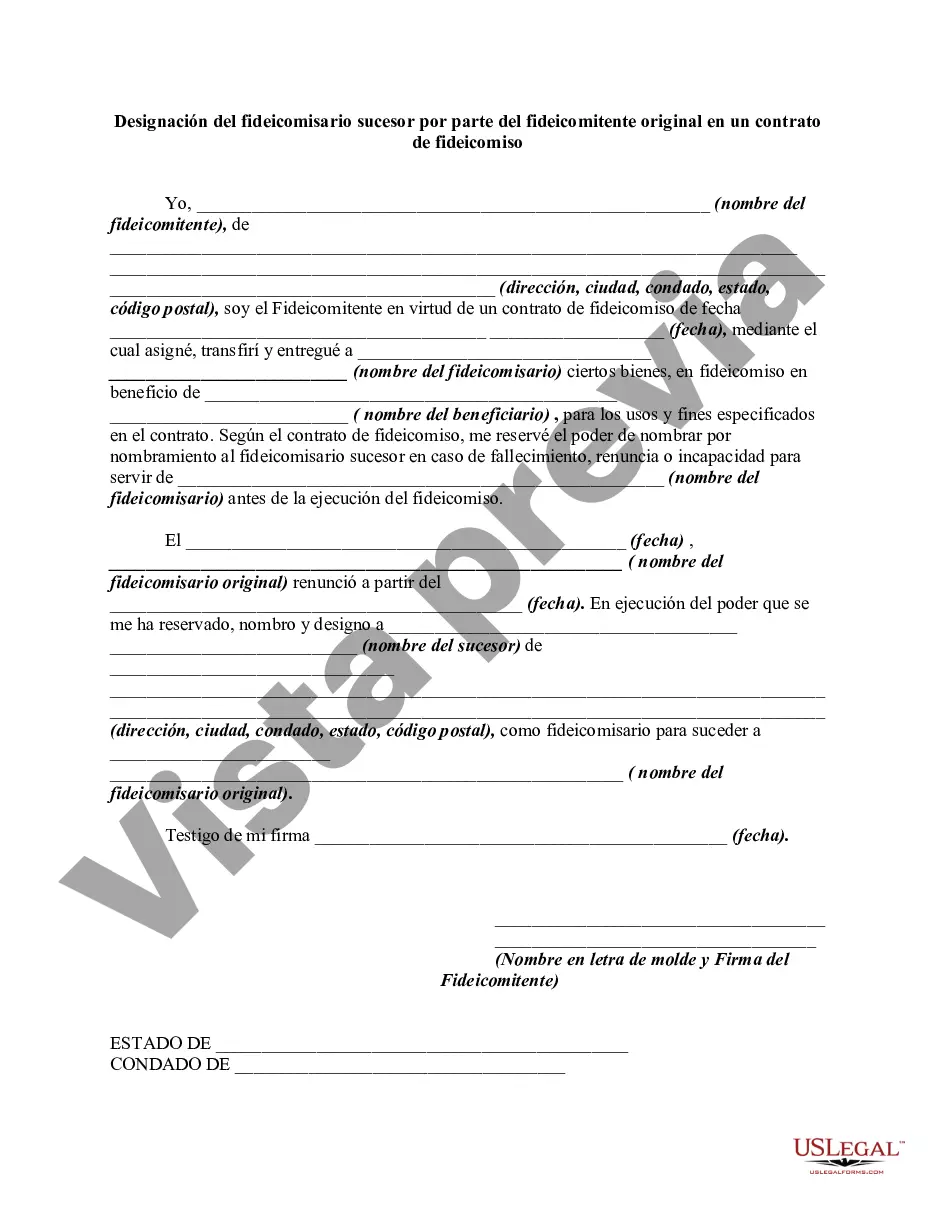

A well drafted trust instrument will generally prescribe the method and manner of substitution, succession, and selection of successor trustees. Such provisions must be carefully followed. A trustee may be given the power to appoint his or her own successor. Also, a trustor may reserve, or a beneficiary may be given, the power to change trustees. This form is a sample of a trustor appointing a successor trustee after the resignation of the original trustee.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

San Jose, California Appointment of Successor Trustee By Original Trust or in a Trust Agreement: A Comprehensive Overview In San Jose, California, the appointment of a successor trustee by the original trust or in a trust agreement is a crucial process that ensures the seamless transfer of trust administration in case of the original trustee's incapacity or unavailability. This legal arrangement allows the trust or to name an individual or entity capable of upholding the fiduciary responsibilities and managing the trust assets effectively. Keywords: San Jose, California, appointment of successor trustee, original trust or, trust agreement, trust administration, fiduciary responsibilities, trust assets. Different Types of San Jose, California Appointment of Successor Trustee By Original Trust or in a Trust Agreement: 1. Individual Successor Trustee: In this type, the original trust or designates a specific person as the successor trustee. This individual assumes the role of trustee when the original trustee becomes unable or unwilling to fulfill their duties. It is essential for the successor trustee to possess the necessary financial acumen and knowledge of trust law. 2. Professional Successor Trustee: The original trust or may choose a professional organization, such as a bank or a trust company, as the successor trustee. These entities have expertise in trust administration, investment management, and addressing complex legal and financial matters. Opting for a professional trustee ensures a highly competent and impartial management of the trust. 3. Co-Trustees: In some cases, the trust or may appoint multiple individuals or entities to serve as co-trustees. This arrangement allows for the sharing of responsibilities and diverse expertise among multiple trustees. The trust document will define the decision-making process and distribution of work among the co-trustees. Key Responsibilities of the Successor Trustee: 1. Asset Management: The successor trustee must diligently manage the trust assets, including investments, real estate, and personal property, in the best interest of the beneficiaries. 2. Record-Keeping: Maintaining accurate records of all transactions, distributions, and financial statements is crucial for transparency and accountability. 3. Fiduciary Duties: The successor trustee must uphold fiduciary responsibilities, acting in the beneficiaries' best interests, avoiding conflicts of interest, and exercising sound judgement. 4. Communication: Regular and effective communication with beneficiaries is essential, providing them with updates on trust administration, answering inquiries, and addressing concerns. 5. Legal and Tax Compliance: The successor trustee must ensure compliance with applicable laws and regulations, including tax filing requirements, to avoid any legal or financial consequences. 6. Distribution of Assets: In accordance with the trust agreement provisions, the successor trustee must distribute trust assets to the designated beneficiaries in a fair and timely manner. Appointing a successor trustee in a trust agreement in San Jose, California is a vital step to safeguard the trust or's intentions and protect the assets held in the trust. Whether the trust or chooses an individual or a professional entity as the successor trustee, careful consideration should be given to their abilities, qualifications, and trustworthiness to effectively administer the trust.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.