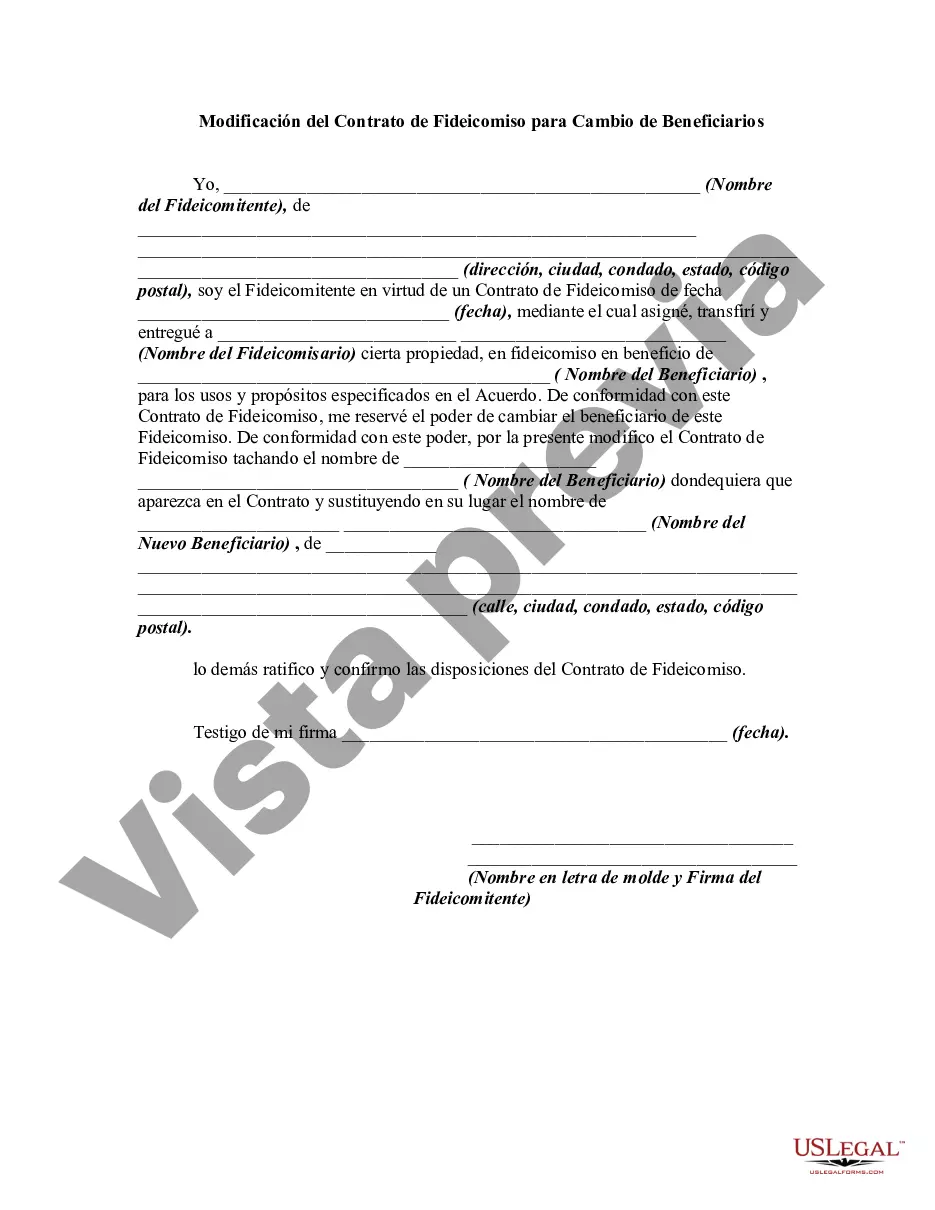

A well drafted trust instrument will generally prescribe the method and manner of amending the trust agreement. A trustor may reserve the power to change beneficiaries. This form is a sample of a trustor amending the trust agreement in order to change beneficiaries.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

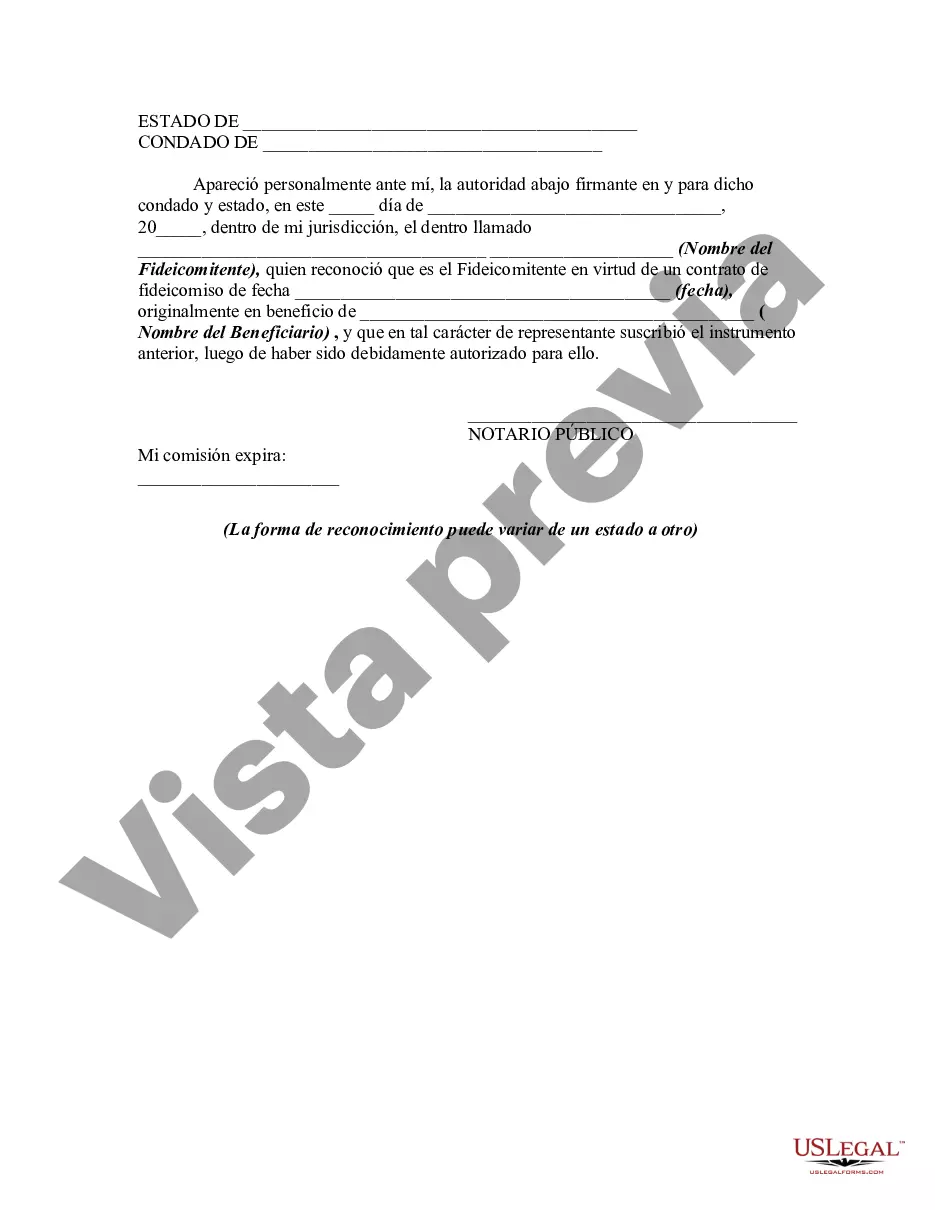

The Nassau New York Amendment to Trust Agreement is a legal document that allows individuals to make changes to the beneficiaries listed in their trust agreement. A trust agreement is a legal arrangement where one party, known as the settler, transfers assets to another party, known as the trustee, to be held and managed for the benefit of one or more beneficiaries. In the context of Nassau County, New York, there are several types of amendments to a trust agreement that can be made to change beneficiaries. These amendments may include revocable or irrevocable trust amendments, contingent beneficiary changes, and charitable beneficiary changes. A revocable trust amendment in Nassau County New York refers to a change made to a trust agreement that can be modified or revoked by the settler during their lifetime. This type of amendment allows for flexibility in altering beneficiaries and can be useful in cases where the settler's preferences or circumstances change over time. Conversely, an irrevocable trust amendment in Nassau County New York involves changes made to a trust agreement that cannot be altered or terminated without the consent of all parties involved, including the beneficiaries. This type of amendment requires careful consideration, as it typically involves complex legal processes. Another type of amendment that can be made to a trust agreement in Nassau County New York is a contingent beneficiary change. In this scenario, individuals can name alternate beneficiaries who will receive the trust's assets if the primary beneficiary is unable to receive them. This ensures that the settler's intentions are upheld, even in unforeseen circumstances. Additionally, Nassau County residents may also opt for charitable beneficiary changes within their trust agreement. By designating charitable organizations or causes as beneficiaries, individuals can provide ongoing support to causes they care about even after their passing. This type of amendment allows for philanthropic endeavors to continue in alignment with the settler's wishes. In conclusion, the Nassau New York Amendment to Trust Agreement is a crucial legal tool that enables individuals to modify beneficiary designations within their trust agreement. Whether it involves revocable or irrevocable trusts, contingent beneficiary changes, or charitable beneficiary changes, seeking legal assistance is essential to ensure compliance with Nassau County's laws and regulations.The Nassau New York Amendment to Trust Agreement is a legal document that allows individuals to make changes to the beneficiaries listed in their trust agreement. A trust agreement is a legal arrangement where one party, known as the settler, transfers assets to another party, known as the trustee, to be held and managed for the benefit of one or more beneficiaries. In the context of Nassau County, New York, there are several types of amendments to a trust agreement that can be made to change beneficiaries. These amendments may include revocable or irrevocable trust amendments, contingent beneficiary changes, and charitable beneficiary changes. A revocable trust amendment in Nassau County New York refers to a change made to a trust agreement that can be modified or revoked by the settler during their lifetime. This type of amendment allows for flexibility in altering beneficiaries and can be useful in cases where the settler's preferences or circumstances change over time. Conversely, an irrevocable trust amendment in Nassau County New York involves changes made to a trust agreement that cannot be altered or terminated without the consent of all parties involved, including the beneficiaries. This type of amendment requires careful consideration, as it typically involves complex legal processes. Another type of amendment that can be made to a trust agreement in Nassau County New York is a contingent beneficiary change. In this scenario, individuals can name alternate beneficiaries who will receive the trust's assets if the primary beneficiary is unable to receive them. This ensures that the settler's intentions are upheld, even in unforeseen circumstances. Additionally, Nassau County residents may also opt for charitable beneficiary changes within their trust agreement. By designating charitable organizations or causes as beneficiaries, individuals can provide ongoing support to causes they care about even after their passing. This type of amendment allows for philanthropic endeavors to continue in alignment with the settler's wishes. In conclusion, the Nassau New York Amendment to Trust Agreement is a crucial legal tool that enables individuals to modify beneficiary designations within their trust agreement. Whether it involves revocable or irrevocable trusts, contingent beneficiary changes, or charitable beneficiary changes, seeking legal assistance is essential to ensure compliance with Nassau County's laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.