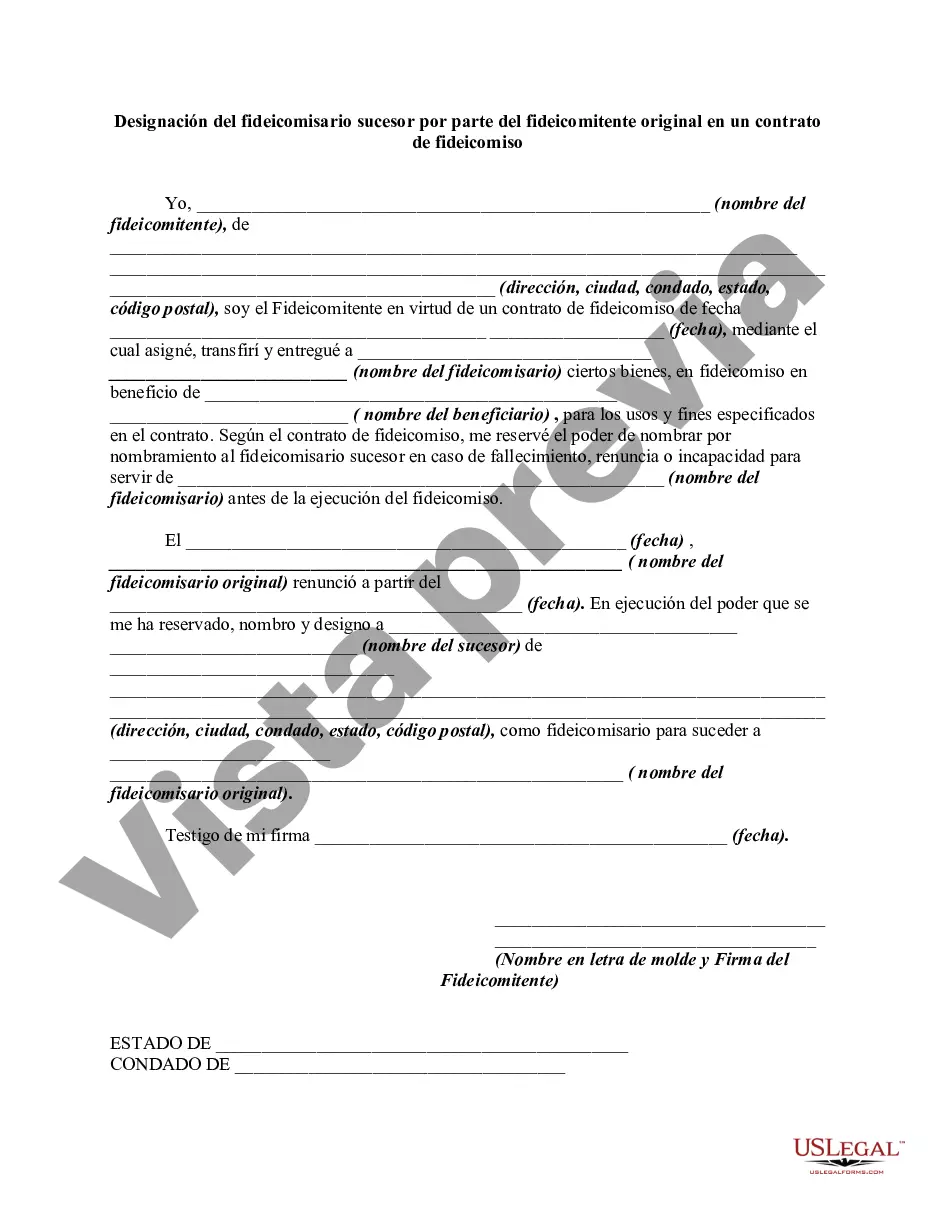

A well drafted trust instrument will generally prescribe the method and manner of substitution, succession, and selection of successor trustees. Such provisions must be carefully followed. A trustee may be given the power to appoint his or her own successor. Also, a trustor may reserve, or a beneficiary may be given, the power to change trustees. This form is a sample of a trustor appointing a successor trustee after the resignation of the original trustee.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

In Phoenix, Arizona, the Appointment of Successor Trustee by the Original Trust or in a Trust Agreement is an essential provision that allows the Trust or to name a trusted individual to take over the responsibilities of managing their trust in the event of their incapacity or death. This appointment ensures the smooth continuation of the trust's administration without major disruption or potential disputes. The Appointment of Successor Trustee is established through a legal document known as a Trust Agreement, which outlines the terms, conditions, and instructions for managing the trust assets. This provision provides flexibility to the Trust or in determining the criteria and qualifications for selecting a successor trustee, ensuring their vision for the trust is upheld. There are various types of Appointment of Successor Trustee that can be specified in a Trust Agreement, depending on the specific needs and intentions of the Trust or. Some common types of successor trustee appointments include: 1. Individual Successor Trustee: This involves appointing a specific person, typically a family member, friend, or trusted advisor, to assume the trustee role upon the Trust or's incapacity or passing. The Trust or may consider relevant factors such as the individual's financial acumen, trust management experience, and integrity when making this appointment. 2. Corporate Trustee: Alternatively, the Trust or may opt to appoint a corporate trustee such as a bank, trust company, or professional fiduciary firm. This choice may be preferred when there is a need for specialized expertise or professional management of the trust assets. Corporate trustees often have extensive experience in managing trusts and can provide long-term stability in the administration of the trust. 3. Co-Trustees: In some cases, the Trust or may choose to appoint multiple individuals or a combination of individuals and corporate entities as co-trustees. This arrangement allows for shared responsibilities and diversified expertise, ensuring a collaborative approach to trust management. When designating an Appointment of Successor Trustee in a Phoenix, Arizona trust arrangement, it is crucial to consider the legal requirements, tax implications, and any specific state laws that may impact the trust's administration. Seeking professional legal counsel and consulting with a qualified estate planning attorney can provide invaluable guidance in drafting and implementing this provision effectively. Overall, the Appointment of Successor Trustee in a Trust Agreement provides peace of mind to the Trust or, knowing that their trust will be transitioned seamlessly and managed according to their wishes, even in unforeseen circumstances. This provision fosters the stability, protection, and preservation of assets for the beneficiaries and ensures the trust's continued success.In Phoenix, Arizona, the Appointment of Successor Trustee by the Original Trust or in a Trust Agreement is an essential provision that allows the Trust or to name a trusted individual to take over the responsibilities of managing their trust in the event of their incapacity or death. This appointment ensures the smooth continuation of the trust's administration without major disruption or potential disputes. The Appointment of Successor Trustee is established through a legal document known as a Trust Agreement, which outlines the terms, conditions, and instructions for managing the trust assets. This provision provides flexibility to the Trust or in determining the criteria and qualifications for selecting a successor trustee, ensuring their vision for the trust is upheld. There are various types of Appointment of Successor Trustee that can be specified in a Trust Agreement, depending on the specific needs and intentions of the Trust or. Some common types of successor trustee appointments include: 1. Individual Successor Trustee: This involves appointing a specific person, typically a family member, friend, or trusted advisor, to assume the trustee role upon the Trust or's incapacity or passing. The Trust or may consider relevant factors such as the individual's financial acumen, trust management experience, and integrity when making this appointment. 2. Corporate Trustee: Alternatively, the Trust or may opt to appoint a corporate trustee such as a bank, trust company, or professional fiduciary firm. This choice may be preferred when there is a need for specialized expertise or professional management of the trust assets. Corporate trustees often have extensive experience in managing trusts and can provide long-term stability in the administration of the trust. 3. Co-Trustees: In some cases, the Trust or may choose to appoint multiple individuals or a combination of individuals and corporate entities as co-trustees. This arrangement allows for shared responsibilities and diversified expertise, ensuring a collaborative approach to trust management. When designating an Appointment of Successor Trustee in a Phoenix, Arizona trust arrangement, it is crucial to consider the legal requirements, tax implications, and any specific state laws that may impact the trust's administration. Seeking professional legal counsel and consulting with a qualified estate planning attorney can provide invaluable guidance in drafting and implementing this provision effectively. Overall, the Appointment of Successor Trustee in a Trust Agreement provides peace of mind to the Trust or, knowing that their trust will be transitioned seamlessly and managed according to their wishes, even in unforeseen circumstances. This provision fosters the stability, protection, and preservation of assets for the beneficiaries and ensures the trust's continued success.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.