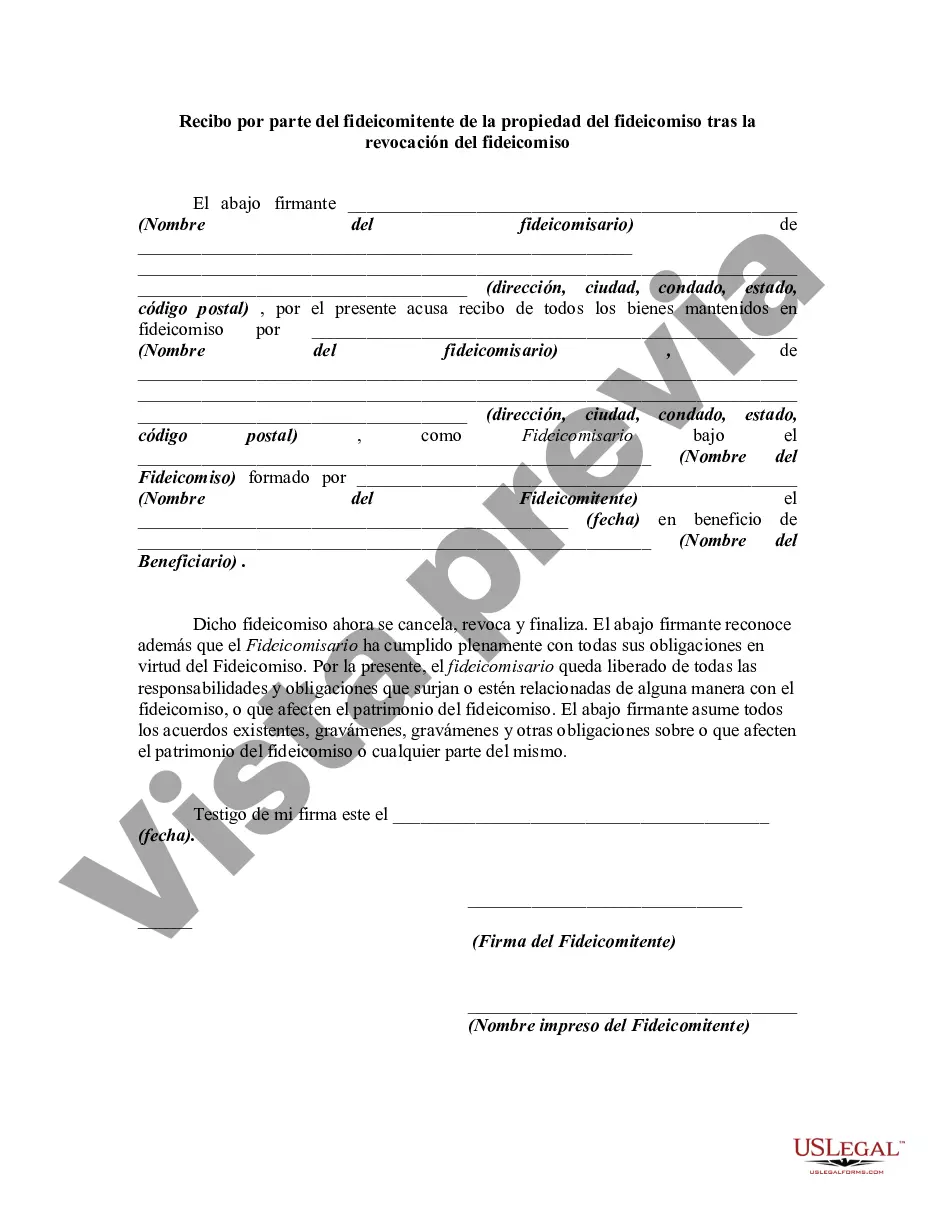

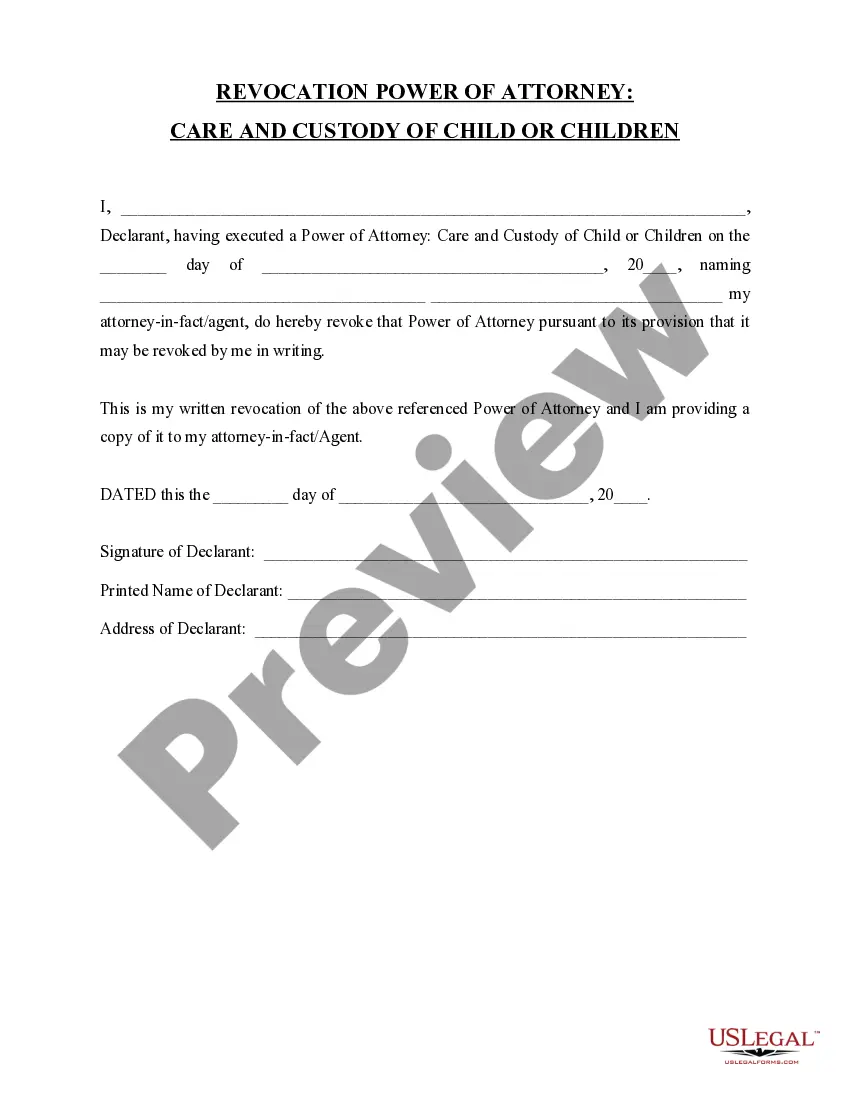

A trustor is the person who created a trust. The trustee is the person who manages a trust. The trustee has a duty to manage the trust's assets in the best interests of the beneficiary or beneficiaries. In this form the trustor is acknowledging receipt from the trustee of all property in the trust following revocation of the trust. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Middlesex County, located in the state of Massachusetts, has various transactional documents related to trust property upon the revocation of a trust, including the Middlesex Massachusetts Receipt by Trust or. This detailed description aims to provide a comprehensive understanding of this document and its significance for individuals involved in trust-related matters. The Middlesex Massachusetts Receipt by Trust or for Trust Property Upon Revocation of Trust serves as a legal acknowledgment of the return or transfer of trust property back to the trust or (also known as the settler or granter) when a trust is revoked or terminated. This document acts as evidence that the trust or has received the assets and property that were originally placed into the trust. Trust revocation can occur for various reasons, such as changes in personal circumstances, alterations in estate planning, or the establishment of a new trust. When a trust is revoked, it is essential to properly account for all assets held within it. The Middlesex Massachusetts Receipt by Trust or plays a crucial role in ensuring a smooth and lawful transition of trust property. The receipt typically includes relevant details such as the trust or's name, the trustee's name, the date of trust revocation, a comprehensive list of the trust assets being returned, and their corresponding values. This document acts as a legal safeguard, protecting the rights and interests of both the trust or and the trustee by confirming the proper return of trust property. There may be different types of Middlesex Massachusetts Receipts by Trust or for Trust Property Upon Revocation of Trust, depending on specific circumstances, such as: 1. Middlesex Massachusetts Receipt by Trust or for Real Estate: This variation of the receipt specifically addresses the return of real estate property held within the trust. It includes detailed information about the property, such as its address, legal description, and any associated documentation required for the transfer. 2. Middlesex Massachusetts Receipt by Trust or for Financial Assets: This type of receipt is utilized when returning financial assets held within the trust, such as bank accounts, investment portfolios, stocks, and bonds. It includes relevant financial information and account details required for the proper transfer or closure of accounts. 3. Middlesex Massachusetts Receipt by Trust or for Personal Property: When returning personal property held within the trust, such as vehicles, jewelry, artwork, or other valuable assets, this receipt variation is used. It includes a detailed inventory of the personal property being transferred and may require additional documentation, appraisals, or valuations to ensure an accurate return. In conclusion, the Middlesex Massachusetts Receipt by Trust or for Trust Property Upon Revocation of Trust is an important legal document used to confirm the proper return of assets and property back to the trust or when a trust is revoked. It ensures transparency and accountability in trust-related transactions, safeguarding the interests of both the trust or and trustee. Different variations of this receipt may exist, tailored to specific types of trust property being returned, such as real estate, financial assets, or personal property.Middlesex County, located in the state of Massachusetts, has various transactional documents related to trust property upon the revocation of a trust, including the Middlesex Massachusetts Receipt by Trust or. This detailed description aims to provide a comprehensive understanding of this document and its significance for individuals involved in trust-related matters. The Middlesex Massachusetts Receipt by Trust or for Trust Property Upon Revocation of Trust serves as a legal acknowledgment of the return or transfer of trust property back to the trust or (also known as the settler or granter) when a trust is revoked or terminated. This document acts as evidence that the trust or has received the assets and property that were originally placed into the trust. Trust revocation can occur for various reasons, such as changes in personal circumstances, alterations in estate planning, or the establishment of a new trust. When a trust is revoked, it is essential to properly account for all assets held within it. The Middlesex Massachusetts Receipt by Trust or plays a crucial role in ensuring a smooth and lawful transition of trust property. The receipt typically includes relevant details such as the trust or's name, the trustee's name, the date of trust revocation, a comprehensive list of the trust assets being returned, and their corresponding values. This document acts as a legal safeguard, protecting the rights and interests of both the trust or and the trustee by confirming the proper return of trust property. There may be different types of Middlesex Massachusetts Receipts by Trust or for Trust Property Upon Revocation of Trust, depending on specific circumstances, such as: 1. Middlesex Massachusetts Receipt by Trust or for Real Estate: This variation of the receipt specifically addresses the return of real estate property held within the trust. It includes detailed information about the property, such as its address, legal description, and any associated documentation required for the transfer. 2. Middlesex Massachusetts Receipt by Trust or for Financial Assets: This type of receipt is utilized when returning financial assets held within the trust, such as bank accounts, investment portfolios, stocks, and bonds. It includes relevant financial information and account details required for the proper transfer or closure of accounts. 3. Middlesex Massachusetts Receipt by Trust or for Personal Property: When returning personal property held within the trust, such as vehicles, jewelry, artwork, or other valuable assets, this receipt variation is used. It includes a detailed inventory of the personal property being transferred and may require additional documentation, appraisals, or valuations to ensure an accurate return. In conclusion, the Middlesex Massachusetts Receipt by Trust or for Trust Property Upon Revocation of Trust is an important legal document used to confirm the proper return of assets and property back to the trust or when a trust is revoked. It ensures transparency and accountability in trust-related transactions, safeguarding the interests of both the trust or and trustee. Different variations of this receipt may exist, tailored to specific types of trust property being returned, such as real estate, financial assets, or personal property.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.