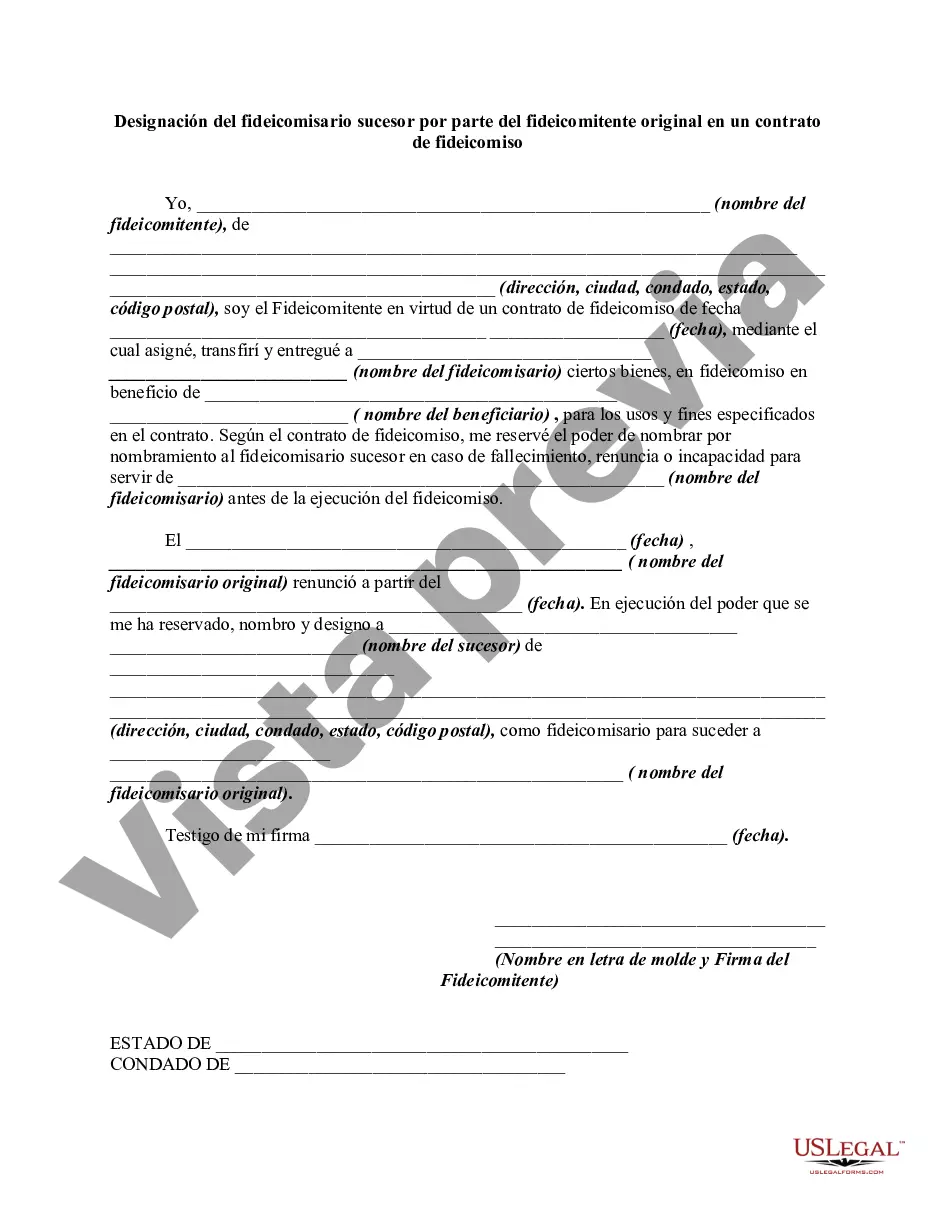

A well drafted trust instrument will generally prescribe the method and manner of substitution, succession, and selection of successor trustees. Such provisions must be carefully followed. A trustee may be given the power to appoint his or her own successor. Also, a trustor may reserve, or a beneficiary may be given, the power to change trustees. This form is a sample of a trustor appointing a successor trustee after the resignation of the original trustee.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Harris Texas Appointment of Successor Trustee By Original Trust or in a Trust Agreement is a legal provision that allows the original trust or (the creator of the trust) to designate a successor trustee in the event that the original trustee is unable or unwilling to fulfill their duties. This appointment ensures that there is a smooth transition of trustee responsibilities and protects the interests of the beneficiaries specified in the trust agreement. The appointment of a successor trustee is a crucial aspect of estate planning and plays a pivotal role in ensuring the effective administration of a trust. By having a designated successor trustee, the original trust or retains control over who will manage their trust assets and make important decisions on behalf of the beneficiaries. In Harris Texas, there are several types of Appointment of Successor Trustee By Original Trust or provisions that can be included in a Trust Agreement: 1. Specific Successor Trustee: This type of provision names a specific individual or entity as the successor trustee. The original trust or can choose a trusted family member, friend, or a professional trust company as the designated successor trustee. 2. Alternate Successor Trustee: In this provision, the original trust or can name multiple individuals or entities as alternates or backups to be appointed as successor trustees. This provides flexibility in case the designated successor trustee is unable or unwilling to act as the trustee. 3. Nominated Successor Trustee: This provision allows the original trust or to nominate a person or entity to be considered as the successor trustee by the court if the need arises. This gives the court guidance and helps ensure that the nominated individual or entity is given priority for appointment. 4. Trustee Removal and Replacement: This provision allows the original trust or to specify the circumstances under which a trustee can be removed and replaced. It can include reasons such as incapacity, death, resignation, or misconduct. By clearly outlining the grounds for trustee removal and replacement, the original trust or ensures that the process is carried out smoothly and in accordance with their intentions. Including the Harris Texas Appointment of Successor Trustee By Original Trust or provision in a Trust Agreement provides peace of mind to the original trust or, knowing that their trust will be properly managed even in unforeseen circumstances. It is important to consult with an experienced attorney familiar with Texas trust laws to ensure that the provisions are tailored to meet the specific needs and requirements of the trust or.The Harris Texas Appointment of Successor Trustee By Original Trust or in a Trust Agreement is a legal provision that allows the original trust or (the creator of the trust) to designate a successor trustee in the event that the original trustee is unable or unwilling to fulfill their duties. This appointment ensures that there is a smooth transition of trustee responsibilities and protects the interests of the beneficiaries specified in the trust agreement. The appointment of a successor trustee is a crucial aspect of estate planning and plays a pivotal role in ensuring the effective administration of a trust. By having a designated successor trustee, the original trust or retains control over who will manage their trust assets and make important decisions on behalf of the beneficiaries. In Harris Texas, there are several types of Appointment of Successor Trustee By Original Trust or provisions that can be included in a Trust Agreement: 1. Specific Successor Trustee: This type of provision names a specific individual or entity as the successor trustee. The original trust or can choose a trusted family member, friend, or a professional trust company as the designated successor trustee. 2. Alternate Successor Trustee: In this provision, the original trust or can name multiple individuals or entities as alternates or backups to be appointed as successor trustees. This provides flexibility in case the designated successor trustee is unable or unwilling to act as the trustee. 3. Nominated Successor Trustee: This provision allows the original trust or to nominate a person or entity to be considered as the successor trustee by the court if the need arises. This gives the court guidance and helps ensure that the nominated individual or entity is given priority for appointment. 4. Trustee Removal and Replacement: This provision allows the original trust or to specify the circumstances under which a trustee can be removed and replaced. It can include reasons such as incapacity, death, resignation, or misconduct. By clearly outlining the grounds for trustee removal and replacement, the original trust or ensures that the process is carried out smoothly and in accordance with their intentions. Including the Harris Texas Appointment of Successor Trustee By Original Trust or provision in a Trust Agreement provides peace of mind to the original trust or, knowing that their trust will be properly managed even in unforeseen circumstances. It is important to consult with an experienced attorney familiar with Texas trust laws to ensure that the provisions are tailored to meet the specific needs and requirements of the trust or.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.