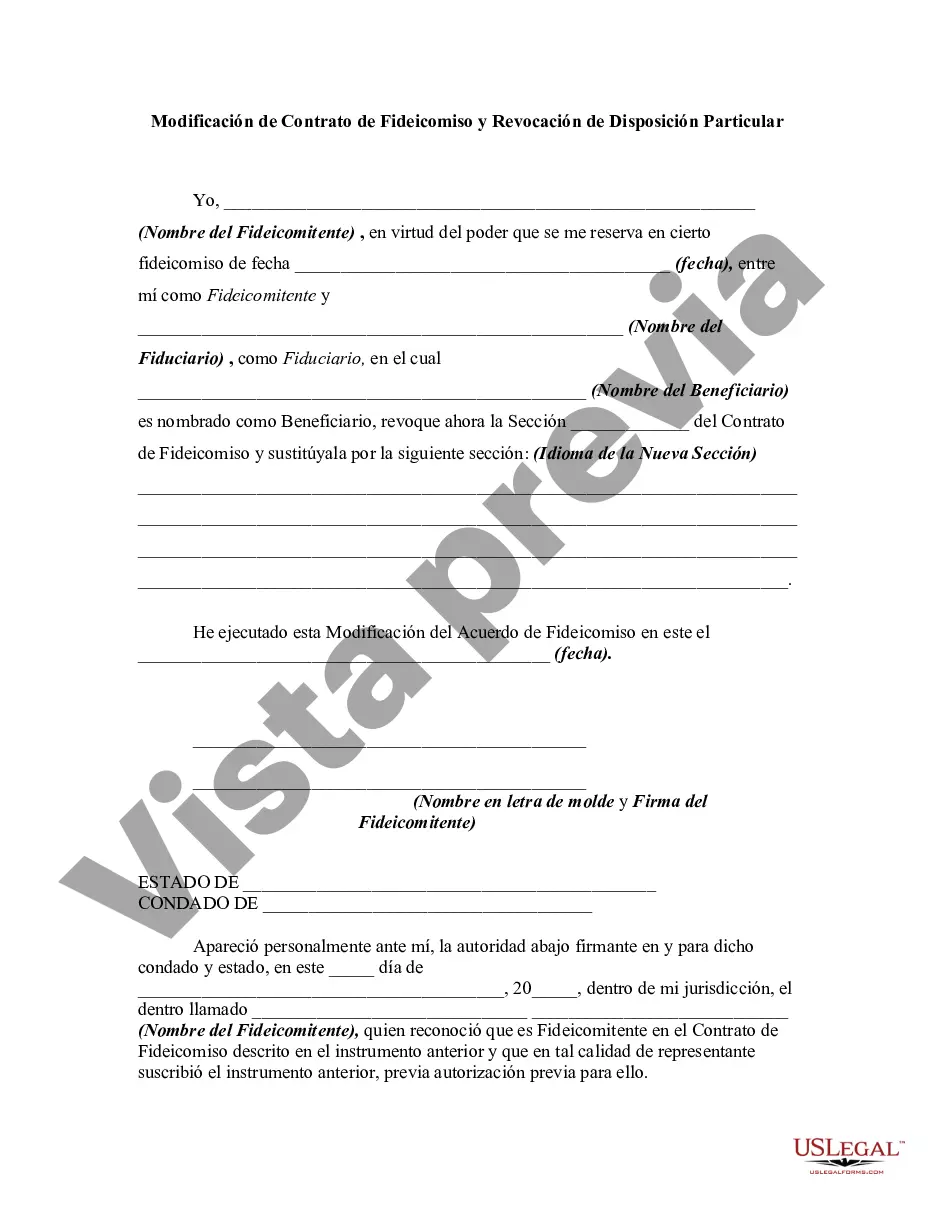

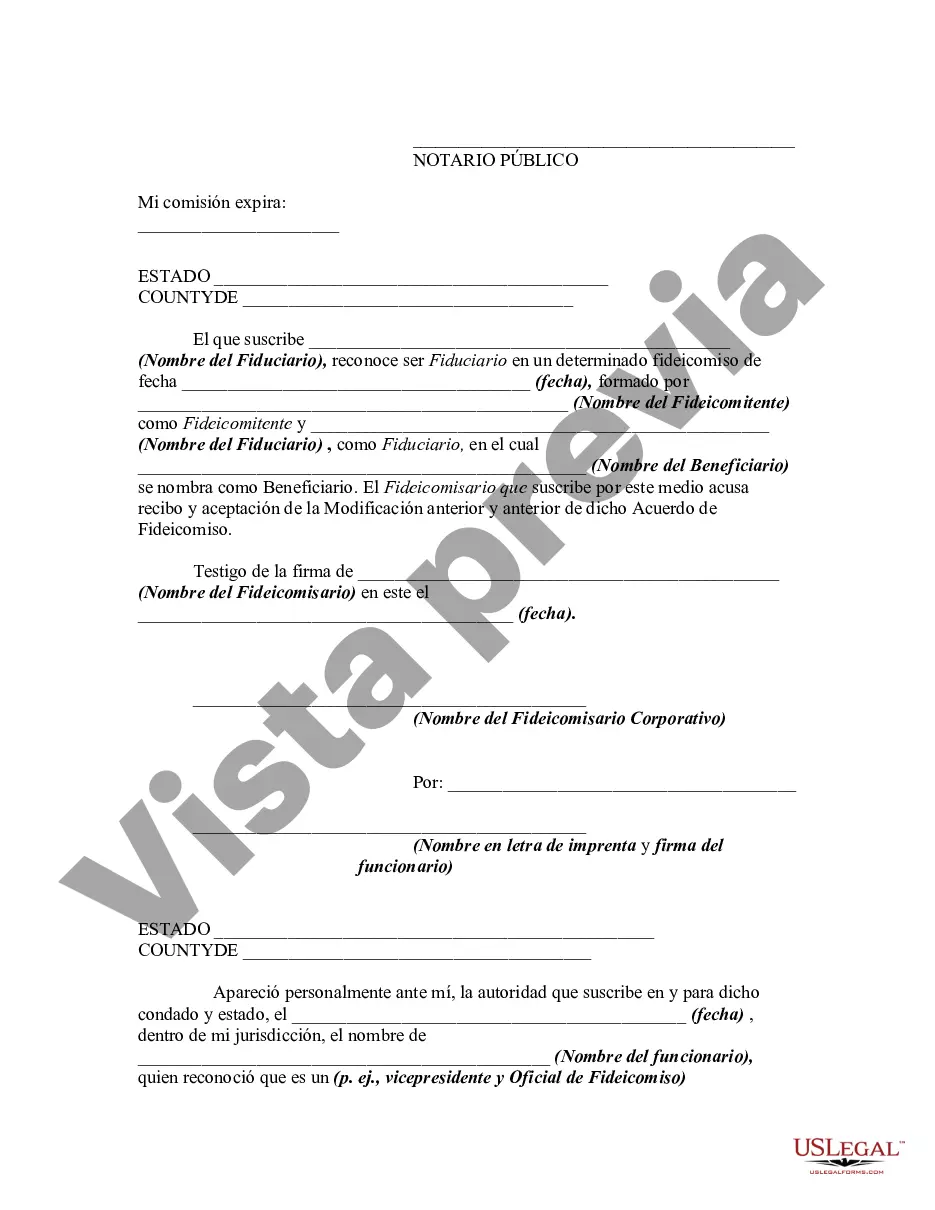

In this form, the trustor is amending the trust, pursuant to the power and authority he/she retained in the original trust agreement. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Harris Texas Amendment of Trust Agreement and Revocation of Particular Provision is a legal document that allows individuals to modify the terms and conditions of an existing trust, as well as to eliminate specific provisions within the trust agreement. This amendment is specifically designed for residents of Harris County, Texas, and serves as a means to update and customize the trust based on changing circumstances and objectives. The Harris Texas Amendment of Trust Agreement offers flexibility to individuals who wish to make alterations to their trust, whether it be changes in beneficiaries, trustees, asset distribution, or any other relevant provisions. It provides a legally binding method to modify the trust according to the granter's evolving needs, without the need to create an entirely new trust. Furthermore, the Revocation of Particular Provision is specifically used in conjunction with the amendment, allowing individuals to remove or revoke a particular provision within their trust that is no longer applicable or desired. This provision revocation provides individuals with the opportunity to adapt their trust in line with their current wishes, ensuring that the document accurately reflects their intentions. The types of Harris Texas Amendment of Trust Agreement and Revocation of Particular Provision can vary depending on the specific requirements and objectives of the granter. Examples may include: 1. Amendment to Beneficiary Designation: This type of amendment allows granters to modify or update the beneficiaries named in their trust, taking into account changes in personal relationships, family dynamics, or charitable giving preferences. 2. Amendment to Trustee Appointment: Granters may use this type of amendment to change the individuals or entities appointed as trustees, allowing for the replacement or addition of new trustees who will oversee the management and administration of the trust assets. 3. Amendment to Asset Distribution: This amendment focuses on modifying the manner in which assets are distributed among beneficiaries. It provides flexibility in adjusting the proportions or timing of distributions, ensuring that the trust aligns with the granter's current intentions. 4. Amendment to Terms and Conditions: Granters may opt for this type of amendment to revise specific terms and conditions within the trust agreement. This could include alterations to investment strategies, governing laws, or any other provision that requires modification. 5. Complete Revocation and Creation of New Trust: In some instances, granters may decide to completely revoke the existing trust and establish a new one. This approach allows for a comprehensive overhaul of the trust agreement, incorporating updated goals, beneficiaries, or trustees. The Harris Texas Amendment of Trust Agreement and Revocation of Particular Provision offer individuals the opportunity to tailor their trust to match their ever-changing circumstances and wishes. It is advisable to consult with a qualified attorney or legal professional experienced in trust law to ensure that any amendments or revocations are carried out correctly and in compliance with relevant laws and regulations.The Harris Texas Amendment of Trust Agreement and Revocation of Particular Provision is a legal document that allows individuals to modify the terms and conditions of an existing trust, as well as to eliminate specific provisions within the trust agreement. This amendment is specifically designed for residents of Harris County, Texas, and serves as a means to update and customize the trust based on changing circumstances and objectives. The Harris Texas Amendment of Trust Agreement offers flexibility to individuals who wish to make alterations to their trust, whether it be changes in beneficiaries, trustees, asset distribution, or any other relevant provisions. It provides a legally binding method to modify the trust according to the granter's evolving needs, without the need to create an entirely new trust. Furthermore, the Revocation of Particular Provision is specifically used in conjunction with the amendment, allowing individuals to remove or revoke a particular provision within their trust that is no longer applicable or desired. This provision revocation provides individuals with the opportunity to adapt their trust in line with their current wishes, ensuring that the document accurately reflects their intentions. The types of Harris Texas Amendment of Trust Agreement and Revocation of Particular Provision can vary depending on the specific requirements and objectives of the granter. Examples may include: 1. Amendment to Beneficiary Designation: This type of amendment allows granters to modify or update the beneficiaries named in their trust, taking into account changes in personal relationships, family dynamics, or charitable giving preferences. 2. Amendment to Trustee Appointment: Granters may use this type of amendment to change the individuals or entities appointed as trustees, allowing for the replacement or addition of new trustees who will oversee the management and administration of the trust assets. 3. Amendment to Asset Distribution: This amendment focuses on modifying the manner in which assets are distributed among beneficiaries. It provides flexibility in adjusting the proportions or timing of distributions, ensuring that the trust aligns with the granter's current intentions. 4. Amendment to Terms and Conditions: Granters may opt for this type of amendment to revise specific terms and conditions within the trust agreement. This could include alterations to investment strategies, governing laws, or any other provision that requires modification. 5. Complete Revocation and Creation of New Trust: In some instances, granters may decide to completely revoke the existing trust and establish a new one. This approach allows for a comprehensive overhaul of the trust agreement, incorporating updated goals, beneficiaries, or trustees. The Harris Texas Amendment of Trust Agreement and Revocation of Particular Provision offer individuals the opportunity to tailor their trust to match their ever-changing circumstances and wishes. It is advisable to consult with a qualified attorney or legal professional experienced in trust law to ensure that any amendments or revocations are carried out correctly and in compliance with relevant laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.