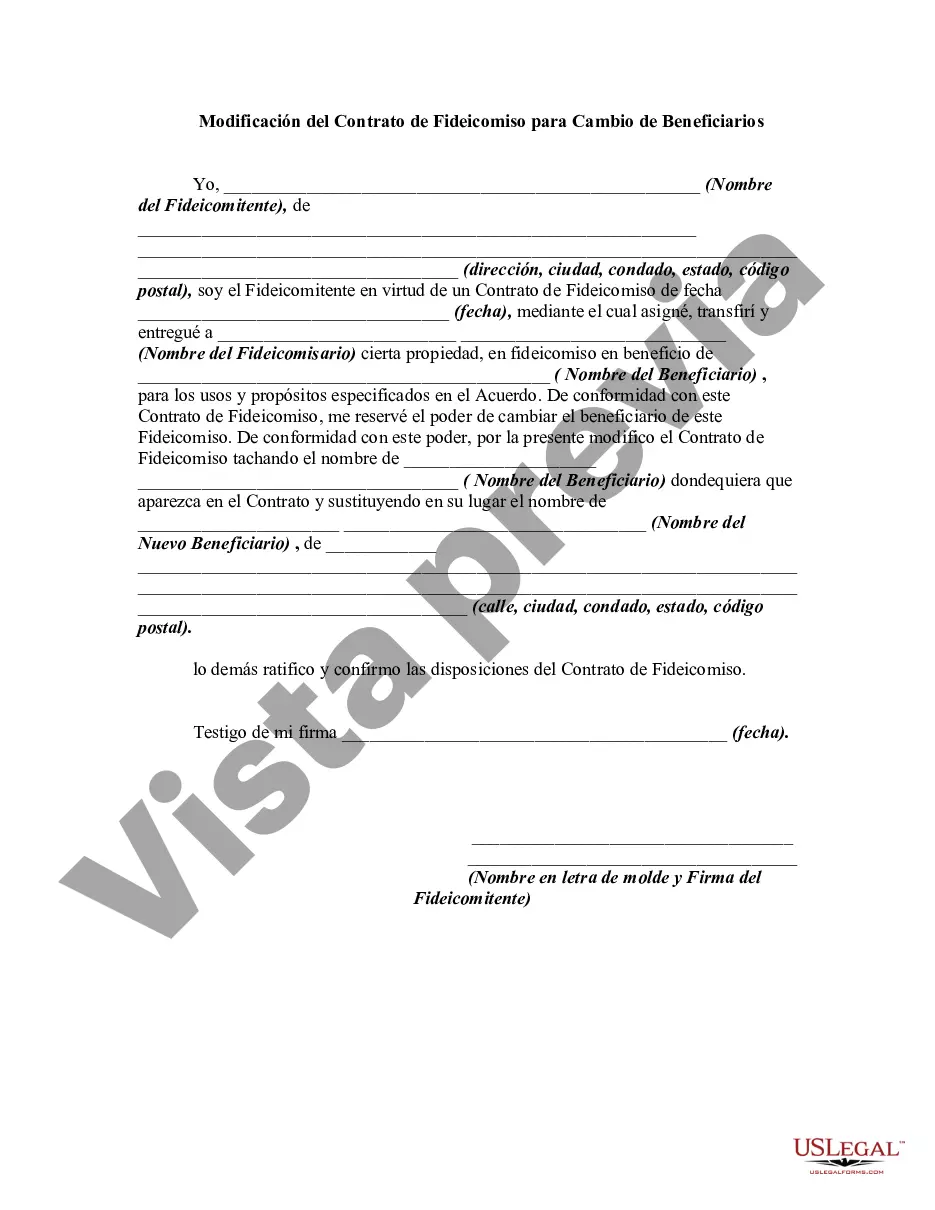

A well drafted trust instrument will generally prescribe the method and manner of amending the trust agreement. A trustor may reserve the power to change beneficiaries. This form is a sample of a trustor amending the trust agreement in order to change beneficiaries.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

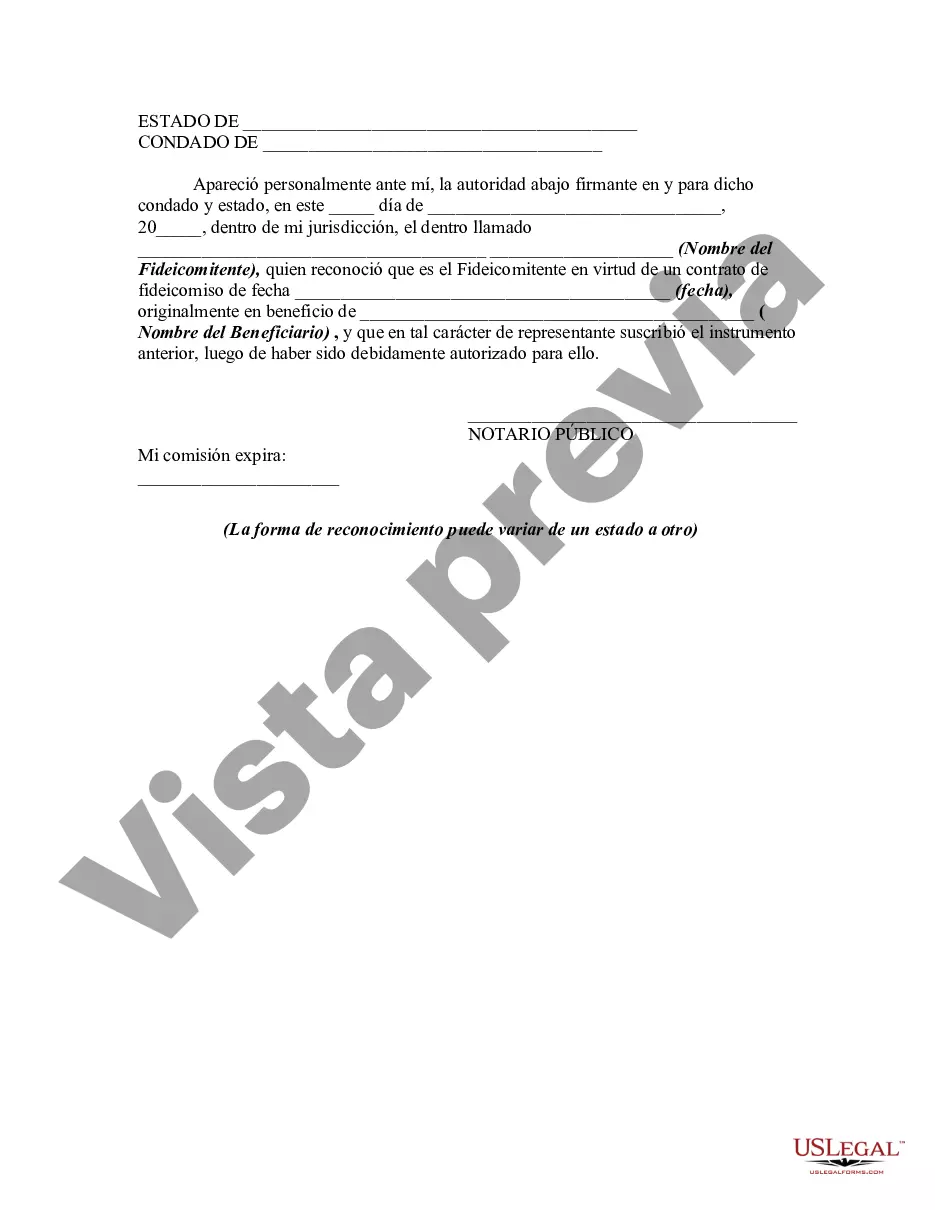

Title: Mecklenburg North Carolina Amendment to Trust Agreement in Order to Change Beneficiaries: A Comprehensive Guide Introduction: In Mecklenburg, North Carolina, an Amendment to a Trust Agreement provides individuals with the opportunity to modify the beneficiaries named in their trust. This legal process allows granters (the person creating the trust) to adapt their estate plan to reflect changing circumstances, ensuring their assets are distributed according to their wishes. This article aims to provide a detailed description of the Mecklenburg North Carolina Amendment to Trust Agreement process while highlighting its different types. 1. What is a Trust Agreement? A Trust Agreement is a legal document that outlines the provisions for asset management and distribution during and after the granter's lifetime. By creating a trust, the granter transfers ownership of assets to a trustee who administers them for the benefit of specified beneficiaries. 2. Understanding the Mecklenburg North Carolina Amendment to Trust Agreement: The Mecklenburg North Carolina Amendment to Trust Agreement enables granters to modify the terms of an existing trust, including changing beneficiaries, without revoking the entire document. It provides the flexibility needed to ensure the trust remains effective and aligned with the granter's evolving goals and circumstances. 3. Reasons to Change Beneficiaries: a. Life Events: Marriage, divorce, birth, adoption, or death within the family may warrant changes to the beneficiaries listed in the trust. b. Shifted Priorities: As personal relationships evolve, a granter may decide to redirect their assets to support different individuals or causes. c. Financial Considerations: Economic circumstances such as changes in income, investment portfolios, or significant liabilities may necessitate revisiting beneficiaries. 4. Process of Amending a Trust Agreement in Mecklenburg North Carolina: a. Consultation with an Attorney: Seek guidance from an experienced trust attorney in Mecklenburg, North Carolina who specializes in estate planning and trust law. b. Reviewing the Trust Agreement: Carefully analyze the original trust document to understand its current terms and specific provisions related to beneficiary changes. c. Drafting the Amendment: Collaborate with your attorney to prepare a legally sound amendment incorporating the desired changes to the trust's beneficiaries. d. Signing and Notarization: Execute the amendment in the presence of a notary, adhering to the specific signing requirements of Mecklenburg North Carolina law. e. Distribution and Documentation: Ensure a copy of the amendment is provided to all relevant parties and retain an executed copy for your records. 5. Different Types of Mecklenburg North Carolina Amendment to Trust Agreement: a. General Amendment: Allows changes to various provisions of the trust agreement. b. Specific Beneficiary Amendment: Pertains to modifying the beneficiaries' list while keeping other trust provisions intact. Conclusion: The Mecklenburg North Carolina Amendment to Trust Agreement is a valuable legal tool that grants flexibility in adapting a trust according to changing circumstances. Whether due to alterations within the family, financial considerations, or revised priorities, the ability to change beneficiaries ensures a granter's intentions are accurately reflected in their estate plan. To navigate this complex process, it is crucial to consult with a knowledgeable trust attorney in Mecklenburg, North Carolina, who can guide you through the amendment process and ensure compliance with relevant legal requirements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.