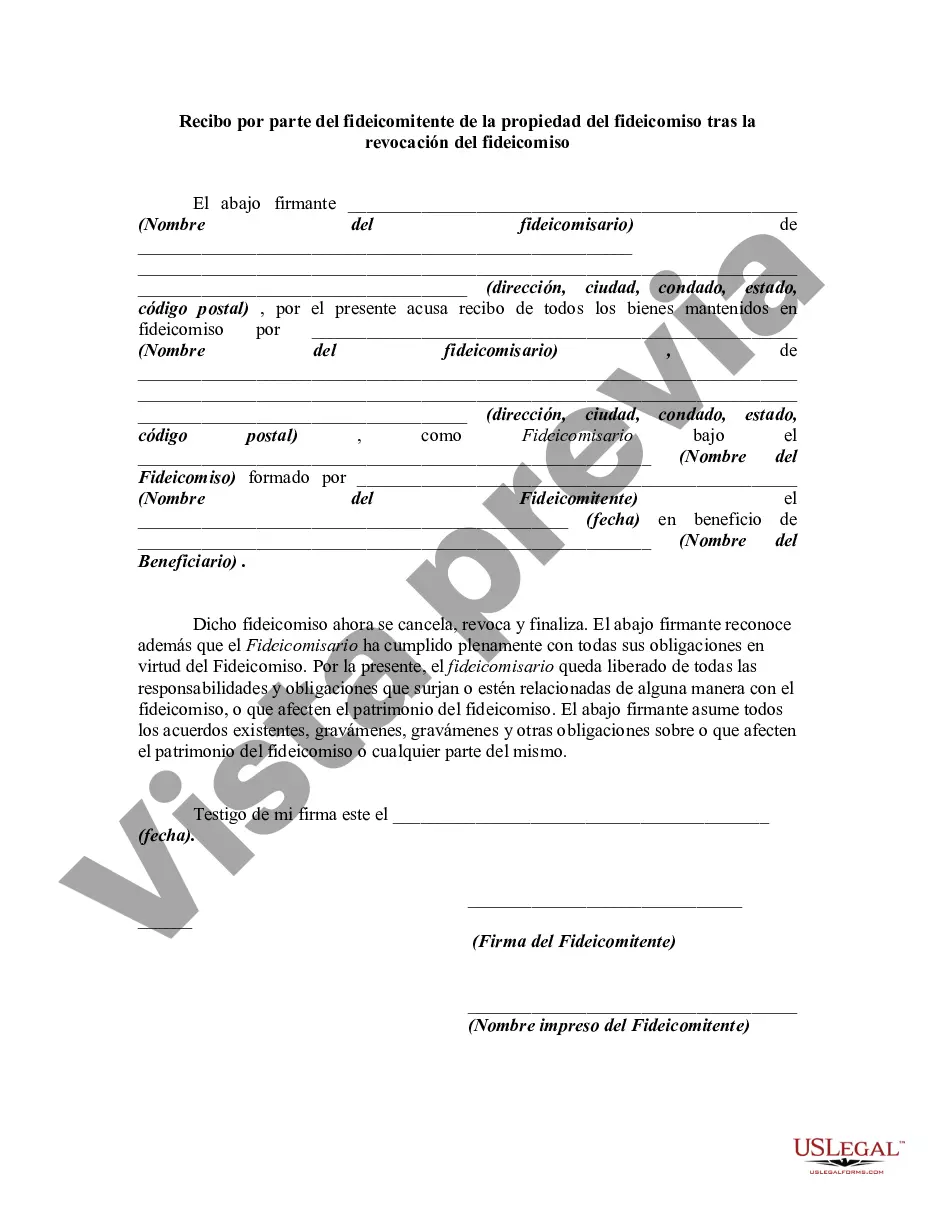

A trustor is the person who created a trust. The trustee is the person who manages a trust. The trustee has a duty to manage the trust's assets in the best interests of the beneficiary or beneficiaries. In this form the trustor is acknowledging receipt from the trustee of all property in the trust following revocation of the trust. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

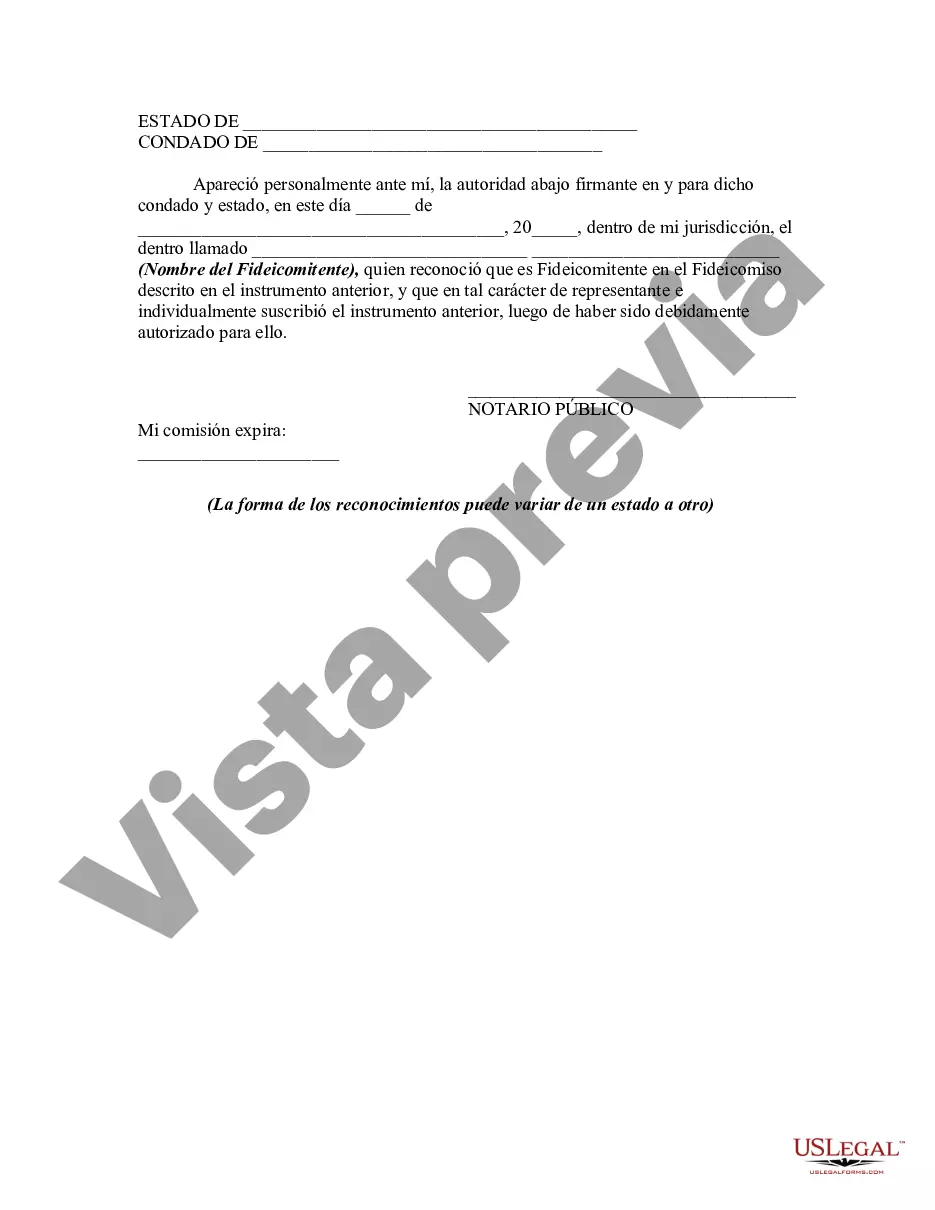

Harris Texas Receipt by Trust or for Trust Property Upon Revocation of Trust is an important legal document used in the state of Harris, Texas for the purpose of acknowledging the return of trust property following the revocation of a trust. This detailed description will shed light on the significance of this document, its key components, and the different types it may encompass. In the state of Texas, a trust is created to ensure the proper management and distribution of assets, typically for the benefit of beneficiaries. However, there are instances where the trust or, which is the individual who created the trust, may decide to revoke the trust for various reasons such as changes in financial circumstances, family dynamics, or personal preferences. When a trust is revoked, the trust or needs to retrieve the assets or properties that were originally placed within the trust. This is where the Harris Texas Receipt by Trust or for Trust Property Upon Revocation of Trust comes into play. It serves as a formal acknowledgment of the return and receipt of the trust property by the trust or their designated representative. The receipt typically includes essential information such as: 1. Trust or's Name: The legal name of the trust or who is revoking the trust and receiving the property. 2. Trust Property Details: A detailed description of the trust property being returned, including any identifying information or specific characteristics. 3. Date of Revocation: The date when the trust was officially revoked. 4. Witness Signatures: Signatures of individuals who witnessed the trust property being returned and received by the trust or. 5. Notary Seal: The receipt may require notarization to validate its authenticity and ensure legal compliance. Different types or variations of the Harris Texas Receipt by Trust or for Trust Property Upon Revocation of Trust may exist based on specific circumstances or the provisions stated in the original trust agreement. These variations may include: 1. Revocable Living Trust Receipt: This type of receipt is issued upon the revocation of a revocable living trust, which is a commonly used trust arrangement for estate planning purposes. It acknowledges the return of assets from the trust to the trust or after revocation. 2. Testamentary Trust Property Receipt: In cases where a testamentary trust, which is established through a will, is revoked, this type of receipt would be issued. It confirms the receipt of trust property from the testamentary trust following its revocation. It is important to consult with a legal professional to ensure the proper creation and execution of the Harris Texas Receipt by Trust or for Trust Property Upon Revocation of Trust. The contents and requirements may vary based on specific state laws, individual circumstances, or the terms of the trust agreement.Harris Texas Receipt by Trust or for Trust Property Upon Revocation of Trust is an important legal document used in the state of Harris, Texas for the purpose of acknowledging the return of trust property following the revocation of a trust. This detailed description will shed light on the significance of this document, its key components, and the different types it may encompass. In the state of Texas, a trust is created to ensure the proper management and distribution of assets, typically for the benefit of beneficiaries. However, there are instances where the trust or, which is the individual who created the trust, may decide to revoke the trust for various reasons such as changes in financial circumstances, family dynamics, or personal preferences. When a trust is revoked, the trust or needs to retrieve the assets or properties that were originally placed within the trust. This is where the Harris Texas Receipt by Trust or for Trust Property Upon Revocation of Trust comes into play. It serves as a formal acknowledgment of the return and receipt of the trust property by the trust or their designated representative. The receipt typically includes essential information such as: 1. Trust or's Name: The legal name of the trust or who is revoking the trust and receiving the property. 2. Trust Property Details: A detailed description of the trust property being returned, including any identifying information or specific characteristics. 3. Date of Revocation: The date when the trust was officially revoked. 4. Witness Signatures: Signatures of individuals who witnessed the trust property being returned and received by the trust or. 5. Notary Seal: The receipt may require notarization to validate its authenticity and ensure legal compliance. Different types or variations of the Harris Texas Receipt by Trust or for Trust Property Upon Revocation of Trust may exist based on specific circumstances or the provisions stated in the original trust agreement. These variations may include: 1. Revocable Living Trust Receipt: This type of receipt is issued upon the revocation of a revocable living trust, which is a commonly used trust arrangement for estate planning purposes. It acknowledges the return of assets from the trust to the trust or after revocation. 2. Testamentary Trust Property Receipt: In cases where a testamentary trust, which is established through a will, is revoked, this type of receipt would be issued. It confirms the receipt of trust property from the testamentary trust following its revocation. It is important to consult with a legal professional to ensure the proper creation and execution of the Harris Texas Receipt by Trust or for Trust Property Upon Revocation of Trust. The contents and requirements may vary based on specific state laws, individual circumstances, or the terms of the trust agreement.

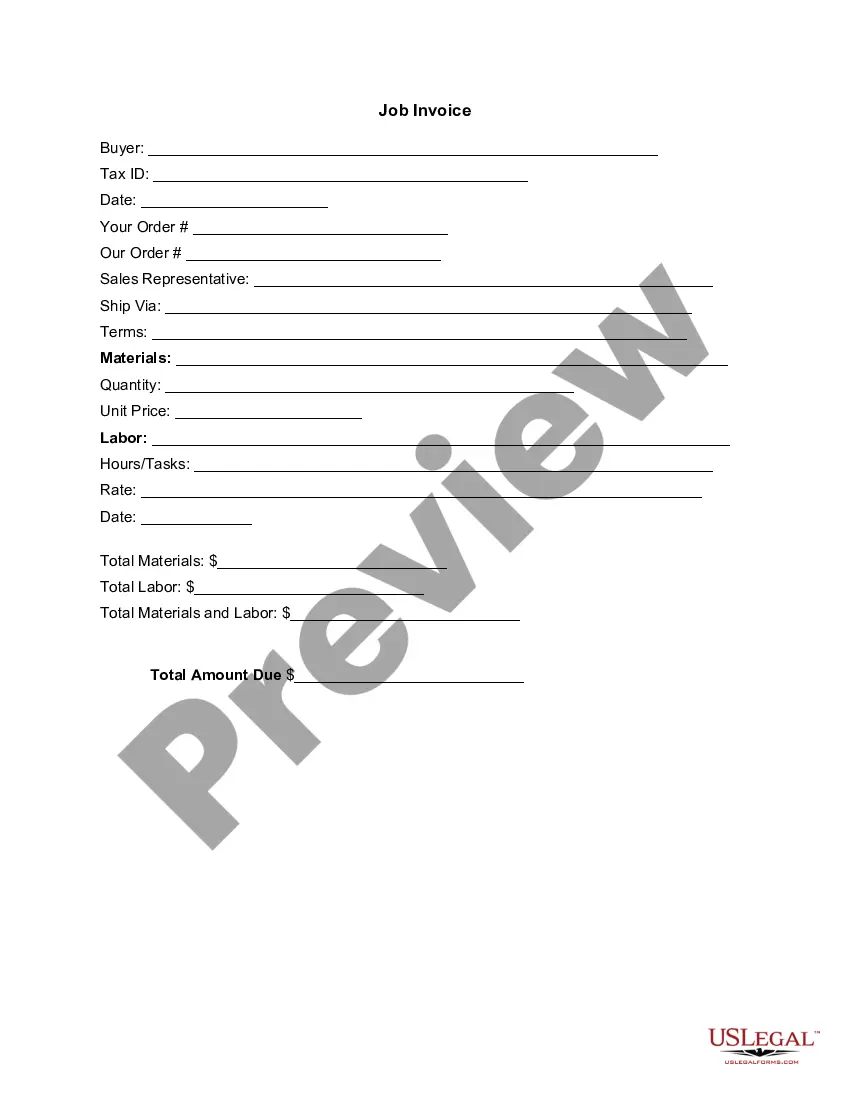

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.