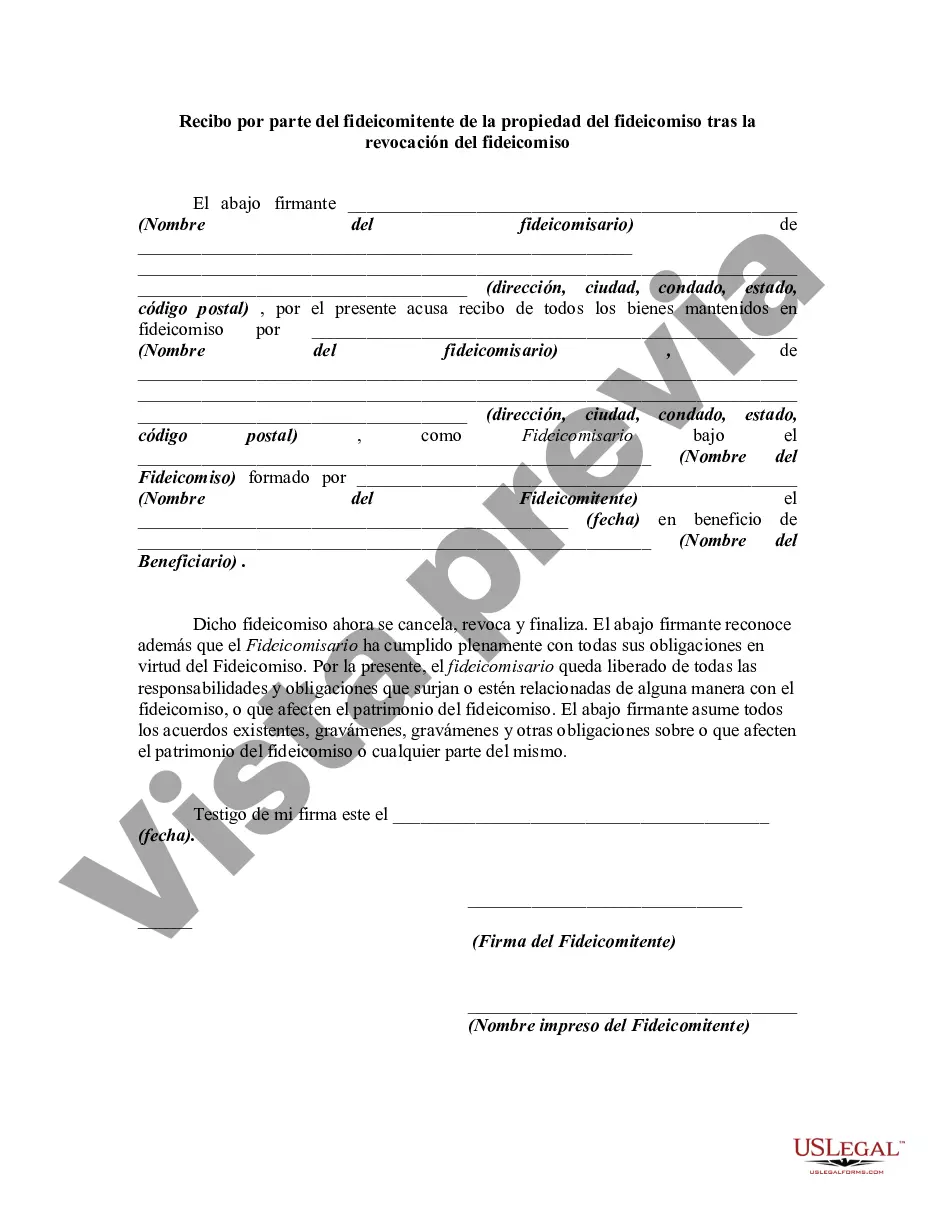

A trustor is the person who created a trust. The trustee is the person who manages a trust. The trustee has a duty to manage the trust's assets in the best interests of the beneficiary or beneficiaries. In this form the trustor is acknowledging receipt from the trustee of all property in the trust following revocation of the trust. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

San Jose, California Receipt by Trust or for Trust Property Upon Revocation of Trust is a legal document that acknowledges the transfer of trust property back to the trust or after the revocation of a trust. This document serves as proof of the return of assets and serves to protect both the trust or and the trustee involved. There are several types of San Jose, California Receipt by Trust or for Trust Property Upon Revocation of Trust, including: 1. Revocation and Receipt of Cash: This type of receipt is used when the trust property consists of cash assets such as bank accounts, cash on hand, or money market funds. It provides a record of the trust or receiving back the cash assets upon the revocation of the trust. 2. Revocation and Receipt of Real Estate: If the trust property includes real estate assets, this type of receipt is used to document the transfer of property ownership back to the trust or after the revocation. It includes details such as the property address, legal description, and any relevant financial considerations. 3. Revocation and Receipt of Securities: When the trust property comprises securities such as stocks, bonds, or mutual funds, this type of receipt is used. It outlines the securities being returned to the trust or upon revocation and includes information like the type of securities, quantity, and any relevant transaction details. 4. Revocation and Receipt of Personal Property: In cases where the trust property consists of personal belongings like jewelry, artwork, vehicles, or household items, this type of receipt is utilized. It describes the specific items being returned to the trust or and may include appraisals or valuations if necessary. Regardless of the type of San Jose, California Receipt by Trust or for Trust Property Upon Revocation of Trust, it is crucial to include certain details for accuracy and clarity. These details include the trust or's name and contact information, trustee details, revocation date, specific property being returned, and the signatures of both the trust or and trustee. This document plays a vital role in ensuring a smooth transfer of assets and legal compliance when revoking a trust in San Jose, California.San Jose, California Receipt by Trust or for Trust Property Upon Revocation of Trust is a legal document that acknowledges the transfer of trust property back to the trust or after the revocation of a trust. This document serves as proof of the return of assets and serves to protect both the trust or and the trustee involved. There are several types of San Jose, California Receipt by Trust or for Trust Property Upon Revocation of Trust, including: 1. Revocation and Receipt of Cash: This type of receipt is used when the trust property consists of cash assets such as bank accounts, cash on hand, or money market funds. It provides a record of the trust or receiving back the cash assets upon the revocation of the trust. 2. Revocation and Receipt of Real Estate: If the trust property includes real estate assets, this type of receipt is used to document the transfer of property ownership back to the trust or after the revocation. It includes details such as the property address, legal description, and any relevant financial considerations. 3. Revocation and Receipt of Securities: When the trust property comprises securities such as stocks, bonds, or mutual funds, this type of receipt is used. It outlines the securities being returned to the trust or upon revocation and includes information like the type of securities, quantity, and any relevant transaction details. 4. Revocation and Receipt of Personal Property: In cases where the trust property consists of personal belongings like jewelry, artwork, vehicles, or household items, this type of receipt is utilized. It describes the specific items being returned to the trust or and may include appraisals or valuations if necessary. Regardless of the type of San Jose, California Receipt by Trust or for Trust Property Upon Revocation of Trust, it is crucial to include certain details for accuracy and clarity. These details include the trust or's name and contact information, trustee details, revocation date, specific property being returned, and the signatures of both the trust or and trustee. This document plays a vital role in ensuring a smooth transfer of assets and legal compliance when revoking a trust in San Jose, California.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.