Unless the continuation of a trust is necessary to carry out a material purpose of the trust (such as tax benefits), the trust may be terminated by agreement of all the beneficiaries if none of them is mentally incompetent or underage (e.g., under 21 in some states). However, termination generally cannot take place when it is contrary to the clearly expressed intention of the trustor. In the absence of a provision in a trust instrument giving the trustee power to terminate the trust, a trustee generally has no control over the continuance of the trust.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

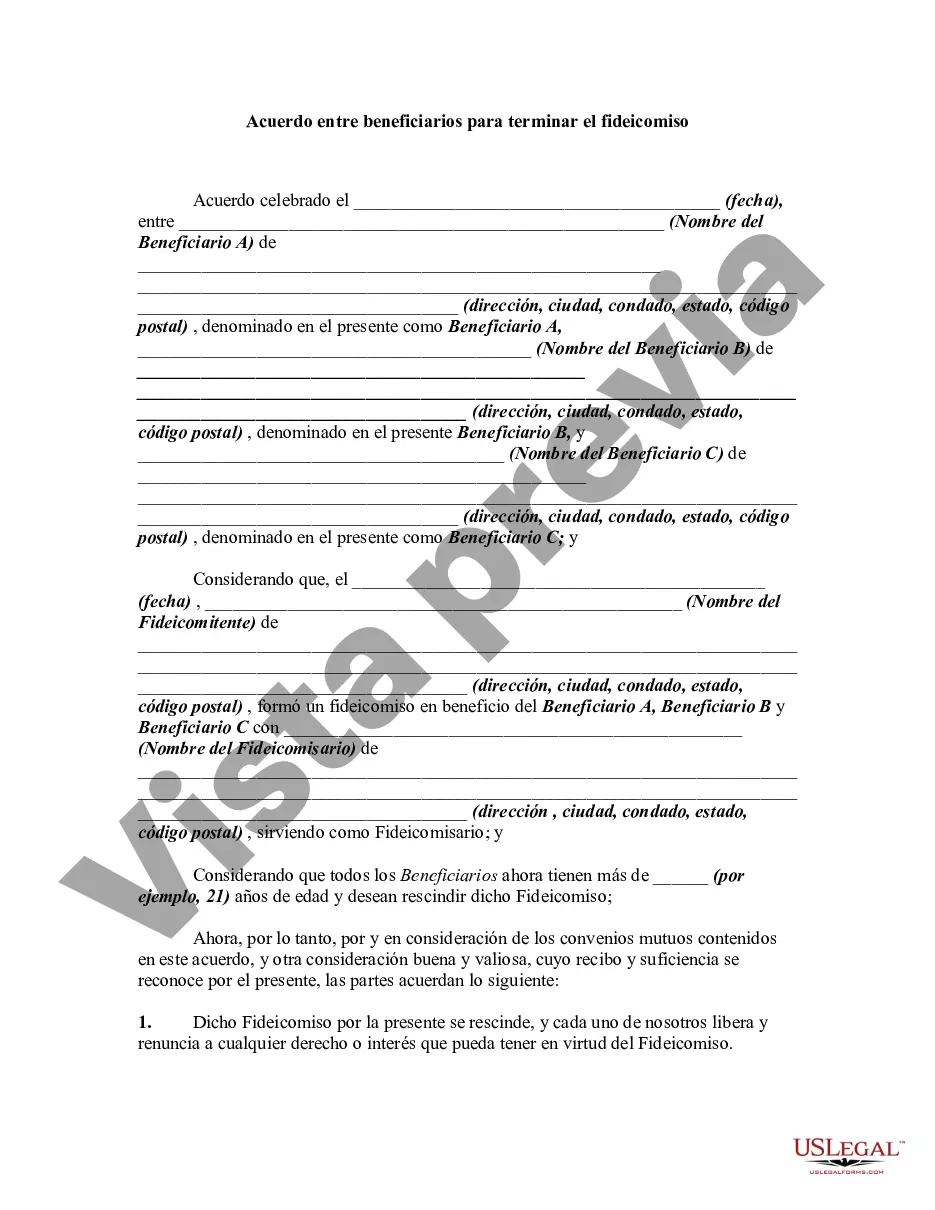

The Chicago Illinois Agreement Among Beneficiaries to Terminate Trust is a legally binding document that provides a mechanism for terminating a trust in the state of Illinois. This agreement involves the agreement between all beneficiaries of the trust to terminate it, thereby revoking its provisions and distributing the trust assets accordingly. One type of Chicago Illinois Agreement Among Beneficiaries to Terminate Trust is the "Revocable Living Trust Termination Agreement." This type of agreement is typically used when the settler of a revocable living trust wishes to terminate the trust during their lifetime. By executing this agreement, the beneficiaries agree to terminate the trust and distribute the trust assets as specified in the agreement. Another type of Chicago Illinois Agreement Among Beneficiaries to Terminate Trust is the "Testamentary Trust Termination Agreement." This agreement is used when the trust was created through a will and is in effect after the death of the testator. The beneficiaries, by entering into this agreement, can terminate the testamentary trust and divide the trust assets among themselves according to the terms outlined in the agreement. The Chicago Illinois Agreement Among Beneficiaries to Terminate Trust includes several key components. Firstly, it specifies the trust's name, date of creation, and the names of all beneficiaries involved in the agreement. The agreement may also state the reason for the trust termination, such as achieving the trust's purpose or meeting certain conditions specified in the trust document. Furthermore, the agreement outlines the procedure for terminating the trust, including any necessary hearings or court approvals required by the Illinois law. It may also include provisions for the distribution of trust assets among the beneficiaries, specifying the percentage or amount each beneficiary is entitled to receive upon termination. Additionally, the Chicago Illinois Agreement Among Beneficiaries to Terminate Trust acts as a release and discharge of liability for the trustees, as it confirms that their duties and responsibilities will cease upon the successful termination of the trust. Overall, the Chicago Illinois Agreement Among Beneficiaries to Terminate Trust provides a comprehensive framework for ending a trust in the state of Illinois. It ensures that all beneficiaries are in agreement and that the trust assets are properly distributed as per the terms agreed upon. This agreement allows for a smooth and legal termination process that benefits all parties involved.The Chicago Illinois Agreement Among Beneficiaries to Terminate Trust is a legally binding document that provides a mechanism for terminating a trust in the state of Illinois. This agreement involves the agreement between all beneficiaries of the trust to terminate it, thereby revoking its provisions and distributing the trust assets accordingly. One type of Chicago Illinois Agreement Among Beneficiaries to Terminate Trust is the "Revocable Living Trust Termination Agreement." This type of agreement is typically used when the settler of a revocable living trust wishes to terminate the trust during their lifetime. By executing this agreement, the beneficiaries agree to terminate the trust and distribute the trust assets as specified in the agreement. Another type of Chicago Illinois Agreement Among Beneficiaries to Terminate Trust is the "Testamentary Trust Termination Agreement." This agreement is used when the trust was created through a will and is in effect after the death of the testator. The beneficiaries, by entering into this agreement, can terminate the testamentary trust and divide the trust assets among themselves according to the terms outlined in the agreement. The Chicago Illinois Agreement Among Beneficiaries to Terminate Trust includes several key components. Firstly, it specifies the trust's name, date of creation, and the names of all beneficiaries involved in the agreement. The agreement may also state the reason for the trust termination, such as achieving the trust's purpose or meeting certain conditions specified in the trust document. Furthermore, the agreement outlines the procedure for terminating the trust, including any necessary hearings or court approvals required by the Illinois law. It may also include provisions for the distribution of trust assets among the beneficiaries, specifying the percentage or amount each beneficiary is entitled to receive upon termination. Additionally, the Chicago Illinois Agreement Among Beneficiaries to Terminate Trust acts as a release and discharge of liability for the trustees, as it confirms that their duties and responsibilities will cease upon the successful termination of the trust. Overall, the Chicago Illinois Agreement Among Beneficiaries to Terminate Trust provides a comprehensive framework for ending a trust in the state of Illinois. It ensures that all beneficiaries are in agreement and that the trust assets are properly distributed as per the terms agreed upon. This agreement allows for a smooth and legal termination process that benefits all parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.