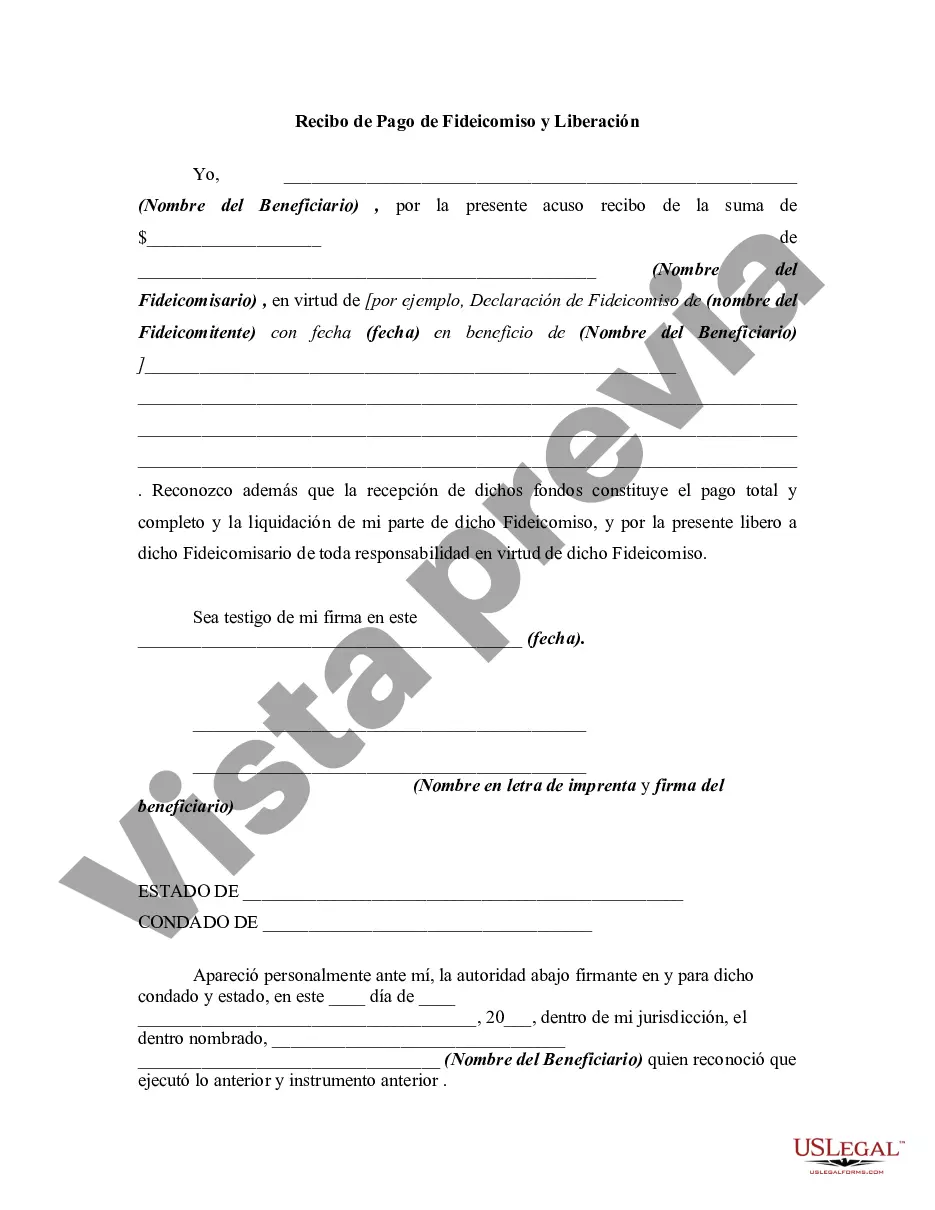

In this form, the beneficiary of a trust acknowledges receipt from the trustee of all monies due to him/her pursuant to the terms of the trust. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Harris Texas Receipt for Payment of Trust Fund and Release is a legal document that serves as evidence of payment made from a trust fund and the subsequent release of any associated obligations or liabilities. This receipt is essential in formalizing the closing of a trust fund or when finalizing financial transactions. The Harris Texas Receipt for Payment of Trust Fund and Release may vary depending on the specific purpose it serves. Here are some of the types: 1. Personal Trust Fund Receipt: This type of receipt is commonly used in cases where an individual or family sets up a trust fund to manage their assets and financial affairs. Once the payment from the trust fund has been received, this receipt outlines the disbursed amount, date of payment, and signifies the release of any outstanding obligations. 2. Charitable Trust Fund Receipt: When individuals or organizations make donations or contributions to charitable trusts, a distinct type of receipt is issued. This document acknowledges the receipt of the donation, explains how the funds will be used for charitable purposes, and officially releases the donor from any further responsibility. 3. Business Trust Fund Receipt: In business transactions, funds are often held in trust for various purposes such as property purchases, escrow accounts, or settlements. A business trust fund receipt details the payment received, identifies the purpose of the funds, and formally releases the parties involved from any obligations related to the transaction. 4. Estate Trust Fund Receipt: Estate planning involves the management and distribution of assets after a person's death. A receipt for payment of a trust fund within an estate outlines the value of the assets received, the beneficiaries who will benefit from the funds, and affirms the final release of any rights or claims against the estate. Regardless of the specific type, the Harris Texas Receipt for Payment of Trust Fund and Release includes essential elements such as the trustee's contact information, the beneficiary's information, the amount of funds received, the reason for the payment, relevant dates, and any terms or conditions specified in the trust agreement. It is crucial to ensure that this receipt is accurate, as it becomes a crucial supporting document for tax purposes, legal proceedings, and financial record-keeping.Harris Texas Receipt for Payment of Trust Fund and Release is a legal document that serves as evidence of payment made from a trust fund and the subsequent release of any associated obligations or liabilities. This receipt is essential in formalizing the closing of a trust fund or when finalizing financial transactions. The Harris Texas Receipt for Payment of Trust Fund and Release may vary depending on the specific purpose it serves. Here are some of the types: 1. Personal Trust Fund Receipt: This type of receipt is commonly used in cases where an individual or family sets up a trust fund to manage their assets and financial affairs. Once the payment from the trust fund has been received, this receipt outlines the disbursed amount, date of payment, and signifies the release of any outstanding obligations. 2. Charitable Trust Fund Receipt: When individuals or organizations make donations or contributions to charitable trusts, a distinct type of receipt is issued. This document acknowledges the receipt of the donation, explains how the funds will be used for charitable purposes, and officially releases the donor from any further responsibility. 3. Business Trust Fund Receipt: In business transactions, funds are often held in trust for various purposes such as property purchases, escrow accounts, or settlements. A business trust fund receipt details the payment received, identifies the purpose of the funds, and formally releases the parties involved from any obligations related to the transaction. 4. Estate Trust Fund Receipt: Estate planning involves the management and distribution of assets after a person's death. A receipt for payment of a trust fund within an estate outlines the value of the assets received, the beneficiaries who will benefit from the funds, and affirms the final release of any rights or claims against the estate. Regardless of the specific type, the Harris Texas Receipt for Payment of Trust Fund and Release includes essential elements such as the trustee's contact information, the beneficiary's information, the amount of funds received, the reason for the payment, relevant dates, and any terms or conditions specified in the trust agreement. It is crucial to ensure that this receipt is accurate, as it becomes a crucial supporting document for tax purposes, legal proceedings, and financial record-keeping.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.