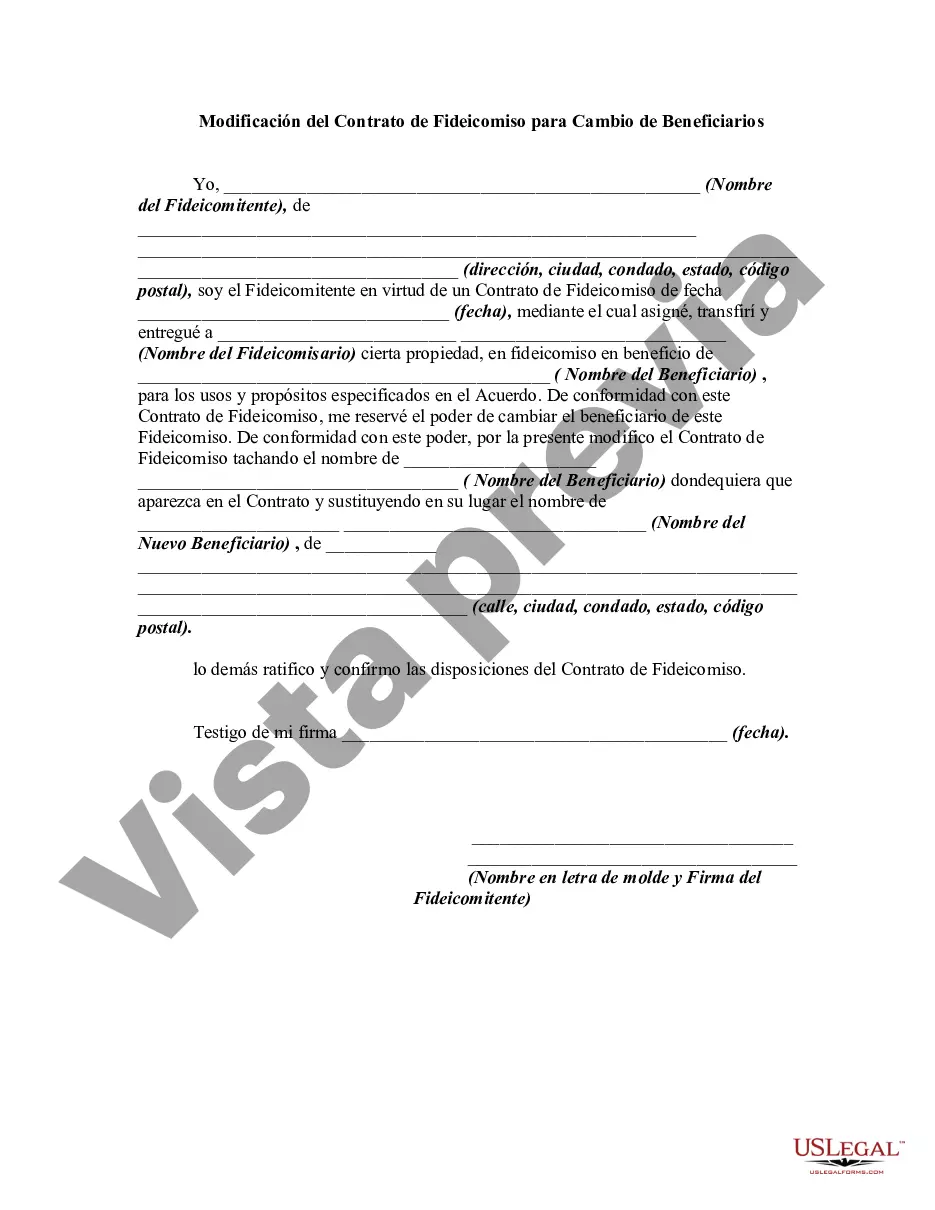

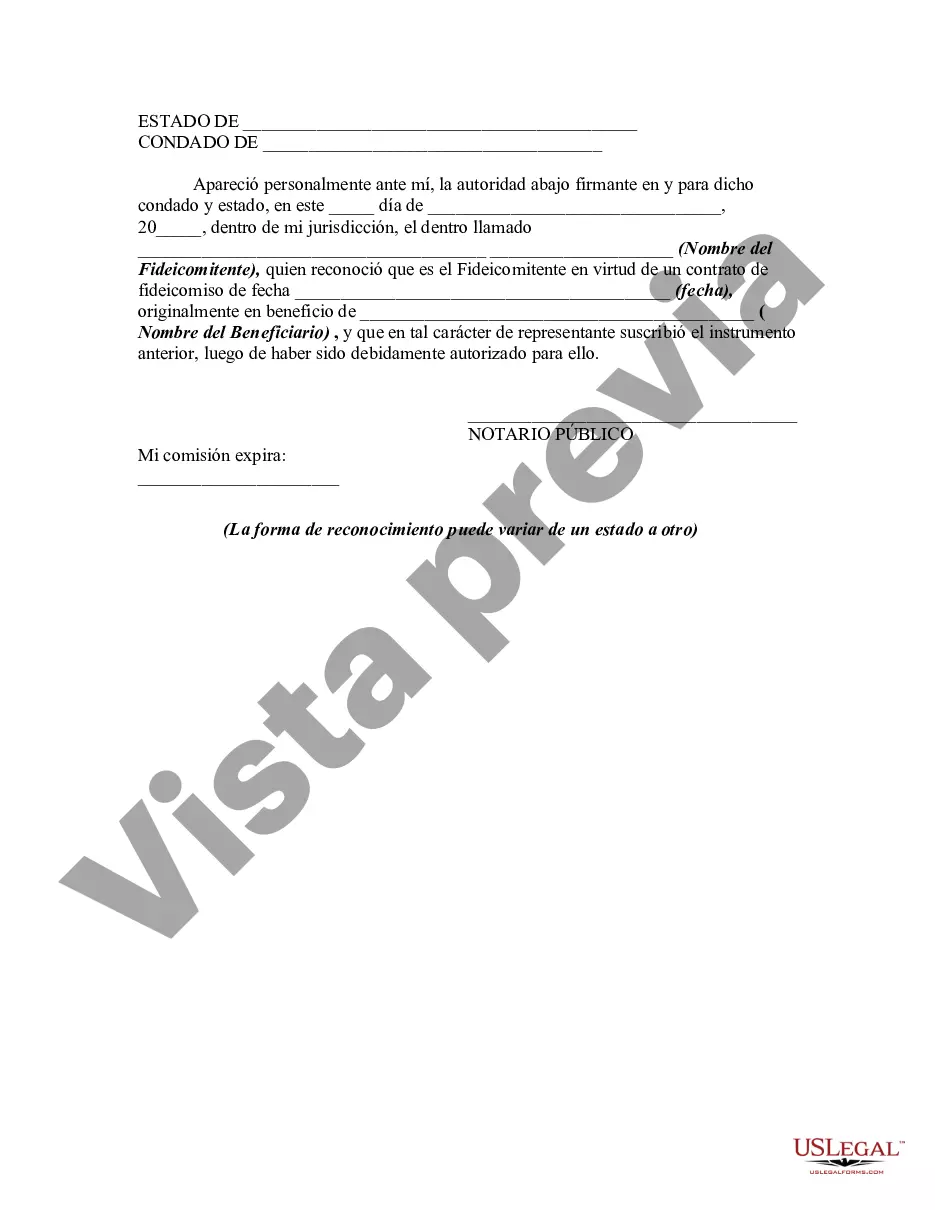

A well drafted trust instrument will generally prescribe the method and manner of amending the trust agreement. A trustor may reserve the power to change beneficiaries. This form is a sample of a trustor amending the trust agreement in order to change beneficiaries.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Suffolk New York Amendment to Trust Agreement in Order to Change Beneficiaries allows for modifications to be made to a trust's beneficiaries in Suffolk County, New York. This legal document enables individuals to amend the terms of an existing trust agreement in order to reflect changes in their personal circumstances, including changes to beneficiaries. By implementing an amendment, individuals have the opportunity to ensure their assets are distributed according to their current wishes. There are various types of Suffolk New York Amendment to Trust Agreement in Order to Change Beneficiaries, depending on the specific needs and intentions of the individual seeking the amendment. Some common types include: 1. Specific Beneficiary Amendment: This amendment allows the trust creator to specify replacement beneficiaries, removing or adding individuals or organizations as intended recipients of trust assets. 2. Percentage Allocation Amendment: With this type of amendment, the trust creator can modify the percentage of assets allocated to each beneficiary, adjusting the distribution of wealth amongst beneficiaries as per their updated preferences. 3. Contingent Beneficiary Amendment: In case of the primary beneficiary's inability to receive trust assets, the creator can designate a new contingent beneficiary or change the existing one, ensuring an alternate individual or entity is selected to receive the assets. 4. Generation-Skipping Transfer Tax Amendment: This amendment addresses estate tax planning concerns for families who wish to transfer assets directly to grandchildren, skipping the next generation. It can include changes to estate tax exemption amounts or modifications to address any alterations in tax laws. Regardless of the type of amendment, it is crucial to ensure compliance with New York state laws and procedures when modifying the trust agreement. Seeking professional legal assistance from a qualified attorney specializing in trusts and estate planning is highly recommended ensuring the amendment is executed correctly and adheres to all legal requirements.The Suffolk New York Amendment to Trust Agreement in Order to Change Beneficiaries allows for modifications to be made to a trust's beneficiaries in Suffolk County, New York. This legal document enables individuals to amend the terms of an existing trust agreement in order to reflect changes in their personal circumstances, including changes to beneficiaries. By implementing an amendment, individuals have the opportunity to ensure their assets are distributed according to their current wishes. There are various types of Suffolk New York Amendment to Trust Agreement in Order to Change Beneficiaries, depending on the specific needs and intentions of the individual seeking the amendment. Some common types include: 1. Specific Beneficiary Amendment: This amendment allows the trust creator to specify replacement beneficiaries, removing or adding individuals or organizations as intended recipients of trust assets. 2. Percentage Allocation Amendment: With this type of amendment, the trust creator can modify the percentage of assets allocated to each beneficiary, adjusting the distribution of wealth amongst beneficiaries as per their updated preferences. 3. Contingent Beneficiary Amendment: In case of the primary beneficiary's inability to receive trust assets, the creator can designate a new contingent beneficiary or change the existing one, ensuring an alternate individual or entity is selected to receive the assets. 4. Generation-Skipping Transfer Tax Amendment: This amendment addresses estate tax planning concerns for families who wish to transfer assets directly to grandchildren, skipping the next generation. It can include changes to estate tax exemption amounts or modifications to address any alterations in tax laws. Regardless of the type of amendment, it is crucial to ensure compliance with New York state laws and procedures when modifying the trust agreement. Seeking professional legal assistance from a qualified attorney specializing in trusts and estate planning is highly recommended ensuring the amendment is executed correctly and adheres to all legal requirements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.