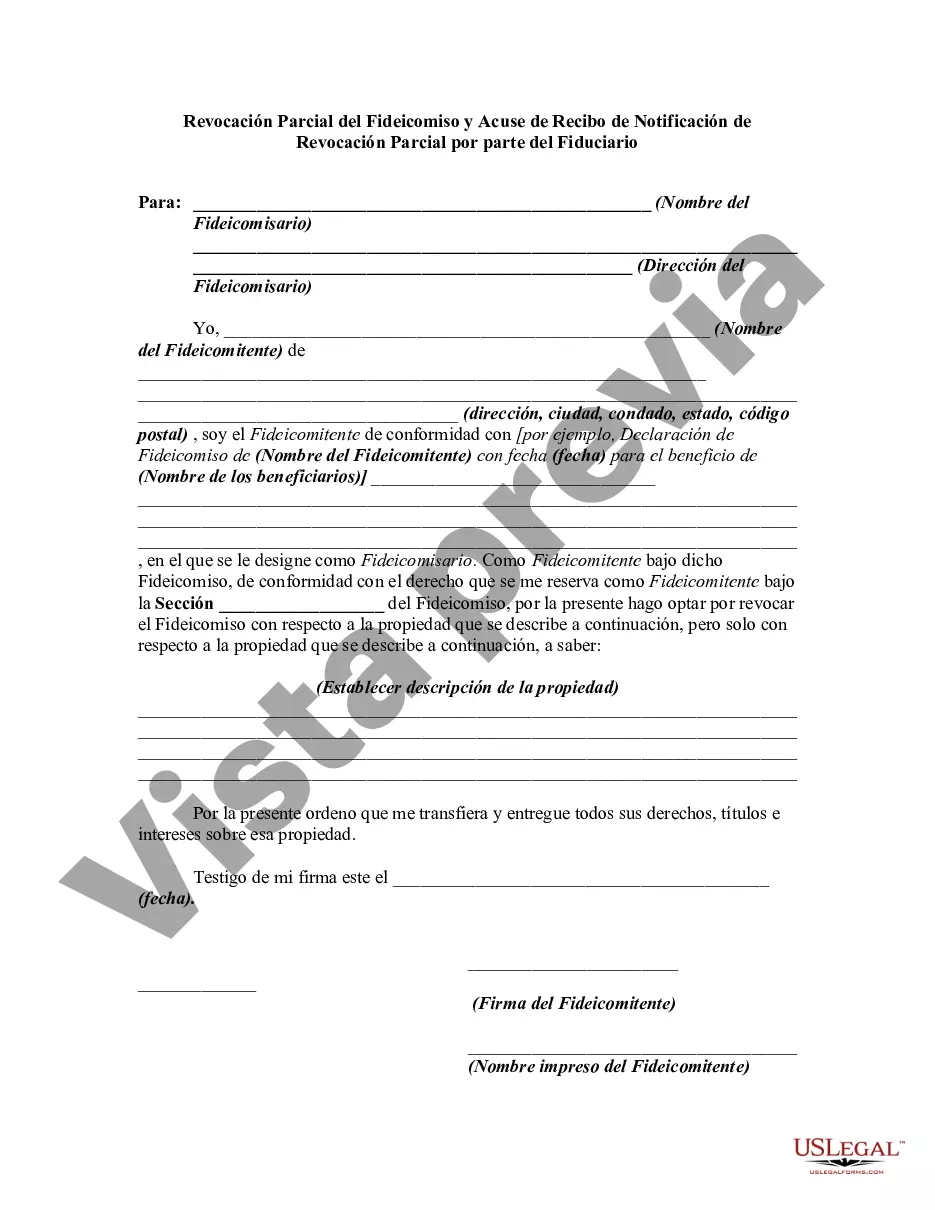

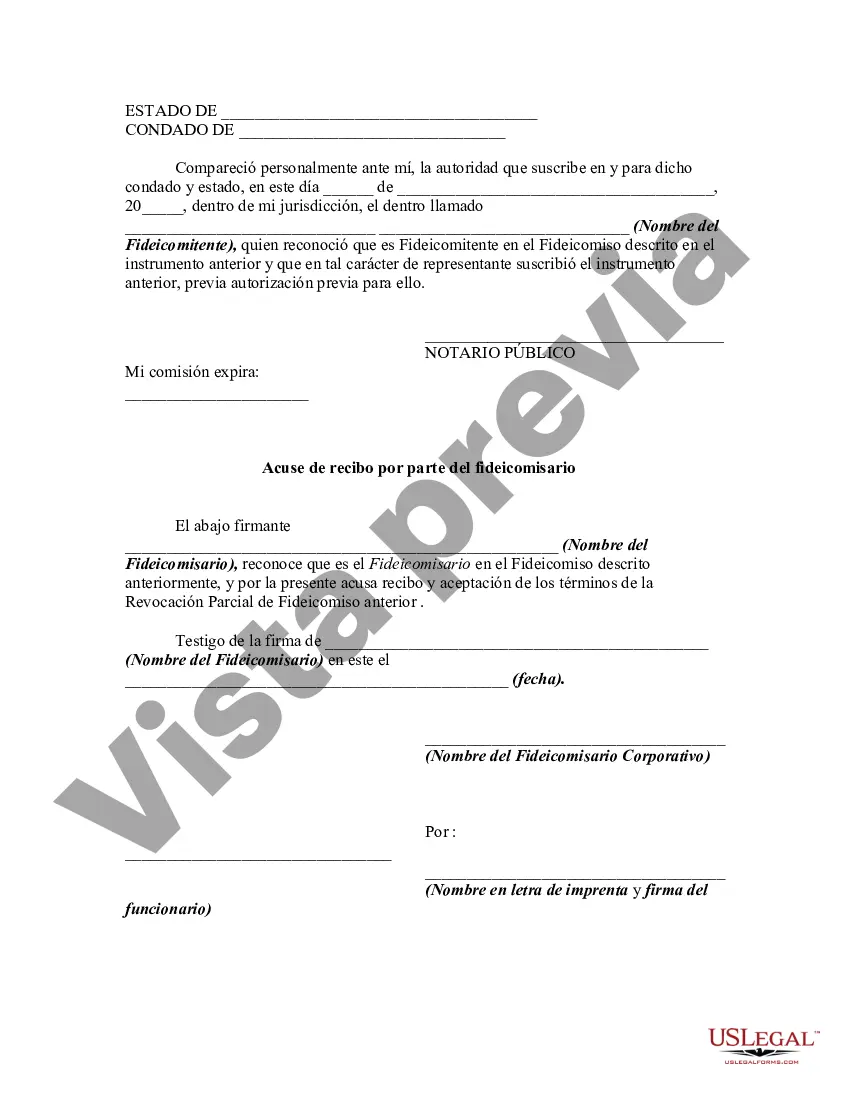

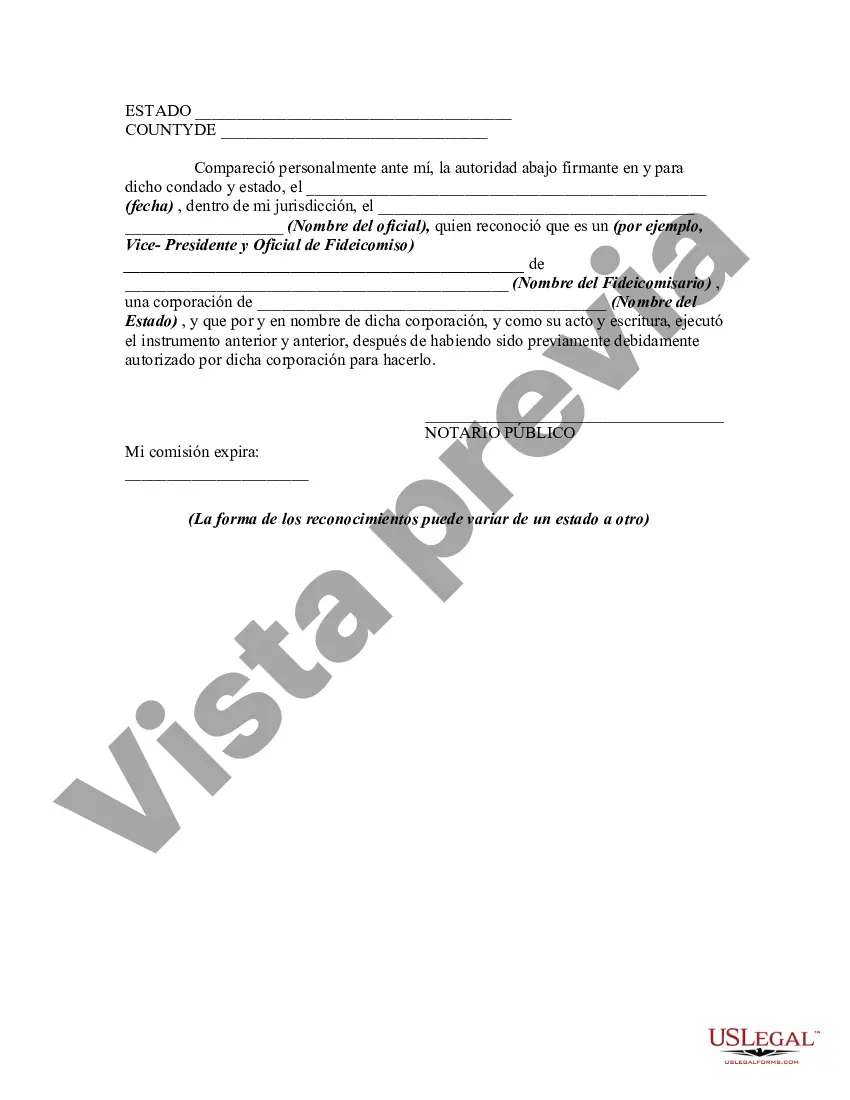

Whether a trust is to be revocable or irrevocable is very important, and the trust instrument should so specify in plain and clear terms. This form is a partial revocation of a trust (as to specific property) by the trustor pursuant to authority given to him/her in the trust instrument. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Title: Understanding Santa Clara California Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee Introduction: Santa Clara, California, is a vibrant city known for its thriving technology industry, exceptional educational institutions, and beautiful surroundings. However, it is also important to understand the legal aspects that come with living in Santa Clara. One such legal aspect is the partial revocation of trust, which involves an acknowledgment of receipt by the trustee. In this article, we'll delve into the details of Santa Clara California Partial Revocation of Trust and Acknowledgment of Receipt of Notice, exploring different types of revocations and their implications. 1. Santa Clara California Partial Revocation of Trust: Partial revocation of trust refers to the modification or alteration of specific provisions within a trust document while leaving the remaining provisions intact. There can be various reasons for a partial revocation, such as changes in personal circumstances, amendments to the trust objectives, or the need to update beneficiaries' details. Understanding the legal procedures associated with partial revocation is crucial for all parties involved. 2. The Role of the Trustee: The trustee is an essential figure in the partial revocation process. They serve as the individual or entity responsible for managing the trust's assets and ensuring compliance with the terms of the trust agreement. In the case of a partial revocation, the trustee plays a pivotal role in acknowledging the receipt of the notice regarding the changes made to the trust, further solidifying the legal legitimacy of the modifications. Types of Santa Clara California Partial Revocation of Trust and Acknowledgment of Receipt by Trustee: a. Partial Revocation to Update Beneficiary Designations: Often, individuals want to modify their trust beneficiaries due to changes in personal circumstances, such as marriages, divorces, births, or deaths. In such cases, a partial revocation is required to update the trust document by removing or adding beneficiaries. The trustee's acknowledgment of receipt is necessary to validate these changes. b. Partial Revocation for Asset Alteration: In certain situations, individuals may want to reallocate or modify the assets specified in their trust. This could involve removing or adding properties, investments, or financial accounts. To make these changes legally binding, a partial revocation is necessary, accompanied by the trustee's acknowledgment of receipt to ensure the smooth transition of assets. c. Partial Revocation to Clarify Trust Provisions: Sometimes, individuals may wish to clarify ambiguous or outdated provisions within their trust. To achieve this, they can opt for a partial revocation, modifying specific clauses or introducing new instructions. The trustee's acknowledgment of receipt is required as evidence of their understanding and acceptance of the modified provisions. Conclusion: Santa Clara, California, is a city where residents understand the importance of ensuring legal compliance in various aspects of life, including trust management. The partial revocation of trust and acknowledgment of receipt by the trustee require careful consideration and adherence to legal procedures. Whether it's updating beneficiaries, altering assets, or clarifying trust provisions, understanding these processes is vital for maintaining a well-managed and legally compliant trust structure in Santa Clara.

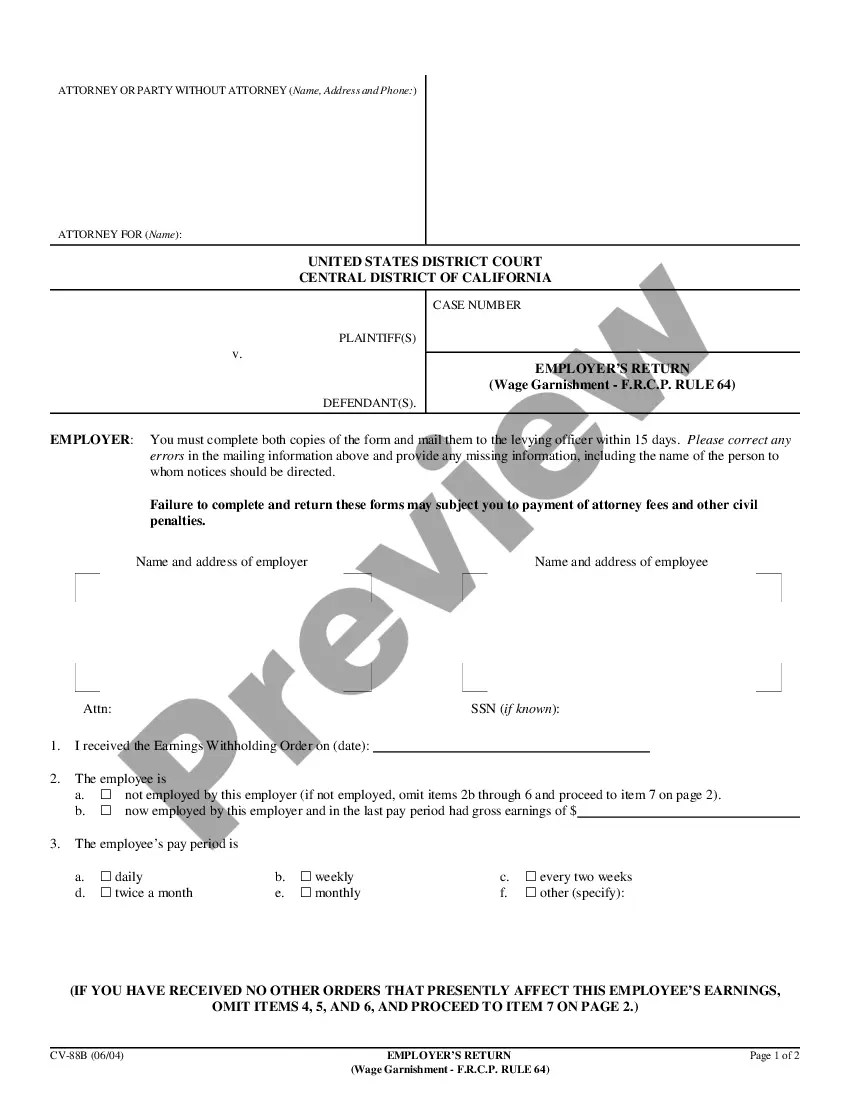

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.