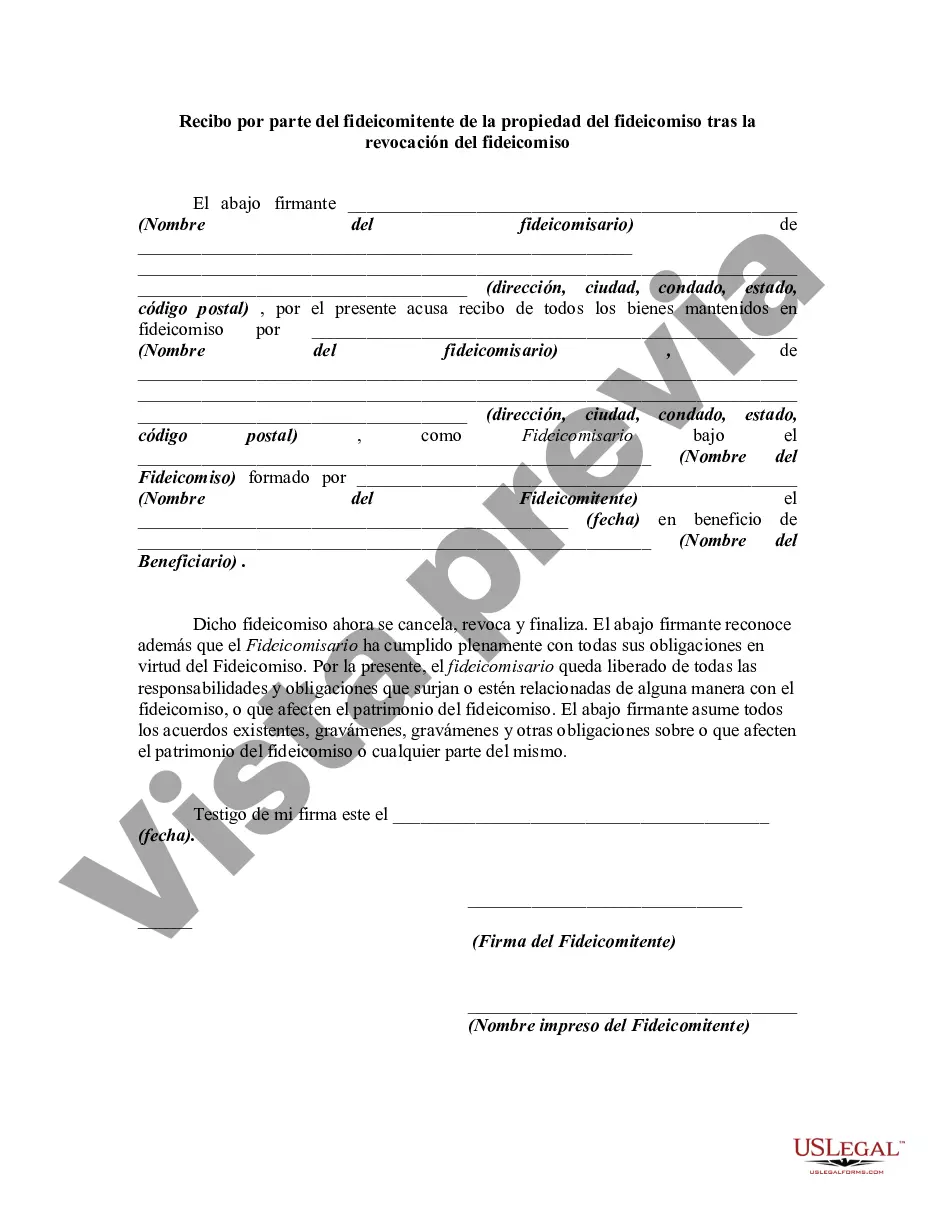

A trustor is the person who created a trust. The trustee is the person who manages a trust. The trustee has a duty to manage the trust's assets in the best interests of the beneficiary or beneficiaries. In this form the trustor is acknowledging receipt from the trustee of all property in the trust following revocation of the trust. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Travis Texas Recibo por parte del fideicomitente de la propiedad del fideicomiso tras la revocación del fideicomiso - Receipt by Trustor for Trust Property Upon Revocation of Trust

Description

How to fill out Recibo Por Parte Del Fideicomitente De La Propiedad Del Fideicomiso Tras La Revocación Del Fideicomiso?

Preparing paperwork for business or personal needs is always a significant obligation.

When formulating an agreement, a public service petition, or a power of attorney, it's crucial to consider all federal and state laws of the specific area.

However, small counties and even municipalities also possess legislative rules that you must account for.

The wonderful aspect of the US Legal Forms library is that all the documents you've ever acquired remain accessible - you can find them in your profile under the My documents tab at any moment.

- All these factors make it stressful and time-consuming to draft Travis Receipt by Trustor for Trust Property Upon Revocation of Trust without expert help.

- It's simple to prevent wasting funds on attorneys drafting your documents and create a legally sound Travis Receipt by Trustor for Trust Property Upon Revocation of Trust independently, using the US Legal Forms online repository.

- It is the best online collection of state-specific legal templates that are professionally verified, so you can be assured of their legitimacy when selecting a sample for your locality.

- Previous subscribed members only need to Log In to their accounts to download the necessary document.

- If you do not yet have a subscription, follow the step-by-step guide below to acquire the Travis Receipt by Trustor for Trust Property Upon Revocation of Trust.

- Review the page you've opened and verify if it contains the document you need.

- To do this, use the form description and preview if those options are accessible.

Form popularity

FAQ

Persona que constituye un fideicomiso destinando los bienes y/o derechos necesarios para el cumplimiento de sus fines, transmitiendo su titularidad al fiduciario.

¿Quienes participan en un fideicomiso?...Cuando se habla del fideicomiso, es necesario distinguir al menos las tres partes principales que componen esta figura mercantil: el fiduciante, el fiduciario y el fideicomisario. Fiduciante.Fiduciario.Fideicomisario.

El fideicomisario es el beneficiario que fue nombrado en el contrato de fideicomiso. Puede ser una persona fisica o moral, que recibira bienes, valores o recursos cuando se cumplan las condiciones establecidas.

Fideicomiso Irrevocable Un Fideicomiso que no puede ser cambiado.

El fideicomiso dispone de los bienes y derechos en cuestion con el objeto de realizar exclusivamente las finalidades senaladas en el propio contrato y en beneficio de la misma persona que transmitio los bienes o de terceros previamente designados.

Un fideicomiso en vida revocable (conocido en ingles como un revocable living trust) es un documento legal que le da la autoridad para tomar decisiones sobre el dinero o los bienes de otra persona mantenidos en un fideicomiso.

Algunos de los tipos de contrato mas frecuente en el mercado actualmente son: Fideicomiso testamentario.Fideicomiso como medio de pago.Fideicomiso de planeacion patrimonial.Fideicomiso estructurado.

El deber fiduciario se trata de la responsabilidad legal de actuar exclusivamente en el mejor interes de aquella persona fisica o moral encargada de un fideicomiso. Fiduciario significa confianza, y la persona con dicho deber tiene una obligacion legal de mantener esa confianza.

Civ. Disposicion testamentaria por la que el testador encarga al heredero, fiduciario, que conserve y transmita la herencia a un tercero, llamado fideicomisario. El fideicomisario adquiere derecho a la sucesion desde la muerte del testador, aunque muera antes que el fiduciario.

En cuanto a sus Obligaciones destacamos las siguientes: 1. - Establecer un fin licito, sin contravenir la moral y el orden publico; 2. - Remunerar al Fiduciario; 3. - Asumir los gastos del Fideicomiso; y, 4.