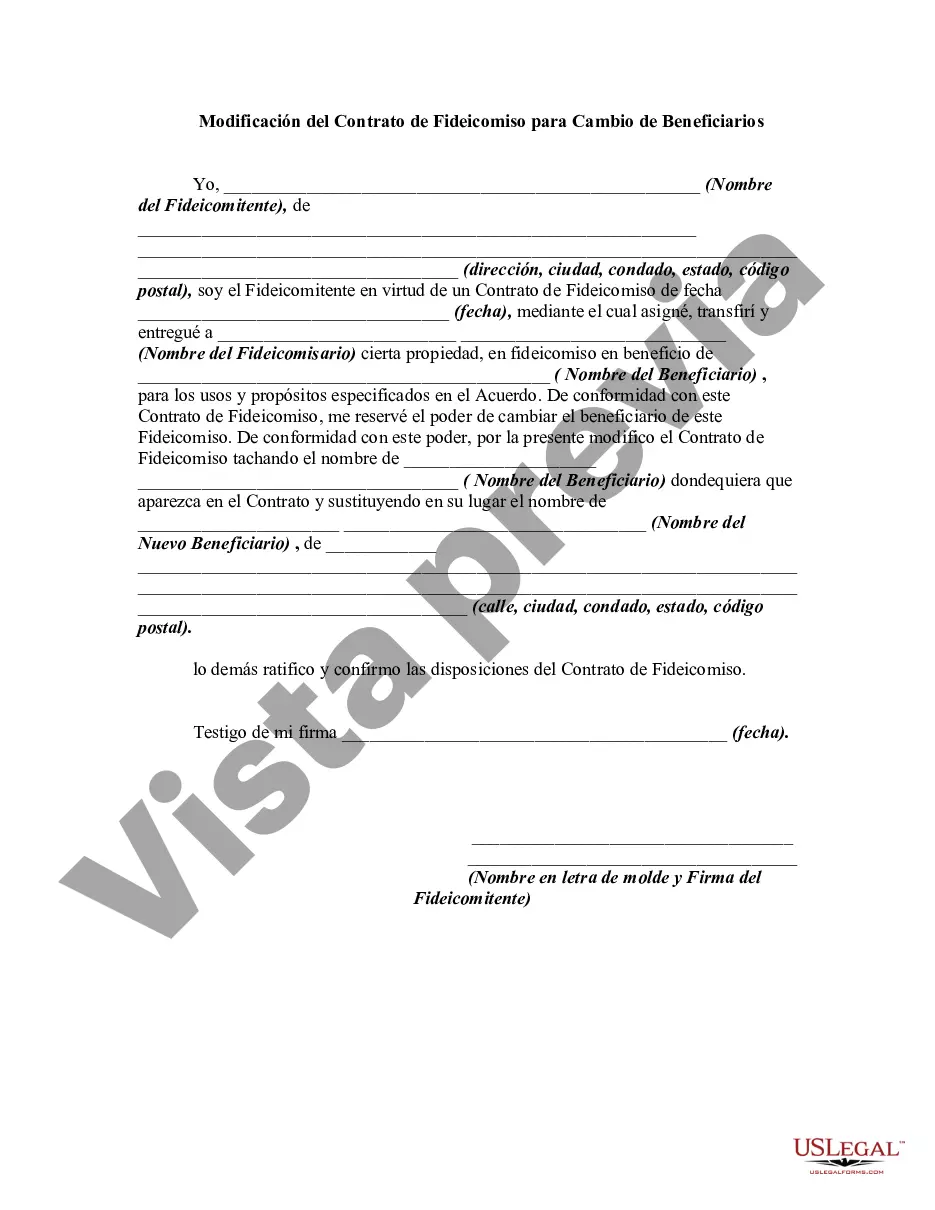

A well drafted trust instrument will generally prescribe the method and manner of amending the trust agreement. A trustor may reserve the power to change beneficiaries. This form is a sample of a trustor amending the trust agreement in order to change beneficiaries.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

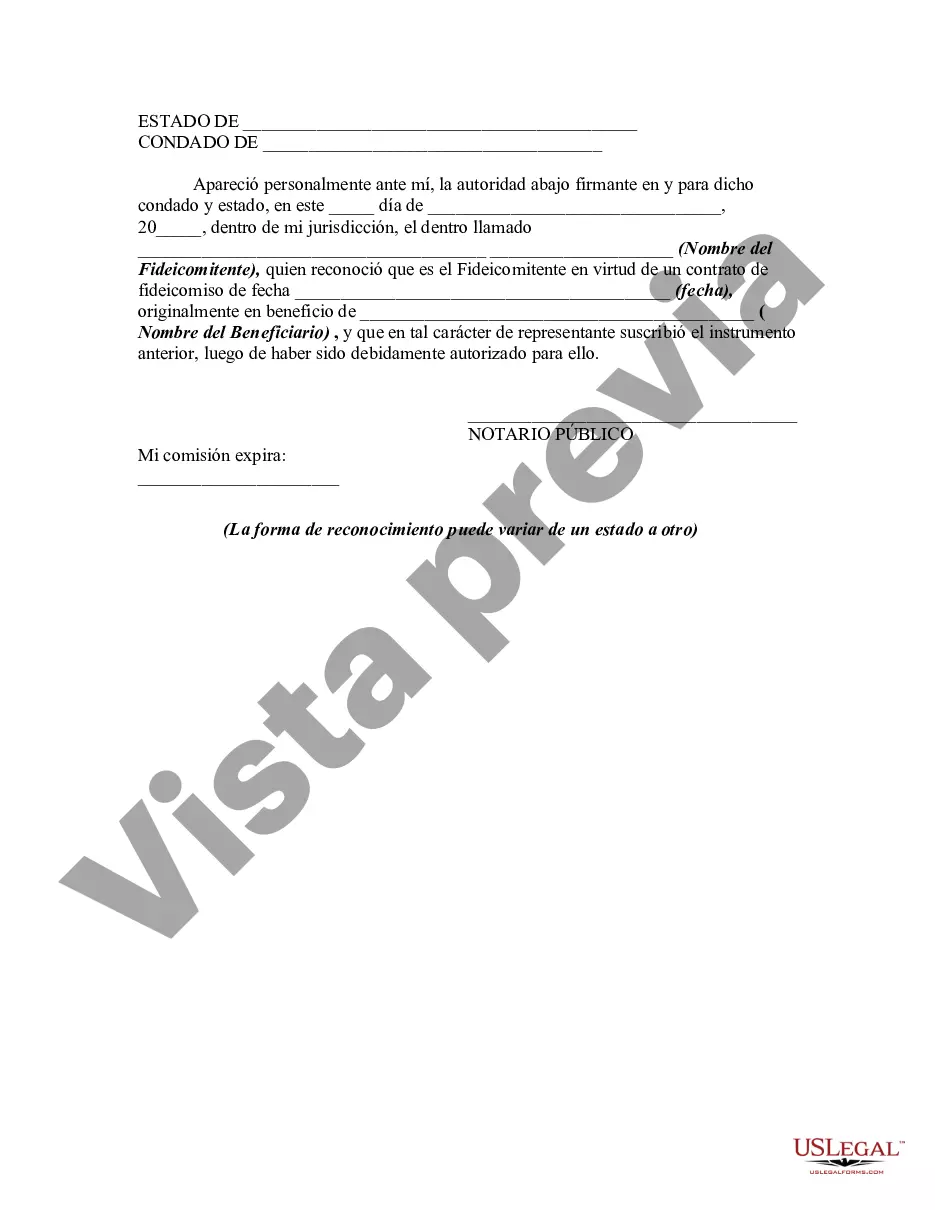

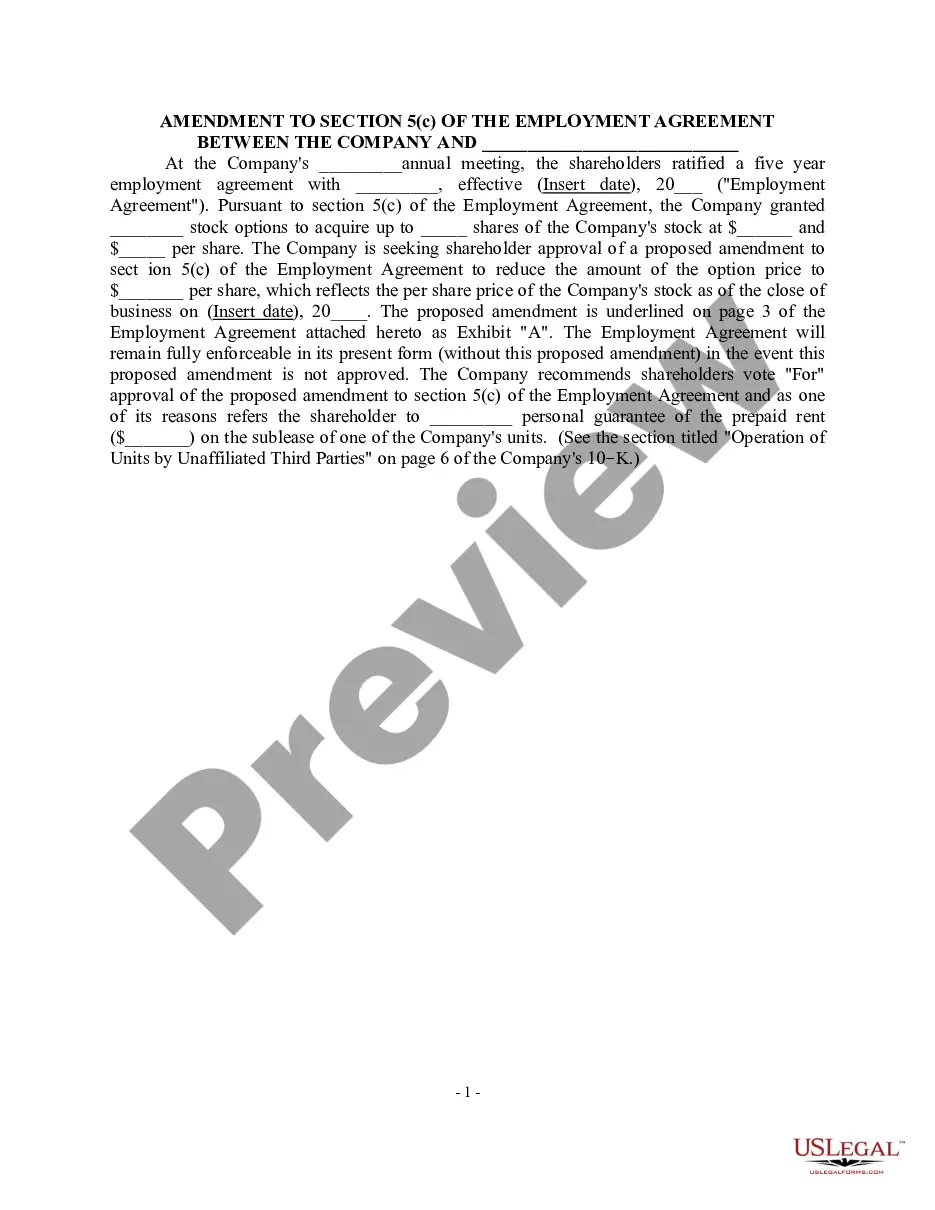

Title: Harris Texas Amendment to Trust Agreement in Order to Change Beneficiaries: A Comprehensive Overview Keywords: Harris Texas, Amendment to Trust Agreement, Change Beneficiaries, trust modification, types of amendments, trust law, beneficiaries' rights, legal process, provisions, estate planning. Introduction: The Harris Texas Amendment to Trust Agreement is a legal provision that allows individuals to modify their trust agreements in order to change beneficiaries. This process is crucial for adjusting estate plans, ensuring the trust reflects the settler's current intentions, and addressing evolving circumstances. This article provides a detailed description of the Harris Texas Amendment to Trust Agreement, covering its significance, different types of amendments, and the steps involved in making changes to beneficiaries. Types of Harris Texas Amendment to Trust Agreement: 1. Beneficiary Addition: This amendment allows for the inclusion of new beneficiaries to an existing trust agreement. Reasons for adding beneficiaries may include the birth or adoption of children, marriage, or to include charitable organizations as beneficiaries. 2. Beneficiary Removal: This amendment permits the removal of beneficiaries previously designated in the trust agreement. It may be necessary due to a change in circumstances, strained relationships, or when beneficiaries are no longer suitable for receiving assets from the trust. 3. Change in Beneficiary Shares: This type of amendment adjusts the proportionate distribution of assets among beneficiaries. It can ensure equitable distribution, account for life changes, or prevent disputes among beneficiaries. 4. Contingent Beneficiary Alteration: This amendment modifies the order of contingent beneficiaries, allowing individuals to update who will inherit assets if the primary beneficiaries are unable to receive them. 5. Change in Beneficiary Conditions: This amendment allows the settler to modify specific conditions or requirements attached to a beneficiary's entitlement. For instance, changing age restrictions, educational requirements, or conditions based on financial responsibility. Steps Involved in Changing Beneficiaries: 1. Consultation with an attorney: Seek advice from a qualified attorney experienced in trust law to understand the legal implications and ensure adherence to the specific Harris Texas regulations. 2. Review the trust agreement: Carefully examine the existing trust document to understand the original provisions, identify the areas requiring modification, and determine the desired changes to the beneficiaries. 3. Drafting the amendment: Collaborate with your attorney to create a legally sound amendment that clearly specifies the intended changes to the beneficiary provisions. 4. Execution and witnessing: Execute the amendment following the appropriate protocol, including signing, notarization, and witnessing as required under Harris Texas laws. 5. Sharing the amendment: Distribute the amended trust agreement to relevant parties, including trustees, beneficiaries, and financial institutions. 6. Record keeping: Keep the original trust agreement, along with the executed amendment, in a safe and accessible location, such as a secure storage facility or with trusted legal counsel. Conclusion: The Harris Texas Amendment to Trust Agreement provides essential flexibility for individuals to modify their trust instruments to change beneficiaries. By understanding the various types of amendments and following the necessary legal process, individuals can ensure their estate plans align with their current wishes and effectively manage the distribution of assets to beneficiaries. To navigate the complexities involved, it is vital to seek professional legal guidance to ensure compliance with Harris Texas regulations and protect beneficiaries' rights.Title: Harris Texas Amendment to Trust Agreement in Order to Change Beneficiaries: A Comprehensive Overview Keywords: Harris Texas, Amendment to Trust Agreement, Change Beneficiaries, trust modification, types of amendments, trust law, beneficiaries' rights, legal process, provisions, estate planning. Introduction: The Harris Texas Amendment to Trust Agreement is a legal provision that allows individuals to modify their trust agreements in order to change beneficiaries. This process is crucial for adjusting estate plans, ensuring the trust reflects the settler's current intentions, and addressing evolving circumstances. This article provides a detailed description of the Harris Texas Amendment to Trust Agreement, covering its significance, different types of amendments, and the steps involved in making changes to beneficiaries. Types of Harris Texas Amendment to Trust Agreement: 1. Beneficiary Addition: This amendment allows for the inclusion of new beneficiaries to an existing trust agreement. Reasons for adding beneficiaries may include the birth or adoption of children, marriage, or to include charitable organizations as beneficiaries. 2. Beneficiary Removal: This amendment permits the removal of beneficiaries previously designated in the trust agreement. It may be necessary due to a change in circumstances, strained relationships, or when beneficiaries are no longer suitable for receiving assets from the trust. 3. Change in Beneficiary Shares: This type of amendment adjusts the proportionate distribution of assets among beneficiaries. It can ensure equitable distribution, account for life changes, or prevent disputes among beneficiaries. 4. Contingent Beneficiary Alteration: This amendment modifies the order of contingent beneficiaries, allowing individuals to update who will inherit assets if the primary beneficiaries are unable to receive them. 5. Change in Beneficiary Conditions: This amendment allows the settler to modify specific conditions or requirements attached to a beneficiary's entitlement. For instance, changing age restrictions, educational requirements, or conditions based on financial responsibility. Steps Involved in Changing Beneficiaries: 1. Consultation with an attorney: Seek advice from a qualified attorney experienced in trust law to understand the legal implications and ensure adherence to the specific Harris Texas regulations. 2. Review the trust agreement: Carefully examine the existing trust document to understand the original provisions, identify the areas requiring modification, and determine the desired changes to the beneficiaries. 3. Drafting the amendment: Collaborate with your attorney to create a legally sound amendment that clearly specifies the intended changes to the beneficiary provisions. 4. Execution and witnessing: Execute the amendment following the appropriate protocol, including signing, notarization, and witnessing as required under Harris Texas laws. 5. Sharing the amendment: Distribute the amended trust agreement to relevant parties, including trustees, beneficiaries, and financial institutions. 6. Record keeping: Keep the original trust agreement, along with the executed amendment, in a safe and accessible location, such as a secure storage facility or with trusted legal counsel. Conclusion: The Harris Texas Amendment to Trust Agreement provides essential flexibility for individuals to modify their trust instruments to change beneficiaries. By understanding the various types of amendments and following the necessary legal process, individuals can ensure their estate plans align with their current wishes and effectively manage the distribution of assets to beneficiaries. To navigate the complexities involved, it is vital to seek professional legal guidance to ensure compliance with Harris Texas regulations and protect beneficiaries' rights.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.