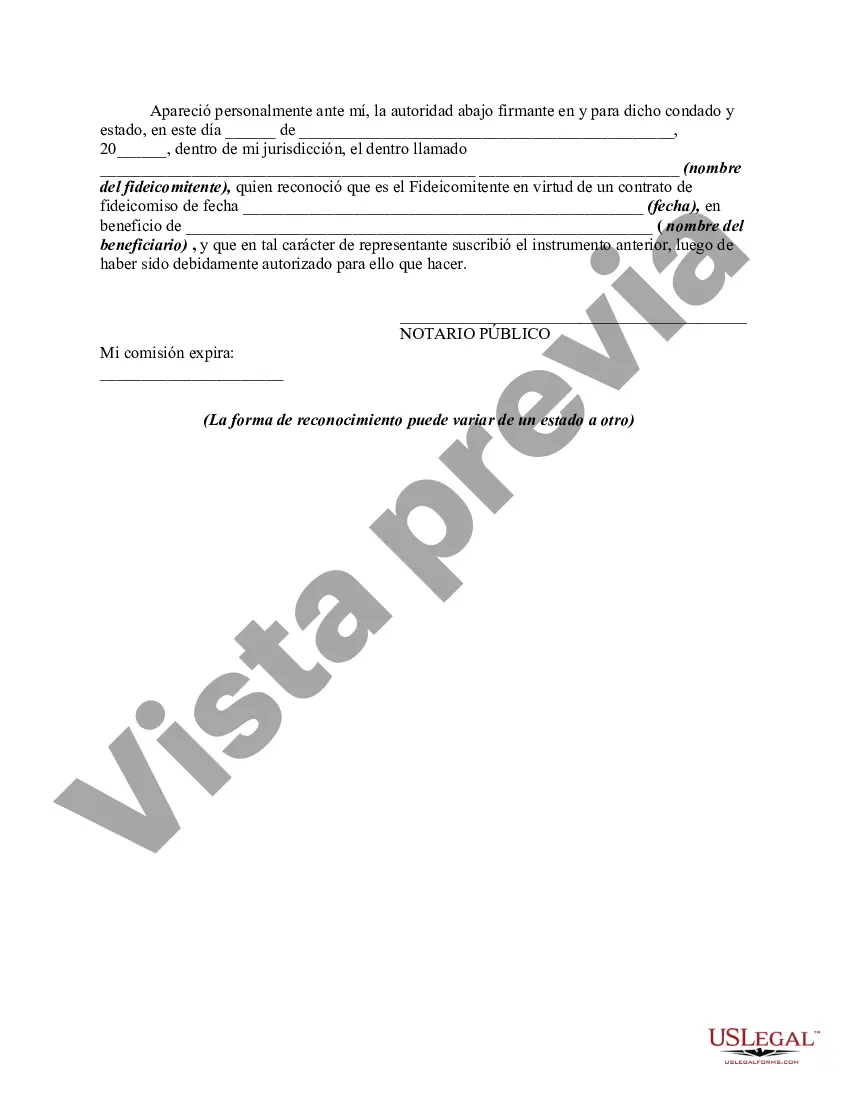

A well drafted trust instrument will generally prescribe the method and manner of substitution, succession, and selection of successor trustees. Such provisions must be carefully followed. A trustee may be given the power to appoint his or her own successor. Also, a trustor may reserve, or a beneficiary may be given, the power to change trustees. This form is a sample of a trustor appointing a successor trustee after the resignation of the original trustee.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

In Collin, Texas, the Appointment of Successor Trustee By Original Trust or in a Trust Agreement holds significant importance in estate planning and asset management. A trust agreement is a legal document that establishes a trust, allowing the original trust or to transfer assets and property to be managed and distributed by a trustee for the benefit of designated beneficiaries. Within a trust agreement, the original trust or has the power to appoint a successor trustee, who would step in and take over the responsibilities and duties of the trustee in the event of their incapacity, resignation, or death. This appointment ensures the smooth continuity and proper administration of the trust, allowing for the preservation and distribution of assets as per the trust or's intentions. In the context of Collin, Texas, there are a few different types of appointments of successor trustees that can be included in a trust agreement. These variations cater to specific circumstances and provide flexibility based on the trust or's preferences. Some common types include: 1. Specific or Individual Successor Trustee: This type allows the original trust or to name a specific person or entity as the successor trustee. This can be a family member, a close friend, a financial institution, or a professional fiduciary. The appointment is usually made based on trust or's confidence in the successor's ability to manage the trust and fulfill their fiduciary duties. 2. Co-Trustee Appointment: In some cases, the original trust or may choose to select multiple individuals or entities as co-trustees to share the responsibilities of administering the trust. This appointment strategy can ensure checks and balances within the trustee role or accommodate situations where expertise from different parties is needed. 3. Contingent or Alternate Successor Trustee: In situations where the initially appointed successor trustee cannot fulfill their duties, a contingent or alternate successor trustee is named. This type of appointment serves as a backup plan and ensures that there is always a designated trustee available to step in and manage the trust when needed. The Appointment of Successor Trustee By Original Trust or in a Trust Agreement is crucial for maintaining control over the trust's assets and ensuring the trust or's intentions are carried out. By thoughtfully considering the appropriate type of successor trustee appointment, trustees can provide a solid foundation for the ongoing management and protection of their assets in Collin, Texas. Remember, it is always advisable to consult with a qualified attorney specializing in estate planning and trusts to ensure the trust agreement meets all legal requirements and reflects the trust or's wishes accurately.In Collin, Texas, the Appointment of Successor Trustee By Original Trust or in a Trust Agreement holds significant importance in estate planning and asset management. A trust agreement is a legal document that establishes a trust, allowing the original trust or to transfer assets and property to be managed and distributed by a trustee for the benefit of designated beneficiaries. Within a trust agreement, the original trust or has the power to appoint a successor trustee, who would step in and take over the responsibilities and duties of the trustee in the event of their incapacity, resignation, or death. This appointment ensures the smooth continuity and proper administration of the trust, allowing for the preservation and distribution of assets as per the trust or's intentions. In the context of Collin, Texas, there are a few different types of appointments of successor trustees that can be included in a trust agreement. These variations cater to specific circumstances and provide flexibility based on the trust or's preferences. Some common types include: 1. Specific or Individual Successor Trustee: This type allows the original trust or to name a specific person or entity as the successor trustee. This can be a family member, a close friend, a financial institution, or a professional fiduciary. The appointment is usually made based on trust or's confidence in the successor's ability to manage the trust and fulfill their fiduciary duties. 2. Co-Trustee Appointment: In some cases, the original trust or may choose to select multiple individuals or entities as co-trustees to share the responsibilities of administering the trust. This appointment strategy can ensure checks and balances within the trustee role or accommodate situations where expertise from different parties is needed. 3. Contingent or Alternate Successor Trustee: In situations where the initially appointed successor trustee cannot fulfill their duties, a contingent or alternate successor trustee is named. This type of appointment serves as a backup plan and ensures that there is always a designated trustee available to step in and manage the trust when needed. The Appointment of Successor Trustee By Original Trust or in a Trust Agreement is crucial for maintaining control over the trust's assets and ensuring the trust or's intentions are carried out. By thoughtfully considering the appropriate type of successor trustee appointment, trustees can provide a solid foundation for the ongoing management and protection of their assets in Collin, Texas. Remember, it is always advisable to consult with a qualified attorney specializing in estate planning and trusts to ensure the trust agreement meets all legal requirements and reflects the trust or's wishes accurately.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.