Whether a trust is to be revocable or irrevocable is very important, and the trust instrument should so specify in plain and clear terms. This form is a revocation of a trust by the trustor pursuant to authority given to him/her in the trust instrument. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

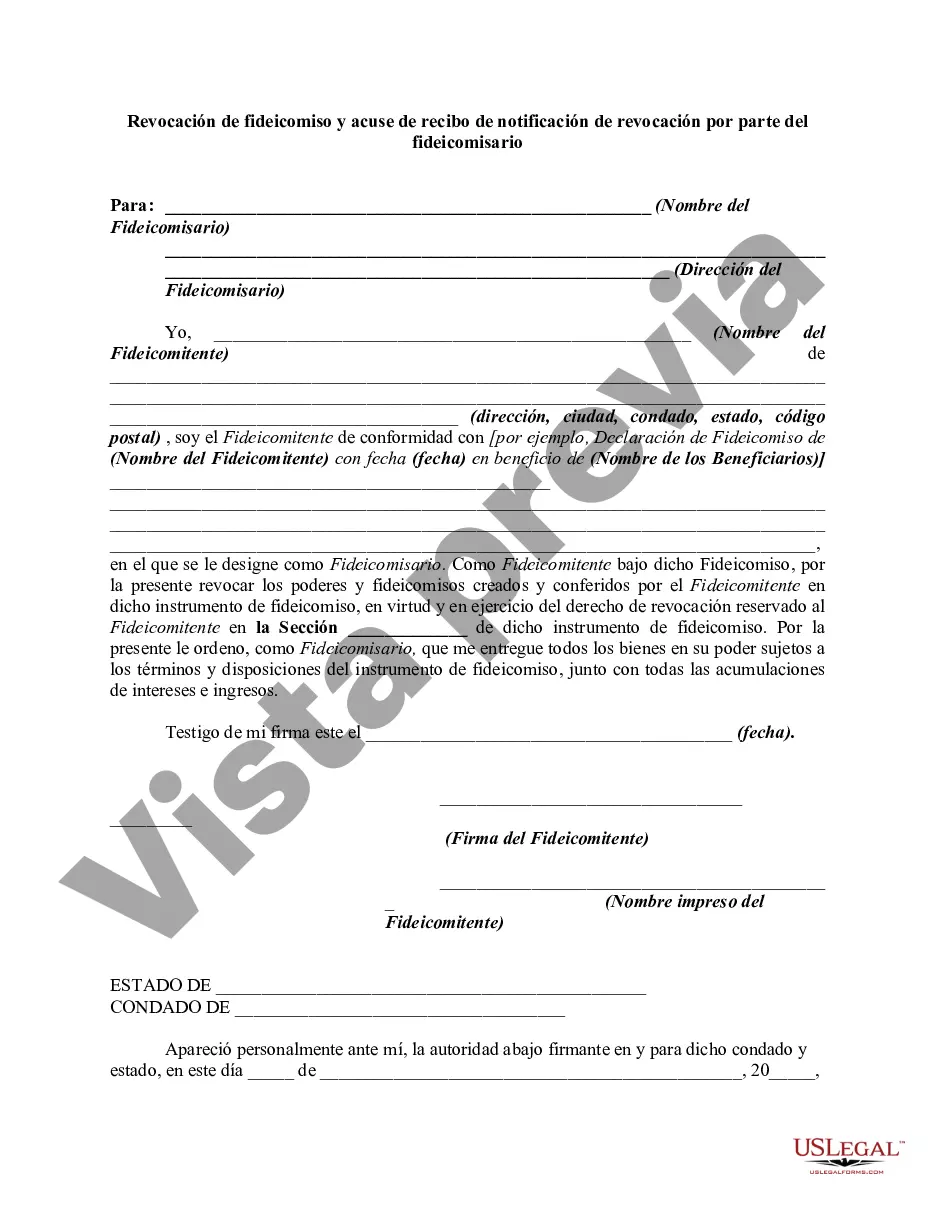

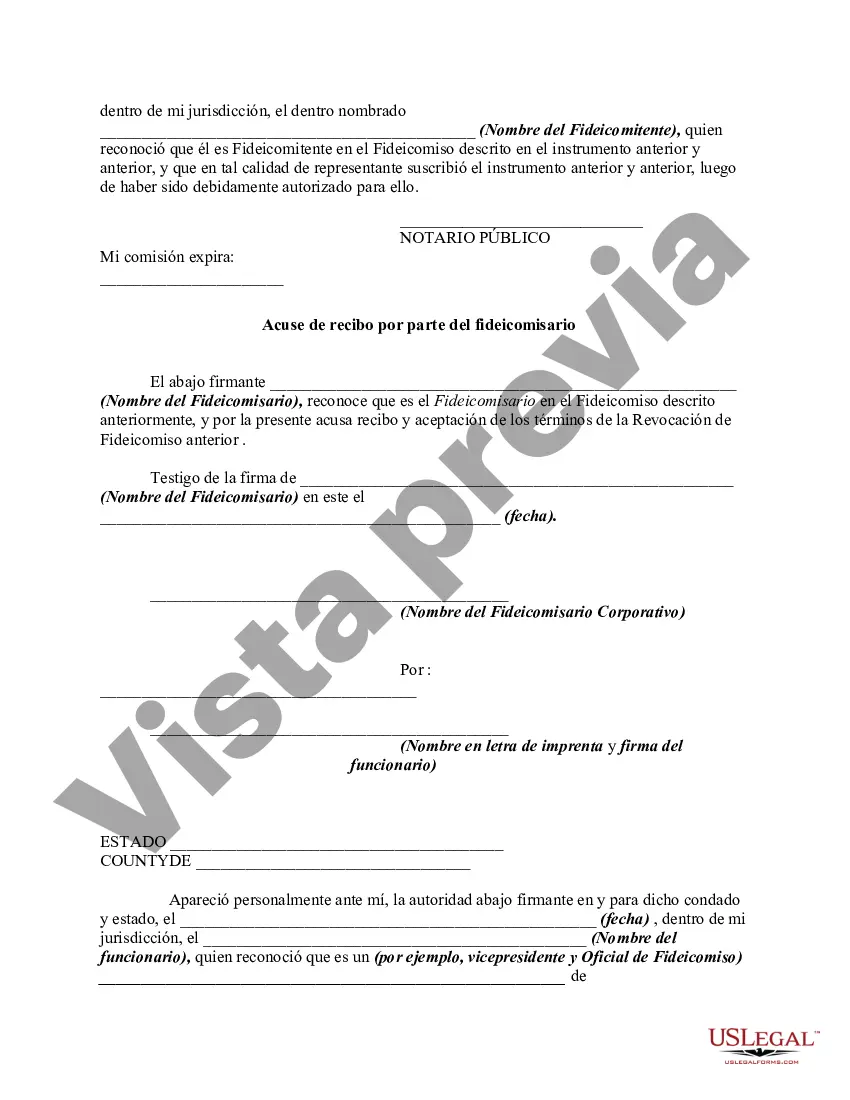

San Jose California Revocation of Trust and Acknowledgment of Receipt of Notice of Revocation by Trustee is a legally binding document that outlines the process of revoking a trust in the city of San Jose, California. This document serves as evidence of the revocation and notifies the trustee of the revocation. In San Jose, there are different types of Revocation of Trust and Acknowledgment of Receipt of Notice of Revocation by Trustee, classified based on the specific circumstances. These include: 1. San Jose California Revocation of Trust due to Granter's Decision: This type of revocation is initiated by the granter (the person who established the trust) to terminate the trust voluntarily. It requires the granter to provide written notice to the trustee, clearly stating their intention to revoke the trust. 2. San Jose California Revocation of Trust due to Beneficiary's Request: In some cases, the trust beneficiaries might request the revocation of the trust, usually when it no longer serves their best interests or is no longer necessary. The beneficiaries must provide written notice to the trustee, expressing their desire to revoke the trust. 3. San Jose California Revocation of Trust due to Trustee's Misconduct: If the trustee breaches their fiduciary duties, engages in fraudulent activities, or fails to fulfill their obligations stated in the trust agreement, the granter or beneficiaries can initiate a revocation. This type of revocation requires proper documentation and evidence of the trustee's misconduct. Regardless of the type of revocation, the process usually involves several key steps: 1. Notice of Revocation: The granter or beneficiaries must provide written notice to the trustee, clearly stating their intention to revoke the trust. This notice must include the trust's details, including the name, date of creation, and any amendments. 2. Acknowledgment of Receipt: The trustee is required to acknowledge the receipt of the notice of revocation promptly. This acknowledgment can be in the form of a signed document that confirms their awareness of the revocation. 3. Documentation: The revocation of trust should be properly documented and recorded. This includes updating legal documents, such as the granter's will, to reflect the changes resulting from the trust's revocation. 4. Distribution of Trust Assets: Once the trust is revoked, the trust assets need to be distributed according to the new arrangement or as specified in the revocation process. This may involve transferring the assets to new accounts or beneficiaries, depending on the circumstances. It is crucial to seek legal assistance when navigating the revocation of a trust in San Jose, California, as it involves complex legal procedures and potential tax implications. Consulting an attorney specializing in estate planning and trusts is highly recommended ensuring compliance with state laws and to protect the interests of all parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.