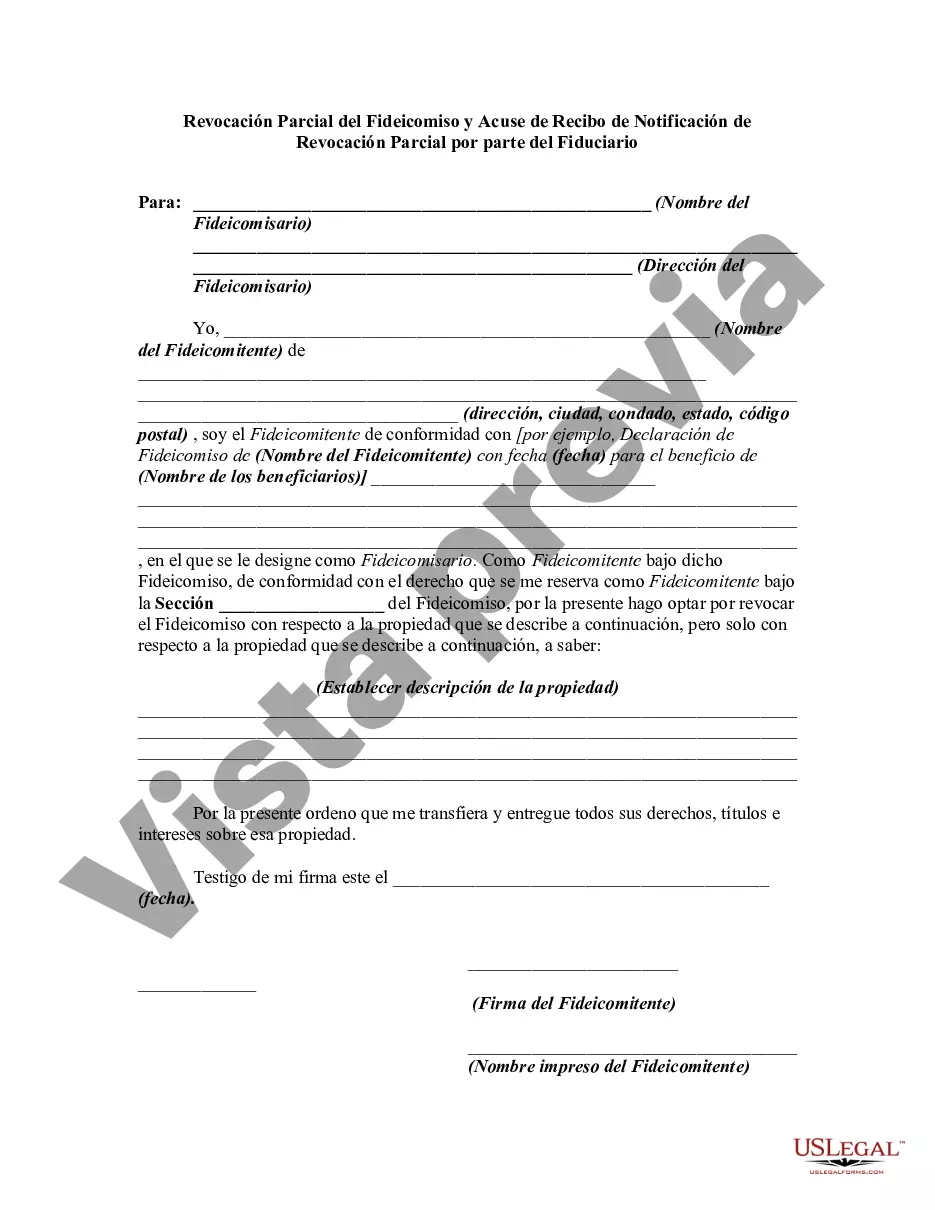

Whether a trust is to be revocable or irrevocable is very important, and the trust instrument should so specify in plain and clear terms. This form is a partial revocation of a trust (as to specific property) by the trustor pursuant to authority given to him/her in the trust instrument. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

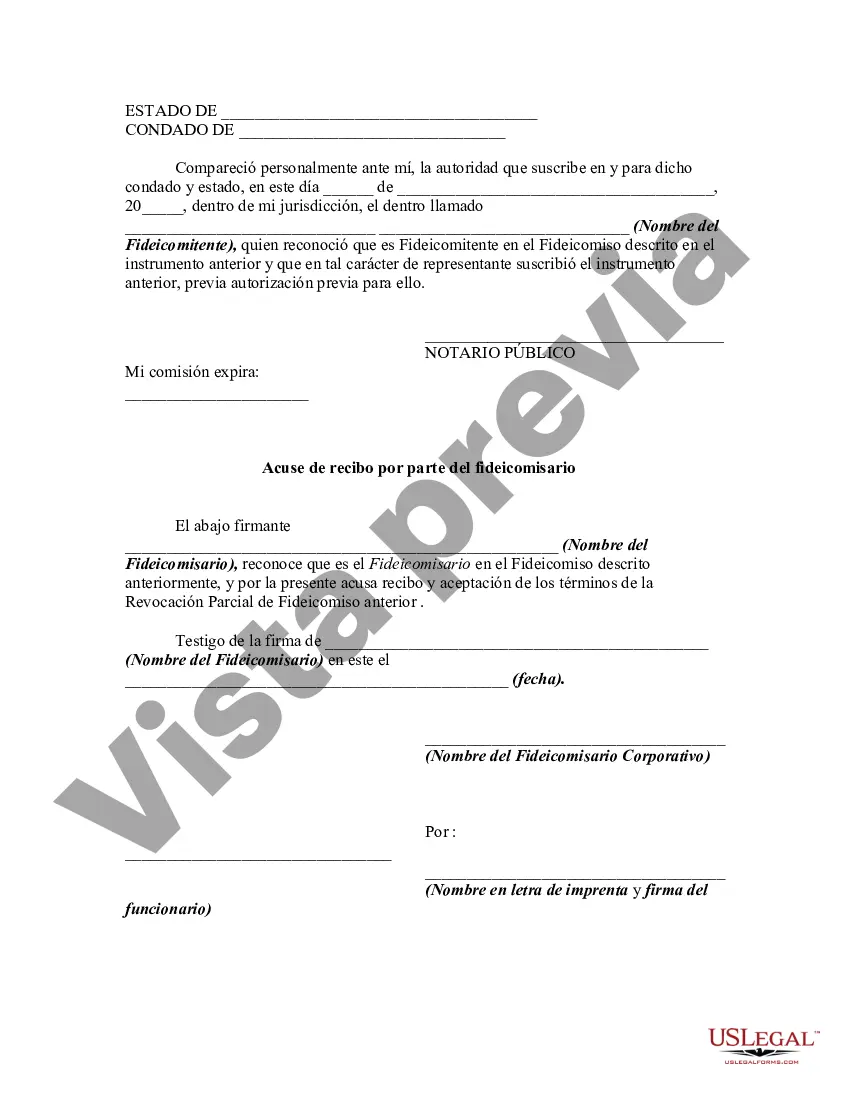

Oakland County, located in Michigan, follows specific procedures for the partial revocation of trust and acknowledgment of receipt of notice by the trustee. This process is significant in managing estates and ensuring that the desired distribution of assets is carried out as per the trust agreement. A partial revocation of trust occurs when the trustee wishes to modify specific provisions within the trust document while leaving the remaining provisions intact. This type of revocation could be due to changes in beneficiaries, assets, or any other circumstance that necessitates revision. It allows the trustee to adapt the trust to meet evolving needs and circumstances. The first step in the Oakland Michigan partial revocation process involves the trustee preparing a formal notice of partial revocation and delivering it to all interested parties, including beneficiaries and interested parties, as outlined in the trust document. The notice must include specific details about the proposed changes, the reasons behind the partial revocation, and any relevant dates or deadlines. Once the notice of partial revocation is delivered, the trustee is required to obtain the acknowledgment of receipt from all parties involved. This acknowledgment serves as proof that all individuals have received the notice and are aware of the proposed amendments to the trust. It helps ensure transparency and minimizes potential disputes or challenges to the partial revocation in the future. Oakland Michigan offers different types of partial revocation of trust, depending on the nature of the modifications required: 1. Amendment Revocation: This type of revocation involves making changes to specific provisions within the trust agreement, such as modifying distribution percentages or adding/removing beneficiaries. 2. Asset Revocation: If the trustee wishes to alter the assets included in the trust, such as transferring or removing certain properties, this form of partial revocation is utilized. 3. Beneficiary Revocation: This type of revocation focuses on modifying or amending the beneficiaries listed in the trust document. It may involve adding or removing individuals or organizations named as beneficiaries. 4. Administrative Revocation: In cases where the trustee needs to modify administrative or procedural aspects of the trust, such as changing successor trustees or altering instructions for managing the trust, this form of revocation is utilized. It is essential to consult with a knowledgeable attorney or estate planner in Oakland County, Michigan, to ensure that the partial revocation of trust and acknowledgment of receipt process follows all legal requirements and safeguards the interests of all involved parties. Proper documentation and adherence to state laws will lead to a smooth and valid modification of the trust.Oakland County, located in Michigan, follows specific procedures for the partial revocation of trust and acknowledgment of receipt of notice by the trustee. This process is significant in managing estates and ensuring that the desired distribution of assets is carried out as per the trust agreement. A partial revocation of trust occurs when the trustee wishes to modify specific provisions within the trust document while leaving the remaining provisions intact. This type of revocation could be due to changes in beneficiaries, assets, or any other circumstance that necessitates revision. It allows the trustee to adapt the trust to meet evolving needs and circumstances. The first step in the Oakland Michigan partial revocation process involves the trustee preparing a formal notice of partial revocation and delivering it to all interested parties, including beneficiaries and interested parties, as outlined in the trust document. The notice must include specific details about the proposed changes, the reasons behind the partial revocation, and any relevant dates or deadlines. Once the notice of partial revocation is delivered, the trustee is required to obtain the acknowledgment of receipt from all parties involved. This acknowledgment serves as proof that all individuals have received the notice and are aware of the proposed amendments to the trust. It helps ensure transparency and minimizes potential disputes or challenges to the partial revocation in the future. Oakland Michigan offers different types of partial revocation of trust, depending on the nature of the modifications required: 1. Amendment Revocation: This type of revocation involves making changes to specific provisions within the trust agreement, such as modifying distribution percentages or adding/removing beneficiaries. 2. Asset Revocation: If the trustee wishes to alter the assets included in the trust, such as transferring or removing certain properties, this form of partial revocation is utilized. 3. Beneficiary Revocation: This type of revocation focuses on modifying or amending the beneficiaries listed in the trust document. It may involve adding or removing individuals or organizations named as beneficiaries. 4. Administrative Revocation: In cases where the trustee needs to modify administrative or procedural aspects of the trust, such as changing successor trustees or altering instructions for managing the trust, this form of revocation is utilized. It is essential to consult with a knowledgeable attorney or estate planner in Oakland County, Michigan, to ensure that the partial revocation of trust and acknowledgment of receipt process follows all legal requirements and safeguards the interests of all involved parties. Proper documentation and adherence to state laws will lead to a smooth and valid modification of the trust.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.