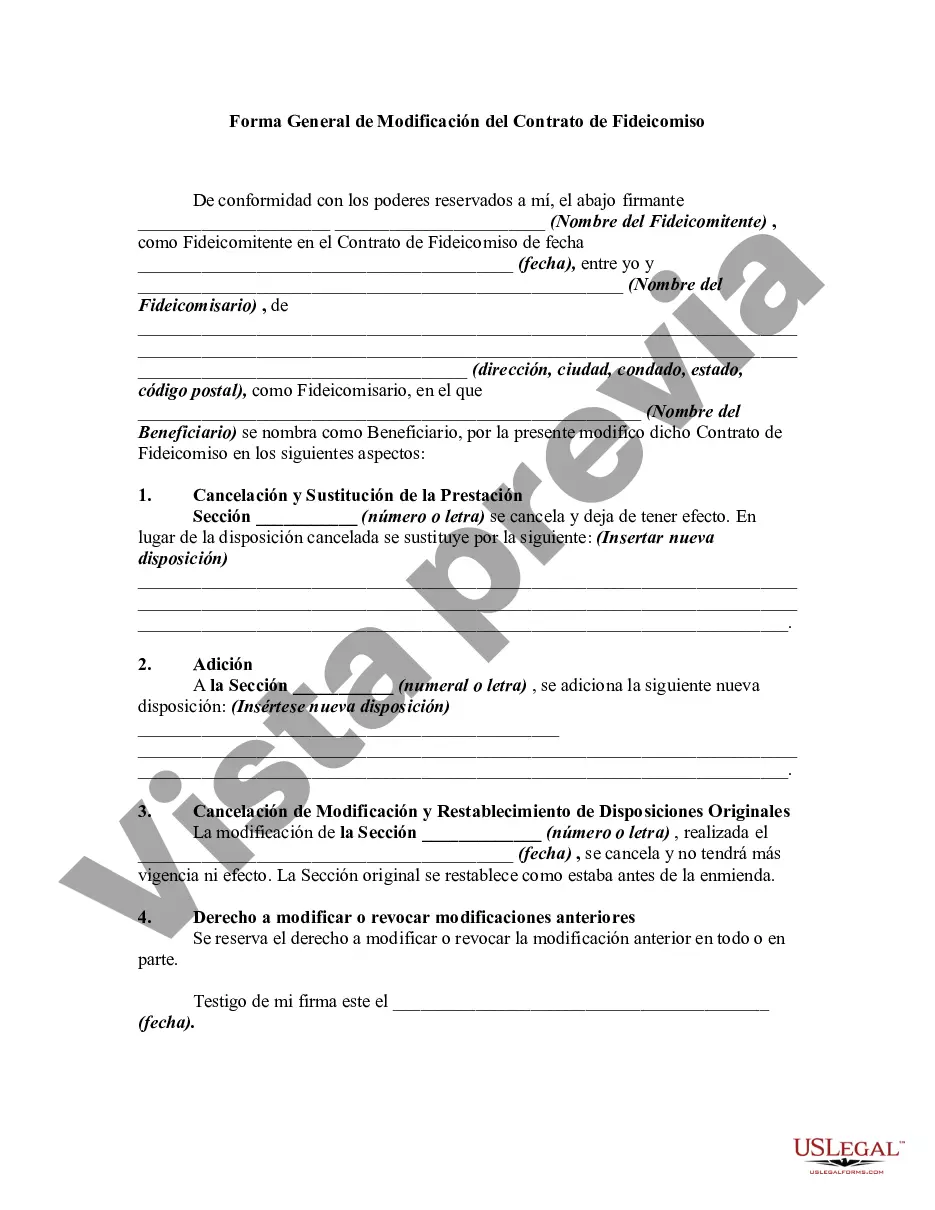

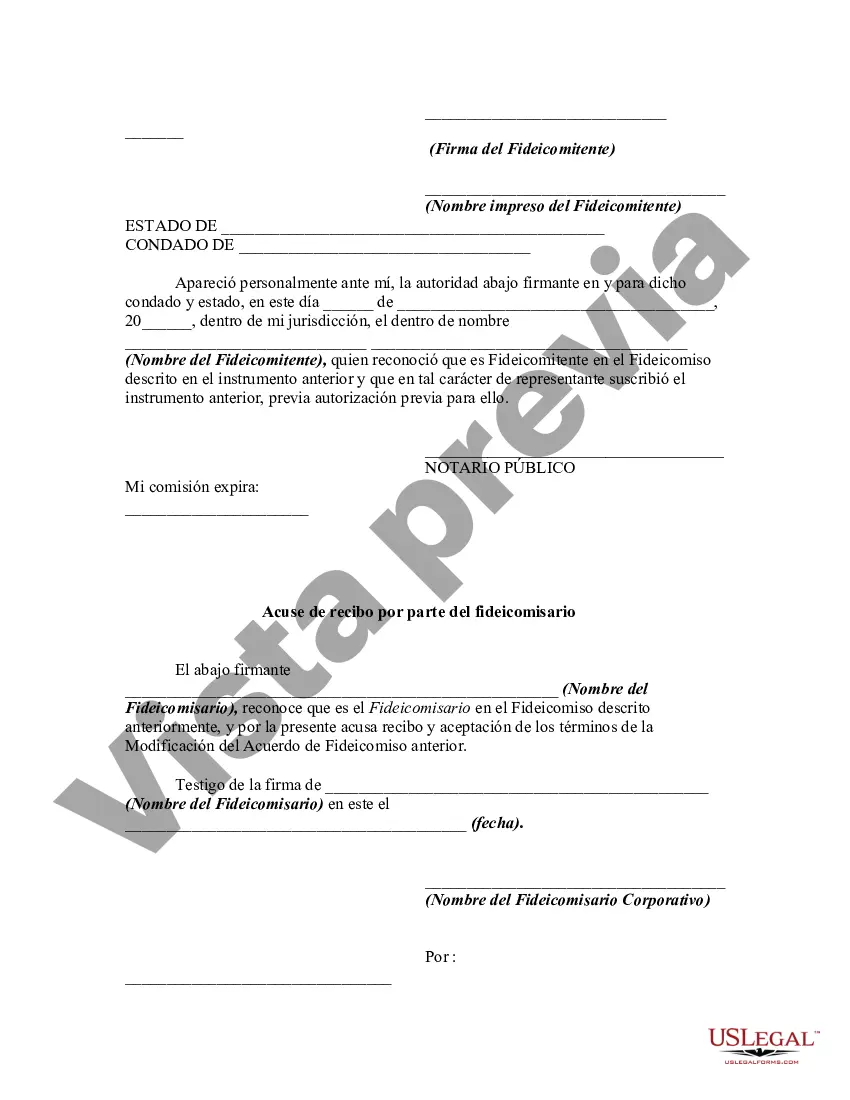

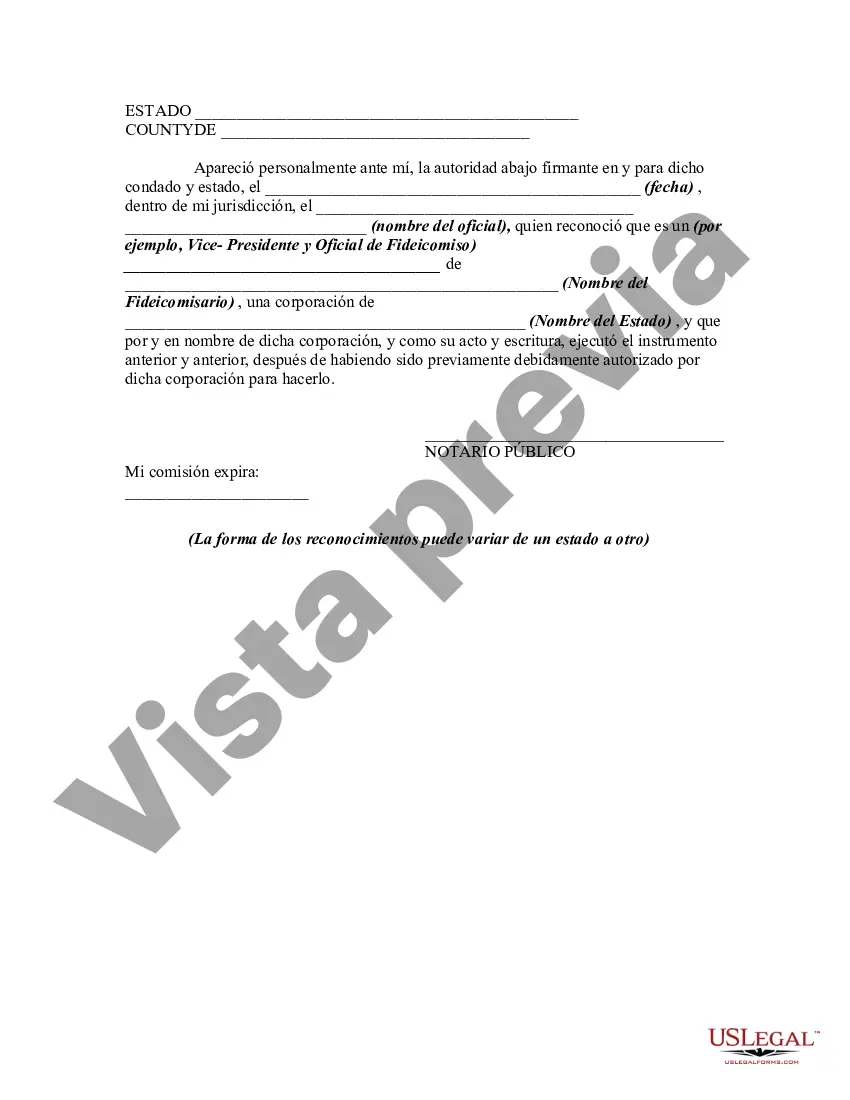

A well drafted trust instrument will generally prescribe the method and manner of amending the trust agreement. This form is a sample of a trustor amending a trust agreement. It is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Lima Arizona General Form of Amendment of Trust Agreement is a legal document that allows individuals to make changes or modifications to an existing trust agreement in Lima, Arizona. This amendment is crucial when the original terms of the trust need to be updated due to new beneficiaries, changed circumstances, or revised provisions. Keywords: Lima Arizona, General Form, Amendment of Trust Agreement, legal document, changes, modifications, existing trust agreement, beneficiaries, circumstances, provisions. Different types of Lima Arizona General Form of Amendment of Trust Agreement may include: 1. Beneficiary Amendment: This type of amendment modifies the designated beneficiaries or their shares within the trust agreement. It can add or remove beneficiaries, change their interests, or redefine their distribution percentages. 2. Successor Trustee Amendment: In certain situations, the trust's original trustee may need to be replaced or revised due to personal reasons, incapacity, or death. This amendment allows individuals to designate a new successor trustee to manage the trust's affairs effectively. 3. Asset Amendment: This type of amendment alters the assets held within the trust. It can involve adding or removing specific properties, investments, or financial accounts. Additionally, it may include changing ownership titles under the trust's name. 4. Administrative Amendment: Sometimes, trust agreements require administrative modifications like updating the contact information of the trust or, trustee, or beneficial parties. This amendment ensures accurate and up-to-date administrative details. 5. Provisions Amendment: Trust provisions dictate various terms such as distribution guidelines, conditions, and restrictions. This type of amendment entails making changes to these provisions to align with the granter's current intentions or to account for legal or personal considerations. 6. Tax Amendment: Tax laws undergo continuous changes, and updating a trust agreement to reflect these modifications can be vital. This amendment involves adjusting provisions related to tax planning, minimizing tax liabilities, or complying with new tax codes to ensure the trust remains tax-efficient. In conclusion, the Lima Arizona General Form of Amendment of Trust Agreement is a versatile legal document that allows individuals to modify the terms and provisions of an existing trust agreement. Different types of amendments address beneficiary modifications, successor trustee appointments, asset adjustments, administrative updates, provisions modifications, and tax-related changes. Consulting with a qualified attorney is advisable when executing any amendments to ensure compliance with local laws and to protect the granter's intentions.The Lima Arizona General Form of Amendment of Trust Agreement is a legal document that allows individuals to make changes or modifications to an existing trust agreement in Lima, Arizona. This amendment is crucial when the original terms of the trust need to be updated due to new beneficiaries, changed circumstances, or revised provisions. Keywords: Lima Arizona, General Form, Amendment of Trust Agreement, legal document, changes, modifications, existing trust agreement, beneficiaries, circumstances, provisions. Different types of Lima Arizona General Form of Amendment of Trust Agreement may include: 1. Beneficiary Amendment: This type of amendment modifies the designated beneficiaries or their shares within the trust agreement. It can add or remove beneficiaries, change their interests, or redefine their distribution percentages. 2. Successor Trustee Amendment: In certain situations, the trust's original trustee may need to be replaced or revised due to personal reasons, incapacity, or death. This amendment allows individuals to designate a new successor trustee to manage the trust's affairs effectively. 3. Asset Amendment: This type of amendment alters the assets held within the trust. It can involve adding or removing specific properties, investments, or financial accounts. Additionally, it may include changing ownership titles under the trust's name. 4. Administrative Amendment: Sometimes, trust agreements require administrative modifications like updating the contact information of the trust or, trustee, or beneficial parties. This amendment ensures accurate and up-to-date administrative details. 5. Provisions Amendment: Trust provisions dictate various terms such as distribution guidelines, conditions, and restrictions. This type of amendment entails making changes to these provisions to align with the granter's current intentions or to account for legal or personal considerations. 6. Tax Amendment: Tax laws undergo continuous changes, and updating a trust agreement to reflect these modifications can be vital. This amendment involves adjusting provisions related to tax planning, minimizing tax liabilities, or complying with new tax codes to ensure the trust remains tax-efficient. In conclusion, the Lima Arizona General Form of Amendment of Trust Agreement is a versatile legal document that allows individuals to modify the terms and provisions of an existing trust agreement. Different types of amendments address beneficiary modifications, successor trustee appointments, asset adjustments, administrative updates, provisions modifications, and tax-related changes. Consulting with a qualified attorney is advisable when executing any amendments to ensure compliance with local laws and to protect the granter's intentions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.