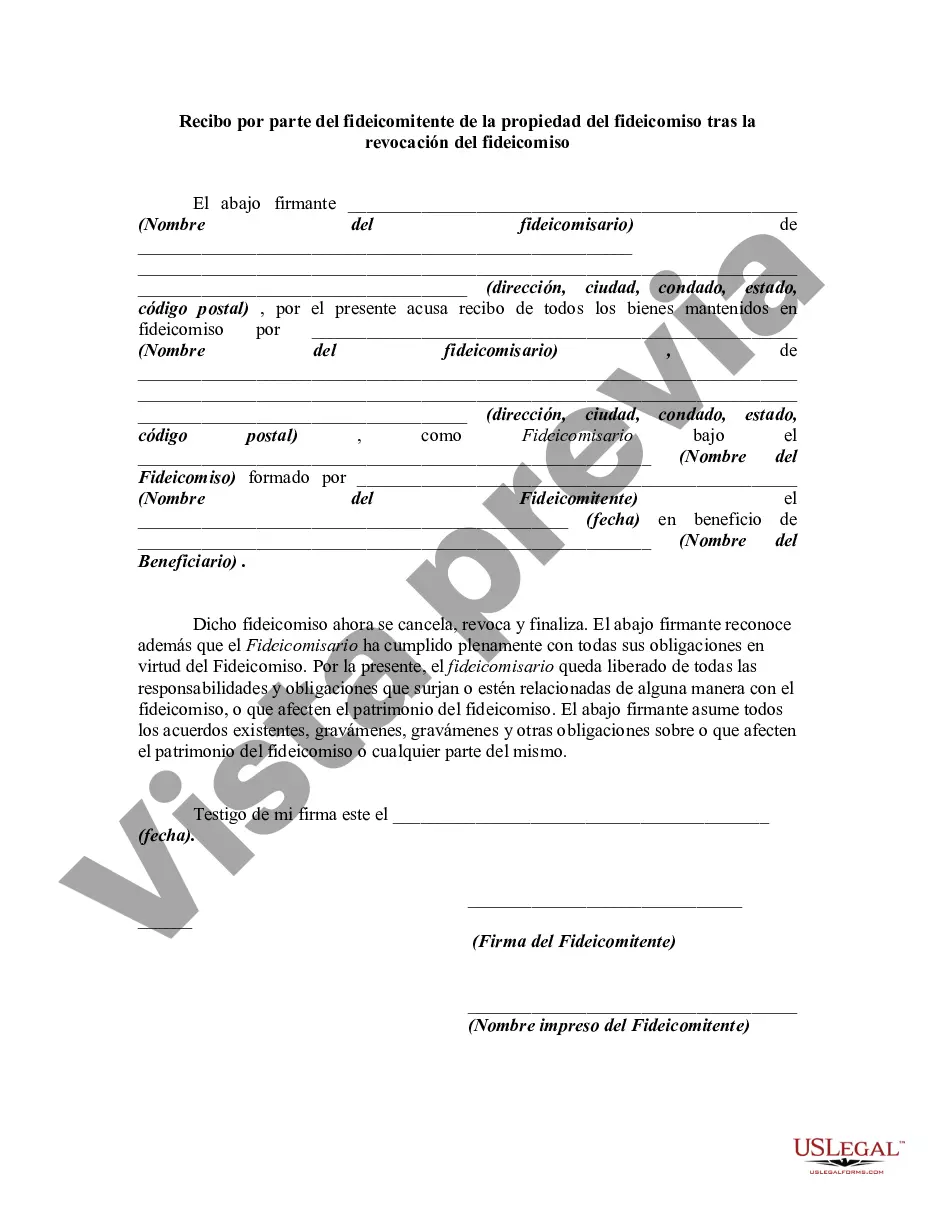

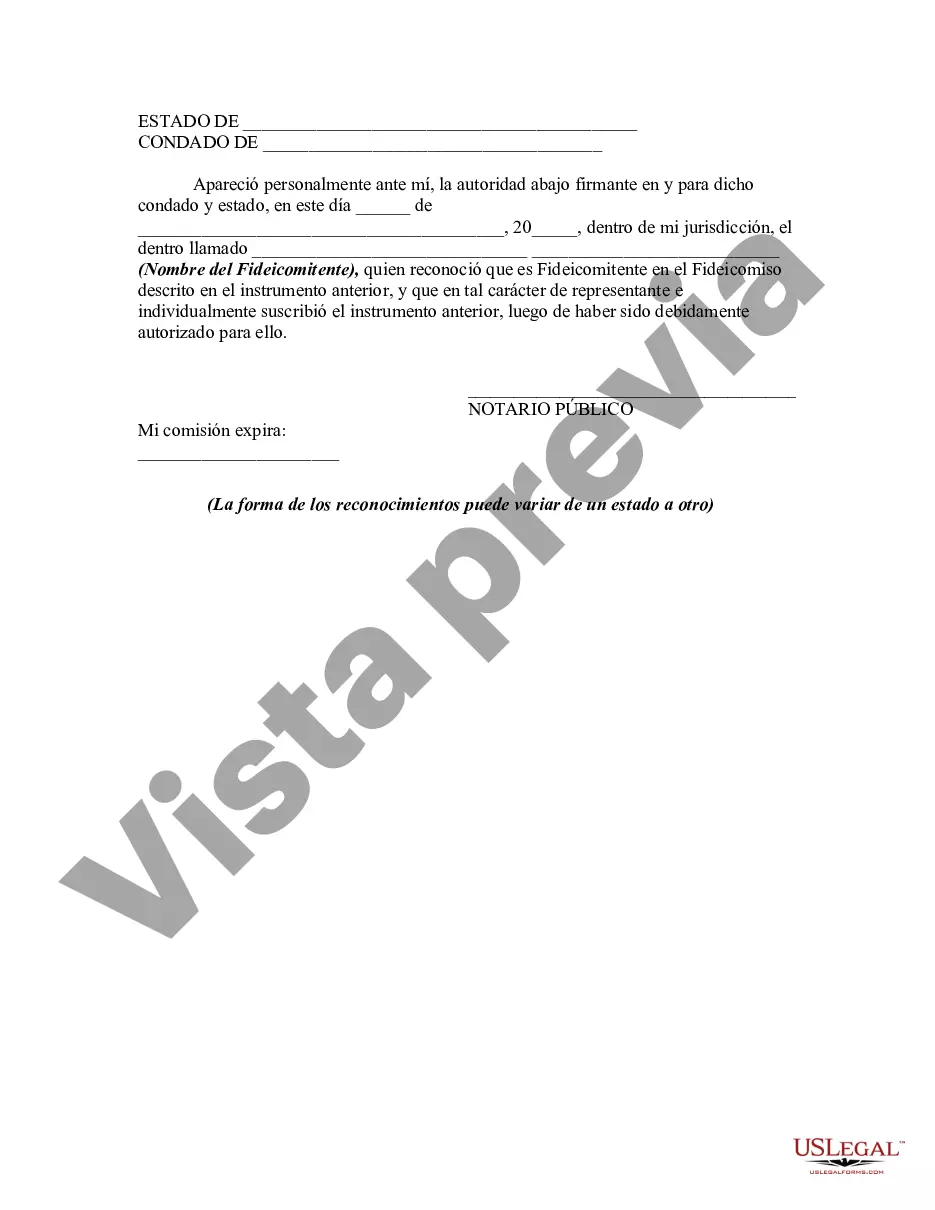

A trustor is the person who created a trust. The trustee is the person who manages a trust. The trustee has a duty to manage the trust's assets in the best interests of the beneficiary or beneficiaries. In this form the trustor is acknowledging receipt from the trustee of all property in the trust following revocation of the trust. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Kings New York Receipt by Trust or for Trust Property Upon Revocation of Trust is a legal document that serves as proof of the transfer of trust property back to the trust or upon the revocation of a trust. It outlines the specific details of the property being returned and the agreement between the trust or and the trustee. This receipt is essential in documenting the return of trust assets and can help resolve potential disputes or misunderstandings between the trust or and the trustee. It ensures that the property is properly accounted for and returned to the trust or in its original condition. There are different types of Kings New York Receipt by Trust or for Trust Property Upon Revocation of Trust, which may include: 1. Residential Property Revocation Receipt: In cases where the trust property consists of residential real estate, this type of receipt outlines the legal transfer of ownership back to the trust or. It includes details such as the property address, identification of any mortgages or encumbrances, and the condition of the property at the time of revocation. 2. Commercial Property Revocation Receipt: Similar to the residential property receipt, this type of receipt specifically pertains to commercial real estate being returned to the trust or. It may include additional information regarding any leases, tenants, or other contractual agreements associated with the property. 3. Financial Assets Revocation Receipt: This type of receipt focuses on the transfer of financial assets, such as stocks, bonds, or bank accounts, back to the trust or upon trust revocation. It includes details about the specific assets being returned, their value, and any necessary account information. 4. Personal Belongings Revocation Receipt: In cases where the trust property comprises personal belongings, such as jewelry, artwork, or collectibles, this receipt ensures their proper return to the trust or. It may include detailed descriptions, photographs, or appraisals of the items to facilitate accurate documentation. In conclusion, a Kings New York Receipt by Trust or for Trust Property Upon Revocation of Trust is a crucial legal document that establishes the return of trust assets to the trust or. It comes in various types depending on the nature of the property being returned, such as residential or commercial real estate, financial assets, or personal belongings.Kings New York Receipt by Trust or for Trust Property Upon Revocation of Trust is a legal document that serves as proof of the transfer of trust property back to the trust or upon the revocation of a trust. It outlines the specific details of the property being returned and the agreement between the trust or and the trustee. This receipt is essential in documenting the return of trust assets and can help resolve potential disputes or misunderstandings between the trust or and the trustee. It ensures that the property is properly accounted for and returned to the trust or in its original condition. There are different types of Kings New York Receipt by Trust or for Trust Property Upon Revocation of Trust, which may include: 1. Residential Property Revocation Receipt: In cases where the trust property consists of residential real estate, this type of receipt outlines the legal transfer of ownership back to the trust or. It includes details such as the property address, identification of any mortgages or encumbrances, and the condition of the property at the time of revocation. 2. Commercial Property Revocation Receipt: Similar to the residential property receipt, this type of receipt specifically pertains to commercial real estate being returned to the trust or. It may include additional information regarding any leases, tenants, or other contractual agreements associated with the property. 3. Financial Assets Revocation Receipt: This type of receipt focuses on the transfer of financial assets, such as stocks, bonds, or bank accounts, back to the trust or upon trust revocation. It includes details about the specific assets being returned, their value, and any necessary account information. 4. Personal Belongings Revocation Receipt: In cases where the trust property comprises personal belongings, such as jewelry, artwork, or collectibles, this receipt ensures their proper return to the trust or. It may include detailed descriptions, photographs, or appraisals of the items to facilitate accurate documentation. In conclusion, a Kings New York Receipt by Trust or for Trust Property Upon Revocation of Trust is a crucial legal document that establishes the return of trust assets to the trust or. It comes in various types depending on the nature of the property being returned, such as residential or commercial real estate, financial assets, or personal belongings.

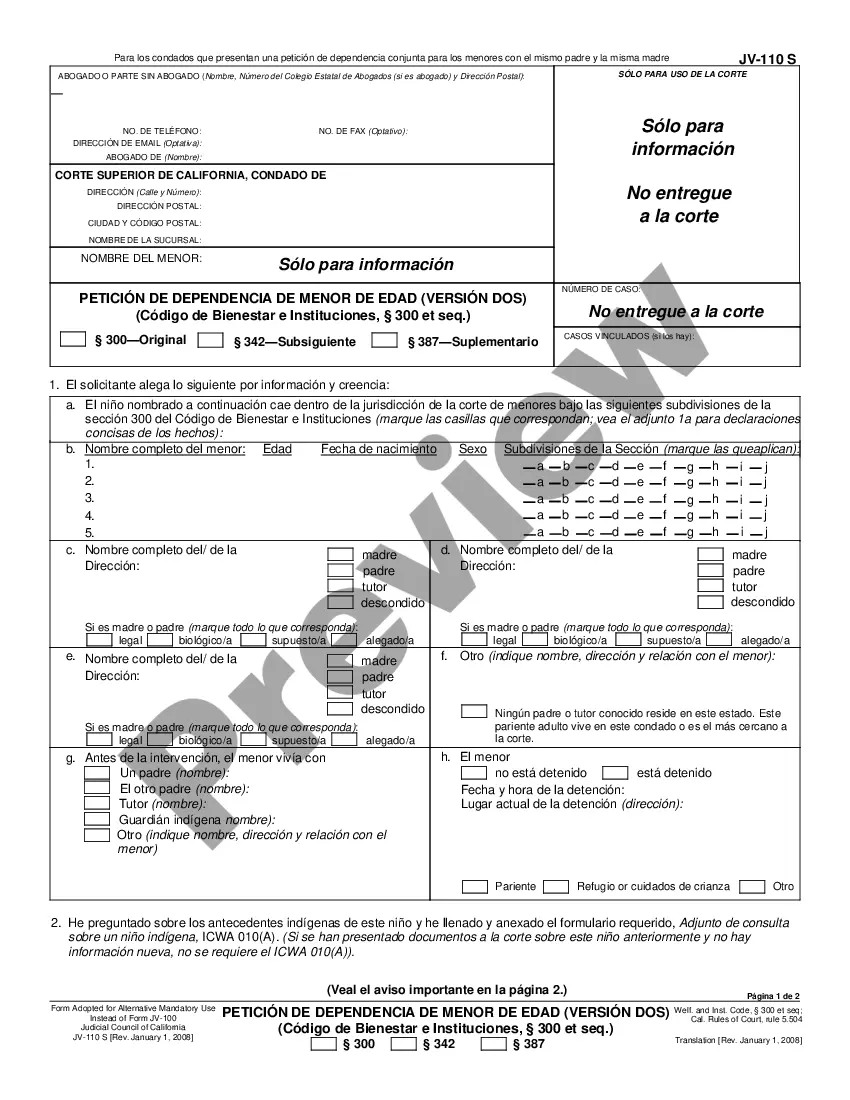

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.