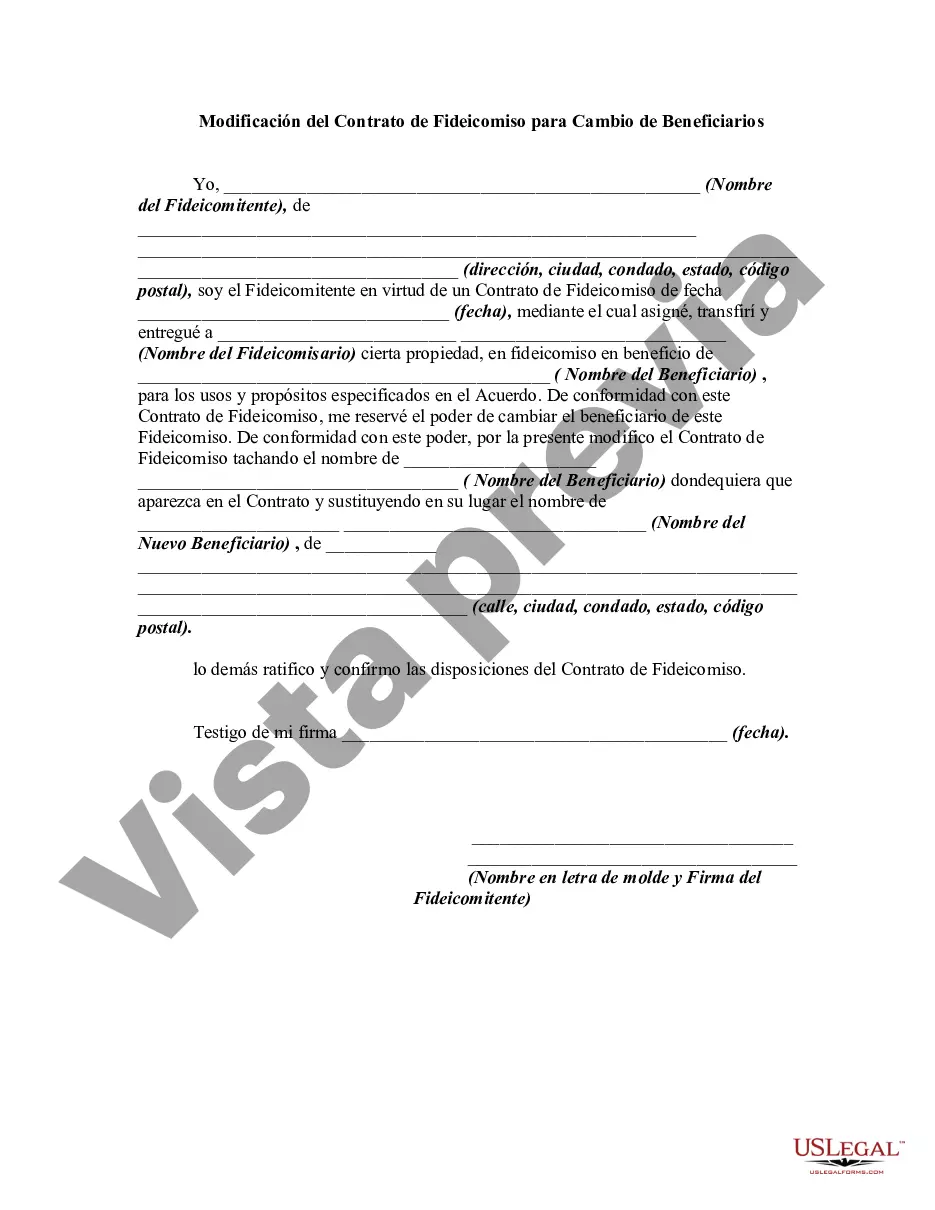

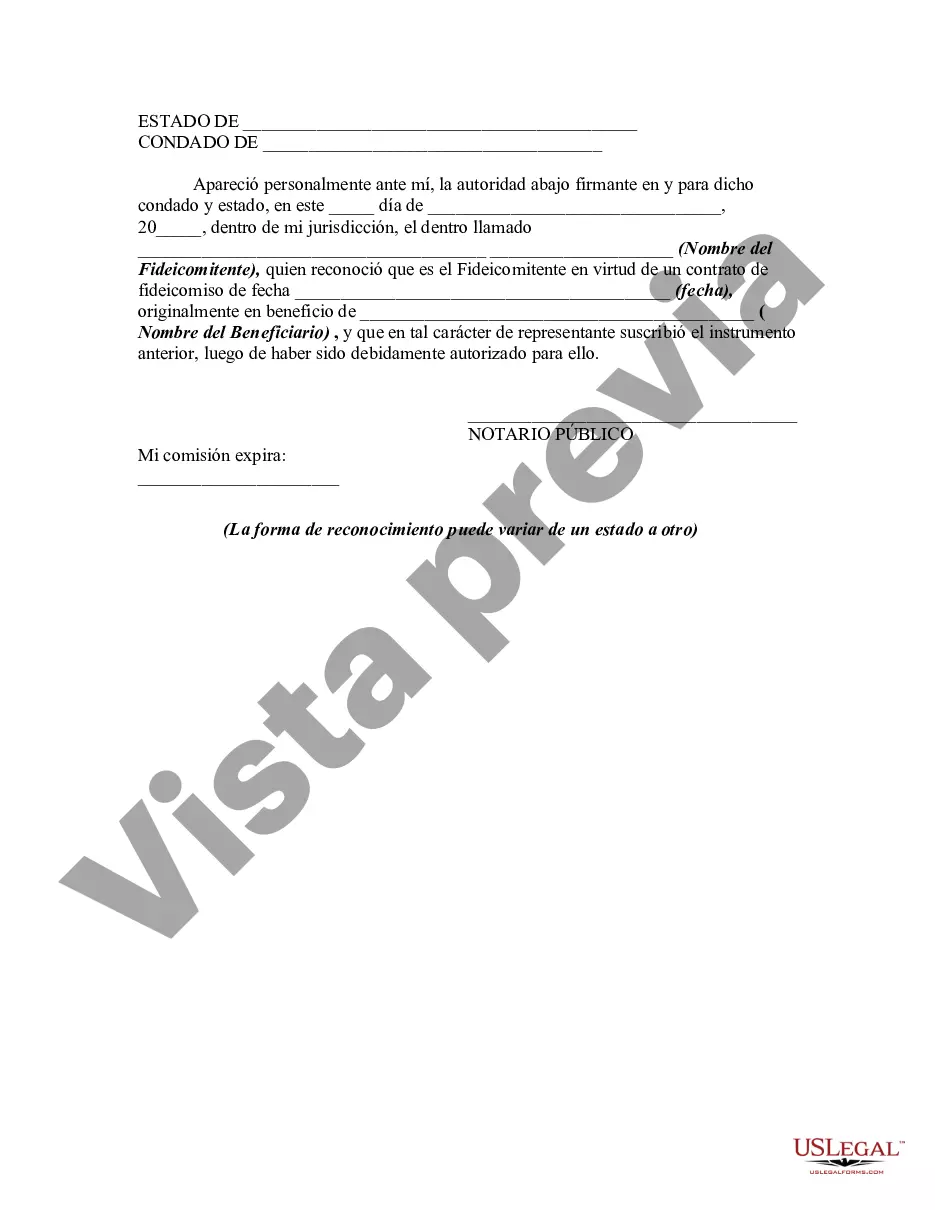

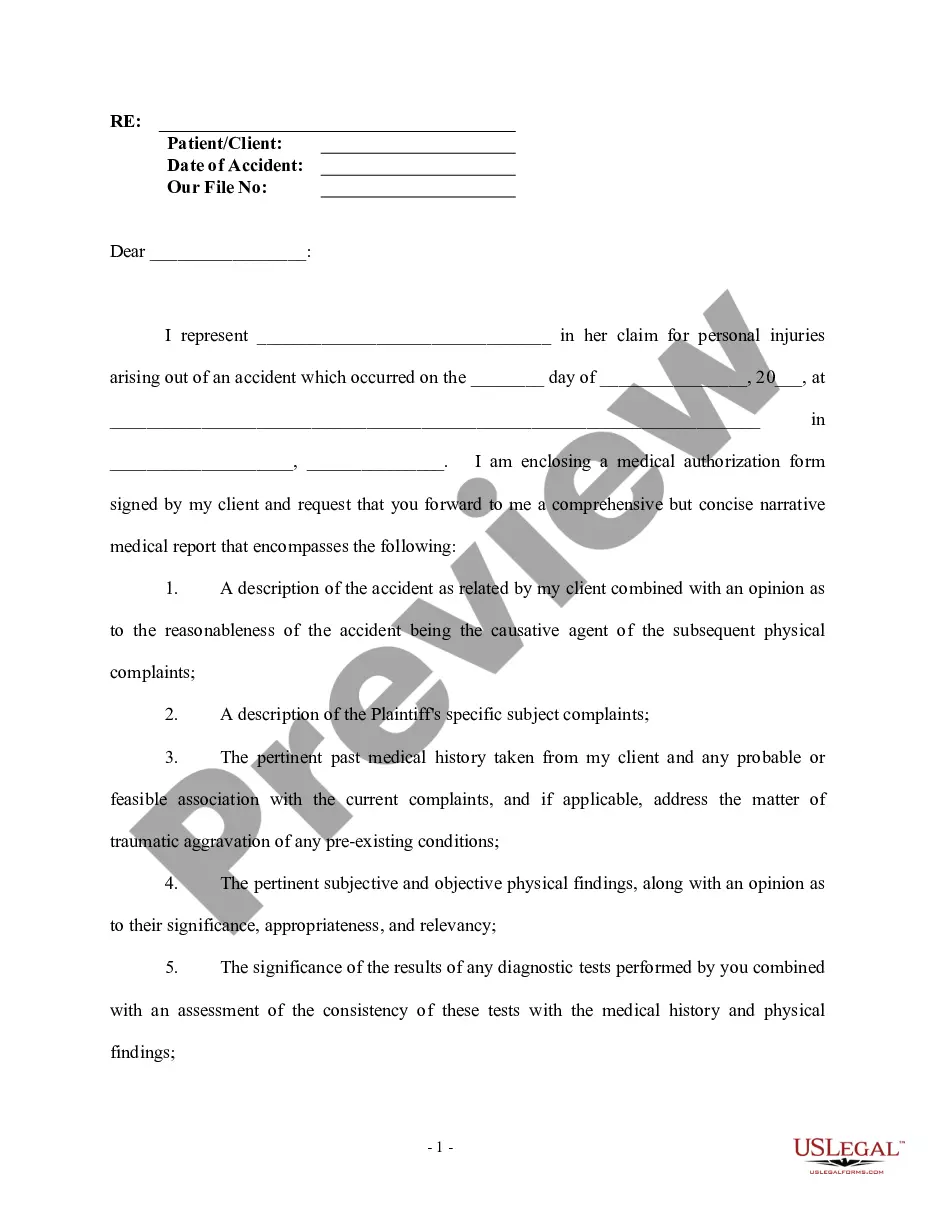

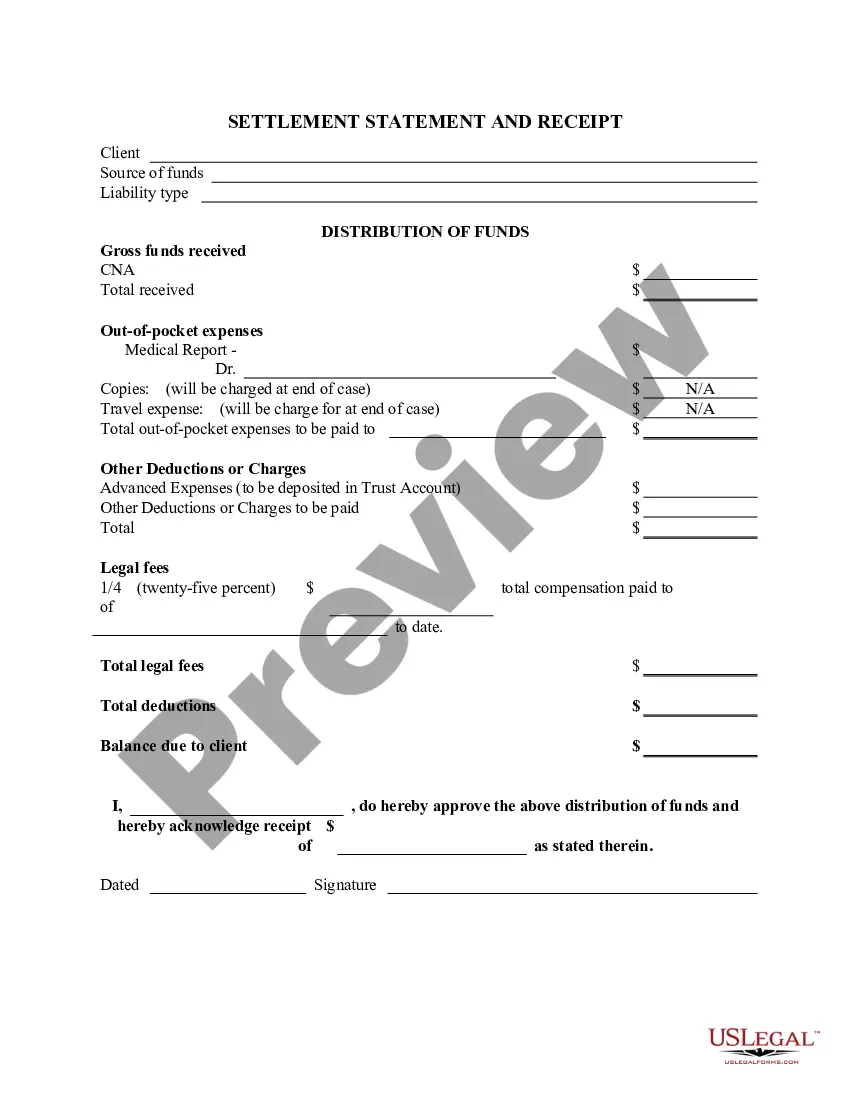

A well drafted trust instrument will generally prescribe the method and manner of amending the trust agreement. A trustor may reserve the power to change beneficiaries. This form is a sample of a trustor amending the trust agreement in order to change beneficiaries.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

San Bernardino California Amendment to Trust Agreement in Order to Change Beneficiaries refers to the process of modifying the beneficiaries listed on a trust agreement in the San Bernardino County of California. This legal procedure allows the trust-maker to update or alter the individuals or entities entitled to receive assets from the trust upon the occurrence of specific events. The Amendment to Trust Agreement serves as an irrevocable document that supersedes the original trust agreement and requires careful consideration and adherence to legal guidelines. By filing this amendment in San Bernardino County, beneficiaries can be added, removed, or their interests adjusted, ensuring that the trust accurately reflects the granter's wishes. There are different types of San Bernardino California Amendments to Trust Agreement in Order to Change Beneficiaries, including: 1. Addition of Beneficiaries: This amendment enables the trust or to add new beneficiaries to the trust, such as children, grandchildren, or charitable organizations, ensuring that their interests are included. 2. Removal of Beneficiaries: The trust-maker may decide to remove certain beneficiaries through this amendment, for reasons such as changes in relationships, financial circumstances, or personal preferences. 3. Changing Beneficiary Shares: This type of amendment adjusts the proportion of assets distributed to the beneficiaries. It allows the trust or to modify the percentage of shares allotted to each beneficiary, considering factors such as their needs, capabilities, and other relevant considerations. 4. Reshuffling Beneficiary Order: In some cases, the trust or might want to change the order in which beneficiaries receive assets from the trust. This type of amendment allows for a rearrangement of the beneficiary hierarchy, ensuring the assets are distributed as per the new order specified. It is crucial to consult an attorney specializing in estate planning, trust administration, or probate in San Bernardino County, California, to ensure the Amendment to Trust Agreement complies with all legal requirements. Moreover, seeking professional guidance can help avoid mistakes or loopholes that may cause conflicts and delays during the implementation of the trust agreement.San Bernardino California Amendment to Trust Agreement in Order to Change Beneficiaries refers to the process of modifying the beneficiaries listed on a trust agreement in the San Bernardino County of California. This legal procedure allows the trust-maker to update or alter the individuals or entities entitled to receive assets from the trust upon the occurrence of specific events. The Amendment to Trust Agreement serves as an irrevocable document that supersedes the original trust agreement and requires careful consideration and adherence to legal guidelines. By filing this amendment in San Bernardino County, beneficiaries can be added, removed, or their interests adjusted, ensuring that the trust accurately reflects the granter's wishes. There are different types of San Bernardino California Amendments to Trust Agreement in Order to Change Beneficiaries, including: 1. Addition of Beneficiaries: This amendment enables the trust or to add new beneficiaries to the trust, such as children, grandchildren, or charitable organizations, ensuring that their interests are included. 2. Removal of Beneficiaries: The trust-maker may decide to remove certain beneficiaries through this amendment, for reasons such as changes in relationships, financial circumstances, or personal preferences. 3. Changing Beneficiary Shares: This type of amendment adjusts the proportion of assets distributed to the beneficiaries. It allows the trust or to modify the percentage of shares allotted to each beneficiary, considering factors such as their needs, capabilities, and other relevant considerations. 4. Reshuffling Beneficiary Order: In some cases, the trust or might want to change the order in which beneficiaries receive assets from the trust. This type of amendment allows for a rearrangement of the beneficiary hierarchy, ensuring the assets are distributed as per the new order specified. It is crucial to consult an attorney specializing in estate planning, trust administration, or probate in San Bernardino County, California, to ensure the Amendment to Trust Agreement complies with all legal requirements. Moreover, seeking professional guidance can help avoid mistakes or loopholes that may cause conflicts and delays during the implementation of the trust agreement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.