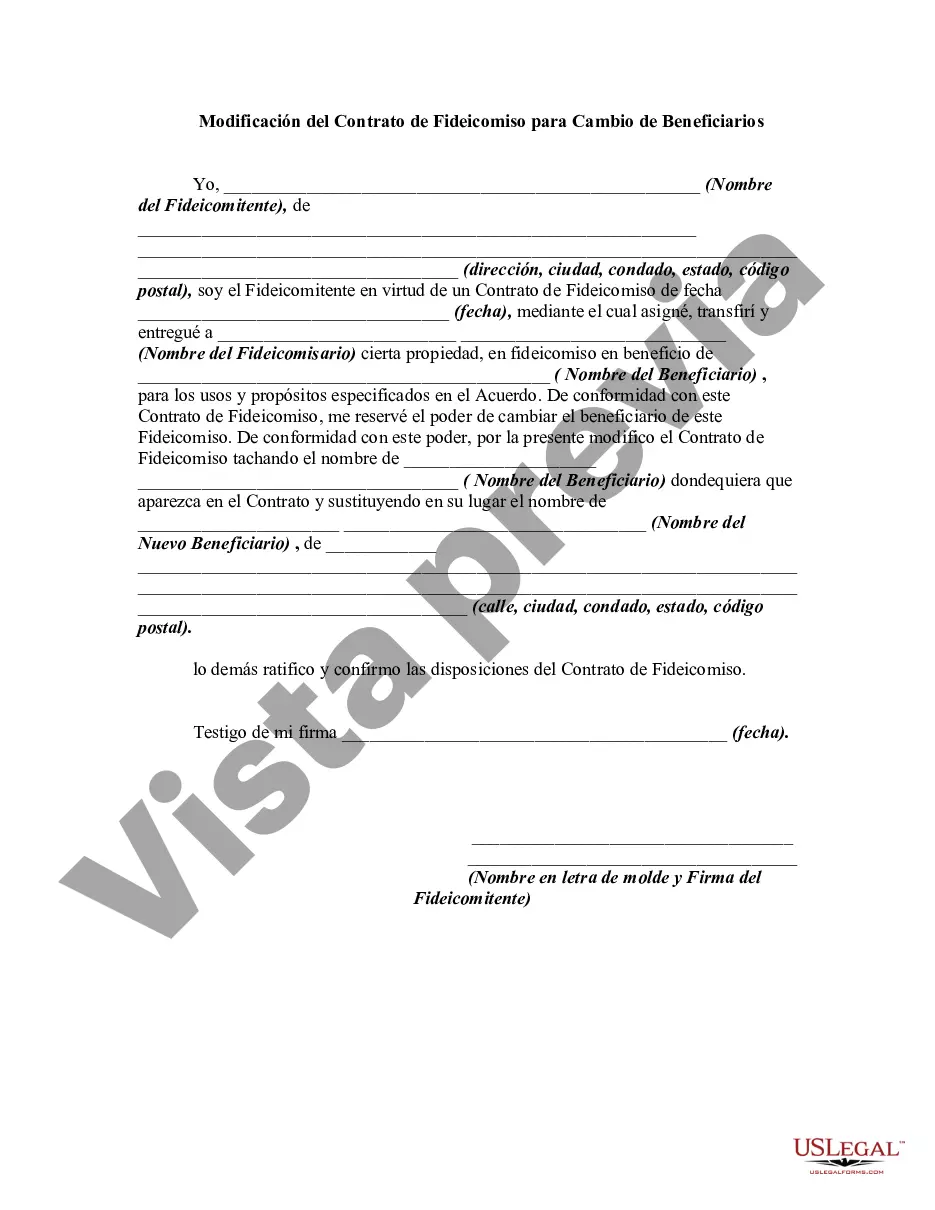

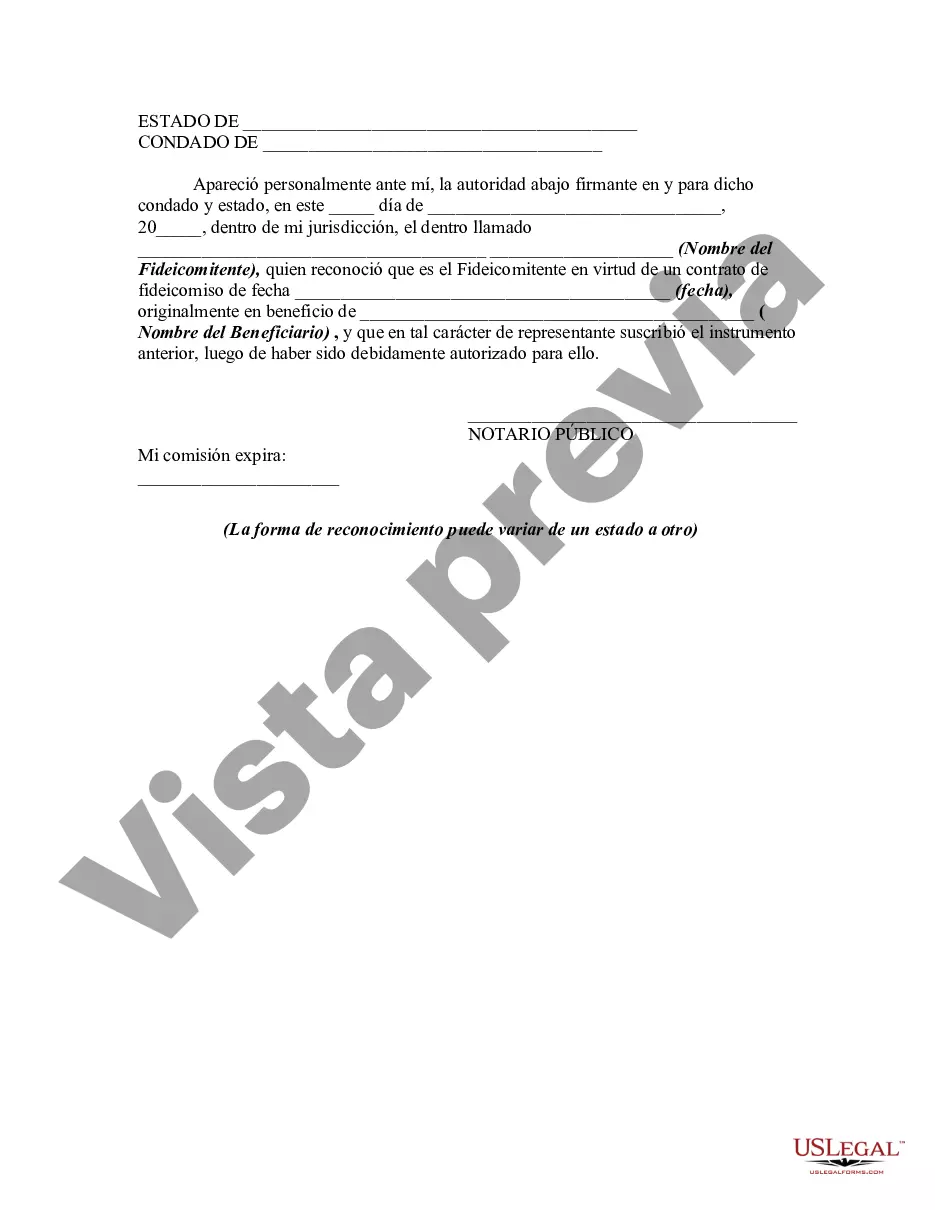

A well drafted trust instrument will generally prescribe the method and manner of amending the trust agreement. A trustor may reserve the power to change beneficiaries. This form is a sample of a trustor amending the trust agreement in order to change beneficiaries.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Bexar Texas Amendment to Trust Agreement is a legal document that allows individuals to make changes to the beneficiaries named in a trust. This amendment is crucial for individuals who want to update or modify their trust to ensure it aligns with their current wishes, financial circumstances, or personal relationships. There are various types of Bexar Texas Amendments to Trust Agreement that cater to different situations and requirements. These include: 1. Standard Bexar Texas Amendment to Trust Agreement: This type of amendment is for individuals who want to make minor changes to their trust beneficiaries. It typically involves adding or removing individuals, adjusting their shares, or updating their personal information. 2. Bexar Texas Amendment to Trust Agreement for Life Changes: Life is dynamic, and circumstances often change, requiring updates to trust beneficiaries. This amendment is suitable for individuals who have experienced major life events such as marriage, divorce, birth, or death and need to reflect these changes in their trust. 3. Bexar Texas Amendment to Trust Agreement for Financial Purposes: In certain cases, individuals may want to change their trust beneficiaries due to financial reasons. This type of amendment allows for modifications to accommodate shifting financial priorities, changes in the value of assets, or adjustments in wealth distribution. 4. Bexar Texas Amendment to Trust Agreement for Charitable Beneficiaries: Those who have a charitable intent and wish to include or modify charitable beneficiaries in their trust can utilize this amendment. It allows individuals to add or remove charitable organizations and specify the portion of assets designated for charitable purposes. 5. Bexar Texas Amendment to Trust Agreement for Special Needs Beneficiaries: When individuals have beneficiaries with special needs, they may need to establish a trust that protects their interests. This amendment helps modify the trust to ensure that the special needs beneficiary is adequately provided for without jeopardizing their eligibility for government benefits. Each type of Bexar Texas Amendment to Trust Agreement requires specific documentation and legal procedures. It is crucial for individuals to consult with an experienced attorney specializing in estate planning and trust administration to ensure compliance with state laws and to accurately execute the desired changes to the trust beneficiaries.The Bexar Texas Amendment to Trust Agreement is a legal document that allows individuals to make changes to the beneficiaries named in a trust. This amendment is crucial for individuals who want to update or modify their trust to ensure it aligns with their current wishes, financial circumstances, or personal relationships. There are various types of Bexar Texas Amendments to Trust Agreement that cater to different situations and requirements. These include: 1. Standard Bexar Texas Amendment to Trust Agreement: This type of amendment is for individuals who want to make minor changes to their trust beneficiaries. It typically involves adding or removing individuals, adjusting their shares, or updating their personal information. 2. Bexar Texas Amendment to Trust Agreement for Life Changes: Life is dynamic, and circumstances often change, requiring updates to trust beneficiaries. This amendment is suitable for individuals who have experienced major life events such as marriage, divorce, birth, or death and need to reflect these changes in their trust. 3. Bexar Texas Amendment to Trust Agreement for Financial Purposes: In certain cases, individuals may want to change their trust beneficiaries due to financial reasons. This type of amendment allows for modifications to accommodate shifting financial priorities, changes in the value of assets, or adjustments in wealth distribution. 4. Bexar Texas Amendment to Trust Agreement for Charitable Beneficiaries: Those who have a charitable intent and wish to include or modify charitable beneficiaries in their trust can utilize this amendment. It allows individuals to add or remove charitable organizations and specify the portion of assets designated for charitable purposes. 5. Bexar Texas Amendment to Trust Agreement for Special Needs Beneficiaries: When individuals have beneficiaries with special needs, they may need to establish a trust that protects their interests. This amendment helps modify the trust to ensure that the special needs beneficiary is adequately provided for without jeopardizing their eligibility for government benefits. Each type of Bexar Texas Amendment to Trust Agreement requires specific documentation and legal procedures. It is crucial for individuals to consult with an experienced attorney specializing in estate planning and trust administration to ensure compliance with state laws and to accurately execute the desired changes to the trust beneficiaries.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.