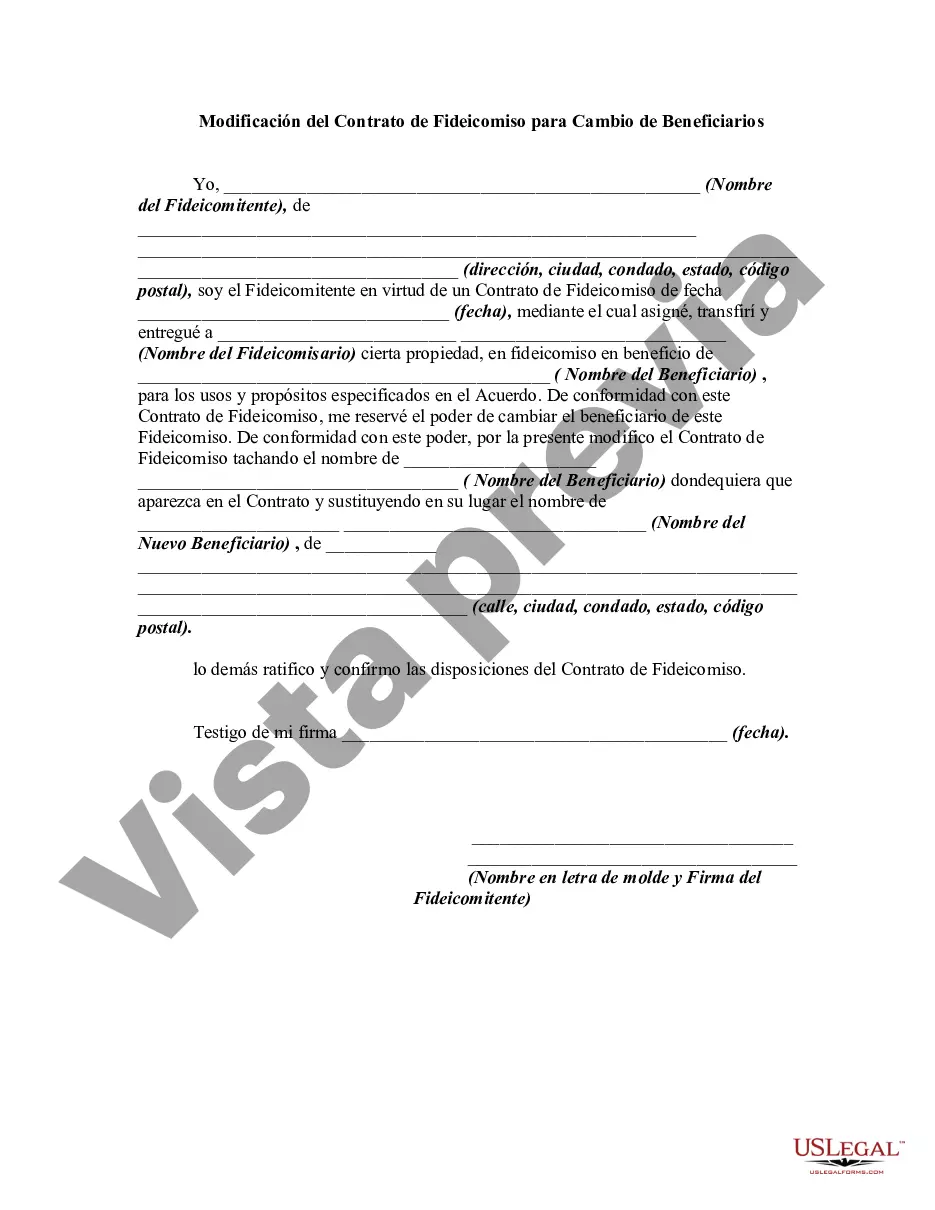

A well drafted trust instrument will generally prescribe the method and manner of amending the trust agreement. A trustor may reserve the power to change beneficiaries. This form is a sample of a trustor amending the trust agreement in order to change beneficiaries.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

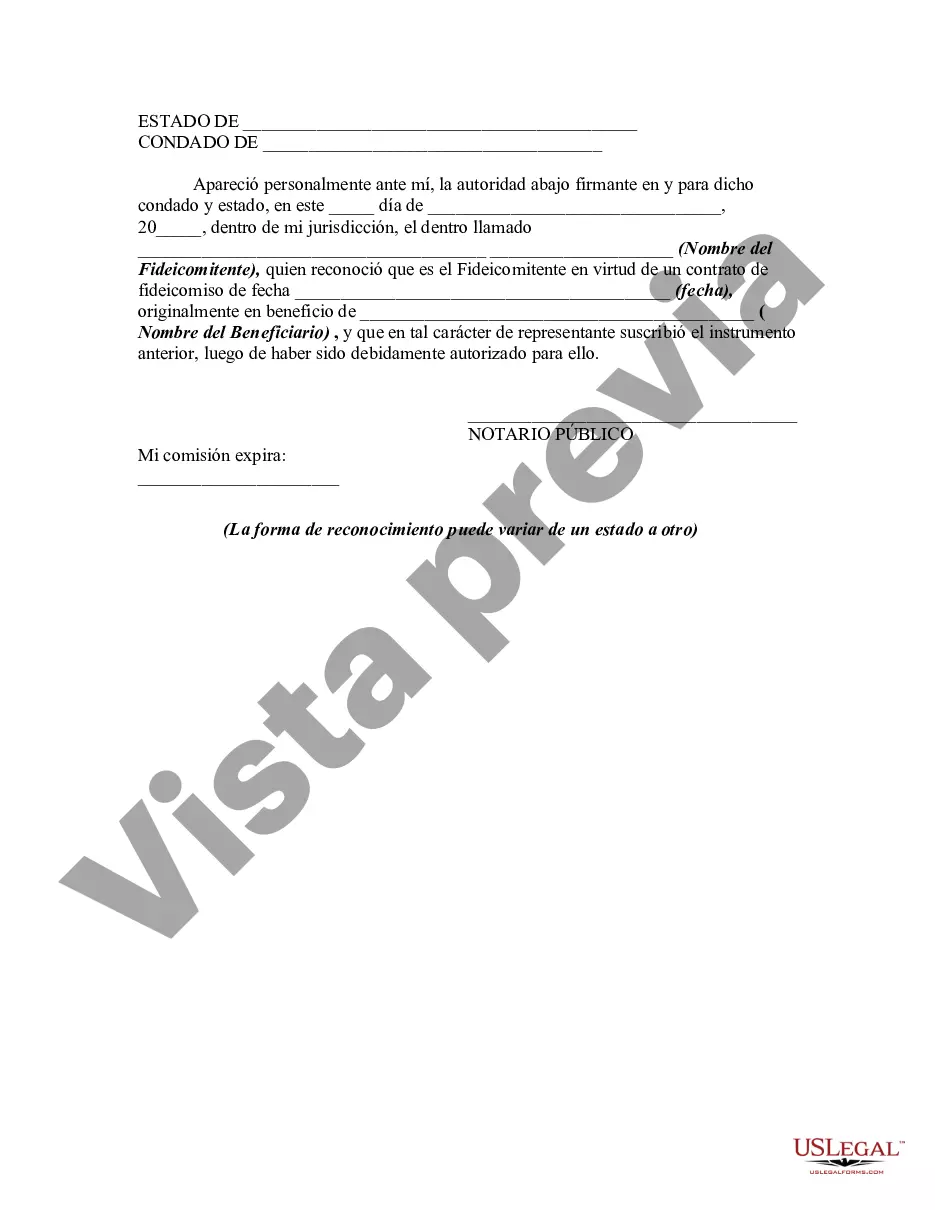

Chicago Illinois Amendment to Trust Agreement in Order to Change Beneficiaries is a legal process that allows for modification of the beneficiaries named in a trust agreement in Chicago, Illinois. This amendment is essential when there is a need to update or alter beneficiary designations due to various reasons such as changes in personal circumstances, life events, or wish to include new beneficiaries. One type of Chicago Illinois Amendment to Trust Agreement in Order to Change Beneficiaries is a general amendment. A general amendment allows for the modification of multiple beneficiaries at once and is commonly used when there are substantial changes required. Another type is a specific amendment, which focuses on altering the beneficiaries of a specific portion or asset within the trust agreement. For example, if the trust includes multiple properties, this type of amendment enables changing beneficiaries for a specific property. The process of a Chicago Illinois Amendment to Trust Agreement in Order to Change Beneficiaries usually begins by drafting the amendment document, which outlines the desired changes clearly. The document should include the trust's original identification details, the specific sections to be altered, and the updated beneficiary information. Once the amendment is drafted, it needs to be signed and notarized by the trust or, also known as the creator or settler of the trust. The trust or's signature should be witnessed by two adults who are not beneficiaries of the trust. After obtaining the necessary signatures, the completed amendment document should then be attached to the original trust agreement. It is crucial to maintain a copy of both the amended trust agreement and the amendment for records and reference. To make the amendment legally effective, it is advisable to notify all affected parties, including the previous and updated beneficiaries, of the changes made. This ensures transparency and mitigates potential disputes or misunderstandings in the future. In conclusion, a Chicago Illinois Amendment to Trust Agreement in Order to Change Beneficiaries allows for necessary modifications to be made to the beneficiaries named in a trust agreement. Whether it is a general amendment or a specific amendment, following the correct legal procedures and ensuring proper documentation is crucial to successfully change the beneficiaries in a trust agreement.Chicago Illinois Amendment to Trust Agreement in Order to Change Beneficiaries is a legal process that allows for modification of the beneficiaries named in a trust agreement in Chicago, Illinois. This amendment is essential when there is a need to update or alter beneficiary designations due to various reasons such as changes in personal circumstances, life events, or wish to include new beneficiaries. One type of Chicago Illinois Amendment to Trust Agreement in Order to Change Beneficiaries is a general amendment. A general amendment allows for the modification of multiple beneficiaries at once and is commonly used when there are substantial changes required. Another type is a specific amendment, which focuses on altering the beneficiaries of a specific portion or asset within the trust agreement. For example, if the trust includes multiple properties, this type of amendment enables changing beneficiaries for a specific property. The process of a Chicago Illinois Amendment to Trust Agreement in Order to Change Beneficiaries usually begins by drafting the amendment document, which outlines the desired changes clearly. The document should include the trust's original identification details, the specific sections to be altered, and the updated beneficiary information. Once the amendment is drafted, it needs to be signed and notarized by the trust or, also known as the creator or settler of the trust. The trust or's signature should be witnessed by two adults who are not beneficiaries of the trust. After obtaining the necessary signatures, the completed amendment document should then be attached to the original trust agreement. It is crucial to maintain a copy of both the amended trust agreement and the amendment for records and reference. To make the amendment legally effective, it is advisable to notify all affected parties, including the previous and updated beneficiaries, of the changes made. This ensures transparency and mitigates potential disputes or misunderstandings in the future. In conclusion, a Chicago Illinois Amendment to Trust Agreement in Order to Change Beneficiaries allows for necessary modifications to be made to the beneficiaries named in a trust agreement. Whether it is a general amendment or a specific amendment, following the correct legal procedures and ensuring proper documentation is crucial to successfully change the beneficiaries in a trust agreement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.