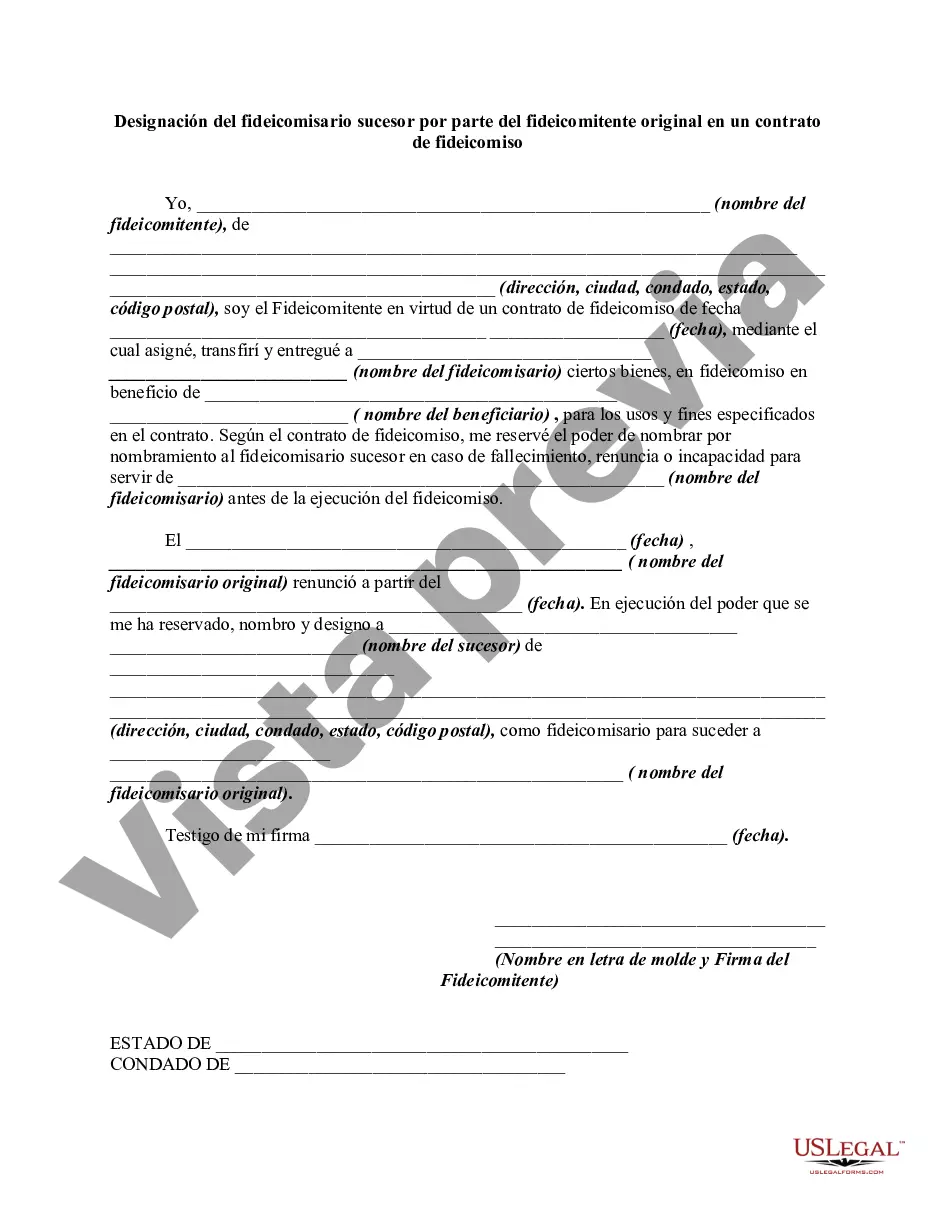

A well drafted trust instrument will generally prescribe the method and manner of substitution, succession, and selection of successor trustees. Such provisions must be carefully followed. A trustee may be given the power to appoint his or her own successor. Also, a trustor may reserve, or a beneficiary may be given, the power to change trustees. This form is a sample of a trustor appointing a successor trustee after the resignation of the original trustee.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Nassau New York is a county located on Long Island, New York. It is known for its rich history, beautiful landscapes, and vibrant communities. When it comes to estate planning and trust agreements, the appointment of a successor trustee is a crucial aspect to consider. In a trust agreement, the original trust or has the ability to designate a successor trustee who will manage and administer the trust in the event of their incapacity or death. This appointment ensures the seamless transition of trust responsibilities and helps safeguard the assets held within the trust. There are several types of Nassau New York Appointment of Successor Trustee By Original Trust or in a Trust Agreement, each serving a specific purpose: 1. Immediate Successor Trustee: This type of appointment designates a successor trustee who will assume their role immediately after the original trust or becomes incapacitated or passes away. The immediate successor trustee steps in without delay and takes over the responsibilities outlined in the trust agreement. 2. Contingent Successor Trustee: In some cases, the original trust or may specify a contingent successor trustee, who will assume the role only if the primary successor trustee is unable or unwilling to fulfill their duties. This designation provides a backup plan to ensure the smooth continuation of the trust administration. 3. Co-Trustee Appointment: The original trust or may choose to appoint a co-trustee alongside themselves to oversee the trust. This arrangement allows for shared decision-making and ensures that there's always a trustee available to manage the trust assets. 4. Joint Successor Trustee: Similar to co-trustees, joint successor trustees are appointed by the original trust or to serve in a shared capacity. However, joint successor trustees typically step into the role simultaneously, sharing equal responsibility for the trust administration. 5. Third-Party Professional Trustee: In certain circumstances, the original trust or may opt to appoint a professional trustee, such as a bank or trust company, as the successor trustee. These entities have the expertise and experience to manage complex trusts effectively, ensuring the fulfillment of the trust or's wishes. It's important for individuals in Nassau New York who are creating a trust agreement to carefully consider the appointment of a successor trustee. This decision should be made after thorough research and consultation with legal professionals familiar with New York estate and trust laws. By selecting an appropriate successor trustee, trustees can ensure that their assets are managed and distributed as intended, providing peace of mind for themselves and their beneficiaries.Nassau New York is a county located on Long Island, New York. It is known for its rich history, beautiful landscapes, and vibrant communities. When it comes to estate planning and trust agreements, the appointment of a successor trustee is a crucial aspect to consider. In a trust agreement, the original trust or has the ability to designate a successor trustee who will manage and administer the trust in the event of their incapacity or death. This appointment ensures the seamless transition of trust responsibilities and helps safeguard the assets held within the trust. There are several types of Nassau New York Appointment of Successor Trustee By Original Trust or in a Trust Agreement, each serving a specific purpose: 1. Immediate Successor Trustee: This type of appointment designates a successor trustee who will assume their role immediately after the original trust or becomes incapacitated or passes away. The immediate successor trustee steps in without delay and takes over the responsibilities outlined in the trust agreement. 2. Contingent Successor Trustee: In some cases, the original trust or may specify a contingent successor trustee, who will assume the role only if the primary successor trustee is unable or unwilling to fulfill their duties. This designation provides a backup plan to ensure the smooth continuation of the trust administration. 3. Co-Trustee Appointment: The original trust or may choose to appoint a co-trustee alongside themselves to oversee the trust. This arrangement allows for shared decision-making and ensures that there's always a trustee available to manage the trust assets. 4. Joint Successor Trustee: Similar to co-trustees, joint successor trustees are appointed by the original trust or to serve in a shared capacity. However, joint successor trustees typically step into the role simultaneously, sharing equal responsibility for the trust administration. 5. Third-Party Professional Trustee: In certain circumstances, the original trust or may opt to appoint a professional trustee, such as a bank or trust company, as the successor trustee. These entities have the expertise and experience to manage complex trusts effectively, ensuring the fulfillment of the trust or's wishes. It's important for individuals in Nassau New York who are creating a trust agreement to carefully consider the appointment of a successor trustee. This decision should be made after thorough research and consultation with legal professionals familiar with New York estate and trust laws. By selecting an appropriate successor trustee, trustees can ensure that their assets are managed and distributed as intended, providing peace of mind for themselves and their beneficiaries.

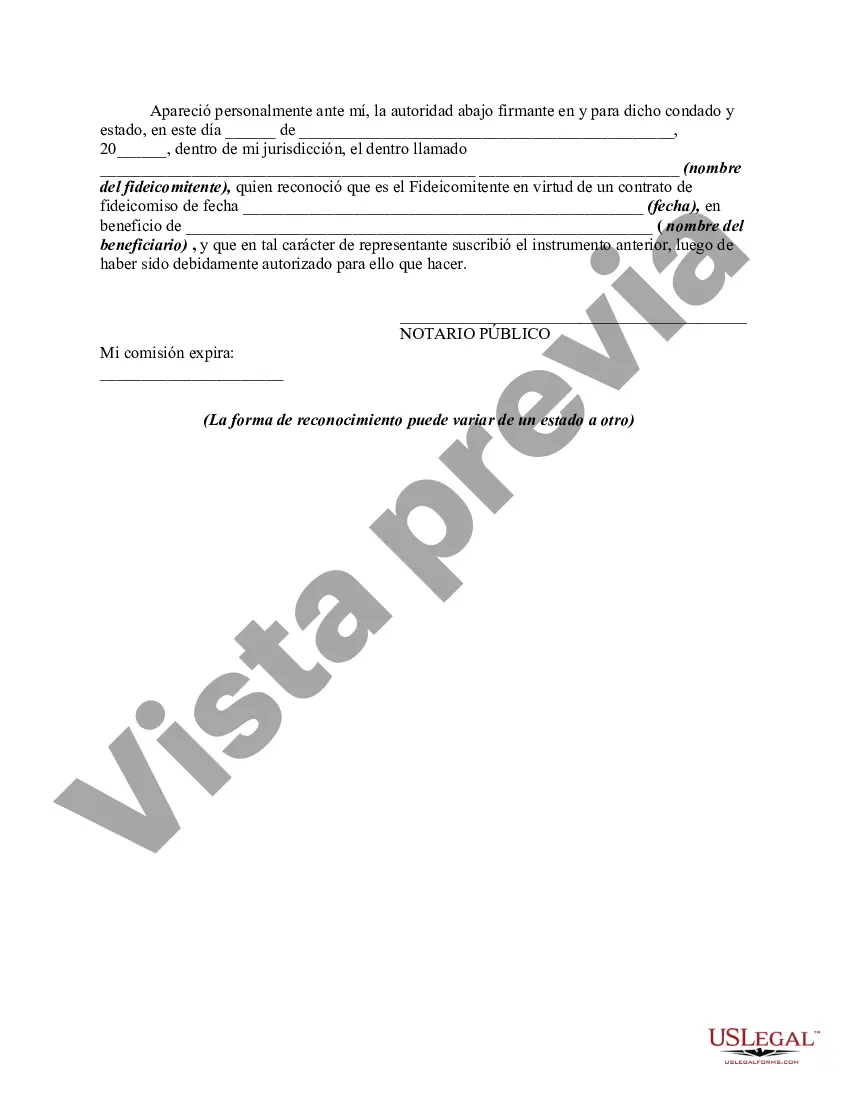

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.