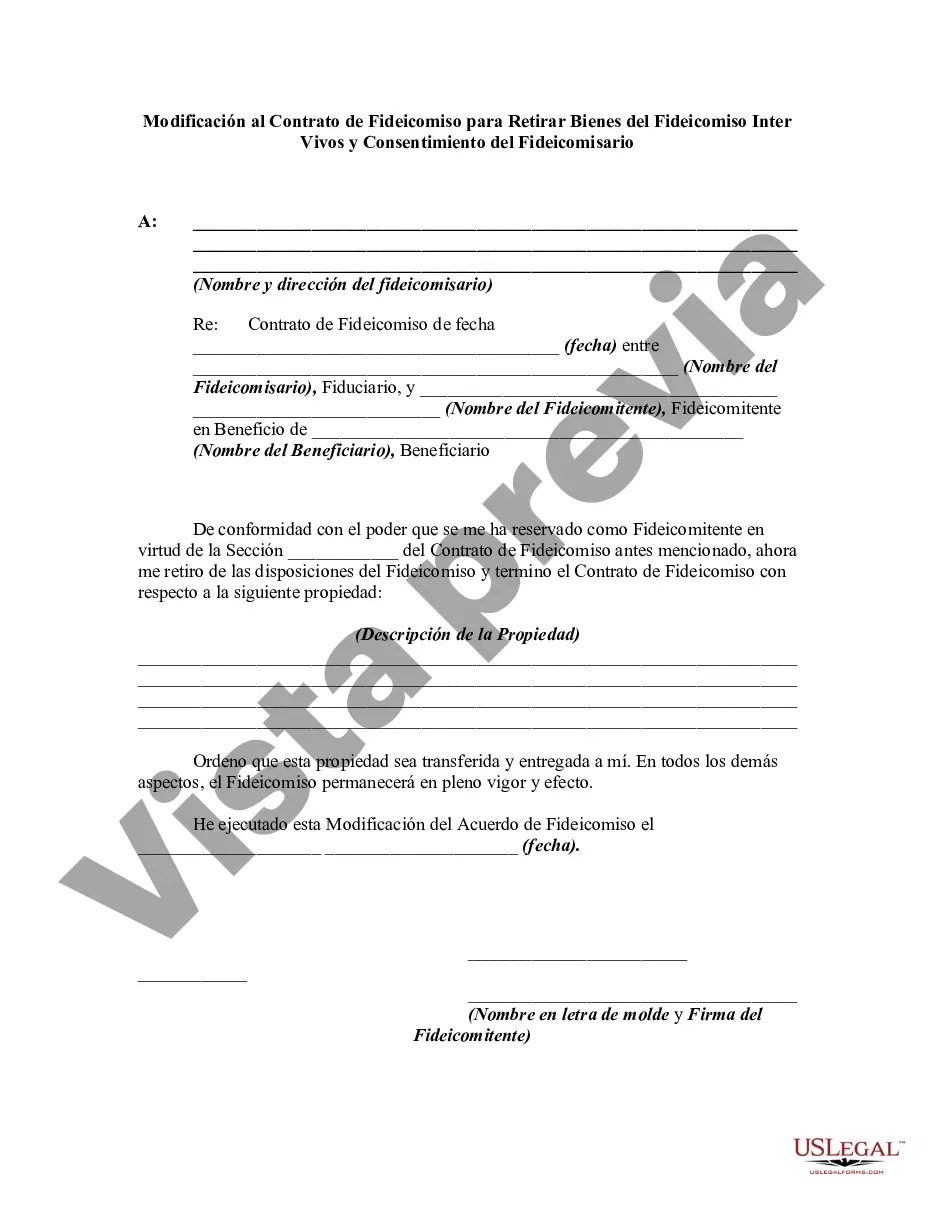

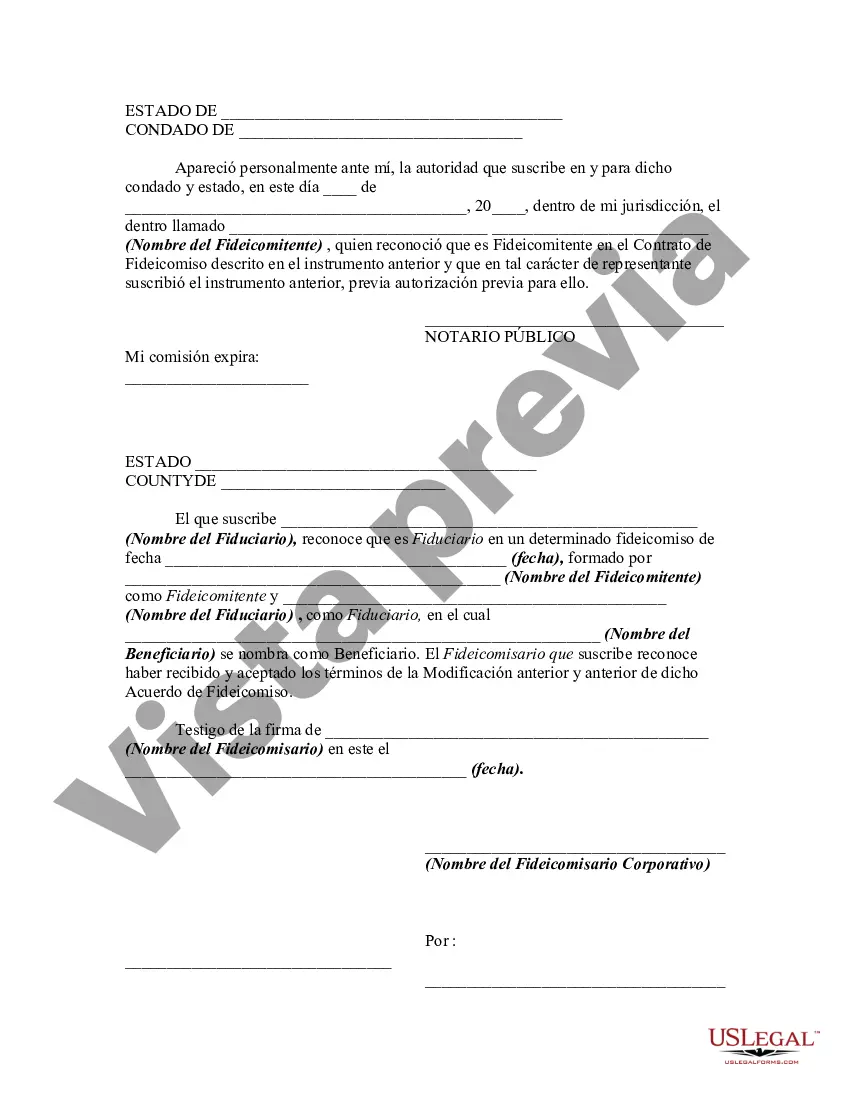

A well drafted trust instrument will generally prescribe the method and manner of amending the trust agreement. A trustor may reserve the power to withdraw property from the trust. This form is a sample of a trustor amending the trust agreement in order to withdraw property from the trust.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Clark Nevada Amendment to Trust Agreement is a legal document that provides individuals with the ability to withdraw property from an Inter Vivos Trust. This amendment enables trust beneficiaries to modify the terms of the trust, specifically allowing them to remove certain assets from the trust and have them transferred back into their ownership. It is essential to have the Consent of Trustee, which confirms the trustee's approval of the property withdrawal. There are various types of Clark Nevada Amendments to Trust Agreements that can facilitate the withdrawal of property from Inter Vivos Trusts while ensuring a smooth process. These types may include: 1. Clark Nevada Amendment to Trust Agreement for Real Estate Withdrawal: This variation of the amendment specifically focuses on withdrawing real estate assets from the trust. It is commonly used when beneficiaries want to regain ownership of properties held within the Inter Vivos Trust. 2. Clark Nevada Amendment to Trust Agreement for Financial Asset Withdrawal: This specific amendment pertains to the withdrawal of financial assets, such as stocks, bonds, or investment portfolios, from the Inter Vivos Trust. It provides beneficiaries with the means to have these assets transferred into their individual accounts. 3. Clark Nevada Amendment to Trust Agreement for Personal Belongings Withdrawal: This amendment type allows beneficiaries to withdraw personal belongings, such as jewelry, artwork, furniture, or vehicles, from the Inter Vivos Trust. It ensures that individuals can regain possession of sentimental or valuable items. 4. Clark Nevada Amendment to Trust Agreement for Business Asset Withdrawal: When a trust includes business or commercial assets, this specialized amendment permits beneficiaries to withdraw and reacquire ownership over the business assets contained within the Inter Vivos Trust. In all these cases, obtaining the Consent of Trustee is crucial. This requirement confirms that the trustee, who manages and administers the trust, agrees to the withdrawal of property and acknowledges the beneficiary's right to take back specific assets. The Consent of Trustee acts as a legal safeguard and ensures that the withdrawal process complies with the trust's terms and applicable laws. Note: It is recommended to consult with an attorney specializing in estate planning and trust law to determine the specific type of Clark Nevada Amendment to Trust Agreement required for the withdrawal of property from an Inter Vivos Trust in compliance with state regulations and individual circumstances.The Clark Nevada Amendment to Trust Agreement is a legal document that provides individuals with the ability to withdraw property from an Inter Vivos Trust. This amendment enables trust beneficiaries to modify the terms of the trust, specifically allowing them to remove certain assets from the trust and have them transferred back into their ownership. It is essential to have the Consent of Trustee, which confirms the trustee's approval of the property withdrawal. There are various types of Clark Nevada Amendments to Trust Agreements that can facilitate the withdrawal of property from Inter Vivos Trusts while ensuring a smooth process. These types may include: 1. Clark Nevada Amendment to Trust Agreement for Real Estate Withdrawal: This variation of the amendment specifically focuses on withdrawing real estate assets from the trust. It is commonly used when beneficiaries want to regain ownership of properties held within the Inter Vivos Trust. 2. Clark Nevada Amendment to Trust Agreement for Financial Asset Withdrawal: This specific amendment pertains to the withdrawal of financial assets, such as stocks, bonds, or investment portfolios, from the Inter Vivos Trust. It provides beneficiaries with the means to have these assets transferred into their individual accounts. 3. Clark Nevada Amendment to Trust Agreement for Personal Belongings Withdrawal: This amendment type allows beneficiaries to withdraw personal belongings, such as jewelry, artwork, furniture, or vehicles, from the Inter Vivos Trust. It ensures that individuals can regain possession of sentimental or valuable items. 4. Clark Nevada Amendment to Trust Agreement for Business Asset Withdrawal: When a trust includes business or commercial assets, this specialized amendment permits beneficiaries to withdraw and reacquire ownership over the business assets contained within the Inter Vivos Trust. In all these cases, obtaining the Consent of Trustee is crucial. This requirement confirms that the trustee, who manages and administers the trust, agrees to the withdrawal of property and acknowledges the beneficiary's right to take back specific assets. The Consent of Trustee acts as a legal safeguard and ensures that the withdrawal process complies with the trust's terms and applicable laws. Note: It is recommended to consult with an attorney specializing in estate planning and trust law to determine the specific type of Clark Nevada Amendment to Trust Agreement required for the withdrawal of property from an Inter Vivos Trust in compliance with state regulations and individual circumstances.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.