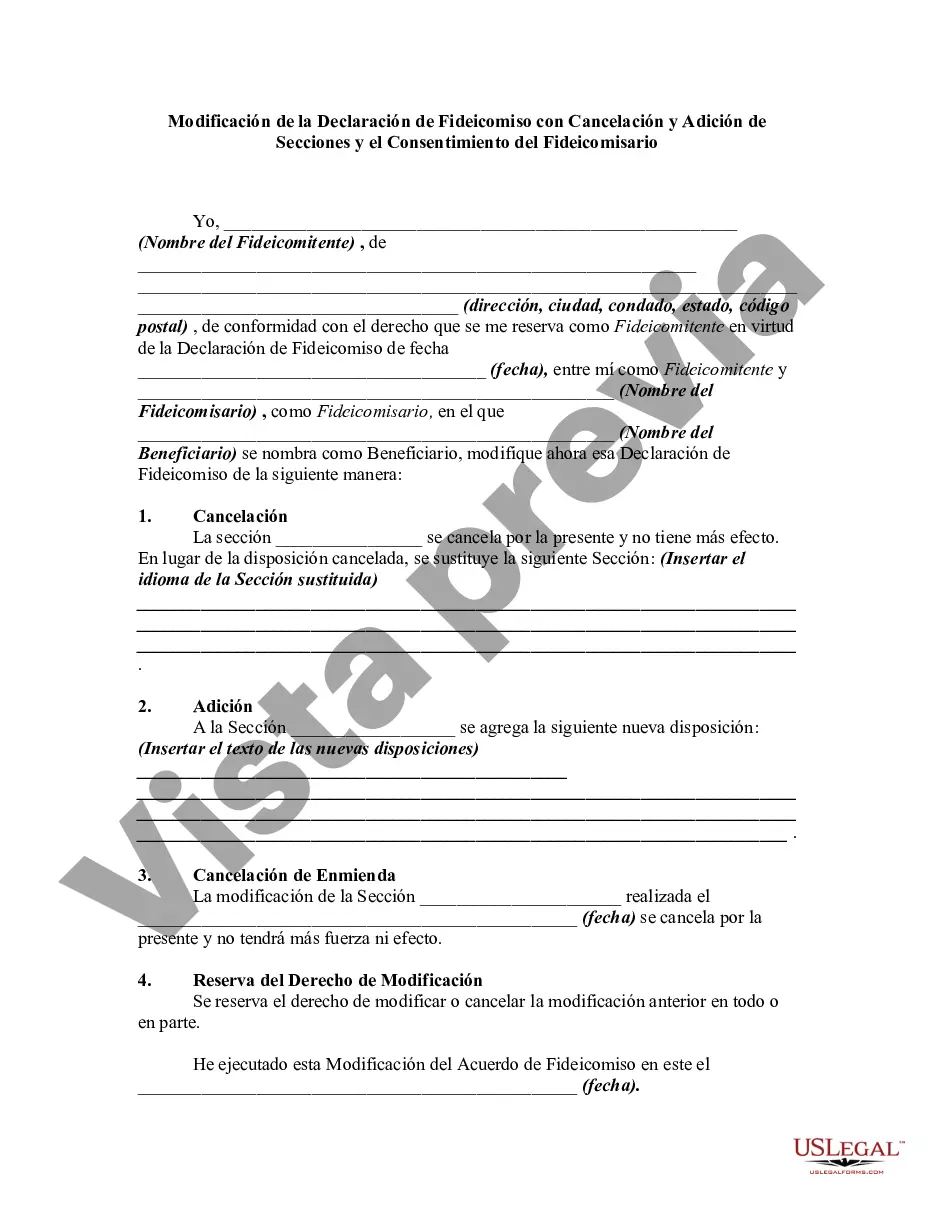

In this form, the trustor is amending the trust, pursuant to the power and authority he/she retained in the original trust agreement. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

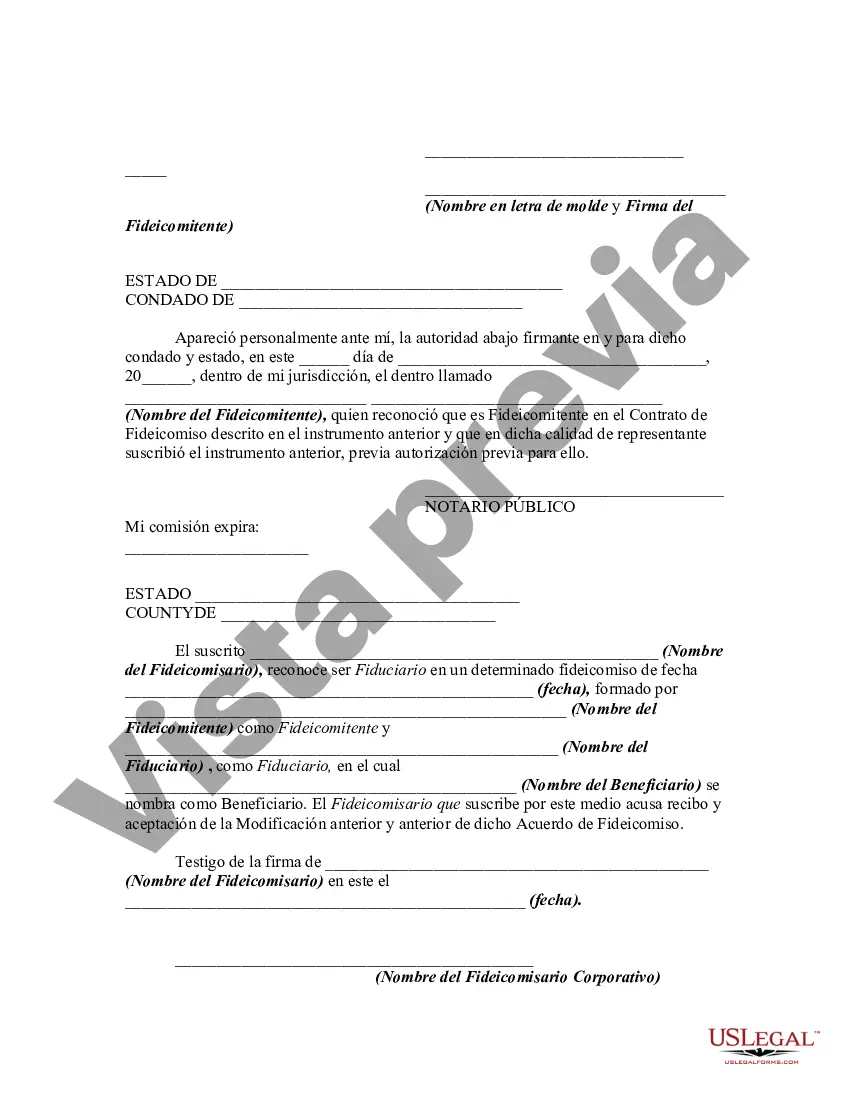

Title: Understanding the Harris Texas Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee Keywords: Harris Texas, Amendment of Declaration of Trust, Cancellation, Addition of Sections, Consent of Trustee Introduction: In Harris Texas, the Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee is a legal process that allows changes to be made to a trust agreement. This comprehensive guide will explain the different types and purposes of such amendments and provide insights into the role of the trustee in the process. 1. Harris Texas Amendment of Declaration of Trust: The Harris Texas Amendment of Declaration of Trust refers to the modification or alteration of the original trust agreement. This amendment allows the trust document to be updated to reflect changes in circumstances, beneficiaries, or any other aspect detailed within the trust agreement. 2. Cancellation and Addition of Sections: Under the Harris Texas Amendment of Declaration of Trust, cancellation involves the removal or elimination of certain sections within the trust document. This could be necessary to update obsolete provisions, rectify errors, or adjust the trust's terms to better align with the settler's intentions. Conversely, an addition of sections involves including new provisions or clauses into the trust agreement. These additions cater to changing circumstances or to address current legal requirements, allowing the trust to remain relevant and effective. 3. Consent of Trustee: The consent of trustee is an essential requirement for any amendment to the Declaration of Trust in Harris Texas. The trustee, being the individual or entity responsible for managing the trust, must provide their approval before any changes can be made. The consent ensures that the trustee is aware of and agrees to the proposed modifications, thus protecting the interests of all parties involved. Types of Harris Texas Amendment of Declaration of Trust with Cancellation and Addition of Sections: a. Beneficiary Amendments: These amendments modify the provisions related to beneficiaries, such as adding or removing specific individuals or altering their entitlements within the trust. b. Administrative Amendments: Administrative amendments primarily address the overall management and operation of the trust. These changes may include altering the trustee's powers and responsibilities, updating trust administration guidelines, or clarifying accounting and reporting procedures. c. Tax-related Amendments: When changes in tax laws occur, amendments may be necessary to optimize the trust's tax efficiency. These amendments aim to align the trust's provisions with the latest tax regulations, potentially resulting in enhanced benefits or reduced tax burdens. d. Clarification or Correction Amendments: In some cases, amendments may be required to clarify ambiguous language or rectify errors made during the original drafting of the trust agreement. These amendments ensure that the intent of the settler is accurately reflected in the trust document. Conclusion: The Harris Texas Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee is a crucial legal process that allows for necessary changes to be made to a trust agreement. Beneficiary, administrative, tax-related, and clarification or correction amendments are just a few examples of the types of modifications that can occur. It is essential to consult with legal professionals experienced in trust law to ensure that any changes made appropriately align with the settler's intentions and comply with applicable regulations.Title: Understanding the Harris Texas Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee Keywords: Harris Texas, Amendment of Declaration of Trust, Cancellation, Addition of Sections, Consent of Trustee Introduction: In Harris Texas, the Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee is a legal process that allows changes to be made to a trust agreement. This comprehensive guide will explain the different types and purposes of such amendments and provide insights into the role of the trustee in the process. 1. Harris Texas Amendment of Declaration of Trust: The Harris Texas Amendment of Declaration of Trust refers to the modification or alteration of the original trust agreement. This amendment allows the trust document to be updated to reflect changes in circumstances, beneficiaries, or any other aspect detailed within the trust agreement. 2. Cancellation and Addition of Sections: Under the Harris Texas Amendment of Declaration of Trust, cancellation involves the removal or elimination of certain sections within the trust document. This could be necessary to update obsolete provisions, rectify errors, or adjust the trust's terms to better align with the settler's intentions. Conversely, an addition of sections involves including new provisions or clauses into the trust agreement. These additions cater to changing circumstances or to address current legal requirements, allowing the trust to remain relevant and effective. 3. Consent of Trustee: The consent of trustee is an essential requirement for any amendment to the Declaration of Trust in Harris Texas. The trustee, being the individual or entity responsible for managing the trust, must provide their approval before any changes can be made. The consent ensures that the trustee is aware of and agrees to the proposed modifications, thus protecting the interests of all parties involved. Types of Harris Texas Amendment of Declaration of Trust with Cancellation and Addition of Sections: a. Beneficiary Amendments: These amendments modify the provisions related to beneficiaries, such as adding or removing specific individuals or altering their entitlements within the trust. b. Administrative Amendments: Administrative amendments primarily address the overall management and operation of the trust. These changes may include altering the trustee's powers and responsibilities, updating trust administration guidelines, or clarifying accounting and reporting procedures. c. Tax-related Amendments: When changes in tax laws occur, amendments may be necessary to optimize the trust's tax efficiency. These amendments aim to align the trust's provisions with the latest tax regulations, potentially resulting in enhanced benefits or reduced tax burdens. d. Clarification or Correction Amendments: In some cases, amendments may be required to clarify ambiguous language or rectify errors made during the original drafting of the trust agreement. These amendments ensure that the intent of the settler is accurately reflected in the trust document. Conclusion: The Harris Texas Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee is a crucial legal process that allows for necessary changes to be made to a trust agreement. Beneficiary, administrative, tax-related, and clarification or correction amendments are just a few examples of the types of modifications that can occur. It is essential to consult with legal professionals experienced in trust law to ensure that any changes made appropriately align with the settler's intentions and comply with applicable regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.