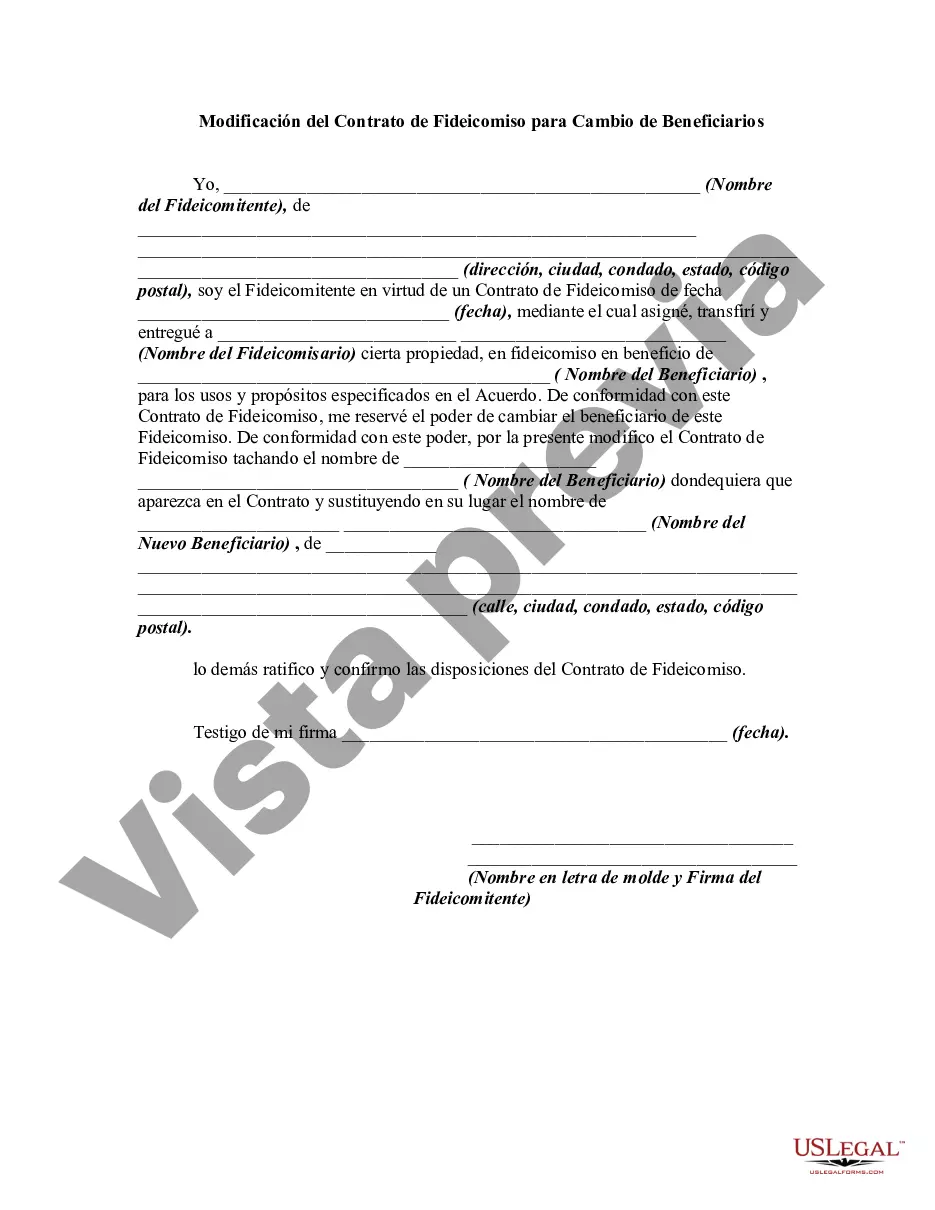

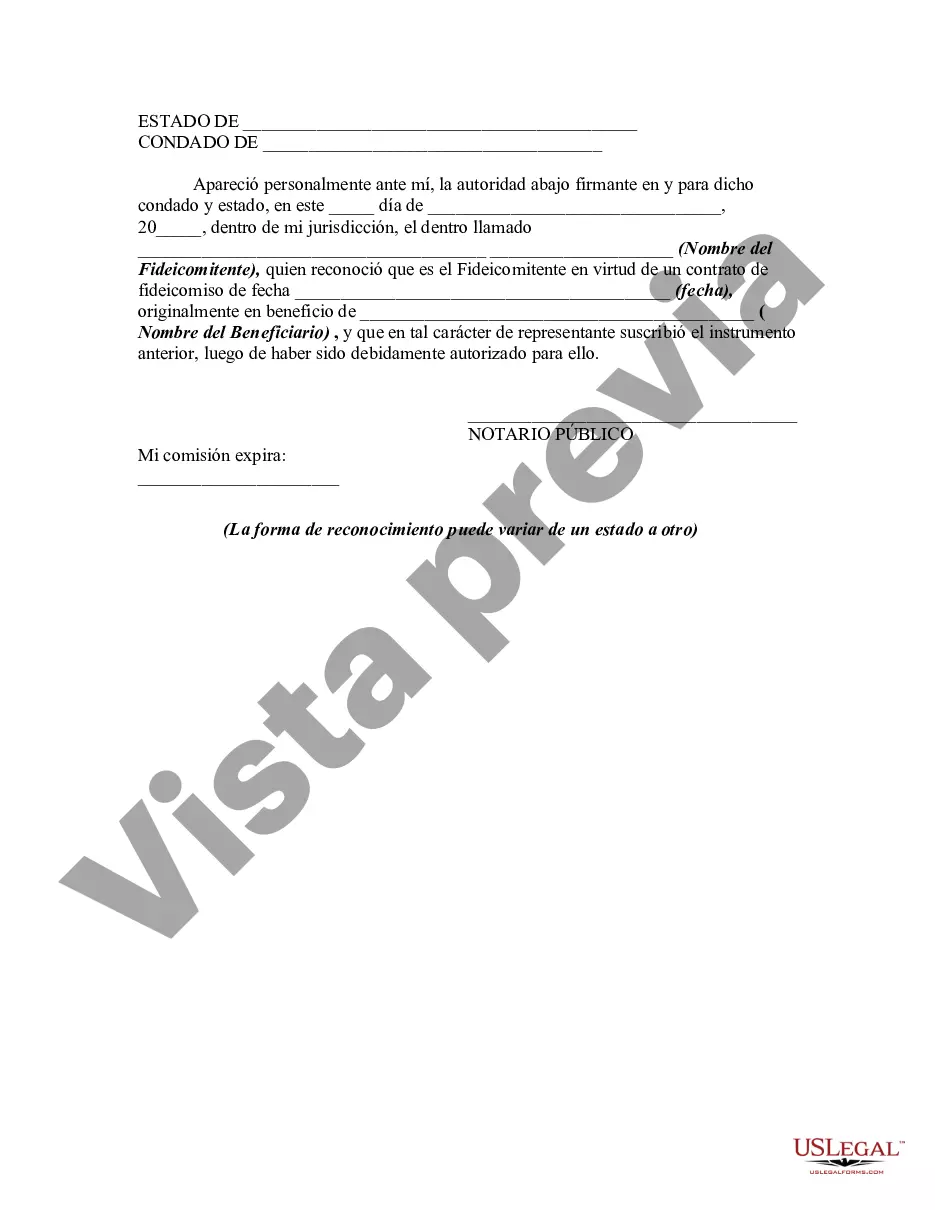

A well drafted trust instrument will generally prescribe the method and manner of amending the trust agreement. A trustor may reserve the power to change beneficiaries. This form is a sample of a trustor amending the trust agreement in order to change beneficiaries.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

San Antonio Texas Amendment to Trust Agreement in Order to Change Beneficiaries allows for modifications to be made to a trust agreement to alter the beneficiaries listed. This legal document is crucial in ensuring that the trust aligns with the granter's wishes, even if circumstances change over time. There are several types of San Antonio Texas Amendment to Trust Agreement in Order to Change Beneficiaries that cater to different situations: 1. General Amendment: A general amendment refers to a modification made to the trust agreement where beneficiaries are added, removed, or their shares are adjusted. This type of amendment is more common when there is a need to make substantial changes to the trust's distribution scheme. 2. Specific Amendment: A specific amendment targets a particular beneficiary or a group of beneficiaries, altering their roles, shares, or provisions within the trust arrangement. It is typically utilized when changes are required for a specific purpose, such as addressing individual needs or addressing family circumstances. 3. Contingent Beneficiary Amendment: A contingent beneficiary amendment addresses the inclusion or exclusion of beneficiaries based on specific triggering events, such as the death or incapacitation of a primary beneficiary. This amendment ensures that alternate beneficiaries are named and are ready to assume their roles if the originally designated beneficiaries are unable to fulfill their responsibilities. 4. Charitable Beneficiary Amendment: A charitable beneficiary amendment focuses on altering the distribution of assets designated for charitable organizations. This type of amendment is commonly employed when a granter wants to modify the percentage or type of assets allocated for charitable purposes, aligning it more accurately with their philanthropic intentions. 5. Successor Beneficiary Amendment: A successor beneficiary amendment is utilized to designate alternate beneficiaries who will inherit the trust's assets if the primary beneficiaries cannot fulfill their roles. By specifying these alternate beneficiaries, it ensures a smooth succession plan is in place and eliminates ambiguity or conflicts that may emerge during the trust administration process. In San Antonio, Texas, Amendment to Trust Agreement in Order to Change Beneficiaries is a crucial legal instrument to ensure that the trust continues to reflect the granter's intentions regarding beneficiary designations. It is recommended to consult with an experienced attorney in trust and estate law to draft and execute such amendments accurately, adhering to the legal requirements of the state of Texas.San Antonio Texas Amendment to Trust Agreement in Order to Change Beneficiaries allows for modifications to be made to a trust agreement to alter the beneficiaries listed. This legal document is crucial in ensuring that the trust aligns with the granter's wishes, even if circumstances change over time. There are several types of San Antonio Texas Amendment to Trust Agreement in Order to Change Beneficiaries that cater to different situations: 1. General Amendment: A general amendment refers to a modification made to the trust agreement where beneficiaries are added, removed, or their shares are adjusted. This type of amendment is more common when there is a need to make substantial changes to the trust's distribution scheme. 2. Specific Amendment: A specific amendment targets a particular beneficiary or a group of beneficiaries, altering their roles, shares, or provisions within the trust arrangement. It is typically utilized when changes are required for a specific purpose, such as addressing individual needs or addressing family circumstances. 3. Contingent Beneficiary Amendment: A contingent beneficiary amendment addresses the inclusion or exclusion of beneficiaries based on specific triggering events, such as the death or incapacitation of a primary beneficiary. This amendment ensures that alternate beneficiaries are named and are ready to assume their roles if the originally designated beneficiaries are unable to fulfill their responsibilities. 4. Charitable Beneficiary Amendment: A charitable beneficiary amendment focuses on altering the distribution of assets designated for charitable organizations. This type of amendment is commonly employed when a granter wants to modify the percentage or type of assets allocated for charitable purposes, aligning it more accurately with their philanthropic intentions. 5. Successor Beneficiary Amendment: A successor beneficiary amendment is utilized to designate alternate beneficiaries who will inherit the trust's assets if the primary beneficiaries cannot fulfill their roles. By specifying these alternate beneficiaries, it ensures a smooth succession plan is in place and eliminates ambiguity or conflicts that may emerge during the trust administration process. In San Antonio, Texas, Amendment to Trust Agreement in Order to Change Beneficiaries is a crucial legal instrument to ensure that the trust continues to reflect the granter's intentions regarding beneficiary designations. It is recommended to consult with an experienced attorney in trust and estate law to draft and execute such amendments accurately, adhering to the legal requirements of the state of Texas.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.